Life Insurance Policy Whole Life

In the realm of financial planning and personal security, life insurance stands as a cornerstone, offering peace of mind and a safety net for individuals and their loved ones. Among the myriad of policies available, whole life insurance has long been a subject of interest and debate. This comprehensive guide aims to unravel the intricacies of whole life insurance, shedding light on its benefits, mechanics, and its place in modern financial strategies.

Understanding Whole Life Insurance: An Overview

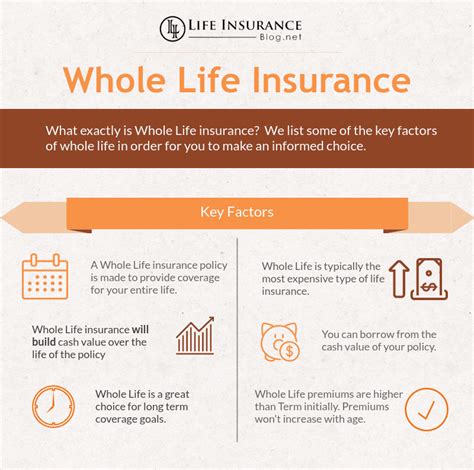

Whole life insurance, a variant of permanent life insurance, is designed to provide coverage for the entirety of an individual’s life. Unlike term life insurance, which offers coverage for a specified period, whole life insurance endures as long as the premiums are paid, ensuring lifelong protection. This enduring nature makes it an attractive proposition for those seeking long-term financial security and peace of mind.

At its core, whole life insurance operates on a simple principle: a portion of the premium payments goes towards building cash value, while the remainder funds the insurance coverage. This cash value component is one of the key distinguishing features of whole life insurance, offering policyholders a form of savings or investment that grows tax-deferred over time.

Whole life insurance policies typically offer a guaranteed death benefit, meaning the amount payable upon the policyholder's death is predetermined and guaranteed, provided premiums are paid. This fixed death benefit provides a sense of certainty and security for beneficiaries, ensuring they receive a predetermined sum regardless of when the policyholder passes away.

The Benefits and Features of Whole Life Insurance

Guaranteed Death Benefit

One of the primary advantages of whole life insurance is its guaranteed death benefit. This feature provides policyholders with the assurance that their loved ones will receive a predetermined sum upon their passing, regardless of market fluctuations or changes in health status. This stability is particularly valuable for those who wish to provide financial security for their family or cover specific long-term expenses, such as funeral costs or estate taxes.

Cash Value Accumulation

Whole life insurance policies accrue cash value over time. This cash value functions as a savings component, growing tax-deferred until the policyholder chooses to withdraw it, borrow against it, or use it to pay future premiums. Policyholders can access this cash value in various ways, offering flexibility and potential tax advantages. The growth of cash value can also be used to offset the cost of premiums, making it an attractive option for long-term financial planning.

Flexibility and Customization

Whole life insurance policies offer a high degree of flexibility and customization. Policyholders can choose the amount of coverage they desire, adjust the premium payments to fit their budget, and even tailor the policy to meet specific needs. For instance, riders can be added to cover specific situations, such as critical illness or accidental death. This flexibility allows individuals to create a policy that aligns with their unique financial goals and circumstances.

Estate Planning and Tax Benefits

Whole life insurance can be a valuable tool for estate planning. The death benefit proceeds are typically paid out income-tax free to beneficiaries, providing a significant financial boost without the burden of taxation. Furthermore, the cash value within the policy can be used to pay estate taxes, ensuring the smooth transfer of assets to heirs without the need for liquidating other investments or property.

Protection Against Lapse

Whole life insurance policies often include a non-forfeiture provision, which ensures the policy will not lapse if premiums are missed. Instead, the policy can be continued as paid-up insurance, providing a reduced death benefit, or it can be converted into a cash value policy. This protection against lapse provides policyholders with added security, knowing their coverage will not be abruptly terminated due to unforeseen circumstances.

How Whole Life Insurance Works: A Step-by-Step Guide

Policy Application and Underwriting

The journey towards securing whole life insurance begins with an application. The applicant provides personal and health information, which is then assessed by the insurance company’s underwriting team. This process evaluates the risk associated with insuring the individual and determines the premium amount and any potential exclusions or limitations.

Premium Payment and Policy Activation

Once the policy is approved, the applicant is required to pay the first premium. This premium payment activates the policy, initiating the coverage and the accrual of cash value. Whole life insurance policies typically require regular premium payments, which can be paid monthly, quarterly, semi-annually, or annually, depending on the policyholder’s preference and budget.

