How Much Will Insurance Increase After A Claim

Understanding how insurance rates can change after a claim is an important aspect of managing your financial well-being. The impact of a claim on your insurance premiums can vary significantly depending on several factors, and it's crucial to be aware of these potential changes to make informed decisions about your coverage.

Factors Influencing Insurance Premium Increases Post-Claim

When an insurance company processes a claim, it assesses the risk associated with the policyholder. This evaluation can lead to an increase in insurance premiums for future coverage. The magnitude of the premium increase is influenced by a combination of factors, including the type of insurance, the nature of the claim, and the policyholder’s history.

Type of Insurance

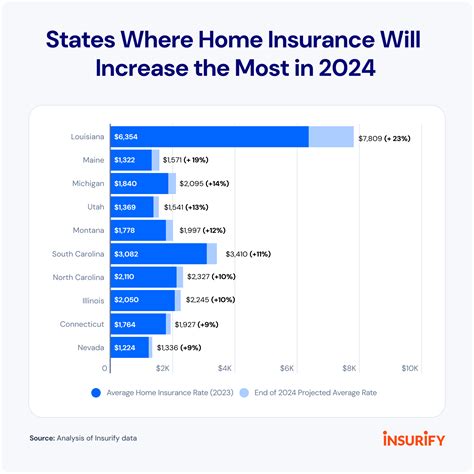

Different types of insurance policies have varying levels of risk and, consequently, different approaches to handling claims. For instance, auto insurance claims often result in more significant premium increases compared to homeowners’ insurance claims. This disparity arises from the higher frequency and cost of auto-related incidents. On the other hand, health insurance claims may not directly impact future premiums, as these policies are typically renewed annually, and rates are determined based on broader demographic and market factors.

Nature of the Claim

The specific details of a claim can greatly affect the potential premium increase. Claims that are deemed more severe or costly are likely to result in larger premium hikes. For instance, a car accident involving significant property damage or personal injury is more likely to lead to a substantial increase in auto insurance premiums compared to a minor fender bender. Similarly, a home insurance claim for a total loss due to a natural disaster would likely have a more significant impact on future premiums than a claim for a broken window.

| Insurance Type | Claim Severity | Potential Premium Increase |

|---|---|---|

| Auto Insurance | Minor Accident | 5-10% |

| Auto Insurance | Major Accident | 20-30% |

| Home Insurance | Minor Property Damage | 3-5% |

| Home Insurance | Total Loss | 15-25% |

Policyholder’s History

Your past insurance history and claim frequency play a crucial role in determining how much your insurance rates will increase after a claim. Insurance companies consider the number and frequency of claims you’ve made in the past when assessing your risk profile. If you’ve had multiple claims within a short period, especially for the same type of insurance, you’re likely to face steeper premium increases.

Other Considerations

There are additional factors that can influence the impact of a claim on your insurance rates. For instance, the insurance company’s claims handling policies and market competition can affect the magnitude of premium increases. Some insurers may be more lenient with claim frequency, while others may have stricter policies, leading to higher premiums for repeat claimants.

Strategies to Minimize Premium Increases

While you can’t entirely prevent insurance rates from increasing after a claim, there are strategies you can employ to potentially minimize the impact:

- Maintain a Clean Claim History: Try to avoid making frequent claims, especially for minor incidents. While it's important to file claims when necessary, doing so sparingly can help keep your insurance rates more stable.

- Bundle Policies: Consider bundling your insurance policies, such as auto and home insurance, with the same provider. This can sometimes lead to discounts and more favorable rates overall.

- Increase Deductibles: Opting for higher deductibles can reduce the frequency of claims and, consequently, help keep your insurance rates lower. However, this strategy requires careful consideration of your financial situation and ability to cover larger deductibles in the event of a claim.

- Shop Around: If you're concerned about premium increases, it's a good idea to periodically shop around for insurance quotes. Comparing rates from different providers can help you identify more affordable options, especially after a claim.

Conclusion

The impact of a claim on your insurance premiums is a complex matter influenced by various factors. By understanding these factors and employing strategic approaches, you can potentially minimize the increase in your insurance rates. Regularly reviewing your insurance policies and staying informed about the potential consequences of claims can help you make more informed decisions about your coverage.

Will my insurance be canceled after a claim?

+In most cases, a single claim will not lead to policy cancellation. However, if you have a history of multiple claims or if the claim is particularly severe, there is a possibility that your insurance provider may choose not to renew your policy. It’s important to maintain open communication with your insurer to understand their specific policies and any potential consequences.

How long do insurance companies keep track of claims?

+Insurance companies typically maintain a record of claims for a significant period, often several years. The exact duration can vary depending on the type of insurance and the insurer’s policies. It’s important to be mindful of this, as a history of claims can impact future insurance rates and eligibility.

Can I negotiate my insurance rates after a claim?

+While it’s not always possible to negotiate insurance rates directly, you can explore options to mitigate the impact of a claim on your premiums. This may include discussing alternative coverage options with your insurer or seeking quotes from other providers to compare rates. It’s important to approach these conversations with a clear understanding of your insurance needs and financial capabilities.