Online Quotes Insurance

In today's digital age, obtaining insurance quotes online has revolutionized the way we protect our valuable assets and ourselves. Online quotes insurance offers a convenient and efficient approach to securing the right coverage for our needs. With just a few clicks, individuals and businesses can access a wide range of insurance options and compare policies to find the best fit. This guide will delve into the intricacies of online quotes insurance, exploring its benefits, the process involved, and how it empowers individuals to make informed decisions about their insurance coverage.

The Rise of Online Quotes Insurance

The insurance industry has witnessed a significant shift towards online platforms, offering a more accessible and transparent way to obtain quotes. This evolution has been driven by several key factors:

- Convenience and Accessibility: Online quotes insurance provides 24/7 access to insurance information and quotes. Individuals can research and compare policies at their own pace, eliminating the need for in-person meetings or lengthy phone calls.

- Speed and Efficiency: Traditional insurance processes often involve lengthy paperwork and multiple interactions with agents. Online platforms streamline this process, allowing users to receive multiple quotes within minutes, saving both time and effort.

- Comparison and Transparency: With online quotes, individuals can easily compare policies from various providers side by side. This transparency empowers consumers to make informed choices, ensuring they find the best coverage at competitive rates.

- Personalization: Online platforms often utilize advanced algorithms and data analysis to provide personalized quotes. By considering an individual's unique circumstances and preferences, these platforms offer tailored insurance solutions.

How Online Quotes Insurance Works

Obtaining insurance quotes online is a straightforward process, designed to be user-friendly and efficient. Here's a step-by-step breakdown of how it works:

Step 1: Choosing an Online Platform

The first step is selecting a reputable online insurance platform. There are numerous options available, including comparison websites, direct insurance provider websites, and broker platforms. Consider factors such as the range of insurance products offered, user reviews, and the platform's ease of use.

Step 2: Providing Information

Once you've chosen a platform, you'll be guided through a series of questions to provide the necessary information for an accurate quote. This typically includes personal details, such as name, address, and date of birth, as well as specific information related to the insurance coverage you're seeking. For example, if you're seeking auto insurance, you'll be asked about your vehicle, driving history, and any additional coverage requirements.

Step 3: Receiving Quotes

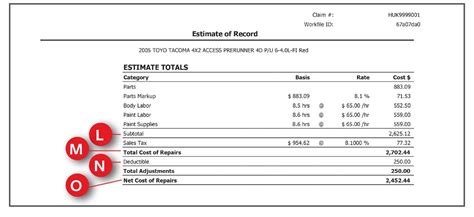

After providing the required information, the online platform will generate quotes from multiple insurance providers. These quotes will include details such as the coverage limits, deductibles, and the overall cost of the policy. You'll have the option to review and compare these quotes, ensuring you understand the coverage and terms offered.

Step 4: Choosing and Applying for Coverage

Once you've found the quote that best suits your needs, you can proceed with the application process. This typically involves verifying your information, providing additional documentation (such as proof of identity or vehicle registration), and agreeing to the terms and conditions of the policy. The application process is often streamlined and can be completed entirely online, making it a quick and hassle-free experience.

Benefits of Online Quotes Insurance

Online quotes insurance offers a multitude of advantages to individuals and businesses seeking insurance coverage. Here are some key benefits:

1. Convenience and Flexibility

Online quotes insurance allows you to obtain quotes and manage your insurance needs at your convenience. Whether it's during the day, in the evening, or on weekends, you can access quotes and compare policies whenever it suits your schedule. This flexibility is particularly beneficial for busy individuals or those with unconventional working hours.

2. Cost Savings

By comparing quotes online, you can easily identify the most cost-effective insurance options. Online platforms often have access to a wider range of providers, allowing you to find competitive rates and potentially save money on your insurance premiums. Additionally, the streamlined application process and reduced administrative costs can further contribute to cost savings.

3. Personalized Coverage

Online quotes insurance platforms utilize advanced algorithms to provide personalized quotes. By considering your unique circumstances and preferences, these platforms can offer tailored coverage options. Whether you require specific add-ons, higher coverage limits, or unique policy features, online quotes insurance ensures you can find the right fit for your needs.

4. Enhanced Transparency

With online quotes, you have the power to compare multiple insurance providers and their policies side by side. This transparency allows you to make informed decisions about your coverage, ensuring you understand the differences between policies and the value they offer. By having all the information at your fingertips, you can choose the policy that best aligns with your requirements.

5. Easy Policy Management

Online insurance platforms often provide convenient tools for policy management. Once you've obtained your insurance coverage, you can easily make policy changes, update personal information, or renew your policy online. This streamlined approach saves time and effort, ensuring a seamless experience throughout the life of your policy.

The Future of Online Quotes Insurance

As technology continues to advance, the future of online quotes insurance looks promising. Here are some potential developments and trends to watch out for:

- Artificial Intelligence (AI) Integration: AI and machine learning algorithms are expected to play an increasingly significant role in online quotes insurance. These technologies can further enhance the personalization of quotes, provide more accurate risk assessments, and offer tailored recommendations based on an individual's unique circumstances.

- Blockchain Technology: Blockchain has the potential to revolutionize the insurance industry by providing secure and transparent record-keeping. This technology can improve data verification, streamline claim processes, and enhance trust between insurance providers and policyholders.

- Telematics and IoT: The integration of telematics and Internet of Things (IoT) devices is already making waves in the insurance industry. By collecting real-time data on driving behavior or property conditions, insurance providers can offer more accurate and dynamic pricing, rewarding safe behavior or proactive maintenance.

- Enhanced Customer Experience: Online insurance platforms are likely to continue focusing on improving the overall customer experience. This includes developing user-friendly interfaces, providing comprehensive educational resources, and offering personalized support to guide individuals through the insurance journey.

Conclusion

Online quotes insurance has transformed the way we access and compare insurance coverage, offering convenience, transparency, and cost-effectiveness. By understanding the process, benefits, and future trends, individuals can make the most of this innovative approach to insurance. As technology advances, the online insurance landscape will continue to evolve, providing even more opportunities for personalized and efficient coverage.

How accurate are online insurance quotes?

+Online insurance quotes are generally accurate, as they are based on the information you provide. However, it’s important to note that quotes are estimates and may vary slightly when you officially apply for coverage. Factors such as your credit score, claims history, and specific policy add-ons can impact the final premium.

Can I negotiate insurance quotes online?

+Negotiating insurance quotes online can be challenging, as many online platforms provide quotes based on predetermined algorithms. However, if you have specific circumstances or requirements, it’s worth reaching out to the insurance provider directly to discuss potential discounts or adjustments.

Are online insurance quotes secure?

+Reputable online insurance platforms prioritize data security. They employ encryption technologies and adhere to privacy regulations to protect your personal information. However, it’s always important to verify the security measures of the platform before providing sensitive data.