Health Insurance Providers In California

The health insurance landscape in California is vast and diverse, catering to the needs of its residents and their varying healthcare requirements. With a population of over 39 million, California boasts a robust healthcare system, and understanding the options provided by various health insurance companies is crucial for residents to make informed choices about their coverage.

Comprehensive Overview of California’s Health Insurance Market

California’s health insurance market is a complex ecosystem, offering a wide range of plans and providers. From major national carriers to regional and local health plans, the state provides an array of choices, ensuring that residents can find coverage tailored to their specific needs. This article delves into the key players, plan options, and unique features of health insurance in California, providing an in-depth analysis to assist individuals and families in navigating this essential aspect of their lives.

Key Health Insurance Providers in California

California’s health insurance market is dominated by a few large national carriers and a host of regional providers. Here’s a breakdown of some of the key players:

- Blue Shield of California: A not-for-profit health plan, Blue Shield offers a comprehensive range of health insurance products, including individual, family, and Medicare plans. With a focus on community engagement and access to quality healthcare, Blue Shield has a strong presence throughout the state.

- Kaiser Permanente: Known for its integrated healthcare delivery system, Kaiser Permanente provides coordinated care through its own network of doctors, hospitals, and medical facilities. This approach ensures seamless care and has made Kaiser a preferred choice for many Californians.

- Anthem Blue Cross: A subsidiary of one of the largest health insurers in the U.S., Anthem Blue Cross offers a wide array of health plans in California, including individual, family, and Medicare options. They are known for their competitive pricing and extensive network of providers.

- Health Net: A subsidiary of Centene Corporation, Health Net provides health coverage to over 3 million Californians. They offer a variety of plans, including Medi-Cal, Medicare, and individual and family health plans, ensuring accessibility and comprehensive coverage.

- UnitedHealthcare: With a nationwide reach, UnitedHealthcare provides a range of health insurance plans in California. They offer individual, family, and Medicare plans, along with specialty plans for dental, vision, and prescription drugs, ensuring a holistic approach to healthcare coverage.

| Provider | Plan Types |

|---|---|

| Blue Shield of California | Individual, Family, Medicare |

| Kaiser Permanente | Integrated Care Plans |

| Anthem Blue Cross | Individual, Family, Medicare |

| Health Net | Medi-Cal, Medicare, Individual, Family |

| UnitedHealthcare | Individual, Family, Medicare, Specialty Plans |

Health Insurance Plan Options in California

California offers a variety of health insurance plans to cater to the diverse needs of its residents. Here’s an overview of the key plan types available:

Individual and Family Plans

Individual and family health plans are designed for those who are not eligible for or do not have access to employer-sponsored health insurance. These plans provide coverage for essential health benefits, including doctor visits, hospital stays, prescription drugs, and more. In California, there is a wide range of individual and family plans available, with varying levels of coverage and premium costs.

Medicare Plans

For residents aged 65 and over, or those with certain disabilities, Medicare plans are a crucial component of the health insurance landscape. In California, Medicare plans are offered by a variety of providers, including the major carriers mentioned earlier. These plans typically include Original Medicare (Parts A and B) and often additional coverage like Part D (prescription drug plans) and Medigap (supplemental insurance plans) to fill gaps in Original Medicare coverage.

Medi-Cal (Medicaid)

Medi-Cal is California’s Medicaid program, providing health coverage to low-income individuals and families, pregnant women, people with disabilities, and the elderly. This program is a vital safety net, ensuring access to essential healthcare services for those who might not otherwise be able to afford it. Medi-Cal covers a wide range of services, including doctor visits, hospital stays, prescription drugs, and more.

Employer-Sponsored Plans

Many Californians receive health insurance through their employers. These employer-sponsored plans offer a range of benefits and are often a cost-effective way for employees to access comprehensive healthcare. The specific coverage and benefits of these plans can vary widely depending on the employer and the plan chosen.

