Average Auto Insurance Premium

Auto insurance is a vital aspect of vehicle ownership, providing financial protection in the event of accidents, theft, or other unforeseen circumstances. Understanding the average auto insurance premium is crucial for individuals seeking to make informed decisions about their coverage. This comprehensive guide will delve into the factors influencing auto insurance costs, explore average premium rates, and offer valuable insights to help you navigate the world of auto insurance with confidence.

Factors Impacting Auto Insurance Premiums

The cost of auto insurance varies significantly based on a multitude of factors. Here are some key considerations that influence the average premium:

1. Geographical Location

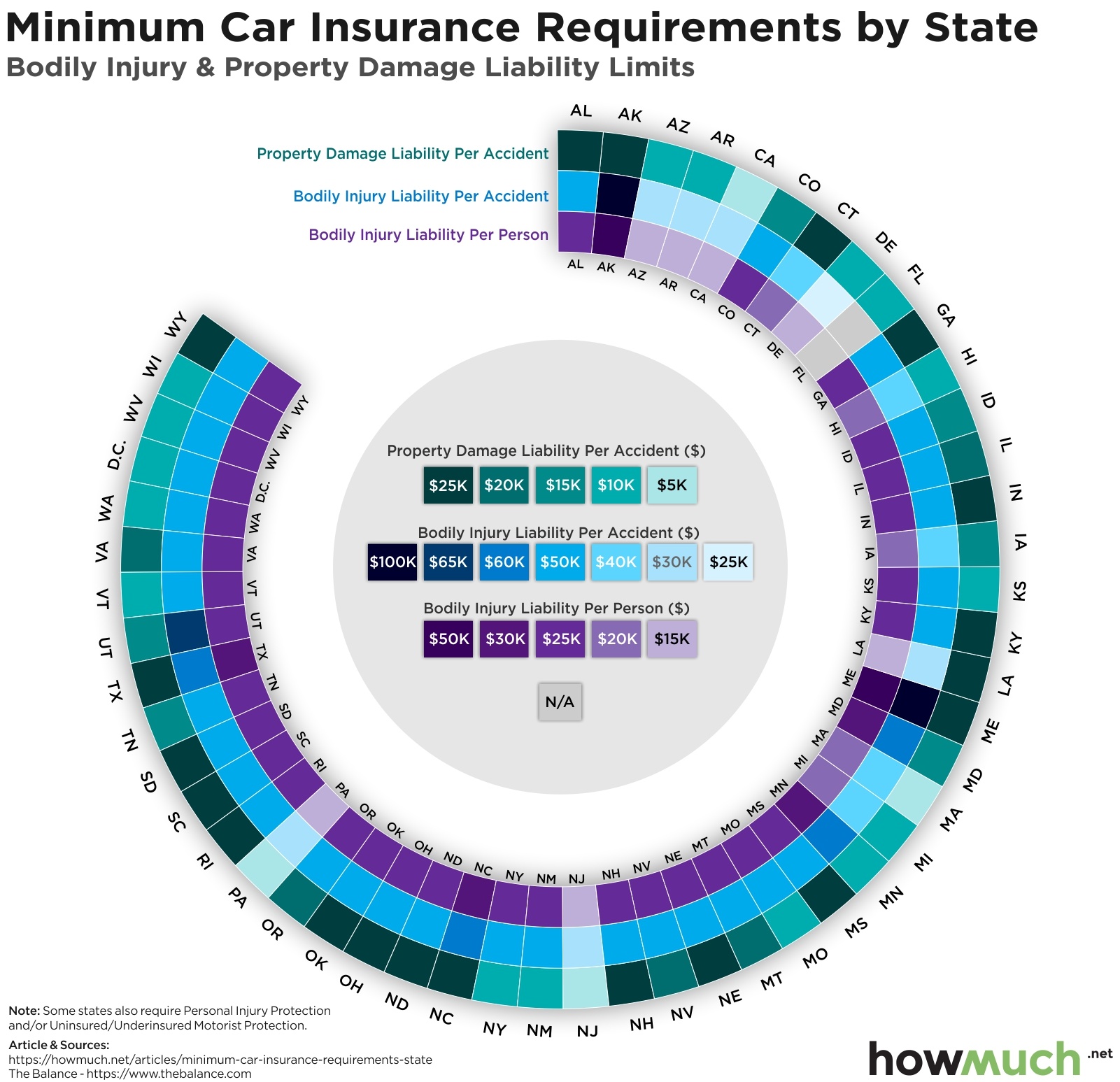

The region where you reside plays a significant role in determining your auto insurance premium. Insurance rates can vary widely between states, counties, and even cities. This variation is primarily due to differences in traffic density, accident rates, and local laws. For instance, urban areas with higher populations and congestion often result in increased insurance costs due to the elevated risk of accidents.

