How Much Is Healthcare Insurance

Healthcare insurance, often referred to as medical insurance, is a crucial aspect of modern healthcare systems, offering financial protection and access to essential medical services. In today's world, where medical expenses can be daunting, understanding the costs associated with healthcare insurance is of utmost importance. This comprehensive guide aims to delve into the factors influencing the price of healthcare insurance, providing you with valuable insights and a deeper understanding of this complex topic.

Unraveling the Cost of Healthcare Insurance

The cost of healthcare insurance is influenced by a multitude of factors, each playing a significant role in determining the final price. Let’s explore these factors in detail to gain a comprehensive understanding.

1. Geographical Location

One of the primary determinants of healthcare insurance costs is the geographical location of the insured individual. Healthcare expenses vary significantly across different regions, and this variability is reflected in insurance premiums. For instance, urban areas with advanced medical facilities and a higher cost of living often result in higher insurance premiums compared to rural areas. Furthermore, the specific state or country’s healthcare regulations and the overall healthcare market dynamics can also impact insurance costs.

| Location | Average Annual Premium |

|---|---|

| Metropolitan City A | $6,500 |

| Suburban Town B | $5,200 |

| Rural County C | $4,800 |

As illustrated in the table above, the average annual premiums can vary significantly based on the location, with metropolitan areas typically having higher costs.

2. Age and Gender

Insurance providers often consider an individual’s age and gender when calculating premiums. Generally, younger individuals are seen as lower-risk and thus enjoy more affordable insurance rates. As individuals age, their healthcare needs tend to increase, leading to higher premiums. Additionally, insurance companies may charge different rates for men and women based on statistical risk factors associated with specific health conditions.

| Age Group | Average Premium (Male) | Average Premium (Female) |

|---|---|---|

| 18-25 years | $3,200 | $3,400 |

| 26-40 years | $4,100 | $4,300 |

| 41-60 years | $6,200 | $6,500 |

The table above showcases how premiums can vary based on age and gender, with older individuals and females generally facing higher costs.

3. Pre-existing Medical Conditions

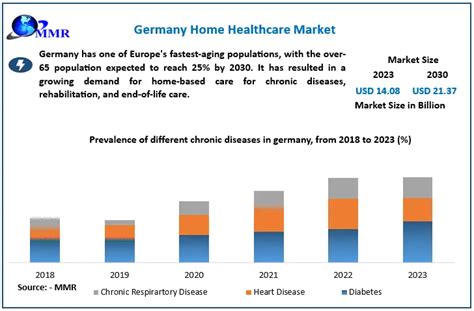

Individuals with pre-existing medical conditions often face higher insurance premiums. Insurance providers assess the risk associated with these conditions and adjust premiums accordingly. Common pre-existing conditions that can impact insurance costs include diabetes, heart disease, cancer, and mental health disorders. It’s important to note that some countries or regions have implemented policies to prevent insurance companies from discriminating based on pre-existing conditions.

4. Type of Insurance Plan

The type of insurance plan chosen by an individual significantly affects the overall cost. Insurance plans can vary widely in terms of coverage, deductibles, copayments, and out-of-pocket expenses. High-deductible health plans (HDHPs) typically offer lower premiums but require individuals to pay a substantial amount out of pocket before the insurance coverage kicks in. On the other hand, comprehensive plans with lower deductibles and copayments often result in higher premiums.

| Plan Type | Average Premium | Deductible |

|---|---|---|

| High-Deductible Plan | $4,800 | $4,000 |

| Comprehensive Plan | $6,200 | $1,500 |

As seen in the table, high-deductible plans have lower premiums but higher deductibles, while comprehensive plans offer more coverage with higher premiums and lower deductibles.

5. Lifestyle and Health Factors

An individual’s lifestyle and health habits can also influence insurance premiums. Insurance providers may consider factors such as smoking, obesity, alcohol consumption, and engagement in high-risk activities. Individuals with unhealthy lifestyles or habits are often charged higher premiums due to the increased risk of developing health issues.

6. Family Size and Coverage

The size of the family and the number of individuals covered under the insurance policy impact the overall cost. Insurance companies offer family plans, but the premium is usually calculated based on the oldest individual in the family. As the family size increases, so do the premiums, as the insurance provider assumes a higher risk with more covered individuals.

7. Employer-Sponsored Plans

Many individuals obtain healthcare insurance through their employers, which often provides a more cost-effective option. Employers typically subsidize a portion of the premium, making insurance more affordable for employees. The specific plan and coverage options offered by an employer can vary, and employees may have the option to choose from different plans with varying premiums and coverage levels.

8. Government Programs and Subsidies

In many countries, government-sponsored healthcare programs play a significant role in reducing the cost of healthcare insurance. These programs, such as Medicare, Medicaid, or national healthcare systems, provide coverage to eligible individuals, often at reduced or no cost. Government subsidies can also make private insurance more affordable for low-income individuals and families.

9. Individual vs. Group Plans

Insurance premiums can differ significantly when comparing individual and group plans. Group plans, often offered by employers, tend to have lower premiums due to the larger pool of individuals and the ability to negotiate better rates. On the other hand, individual plans, which are purchased directly by the insured, may have higher premiums due to the smaller risk pool and less negotiating power.

10. Market Competition and Regulations

The competitive landscape and regulatory environment of the insurance market can also impact premiums. In highly competitive markets, insurance companies may offer more affordable rates to attract customers. Conversely, in less competitive markets or regions with limited insurance providers, premiums may be higher. Additionally, government regulations and policies can influence the pricing structure and the overall affordability of healthcare insurance.

Understanding Healthcare Insurance Costs: A Comprehensive Analysis

The cost of healthcare insurance is a complex interplay of various factors, each contributing to the final premium an individual pays. By understanding these factors, individuals can make more informed decisions when choosing an insurance plan that suits their needs and budget. It’s crucial to research and compare different plans, considering not only the premium but also the coverage, deductibles, and out-of-pocket expenses.

Furthermore, staying informed about changes in healthcare regulations, market dynamics, and available subsidies can help individuals navigate the healthcare insurance landscape more effectively. Whether through employer-sponsored plans, government programs, or private insurance, understanding the cost structure empowers individuals to make choices that align with their healthcare needs and financial capabilities.

What factors can I control to reduce my healthcare insurance costs?

+You can influence your insurance costs by adopting a healthy lifestyle, quitting smoking, and maintaining a healthy weight. Additionally, choosing a high-deductible plan, especially if you’re generally healthy, can result in lower premiums. Comparing different insurance providers and their plans can also help you find more cost-effective options.

How do government programs impact healthcare insurance costs?

+Government programs like Medicare and Medicaid provide healthcare coverage to eligible individuals at reduced or no cost. These programs aim to make healthcare more accessible and affordable, especially for low-income individuals and families. By enrolling in these programs, individuals can significantly reduce their healthcare expenses.

Are there any tax benefits associated with healthcare insurance premiums?

+Yes, in many countries, there are tax benefits associated with healthcare insurance premiums. Individuals may be able to deduct a portion of their insurance premiums from their taxable income, resulting in tax savings. It’s important to consult with a tax professional to understand the specific tax benefits available in your region.