Unique Features and Benefits of California Health Insurance Plans

California’s health insurance plans offer a range of unique features and benefits to residents. Here are some key aspects to consider:

Network of Providers

Health insurance plans in California often have extensive networks of providers, ensuring residents have access to a wide range of healthcare professionals and facilities. These networks can include primary care physicians, specialists, hospitals, and other healthcare providers, giving residents flexibility and choice when seeking care.

Preventive Care Coverage

Many health insurance plans in California provide comprehensive coverage for preventive care services. This includes annual check-ups, screenings, immunizations, and other services aimed at maintaining health and preventing illnesses. By focusing on preventive care, these plans help residents stay healthy and catch potential health issues early on.

Prescription Drug Coverage

Prescription drug coverage is a critical component of many health insurance plans in California. This coverage ensures that residents have access to the medications they need, often at discounted rates. Plans typically have a list of covered drugs, known as a formulary, which can vary based on the plan and the insurer.

Dental and Vision Coverage

While not always included in standard health insurance plans, dental and vision coverage is often offered as an additional benefit or as a separate plan. These plans can provide coverage for a range of dental and vision services, including regular check-ups, cleanings, and vision corrections, ensuring that residents can maintain their overall health and well-being.

Choosing the Right Health Insurance Plan in California

With so many options available, choosing the right health insurance plan in California can be a complex decision. Here are some key factors to consider:

- Your Healthcare Needs: Assess your personal and family healthcare needs, including any ongoing conditions, medications, or anticipated healthcare requirements.

- Network of Providers: Ensure that your preferred healthcare providers are included in the plan's network to avoid out-of-network costs.

- Coverage and Benefits: Review the plan's coverage and benefits to ensure it aligns with your needs, including preventive care, prescription drug coverage, and any additional benefits like dental or vision.

- Cost and Premium: Consider the plan's premium costs, deductibles, copayments, and out-of-pocket maximums to understand the financial implications of the plan.

- Customer Service and Reputation: Research the insurer's customer service reputation and track record to ensure they provide a high level of service and support.

How do I know if I'm eligible for Medi-Cal in California?

+Eligibility for Medi-Cal in California depends on various factors, including age, income, disability status, and family size. You can check your eligibility by visiting the Covered California website or by contacting the California Department of Health Care Services.

What is the difference between an HMO and a PPO health plan in California?

+HMO (Health Maintenance Organization) plans typically require you to choose a primary care physician and obtain referrals for specialist care. They often have lower out-of-pocket costs but a more restricted network of providers. PPO (Preferred Provider Organization) plans offer more flexibility, allowing you to see any in-network provider without a referral, but they may have higher out-of-pocket costs.

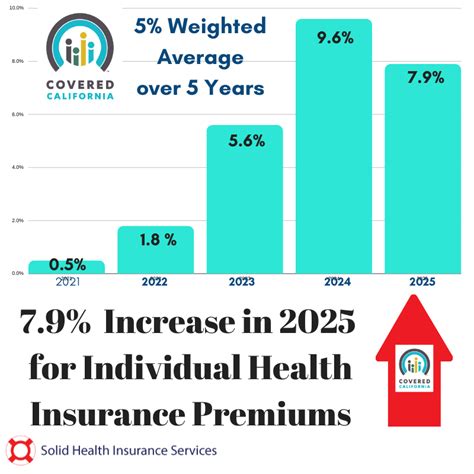

Are there any discounts or subsidies available for health insurance in California?

+Yes, California offers a variety of discounts and subsidies to make health insurance more affordable. These include income-based subsidies for individuals and families purchasing insurance through Covered California, as well as other state-specific programs and discounts offered by various health insurance providers.

California’s health insurance market is a dynamic and essential component of the state’s healthcare system, offering a wide range of options to meet the diverse needs of its residents. By understanding the key providers, plan options, and unique features, Californians can make informed decisions about their health coverage, ensuring access to quality healthcare.