Policy Accumulation and Growth

Over time, the policy accumulates cash value. This growth is driven by a combination of the premium payments and the interest or earnings generated by the policy’s investments. The cash value grows on a tax-deferred basis, meaning no taxes are owed on the growth until the policyholder withdraws funds or uses them to pay premiums.

The insurance company invests the policy's cash value in a variety of assets, including stocks, bonds, and money market instruments. The specific investments and their allocation are determined by the insurance company and may vary based on the policyholder's preferences and the policy's design.

Benefit Payment and Claims

In the event of the policyholder’s death, the beneficiaries named in the policy receive the death benefit. This payment is made directly to the beneficiaries, typically without the need for probate, ensuring a swift and efficient transfer of funds. The death benefit amount is predetermined and guaranteed, as specified in the policy.

If the policyholder needs to access the cash value during their lifetime, they can do so through various means. They can borrow against the cash value, withdraw funds, or use the cash value to pay future premiums. Each of these actions has its own implications and should be carefully considered to ensure the policy continues to meet the policyholder's financial goals and needs.

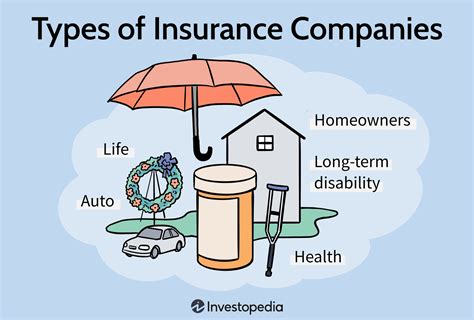

Comparing Whole Life Insurance with Other Policies

Whole Life vs. Term Life Insurance

Term life insurance and whole life insurance are two distinct types of life insurance policies, each with its own set of features and benefits. Term life insurance offers coverage for a specific period, typically 10, 20, or 30 years, and is often more affordable than whole life insurance. It is designed to provide financial protection for a defined period, such as during the years when a family has dependent children or outstanding debts.

On the other hand, whole life insurance provides lifelong coverage, ensuring protection for the policyholder's entire life. While it is more expensive than term life insurance, it offers several advantages, including a guaranteed death benefit, cash value accumulation, and the potential for tax benefits. Whole life insurance is often seen as a long-term financial planning tool, providing both insurance coverage and a savings component.

Whole Life vs. Universal Life Insurance

Universal life insurance is another type of permanent life insurance, similar to whole life insurance. Both policies offer lifelong coverage and the accumulation of cash value. However, universal life insurance policies offer more flexibility in terms of premium payments and death benefit amounts. Policyholders can adjust their premiums and death benefit levels over time, based on their changing financial circumstances and needs.

Whole life insurance, on the other hand, typically has fixed premiums and a guaranteed death benefit. The premiums and death benefit remain unchanged throughout the policy's lifetime, providing a sense of certainty and predictability. The trade-off is that whole life insurance may have slightly lower flexibility compared to universal life insurance, but it offers a more straightforward and stable financial planning option.

Whole Life Insurance in the Context of Financial Planning

When considering whole life insurance as part of a financial plan, it is essential to assess its role within the broader context of an individual’s financial goals and circumstances. Whole life insurance can be a valuable component of a comprehensive financial strategy, offering long-term protection and a potential source of savings.

For individuals with specific long-term financial goals, such as funding a child's education or ensuring sufficient retirement income, whole life insurance can provide a stable and guaranteed source of funds. The cash value accumulation can be used to supplement retirement income, provide a lump sum for education expenses, or cover other significant financial needs. Additionally, the death benefit can ensure that these financial goals are still met even in the event of the policyholder's untimely death.

However, it is important to note that whole life insurance is not the sole solution for all financial planning needs. It should be seen as one tool in a well-rounded financial plan, which may also include other types of insurance, investments, and savings accounts. A holistic financial plan considers an individual's unique circumstances, goals, and risk tolerance, ensuring that whole life insurance is used effectively and efficiently.

The Role of Whole Life Insurance in Modern Financial Strategies

In today’s financial landscape, whole life insurance continues to play a significant role in personal and family financial planning. With an increasing focus on long-term financial security and the rising costs of healthcare and education, whole life insurance offers a reliable and stable solution for individuals seeking to protect their loved ones and plan for the future.

Long-Term Financial Security

Whole life insurance provides a sense of long-term financial security, ensuring that policyholders and their beneficiaries are protected for life. The guaranteed death benefit and the potential for cash value accumulation offer a dual layer of protection, providing both immediate financial support in the event of the policyholder’s death and a potential source of savings or investment over time.