2. Vehicle Type and Usage

The make, model, and year of your vehicle significantly impact your insurance premium. Sports cars, luxury vehicles, and SUVs generally attract higher premiums due to their higher repair costs and greater risk of accidents. Additionally, the primary purpose of your vehicle (commuting, leisure, or business) and the average mileage you cover annually are factors that insurance companies consider when calculating rates.

3. Driver Profile

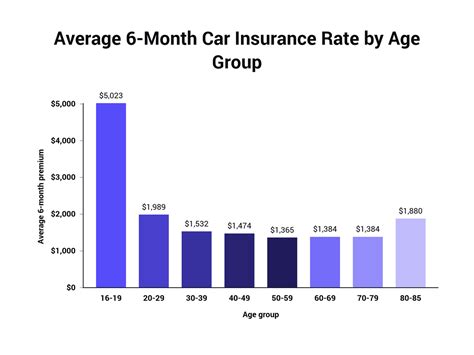

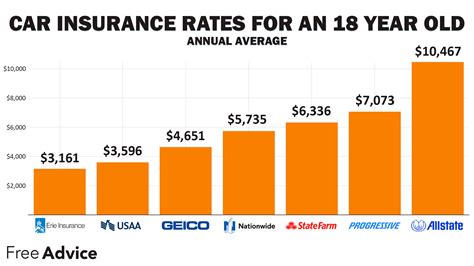

Your driving history and personal characteristics are crucial in determining your insurance premium. Younger drivers, especially those under 25 years old, often face higher premiums due to their lack of driving experience. Insurance companies also consider your gender, marital status, and credit score when assessing risk. A clean driving record with no accidents or traffic violations can lead to lower premiums, while a history of accidents or claims may result in higher costs.

4. Coverage and Deductibles

The level of coverage you choose and the deductibles you select directly impact your insurance premium. Comprehensive and collision coverage, which protect against damage to your vehicle, typically increase premiums. On the other hand, higher deductibles can lower your premium, as you’ll be responsible for a larger portion of the costs in the event of a claim. It’s essential to strike a balance between coverage and affordability to find the right insurance plan for your needs.

5. Claims History

Your past claims history is a significant factor in determining your insurance premium. Insurance companies closely monitor the number and severity of claims you’ve made in the past. Frequent claims, especially those resulting from at-fault accidents, can lead to higher premiums or even non-renewal of your policy. Maintaining a safe driving record and avoiding accidents can help keep your insurance costs down over time.

Average Auto Insurance Premiums

The average auto insurance premium in the United States varies widely depending on the factors mentioned above. According to recent data from the Insurance Information Institute, the average annual cost of auto insurance in the U.S. is around $1,674. However, it’s important to note that this figure is just an average, and actual premiums can be significantly higher or lower based on individual circumstances.

| Region | Average Annual Premium |

|---|---|

| Northeast | $1,569 |

| Midwest | $1,258 |

| South | $1,629 |

| West | $1,739 |

It's worth noting that these averages are subject to change over time due to various factors, including economic conditions, legislative changes, and natural disasters. It's always recommended to obtain quotes from multiple insurance providers to get a clear understanding of the premiums applicable to your specific situation.

State-Specific Average Premiums

To provide a more detailed view, here are the average annual auto insurance premiums for some of the most populous states in the U.S.:

| State | Average Annual Premium |

|---|---|

| California | $1,776 |

| Texas | $1,488 |

| New York | $1,794 |

| Florida | $1,632 |

| Illinois | $1,296 |

| Pennsylvania | $1,440 |

Factors Influencing State-Level Premiums

The differences in average premiums between states can be attributed to various factors, including:

- Traffic and Accident Rates: States with higher traffic volumes and more frequent accidents tend to have higher insurance premiums.

- Population Density: Urban areas with dense populations often result in increased insurance costs due to higher traffic congestion and accident risks.

- Legislative Differences: Each state has its own set of laws and regulations governing auto insurance, which can impact premium rates.

- Weather and Natural Disasters: States prone to severe weather conditions or natural disasters may have higher insurance costs due to increased risk of vehicle damage.

