Car Insurance Low Rate

Welcome to a comprehensive guide on securing the best car insurance rates, a topic that holds significant importance for every vehicle owner. With the vast array of insurance options available, finding the most suitable coverage at an affordable rate can be a daunting task. This article aims to demystify the process, offering expert insights and practical strategies to help you navigate the world of car insurance and unlock the lowest premiums tailored to your specific needs.

Understanding the Fundamentals of Car Insurance

Car insurance is a legal contract that protects vehicle owners from financial losses resulting from accidents, theft, or other unforeseen events. It is a crucial safeguard that ensures you are not left financially burdened in the event of an accident. The coverage offered by car insurance policies can vary significantly, encompassing aspects such as liability, collision, comprehensive, medical payments, and uninsured/underinsured motorist coverage.

The cost of car insurance is determined by a multitude of factors, including the type of vehicle, the driver's age and driving history, the location, and the chosen coverage limits. Insurance companies utilize these factors to assess the risk associated with insuring a particular driver, which ultimately influences the premium rates.

For instance, consider the case of a young driver residing in an urban area with a history of speeding tickets. This driver may be considered a higher risk by insurance providers due to their age, location, and driving record. As a result, they would likely face higher insurance premiums compared to a more experienced driver with a clean record residing in a rural area.

Comparing Quotes: The Key to Unlocking Low Rates

One of the most effective strategies to secure the lowest car insurance rates is to obtain multiple quotes from different insurance providers. This approach allows you to compare the premiums, coverage options, and additional benefits offered by each company. By evaluating these factors, you can make an informed decision and choose the policy that best suits your needs and budget.

When comparing quotes, it's essential to consider not only the premium but also the coverage limits and any additional perks or discounts offered. For example, some insurance companies may provide discounts for bundling car insurance with other policies, such as home or life insurance. Others might offer loyalty discounts for long-term customers or incentives for safe driving practices.

Utilizing Online Comparison Tools

In today’s digital age, numerous online platforms and apps provide convenient tools for comparing car insurance quotes. These platforms often aggregate quotes from multiple providers, making it easier for you to quickly assess and compare various policies. However, it’s crucial to ensure that these tools are reputable and secure to protect your personal information.

One popular online comparison tool is InsuranceQuoteCompare.com, which allows users to input their details and receive personalized quotes from multiple insurers. This platform not only provides a wide range of options but also offers a user-friendly interface, making the comparison process straightforward and efficient.

Consulting with Insurance Brokers

While online comparison tools can be immensely helpful, consulting with an insurance broker can also be advantageous. Insurance brokers are professionals who work with multiple insurance companies and can provide personalized advice based on your specific needs and circumstances. They can guide you through the various policy options, helping you understand the nuances of each and ensuring you make an informed decision.

For instance, an insurance broker might suggest that a particular policy with slightly higher premiums could offer more comprehensive coverage for your unique situation. They can also negotiate with insurance providers on your behalf, potentially securing better rates or additional benefits that may not be readily available to the general public.

Enhancing Your Eligibility for Lower Rates

Apart from comparing quotes, there are several strategies you can employ to enhance your eligibility for lower car insurance rates. These strategies involve improving your driving record, making smart vehicle choices, and utilizing discounts and incentives offered by insurance providers.

Improving Your Driving Record

Insurance companies heavily rely on your driving record to assess the risk of insuring you. A clean driving record with no accidents or violations can significantly lower your insurance premiums. Conversely, a history of accidents or traffic violations can lead to higher rates or even difficulty in securing insurance coverage.

If you have a less-than-perfect driving record, it's important to take steps to improve it. This may involve taking defensive driving courses, which can not only enhance your driving skills but also potentially reduce points on your license and lower your insurance rates. Additionally, maintaining a clean driving record over an extended period can demonstrate your commitment to safe driving and may result in more favorable insurance rates.

Choosing the Right Vehicle

The type of vehicle you drive can also impact your insurance rates. Generally, sports cars, luxury vehicles, and SUVs tend to have higher insurance premiums due to their increased risk of accidents, theft, or damage. On the other hand, sedans, hybrids, and compact cars are often associated with lower insurance costs.

When selecting a vehicle, it's beneficial to consider its safety ratings and insurance costs. Opting for a vehicle with high safety ratings can not only provide peace of mind but also potentially lower your insurance premiums. Insurance companies often offer discounts for vehicles equipped with advanced safety features, such as collision avoidance systems, lane departure warnings, and automatic emergency braking.

Maximizing Discounts and Incentives

Insurance companies offer a variety of discounts and incentives to attract customers and reward safe driving practices. These discounts can significantly reduce your insurance premiums, so it’s crucial to explore all available options.

Common discounts include those for good driving records, safe driving courses, bundling multiple policies (such as car and home insurance), and loyalty discounts for long-term customers. Additionally, some insurers provide discounts for specific professions or memberships, such as military service, teaching, or AAA membership.

For instance, ABC Insurance offers a 15% discount for customers who maintain a good driving record for three consecutive years. They also provide a 10% discount for customers who install approved anti-theft devices in their vehicles, encouraging safer driving and reducing the risk of theft.

