Cheapest Cheapest Car Insurance

Finding the cheapest car insurance can be a daunting task, as it often involves sifting through numerous options and comparing quotes. However, with the right approach and understanding of the factors that influence insurance costs, you can secure affordable coverage for your vehicle. In this comprehensive guide, we will explore the various aspects of car insurance, uncover the secrets to obtaining the lowest rates, and provide valuable insights to help you make informed decisions.

Understanding the Factors That Affect Car Insurance Costs

The cost of car insurance is influenced by a multitude of factors, each playing a significant role in determining your premium. By familiarizing yourself with these factors, you can better understand how insurance companies calculate rates and identify areas where you might be able to save.

Vehicle Type and Usage

The type of vehicle you drive and how you use it are key factors in insurance pricing. Generally, newer and more expensive cars tend to have higher insurance costs due to their higher replacement value and advanced features. Additionally, the purpose for which you use your vehicle, such as commuting, leisure, or business, can also impact your insurance rates. For instance, if you primarily use your car for business purposes, your insurance premiums may be higher due to the increased risk associated with business-related travel.

| Vehicle Type | Average Annual Insurance Cost |

|---|---|

| Economy Car | $800 - $1,200 |

| Mid-Range Sedan | $1,000 - $1,500 |

| Luxury SUV | $1,500 - $2,500 |

| Sports Car | $2,000 - $3,000 |

Note: The above figures are approximate and can vary based on location, driving history, and other factors.

Driver’s Profile and History

Your personal driving record and history are crucial in determining your insurance rates. Insurance companies carefully evaluate your age, gender, driving experience, and past claims or violations. Younger drivers, especially those under 25, often face higher insurance costs due to their lack of experience on the road. Similarly, a history of accidents, traffic violations, or insurance claims can lead to increased premiums. Maintaining a clean driving record and avoiding reckless driving behaviors can significantly impact your insurance costs over time.

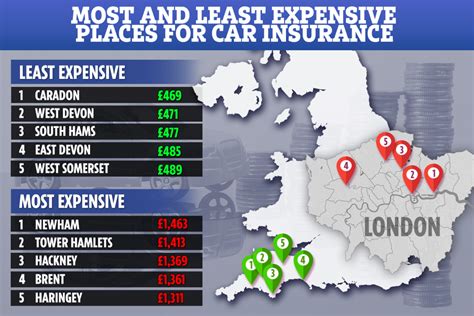

Location and Risk Factors

The area where you live and work plays a significant role in insurance pricing. Insurance companies consider various risk factors associated with different locations, including crime rates, accident frequency, and the likelihood of natural disasters. Areas with higher crime rates or a history of frequent accidents may result in higher insurance premiums. Additionally, if you live in a region prone to natural disasters like hurricanes or earthquakes, your insurance costs may reflect the increased risk.

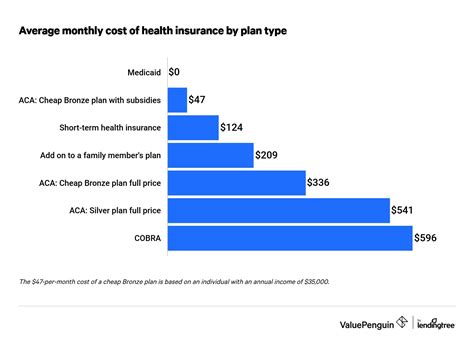

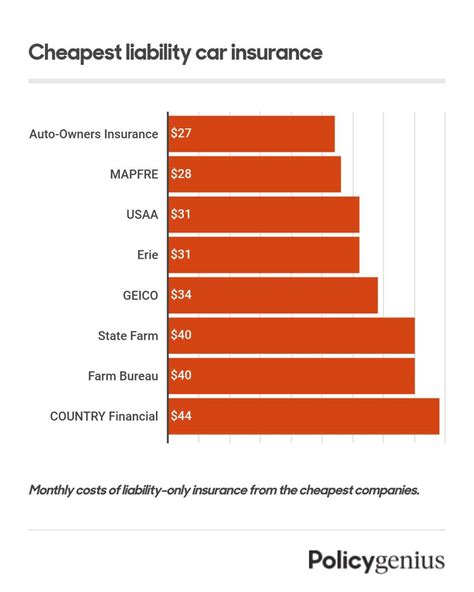

Coverage Options and Limits

The level of coverage you choose and the policy limits you select also affect your insurance costs. Comprehensive and collision coverage, which protect against damage to your vehicle, typically add to the overall cost of your policy. Conversely, liability-only coverage, which only covers damage to other vehicles or property in an accident you cause, can be more affordable. It’s important to carefully assess your needs and choose coverage options that provide adequate protection without exceeding your budget.

