Affordable Health Insurance New Jersey

Navigating Affordable Health Insurance in New Jersey: A Comprehensive Guide

For residents of New Jersey, securing affordable health insurance is a crucial step towards safeguarding their well-being and financial stability. With a diverse range of plans and options available, understanding the intricacies of the healthcare market is essential. This guide aims to provide a comprehensive overview, offering insights and strategies to navigate the complex world of health insurance in the Garden State.

Understanding the New Jersey Health Insurance Landscape

New Jersey boasts a robust healthcare system, offering a multitude of insurance options to cater to the diverse needs of its residents. From major medical plans to specialized coverage, the state provides a comprehensive range of choices. However, with great variety comes the challenge of selecting the right plan that offers both quality coverage and affordability.

One of the key advantages of New Jersey's healthcare market is the presence of state-specific initiatives aimed at making insurance more accessible. These initiatives, such as the New Jersey FamilyCare program, provide low-cost or no-cost coverage to eligible residents, ensuring that healthcare is within reach for those in need.

Key Considerations for Affordable Health Insurance

When seeking affordable health insurance in New Jersey, there are several critical factors to keep in mind. Firstly, understanding the coverage needs of oneself and one’s family is essential. This includes considering factors like pre-existing conditions, regular medication requirements, and the need for specialized care.

Secondly, the cost of premiums plays a pivotal role in selecting an affordable plan. While it's tempting to opt for the lowest premium, it's crucial to balance this with the deductible and out-of-pocket costs, which can significantly impact overall expenses. Plans with higher premiums often come with lower deductibles, making them more cost-effective in the long run.

Lastly, network providers and coverage areas are key considerations. Choosing a plan with a wide network ensures access to a broad range of healthcare services and providers, reducing the likelihood of unexpected costs.

| Factor | Consideration |

|---|---|

| Coverage Needs | Assess individual and family health requirements |

| Premium Costs | Balance premium, deductible, and out-of-pocket expenses |

| Network Providers | Choose a plan with a wide network for comprehensive coverage |

Exploring Affordable Options: A Deep Dive

In the quest for affordable health insurance, New Jersey residents have a variety of avenues to explore. One of the most well-known options is the Health Insurance Marketplace, also known as the Affordable Care Act (ACA) marketplace. This platform offers a range of plans with varying levels of coverage and costs, providing a transparent and accessible way to compare and select insurance.

Marketplace Plans: A Detailed Analysis

The ACA marketplace in New Jersey offers four primary plan categories: Bronze, Silver, Gold, and Platinum. Each category represents a different level of coverage, with Bronze plans typically offering the lowest premiums but higher out-of-pocket costs, and Platinum plans offering the opposite.

For instance, a Silver plan might be an ideal choice for those seeking a balance between premiums and deductibles. These plans often provide coverage for a wide range of services, including preventive care, making them a popular choice for many New Jersey residents.

Furthermore, the marketplace also offers Catastrophic plans, which are designed for individuals under 30 or those with a hardship exemption. These plans provide basic coverage and can be a cost-effective option for those who don't anticipate frequent healthcare needs.

| Plan Type | Coverage Level | Suitability |

|---|---|---|

| Bronze | Low coverage, low premiums | For those with minimal healthcare needs |

| Silver | Moderate coverage, balanced costs | A popular choice for many residents |

| Gold | High coverage, higher premiums | Ideal for those with significant healthcare requirements |

| Platinum | Highest coverage, lowest out-of-pocket costs | For those seeking comprehensive coverage |

| Catastrophic | Basic coverage, low premiums | Suitable for young adults or those with exemptions |

Special Programs and Subsidies: A Helping Hand

New Jersey recognizes the financial strain that healthcare can impose and has implemented several programs to assist residents in obtaining affordable coverage. These programs, often in the form of subsidies or tax credits, can significantly reduce the cost of insurance, making it more accessible.

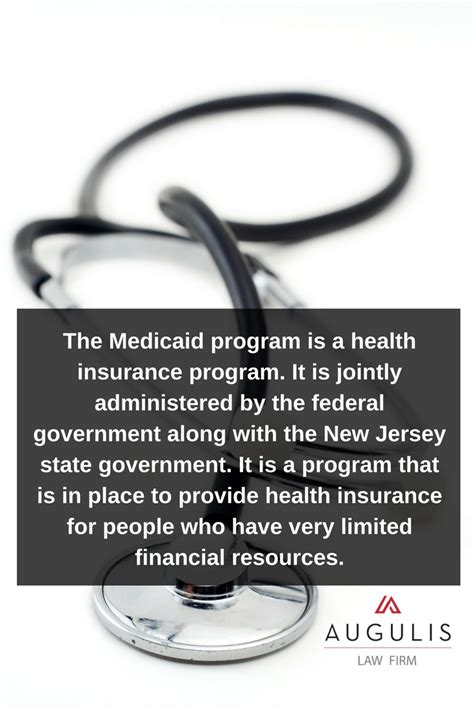

New Jersey FamilyCare: A Comprehensive Program

New Jersey FamilyCare is a state-funded program designed to provide low-cost or no-cost health coverage to eligible residents. This program is particularly beneficial for families, children, pregnant women, and individuals with disabilities, offering a range of services including doctor visits, hospital care, and prescription medications.

