Better Auto Insurance

Welcome to an in-depth exploration of the world of auto insurance, a topic that impacts millions of vehicle owners around the globe. Auto insurance is a crucial aspect of vehicle ownership, providing financial protection and peace of mind. However, navigating the complex landscape of insurance policies, coverage options, and industry jargon can be a daunting task. In this comprehensive guide, we aim to demystify the process, offering expert insights and practical advice to help you make informed decisions about your auto insurance.

Understanding Auto Insurance: A Comprehensive Overview

Auto insurance is a contract between you, the policyholder, and the insurance company. It provides financial protection against physical damage and/or bodily injury resulting from traffic accidents and other incidents, such as theft or natural disasters. The specific coverage offered by an auto insurance policy can vary significantly, depending on the provider, the policy type, and the options chosen by the policyholder.

Key Components of Auto Insurance Policies

Every auto insurance policy is unique, but there are several standard components that are typically included. These include:

- Liability Coverage: This is the most basic form of auto insurance, covering the cost of damage you cause to others’ vehicles or property in an accident. It also covers bodily injury claims made against you by the other party involved in the accident.

- Comprehensive Coverage: This optional coverage protects against damage caused by events other than collisions, such as theft, vandalism, fire, or natural disasters. It provides a more comprehensive level of protection for your vehicle.

- Collision Coverage: This coverage is also optional and pays for repairs to your vehicle after an accident, regardless of who is at fault. It is particularly beneficial if you have a newer or more expensive vehicle.

- Personal Injury Protection (PIP): PIP coverage, often required in no-fault states, covers medical expenses and lost wages for you and your passengers, regardless of who caused the accident.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who either doesn’t have insurance or doesn’t have enough insurance to cover the damages.

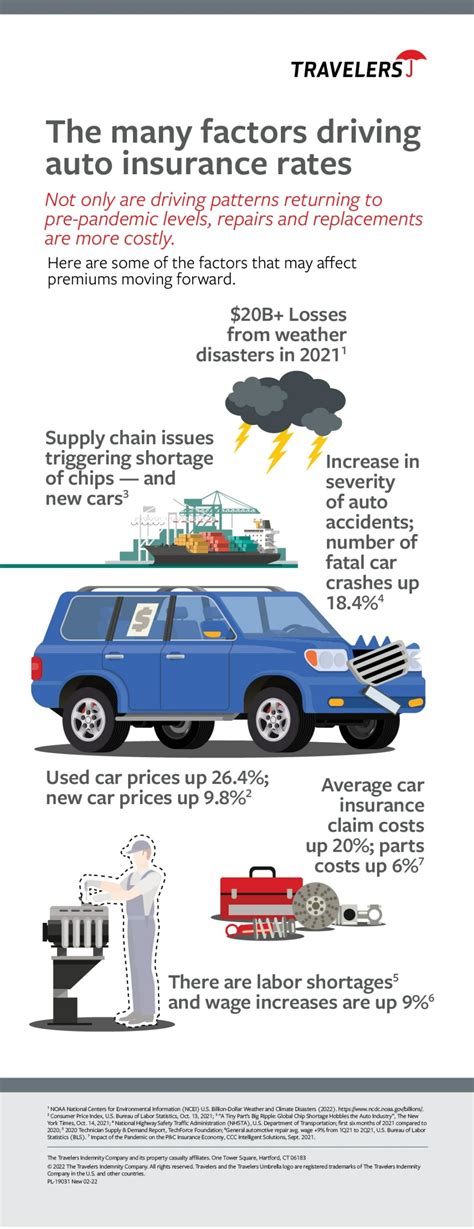

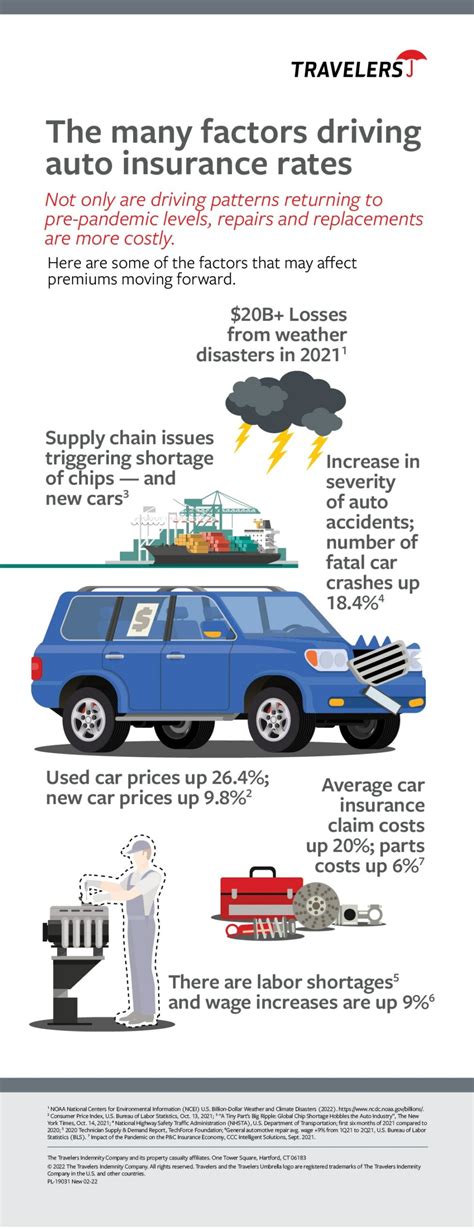

Factors Affecting Auto Insurance Rates

The cost of auto insurance is influenced by a multitude of factors, including:

- Vehicle Type: The make, model, and year of your vehicle can significantly impact your insurance rates. Generally, newer, more expensive vehicles, sports cars, and luxury vehicles tend to have higher premiums due to their higher replacement costs and potential for higher repair costs.