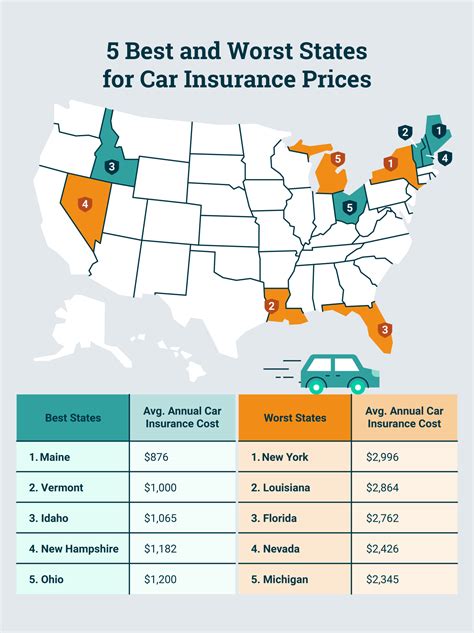

The Impact of Location and Demographic Factors

Your location and certain demographic factors can also influence your car insurance rates. Insurance providers consider these aspects to assess the risk associated with insuring you in a particular area.

Location-Based Factors

Insurance rates can vary significantly based on your location. Urban areas often have higher insurance premiums compared to rural areas due to increased traffic congestion, higher accident rates, and a greater risk of theft or vandalism. Additionally, the cost of repairs and medical care can be higher in urban areas, which further contributes to higher insurance rates.

For instance, a driver residing in a densely populated city like New York City may pay significantly more for car insurance compared to a driver in a rural town in Iowa. This disparity is primarily due to the higher risk factors associated with urban driving conditions.

Demographic Factors

Demographic factors, such as age, gender, and marital status, can also impact your insurance rates. Insurance companies often use these factors to assess the risk associated with insuring a particular individual. While some of these factors are beyond your control, understanding how they influence rates can help you make informed decisions when choosing insurance coverage.

For example, younger drivers, particularly those under the age of 25, often face higher insurance premiums due to their perceived lack of driving experience and higher risk of accidents. Similarly, male drivers may pay slightly higher premiums compared to female drivers, as statistics show that men are involved in more accidents on average.

The Future of Car Insurance: Technological Advancements

The car insurance industry is continuously evolving, and technological advancements are playing a significant role in shaping its future. These innovations are not only transforming the way insurance is purchased and managed but also offering new opportunities for drivers to save on their premiums.

Telematics and Usage-Based Insurance

Telematics is a technology that utilizes data transmission to provide real-time information about a vehicle’s location, speed, and driving behavior. This technology is being increasingly used by insurance companies to offer usage-based insurance policies, also known as pay-as-you-drive or pay-how-you-drive insurance.

With usage-based insurance, drivers can opt to have their premiums calculated based on their actual driving behavior rather than on general risk factors. This means that safe drivers who drive less frequently or during off-peak hours can potentially benefit from lower insurance rates. Insurance companies like DriveSafe are pioneering this approach, offering discounts to drivers who demonstrate safe and responsible driving habits.

Artificial Intelligence and Data Analytics

Artificial intelligence (AI) and data analytics are also transforming the car insurance landscape. Insurance companies are leveraging these technologies to analyze vast amounts of data, including driving behavior, accident trends, and repair costs, to more accurately assess risk and set insurance premiums.

For instance, AI-driven algorithms can analyze historical accident data to identify high-risk areas or times of day, allowing insurance companies to adjust premiums accordingly. Additionally, AI can process claims more efficiently, reducing the time and cost associated with processing and settling insurance claims.

Autonomous Vehicles and Insurance

The rise of autonomous vehicles (AVs) is poised to revolutionize the car insurance industry. As AV technology continues to advance and become more prevalent, insurance providers will need to adapt their policies and premiums to accommodate this new paradigm.

With AVs, the risk of human error-related accidents is significantly reduced, potentially leading to lower insurance premiums. However, new risks associated with AV technology, such as software failures or hacking, will need to be addressed in insurance policies. Insurance companies like AutonomousInsure are already exploring these emerging risks and developing insurance products tailored to AVs.

Conclusion: Securing the Best Car Insurance Rates

Securing the best car insurance rates requires a comprehensive understanding of the factors that influence premiums and a proactive approach to comparison shopping and policy selection. By comparing quotes, improving your driving record, making smart vehicle choices, and maximizing discounts, you can significantly reduce your insurance costs.

Additionally, staying abreast of technological advancements in the car insurance industry can provide new opportunities for savings. As the industry evolves, embracing these advancements and adapting to the changing landscape will be crucial for securing the most favorable insurance rates.

Remember, car insurance is a vital investment to protect yourself and your assets. By following the strategies outlined in this guide, you can navigate the complex world of car insurance with confidence and find the coverage that best meets your needs at the lowest possible rate.

How often should I review my car insurance policy and rates?

+It’s recommended to review your car insurance policy and rates at least once a year, or whenever you experience significant life changes such as moving to a new location, purchasing a new vehicle, or getting married. Regular reviews ensure you are always getting the best value and coverage for your needs.

What are some common discounts offered by insurance companies?

+Common discounts include good driver discounts for maintaining a clean driving record, safe driver discounts for completing defensive driving courses, multi-policy discounts for bundling car insurance with other policies like home or life insurance, and loyalty discounts for long-term customers.

Can I switch insurance providers to get a better rate?

+Absolutely! Shopping around and comparing quotes from different insurance providers is an effective way to find the best rate. If you find a better deal elsewhere, you can switch providers without any major issues. Just ensure your new policy starts on the same day your old policy ends to avoid any coverage gaps.