To qualify for New Jersey FamilyCare, individuals must meet certain income requirements. The program offers different levels of coverage based on income, ensuring that even those with lower incomes can access quality healthcare.

Premium Tax Credits: Reducing the Financial Burden

For those purchasing health insurance through the ACA marketplace, premium tax credits can provide significant financial relief. These credits are based on income and family size, and they directly reduce the monthly premium cost. The aim is to make insurance more affordable, especially for middle- and low-income households.

To determine eligibility for premium tax credits, individuals can use the HealthCare.gov premium estimator tool. This tool provides an estimate of potential savings, helping residents make informed decisions about their insurance choices.

Navigating the Enrollment Process

The enrollment process for health insurance in New Jersey can seem daunting, but with the right guidance, it can be a straightforward and efficient experience. Whether enrolling through the ACA marketplace or a private insurer, understanding the steps and timelines is crucial.

Open Enrollment Period: A Critical Window

In New Jersey, the Open Enrollment Period typically runs from November 1st to December 15th each year. During this window, individuals can enroll in a new plan, switch plans, or make changes to their existing coverage. It’s important to note that outside of this period, enrollment is generally only possible in specific circumstances, such as a qualifying life event.

To ensure a smooth enrollment process, it's advisable to gather all necessary documents beforehand. This includes proof of identity, income, and residency. Having these documents ready can expedite the process and reduce potential delays.

Special Enrollment Periods: Understanding the Exceptions

Outside of the Open Enrollment Period, individuals may still be able to enroll in health insurance if they experience a qualifying life event. These events, such as marriage, birth of a child, or loss of other health coverage, trigger a Special Enrollment Period (SEP), allowing for enrollment outside the regular window.

It's crucial to understand the specific qualifying events and the timeline for SEPs. Generally, individuals have 60 days from the qualifying event to enroll, so being aware of these deadlines is essential for seamless coverage transitions.

Future Outlook and Industry Insights

The landscape of health insurance in New Jersey is continually evolving, influenced by policy changes, market trends, and technological advancements. As we look ahead, several key trends and developments are shaping the future of affordable healthcare in the state.

The Impact of Telehealth and Digital Innovations

The rise of telehealth services has revolutionized the way healthcare is delivered, offering convenience and accessibility to patients. In New Jersey, the adoption of telehealth has been rapid, with many insurers now covering virtual visits. This trend is expected to continue, with insurers investing in digital platforms and technologies to enhance the patient experience and reduce costs.

Policy Changes and Market Dynamics

Policy decisions at the state and federal levels can significantly impact the cost and availability of health insurance. In New Jersey, ongoing efforts to expand coverage and improve affordability, such as the implementation of reinsurance programs, are expected to stabilize premiums and enhance access to care. However, federal policy changes, such as potential modifications to the ACA, could introduce new challenges and opportunities.

Industry Innovations: A Focus on Value and Quality

The healthcare industry in New Jersey is witnessing a shift towards value-based care models, where payment is tied to the quality and outcomes of care provided. This approach is expected to drive down costs and improve patient experiences. Additionally, the integration of data analytics and artificial intelligence is enhancing the precision and efficiency of healthcare delivery, further contributing to cost reductions.

As the industry continues to innovate, New Jersey residents can anticipate improved access to affordable, high-quality healthcare. The state's commitment to expanding coverage and its focus on value-based care bode well for the future, ensuring that residents can obtain the care they need without straining their finances.

How can I determine if I’m eligible for New Jersey FamilyCare?

+Eligibility for New Jersey FamilyCare is primarily based on income. To determine your eligibility, you can use the online NJ FamilyCare Eligibility Tool or contact the program directly. They will guide you through the process and help you understand if you qualify for any of the program’s coverage levels.

What happens if I miss the Open Enrollment Period?

+If you miss the Open Enrollment Period, you may still be able to enroll in health insurance if you experience a qualifying life event. These events trigger a Special Enrollment Period (SEP), allowing you to enroll outside the regular window. It’s important to be aware of the specific qualifying events and timelines for SEPs to ensure you don’t miss out on coverage.

Are there any resources to help me compare health insurance plans in New Jersey?

+Yes, there are several resources available to help you compare health insurance plans in New Jersey. The HealthCare.gov website provides a comprehensive platform to compare plans, understand coverage details, and estimate costs. Additionally, the New Jersey FamilyCare website offers information on state-specific programs and eligibility guidelines.