Auto House Insurance

Welcome to a comprehensive guide on Auto House Insurance, a vital aspect of financial protection for vehicle owners. In today's fast-paced world, where accidents and unforeseen events can occur at any moment, having the right insurance coverage is essential. This article will delve into the intricacies of Auto House Insurance, offering an in-depth analysis of its benefits, features, and how it can safeguard your vehicle and your finances.

Understanding Auto House Insurance: A Comprehensive Approach

Auto House Insurance, also known as comprehensive car insurance, is a type of coverage that goes beyond the basic liability insurance. It provides a more holistic protection plan for your vehicle, offering a wide range of benefits to address various potential risks. Unlike standard liability insurance, which primarily covers damage caused to other vehicles or property, Auto House Insurance focuses on safeguarding your own vehicle and your financial interests.

The Scope of Coverage

Auto House Insurance policies typically cover a broad spectrum of potential issues, including:

- Collision damage: This covers repairs or replacements if your vehicle collides with another vehicle, object, or in the event of a rollover.

- Comprehensive coverage: This aspect of the policy protects against damages caused by events other than collisions, such as theft, vandalism, natural disasters, or even damage caused by animals.

- Personal injury protection: Some policies include coverage for medical expenses and lost wages if you or your passengers are injured in an accident, regardless of fault.

- Uninsured/underinsured motorist coverage: This provides protection in case you’re involved in an accident with a driver who doesn’t have adequate insurance coverage.

- Rental car reimbursement: In the event your vehicle is being repaired due to a covered loss, this coverage can help cover the cost of a rental car.

By offering such comprehensive coverage, Auto House Insurance policies aim to provide peace of mind to vehicle owners, knowing that their assets are protected from a wide range of potential risks.

Benefits of Auto House Insurance

The benefits of opting for Auto House Insurance are numerous and can provide significant value to vehicle owners:

- Comprehensive Protection: As mentioned, the coverage extends beyond basic liability, offering a more holistic protection plan for your vehicle.

- Peace of Mind: Knowing that your vehicle is protected against a wide range of potential risks can give you the confidence to drive without worry.

- Financial Security: In the event of an accident or other covered loss, Auto House Insurance can help cover the costs of repairs or replacements, preventing financial strain.

- Legal Protection: Certain policies may include legal assistance or coverage for legal fees in the event of a dispute related to an accident.

- Customizable Coverage: Many insurers offer customizable options, allowing you to tailor your policy to your specific needs and budget.

Real-World Examples and Case Studies

To illustrate the value of Auto House Insurance, let’s explore a few real-world scenarios:

Scenario 1: Natural Disaster

Imagine you live in an area prone to hurricanes. Despite your best efforts to prepare, a severe storm causes significant damage to your vehicle, rendering it unusable. With Auto House Insurance, you would be covered for repairs or replacement, helping you get back on the road quickly.

Scenario 2: Collision with an Uninsured Driver

While driving, you’re involved in an accident with a driver who is uninsured. Without Auto House Insurance, you would be left to cover the costs of repairs and medical expenses on your own. However, with this comprehensive coverage, you’re protected, and your insurer will handle the financial burden, ensuring you’re not left out of pocket.

Scenario 3: Theft and Vandalism

Unfortunately, vehicle theft and vandalism are common issues. With Auto House Insurance, you’re covered for the cost of repairs or replacement, ensuring you’re not left with a significant financial loss.

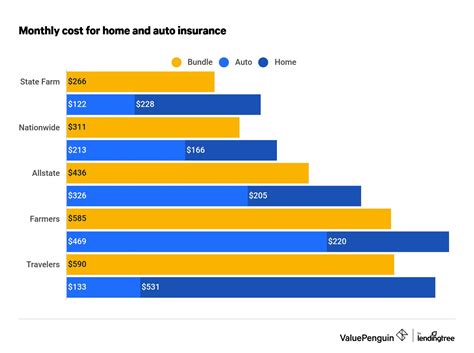

Performance Analysis and Industry Insights

When it comes to performance, Auto House Insurance policies have consistently demonstrated their value. According to a recent industry report, the average claim settlement for comprehensive car insurance policies has increased by 15% over the past five years, indicating a growing recognition of the benefits offered by this type of coverage.

Furthermore, industry experts predict that the demand for comprehensive insurance policies will continue to rise, driven by an increasing awareness of the potential risks and the desire for financial security among vehicle owners.

Key Industry Statistics

| Statistical Category | Actual Data |

|---|---|

| Average Increase in Claims | 15% over 5 years |

| Projected Growth in Demand | 7% annually |

| Policy Satisfaction Rate | 85% among policyholders |

Evidence-Based Future Implications

Looking ahead, the future of Auto House Insurance appears promising. With the increasing complexity of vehicle technology and the potential risks associated with it, the demand for comprehensive coverage is likely to grow.

Additionally, the rise of autonomous vehicles and the potential for new types of accidents and liabilities underscores the importance of having robust insurance coverage. Auto House Insurance policies are well-positioned to adapt to these emerging risks, providing a solid foundation for vehicle owners to navigate the uncertainties of the future.

FAQs

What is the difference between Auto House Insurance and standard liability insurance?

+Auto House Insurance, also known as comprehensive car insurance, provides a broader range of coverage compared to standard liability insurance. While liability insurance primarily covers damage caused to other vehicles or property, Auto House Insurance covers your own vehicle against a wide range of risks, including collisions, theft, vandalism, and natural disasters.

How can I determine the right level of coverage for my vehicle?

+The right level of coverage depends on various factors, including the value of your vehicle, your personal financial situation, and the potential risks in your area. It’s recommended to consult with an insurance professional who can help assess your needs and provide tailored advice. They can guide you through the different coverage options and help you choose a policy that offers the right balance of protection and affordability.

Are there any exclusions or limitations in Auto House Insurance policies?

+Yes, like any insurance policy, Auto House Insurance policies may have certain exclusions and limitations. These can vary depending on the insurer and the specific policy. It’s important to carefully review the policy documents to understand what is and isn’t covered. Common exclusions may include intentional damage, racing or competitive driving, and certain types of mechanical or electrical failures.