- Location: The area where you live and drive plays a role in determining your insurance rates. Urban areas with higher populations and higher rates of accidents and thefts typically have higher insurance premiums.

- Driving History: Your driving record is a major factor in determining your insurance rates. A clean driving record with no accidents or moving violations will generally result in lower premiums. On the other hand, a history of accidents or traffic violations can lead to higher insurance costs.

- Credit Score: Believe it or not, your credit score can also affect your insurance rates. Many insurance companies use credit-based insurance scores to assess the risk of insuring a driver. A higher credit score often corresponds to lower insurance premiums.

- Age and Gender: Young drivers, especially males, are statistically more likely to be involved in accidents, leading to higher insurance rates for this demographic. As you age and gain more driving experience, your insurance rates may decrease.

Tips for Choosing the Right Auto Insurance

Selecting the right auto insurance policy involves careful consideration of your needs and budget. Here are some tips to help you make an informed decision:

- Compare quotes from multiple insurance providers to find the best coverage at the most competitive price.

- Understand your coverage needs. Do you need comprehensive and collision coverage, or can you manage with liability-only coverage?

- Consider adding additional coverage options, such as rental car reimbursement or roadside assistance, if they align with your needs.

- Review your policy annually and adjust your coverage as your circumstances change. For instance, if you’ve paid off your vehicle, you may no longer need collision coverage.

- Take advantage of discounts. Many insurance companies offer discounts for safe driving, good grades, loyalty, and more.

| Discount Type | Description |

|---|---|

| Safe Driver Discount | Offered to drivers with a clean driving record, free of accidents and violations. |

| Multi-Policy Discount | Provided when you bundle multiple insurance policies, such as auto and home insurance, with the same provider. |

| Good Student Discount | Available to students who maintain a certain GPA or academic standing. |

| Anti-Theft Device Discount | Offered for vehicles equipped with anti-theft devices, such as alarms or tracking systems. |

| Loyalty Discount | Provided to long-term customers who have maintained their policy with the same provider for several years. |

The Future of Auto Insurance: Technology and Innovation

The auto insurance industry is undergoing significant transformation due to technological advancements and changing consumer expectations. Here’s a glimpse into the future of auto insurance:

Telematics and Usage-Based Insurance

Telematics devices, often installed in vehicles, collect real-time data about driving behavior, such as speed, acceleration, and mileage. This data is then used to calculate insurance premiums based on actual driving habits. Usage-Based Insurance (UBI) offers policyholders the opportunity to lower their premiums by demonstrating safe driving practices.

Connected Car Technology

The rise of connected car technology, where vehicles are equipped with advanced connectivity features, presents new opportunities for auto insurers. Insurers can leverage this data to offer more personalized insurance products, provide real-time driving feedback, and even offer rewards for safe driving.

Artificial Intelligence and Machine Learning

AI and machine learning algorithms are being used to analyze vast amounts of data, including driving behavior, weather patterns, and accident statistics, to predict and mitigate risks more effectively. These technologies can also streamline the claims process, making it faster and more efficient.

The Rise of Insurtech

Insurtech startups are disrupting the traditional auto insurance model by offering innovative, tech-driven solutions. These companies often leverage AI, blockchain, and other advanced technologies to provide more efficient, customer-centric insurance products and services.

Autonomous Vehicles and Insurance

The advent of autonomous vehicles is set to revolutionize the auto insurance industry. As self-driving cars become more prevalent, the focus of insurance coverage may shift from driver-related factors to vehicle-related risks, such as software failures or cyberattacks.

Conclusion: Empowering You to Make Informed Choices

Understanding auto insurance is a crucial step towards financial security and peace of mind. By familiarizing yourself with the various components of auto insurance policies, the factors influencing insurance rates, and the technological advancements shaping the future of the industry, you can make more informed decisions about your auto insurance needs.

Remember, auto insurance is not a one-size-fits-all proposition. Your unique circumstances, from the type of vehicle you drive to your driving history and location, will influence the coverage and cost of your insurance policy. It's essential to shop around, compare quotes, and tailor your policy to your specific needs.

As you navigate the complex world of auto insurance, keep in mind the valuable insights and expert advice presented in this guide. Whether you're a seasoned driver or a new car owner, making informed choices about your auto insurance is a crucial step towards safeguarding your financial well-being and ensuring your peace of mind on the road.

What is the difference between liability and comprehensive coverage in auto insurance?

+Liability coverage is the most basic form of auto insurance, covering the cost of damage you cause to others’ vehicles or property in an accident. It also covers bodily injury claims made against you by the other party involved. Comprehensive coverage, on the other hand, protects against damage caused by events other than collisions, such as theft, vandalism, fire, or natural disasters. It provides a more comprehensive level of protection for your vehicle.

How do my driving history and credit score impact my auto insurance rates?

+Your driving history and credit score are both significant factors in determining your auto insurance rates. A clean driving record with no accidents or moving violations will generally result in lower premiums. Conversely, a history of accidents or traffic violations can lead to higher insurance costs. Similarly, a higher credit score often corresponds to lower insurance premiums, as it indicates a lower risk profile.

What is usage-based insurance (UBI), and how can it benefit me?

+Usage-Based Insurance (UBI) is a type of auto insurance where premiums are calculated based on your actual driving behavior, as monitored by a telematics device installed in your vehicle. This means that if you demonstrate safe driving practices, you may be eligible for lower insurance premiums. UBI can be a great way to save money on your auto insurance if you’re a cautious and responsible driver.