Discounts and Special Programs

Insurance companies often offer a range of discounts and special programs to attract customers and encourage safe driving behaviors. These discounts can significantly reduce your insurance costs. Some common discounts include safe driver discounts, multi-policy discounts (bundling car insurance with other types of insurance), good student discounts, and loyalty discounts for long-term customers. Additionally, some insurers provide discounts for vehicles equipped with advanced safety features or for drivers who complete defensive driving courses.

Strategies to Find the Cheapest Car Insurance

Now that we’ve explored the factors influencing car insurance costs, let’s delve into practical strategies to help you find the cheapest insurance options available to you.

Shop Around and Compare Quotes

One of the most effective ways to find cheap car insurance is to shop around and compare quotes from multiple insurance providers. Each insurer uses its own formula to calculate premiums, so the rates offered can vary significantly. By obtaining quotes from various companies, you can identify the insurer that offers the best combination of coverage and cost for your specific needs.

To make the comparison process easier, consider using online insurance comparison tools or contacting insurance brokers who can provide quotes from multiple insurers. These tools can save you time and effort by presenting a range of options in one place.

Adjust Your Coverage Levels

Reviewing your current coverage levels and making adjustments can potentially lower your insurance costs. Assess whether you have the right amount of coverage for your needs and consider reducing coverage in areas where you feel comfortable taking on more risk. For example, if you have an older vehicle with low market value, you might consider removing comprehensive and collision coverage, as the cost of these coverages may outweigh the benefits.

However, it's essential to strike a balance between saving money and maintaining adequate protection. Ensure you have enough liability coverage to protect your assets in the event of an accident. Consult with an insurance professional to understand the implications of changing your coverage levels and make informed decisions.

Explore Group and Affinity Discounts

Many insurance companies offer group or affinity discounts to certain organizations or associations. These discounts are often available to members of professional organizations, alumni associations, or employee groups. By affiliating yourself with these groups, you may be eligible for reduced insurance rates. Check with your employer, alumni office, or professional association to see if they offer any insurance-related benefits or discounts.

Improve Your Driving Record

Maintaining a clean driving record is crucial for keeping your insurance costs low. Insurance companies closely monitor your driving history, and a single traffic violation or accident can significantly impact your premiums. Focus on practicing safe driving behaviors, obeying traffic laws, and avoiding risky maneuvers. By demonstrating responsible driving habits, you can improve your chances of obtaining lower insurance rates.

Additionally, consider completing defensive driving courses, as some insurers offer discounts to drivers who have completed these programs. These courses can help you enhance your driving skills and may even lead to a reduction in your insurance premiums.

Utilize Telematics and Usage-Based Insurance

Telematics and usage-based insurance programs are innovative approaches that allow insurance companies to assess your driving behavior and offer personalized insurance rates. With telematics, your vehicle is equipped with a device that tracks your driving habits, such as speeding, hard braking, and time of day driven. Based on this data, insurers can offer discounts to drivers who exhibit safe driving behaviors.

Usage-based insurance programs, on the other hand, focus on the actual usage of your vehicle. These programs often provide discounts for low-mileage drivers or those who primarily use their vehicles for commuting. By opting into these programs, you can potentially lower your insurance costs by demonstrating responsible and limited driving habits.

Conclusion: Finding the Right Balance

Finding the cheapest car insurance involves a careful balance between obtaining adequate coverage and minimizing costs. By understanding the factors that influence insurance rates and implementing the strategies outlined above, you can navigate the insurance market with confidence. Remember to shop around, compare quotes, and make informed decisions about your coverage levels.

Additionally, stay proactive in maintaining a clean driving record, exploring discounts, and utilizing innovative insurance programs. By doing so, you can secure the best value for your car insurance and protect your finances without compromising on the protection you need.

How often should I compare car insurance quotes?

+It’s recommended to compare car insurance quotes at least once a year, especially when your policy is up for renewal. Insurance rates can fluctuate, and by shopping around annually, you can ensure you’re getting the most competitive rates available.

Can I get car insurance without a driving record or history?

+Yes, it is possible to obtain car insurance even if you don’t have a driving record or history. However, insurance companies may require additional information, such as a detailed application or a comprehensive assessment of your driving habits, to determine your insurance rates.

Are there any alternative insurance options for high-risk drivers?

+Yes, there are specialized insurance programs for high-risk drivers, often referred to as non-standard insurance. These programs cater to drivers with a history of accidents, violations, or other factors that make them a higher risk for insurers. While these policies may have higher premiums, they provide coverage for those who may have difficulty obtaining insurance through standard channels.