Tips for Lowering Your Auto Insurance Premium

While auto insurance premiums are influenced by numerous factors, there are steps you can take to potentially reduce your insurance costs:

1. Shop Around

Obtain quotes from multiple insurance providers to compare rates and coverage options. Shopping around can help you identify the most affordable and suitable insurance plan for your needs.

2. Maintain a Clean Driving Record

A safe driving history is crucial in keeping your insurance premiums low. Avoid accidents, traffic violations, and reckless driving to maintain a positive record.

3. Choose a Higher Deductible

Opting for a higher deductible can reduce your premium. However, it’s essential to ensure you can afford the higher deductible in the event of a claim.

4. Take Advantage of Discounts

Many insurance companies offer discounts for various reasons, such as safe driving, bundling multiple policies, or installing anti-theft devices in your vehicle. Be sure to inquire about available discounts when obtaining quotes.

5. Consider Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive insurance, allows premiums to be calculated based on your actual driving habits and mileage. This can be a cost-effective option for low-mileage drivers.

The Future of Auto Insurance

The auto insurance industry is continuously evolving, and several trends are shaping its future. Here are some key developments to watch out for:

1. Telematics and Usage-Based Insurance

Telematics technology, which uses sensors and GPS data to track driving behavior, is becoming increasingly popular. Usage-based insurance plans that utilize telematics can offer personalized premiums based on individual driving habits, potentially providing significant savings for safe drivers.

2. Autonomous Vehicles and Liability

The rise of autonomous vehicles presents new challenges for auto insurance. As self-driving cars become more prevalent, the question of liability in the event of an accident will shift from individual drivers to vehicle manufacturers and software developers. This shift could lead to significant changes in insurance coverage and premiums.

3. Data-Driven Pricing

Insurance companies are leveraging advanced data analytics to more accurately assess risk and price insurance policies. This data-driven approach allows insurers to offer personalized premiums based on individual driving behaviors and risk profiles, potentially leading to more fair and accurate pricing.

4. Digital Transformation

The insurance industry is undergoing a digital transformation, with an increasing emphasis on online services, mobile apps, and automated claims processing. This shift towards digitization can lead to more efficient and convenient insurance experiences for consumers, potentially reducing costs and improving customer satisfaction.

5. Enhanced Safety Features

Advancements in vehicle safety technology, such as advanced driver-assistance systems (ADAS) and collision avoidance systems, are becoming more common in modern vehicles. These safety features can reduce the risk of accidents and lead to lower insurance premiums for drivers who opt for vehicles equipped with such technologies.

Conclusion

Understanding the average auto insurance premium is just the first step in making informed decisions about your coverage. By considering the various factors that influence insurance costs and taking proactive steps to lower your premium, you can find an insurance plan that offers the right balance of coverage and affordability. Additionally, staying informed about industry trends and advancements can help you navigate the evolving world of auto insurance with confidence.

How often should I review my auto insurance policy and premiums?

+

It’s a good practice to review your auto insurance policy and premiums annually, especially when your policy is up for renewal. This allows you to assess whether your coverage still meets your needs and if there are more affordable options available. Additionally, major life changes, such as moving to a new location or purchasing a new vehicle, should prompt a review of your insurance policy to ensure it aligns with your current circumstances.

Can I negotiate my auto insurance premium?

+

While insurance premiums are largely determined by various factors, you can negotiate certain aspects of your policy. For example, you can discuss your coverage limits, deductibles, and optional add-ons with your insurance provider. Additionally, if you have multiple policies with the same insurer, you may be eligible for a loyalty discount or bundle discount, which can reduce your overall premium.

What is the difference between liability-only coverage and full coverage?

+

Liability-only coverage, also known as basic or minimum coverage, provides protection for the other party involved in an accident that you are at fault for. It covers their medical expenses, vehicle repairs, and other related costs. Full coverage, on the other hand, includes liability coverage as well as comprehensive and collision coverage. Comprehensive coverage protects against non-collision incidents like theft, vandalism, or natural disasters, while collision coverage covers damage to your vehicle in an accident.

How do insurance companies determine my insurance group and rating?

+

Insurance companies use various factors to determine your insurance group and rating, which directly impact your premium. These factors include your age, gender, marital status, driving record, credit score, and the type of vehicle you drive. Insurance groups are classifications that group together drivers with similar risk profiles, while the rating is a numerical value assigned to your policy, reflecting the level of risk associated with your driving behavior and circumstances.