Estate Planning and Wealth Transfer

Whole life insurance is a valuable tool for estate planning and wealth transfer. The death benefit proceeds are typically paid out income-tax free to beneficiaries, providing a significant financial boost without the burden of taxation. This can be particularly beneficial for high-net-worth individuals or those with complex estate planning needs, ensuring a smooth and efficient transfer of wealth to the next generation.

Supplemental Retirement Income

The cash value component of whole life insurance can be a valuable source of supplemental retirement income. Policyholders can borrow against the cash value or withdraw funds to supplement their retirement income, providing a flexible and tax-efficient way to access their savings. This can be especially useful for those seeking to maximize their retirement income or bridge the gap between Social Security benefits and their desired retirement lifestyle.

Education Funding

Whole life insurance can also be used to fund education expenses. The cash value accumulation can be used to pay for a child’s or grandchild’s education, providing a reliable source of funds that is not subject to market volatility or inflation. This can be a valuable strategy for those who wish to ensure their loved ones have access to quality education without incurring significant debt.

Real-World Examples and Case Studies

Case Study 1: Estate Planning with Whole Life Insurance

Consider the case of Mr. Johnson, a successful businessman in his late 50s with a substantial estate. Mr. Johnson wishes to ensure that his assets are transferred smoothly to his children upon his death, without the need for probate or excessive taxes. He opts for a whole life insurance policy with a substantial death benefit, which is designed to cover his estate taxes and other transfer costs.

By doing so, Mr. Johnson ensures that his children receive the full benefit of his estate, without the need to sell off assets or liquidate investments to cover taxes. The death benefit proceeds are paid out tax-free, providing a significant financial boost to his children and ensuring the smooth transfer of his wealth.

Case Study 2: Supplemental Retirement Income

Ms. Smith, a retired teacher, has a whole life insurance policy that she purchased several decades ago. Over the years, the policy’s cash value has grown significantly, providing her with a substantial savings component. As she enters retirement, Ms. Smith decides to use the cash value to supplement her retirement income.

She borrows against the cash value, using the funds to cover her living expenses and travel costs. By doing so, Ms. Smith is able to maintain her desired retirement lifestyle without dipping into her other investments or retirement accounts. The whole life insurance policy provides her with a flexible and tax-efficient source of income, ensuring a comfortable retirement.

Case Study 3: Education Funding

John and Sarah, a young couple with a newborn child, are already thinking about their child’s future education expenses. They opt for a whole life insurance policy with a small death benefit, designed primarily for the cash value accumulation. As the policy matures over the next 18 years, the cash value grows, providing a substantial sum to cover their child’s college education expenses.

By using whole life insurance as an education funding tool, John and Sarah are able to provide a reliable and tax-efficient source of funds for their child's education. The policy's cash value is not subject to market fluctuations, ensuring that their child's education is funded regardless of economic conditions. This strategic use of whole life insurance allows them to plan for their child's future with confidence.

Conclusion: The Enduring Value of Whole Life Insurance

Whole life insurance remains a vital component of modern financial planning, offering a range of benefits and features that cater to a variety of financial needs and goals. From long-term financial security to estate planning and wealth transfer, whole life insurance provides a stable and reliable solution for individuals seeking to protect their loved ones and plan for the future.

While whole life insurance may not be suitable for everyone, its enduring value and versatility make it a valuable consideration for those seeking lifelong protection and a potential source of savings. By understanding the mechanics and benefits of whole life insurance, individuals can make informed decisions about their financial future, ensuring they have the tools and resources to achieve their goals and protect their loved ones.

How much does whole life insurance cost?

+The cost of whole life insurance can vary significantly depending on several factors, including the policyholder’s age, health status, and the amount of coverage desired. In general, whole life insurance is more expensive than term life insurance due to its lifelong coverage and cash value accumulation. Premiums can range from a few hundred dollars to several thousand dollars annually.

Can I borrow against the cash value of my whole life insurance policy?

+Yes, policyholders can borrow against the cash value of their whole life insurance policy. This is known as a policy loan and allows the policyholder to access the funds for various purposes, such as covering emergency expenses or supplementing income. However, it’s important to note that policy loans accrue interest and, if not repaid, can reduce the policy’s death benefit or cash value.

Is whole life insurance suitable for all individuals and families?

+Whole life insurance may not be the best option for everyone. It is typically more expensive than other types of life insurance and requires consistent premium payments over a long period. Individuals who are young, healthy, and have specific short-term financial goals may find term life insurance more suitable and cost-effective. However, for those seeking long-term financial security and a potential savings component, whole life insurance can be an attractive choice.