Best Vehicle Insurance Quotes

When it comes to securing the best vehicle insurance quotes, there are numerous factors to consider. With the right approach and understanding of the market, you can navigate the insurance landscape and find policies that offer excellent coverage at competitive rates. In this comprehensive guide, we'll delve into the world of vehicle insurance, providing expert insights and practical tips to help you make informed decisions and secure the most advantageous quotes for your needs.

Understanding Vehicle Insurance

Vehicle insurance is a crucial aspect of responsible vehicle ownership, providing financial protection in the event of accidents, theft, or other unforeseen circumstances. It’s a legal requirement in many jurisdictions, ensuring that drivers can cover potential liabilities and damages. The insurance market is vast and diverse, offering a range of policies tailored to different vehicle types, driver profiles, and specific needs.

Types of Vehicle Insurance

The insurance landscape is divided into several key categories, each catering to different requirements:

- Liability Insurance: Covers the policyholder for bodily injury and property damage claims made by others in an accident for which the insured driver is at fault.

- Comprehensive Insurance: Offers broad coverage, including protection against theft, vandalism, natural disasters, and collisions with animals, in addition to liability coverage.

- Collision Insurance: Covers damage to the insured vehicle in the event of a collision, regardless of fault.

- Gap Insurance: Provides coverage for the difference between the actual cash value of a vehicle and the remaining balance on a lease or loan, protecting against financial loss in total write-offs.

- Uninsured/Underinsured Motorist Coverage: Protects the insured driver in cases where the at-fault driver lacks sufficient insurance coverage.

Factors Influencing Insurance Quotes

Insurance providers assess a multitude of factors when determining quotes. Understanding these factors can empower you to negotiate better rates and make informed choices. Key considerations include:

- Vehicle Type and Usage: The make, model, and age of your vehicle, as well as the primary purpose of its use, play a significant role in determining insurance rates.

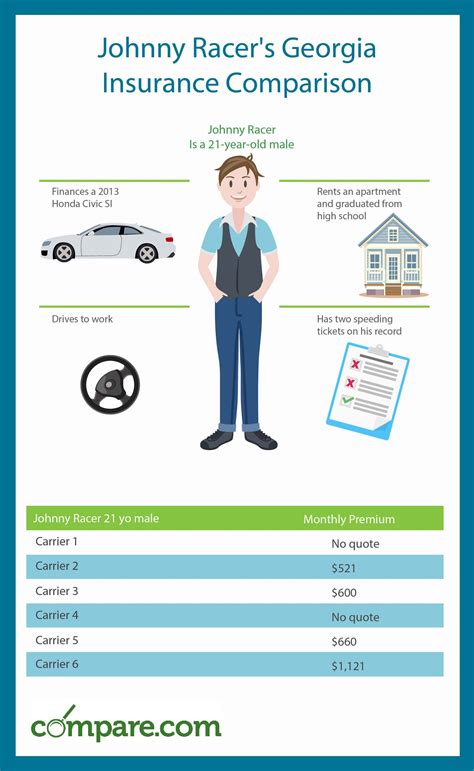

- Driver Profile: Your driving history, including any accidents or violations, is a critical factor. Younger drivers and those with a history of accidents or traffic violations may face higher premiums.

- Location: Insurance rates can vary widely based on geographic location, with urban areas often commanding higher premiums due to increased traffic and potential risks.

- Coverage Preferences: The level of coverage you opt for, including liability limits, deductibles, and additional coverage options, directly impacts your insurance quote.

- Discounts and Bundling: Many insurance companies offer discounts for safe driving, good student records, loyalty, or bundling multiple policies. Taking advantage of these discounts can significantly reduce your overall insurance costs.

Securing the Best Insurance Quotes

Securing the most advantageous insurance quotes requires a strategic approach and a thorough understanding of the market. Here are some expert tips to help you navigate the process:

Compare Multiple Quotes

Obtaining quotes from multiple insurance providers is essential to ensure you’re getting the best deal. Comparison shopping allows you to identify variations in coverage and pricing, helping you make informed decisions. Online comparison tools and insurance brokers can streamline this process, providing a comprehensive overview of available options.

Understand Your Coverage Needs

Assessing your specific coverage requirements is crucial. Consider your vehicle’s value, your financial situation, and potential risks you want to mitigate. For instance, if you have a valuable classic car, comprehensive insurance may be essential to protect against theft and damage. On the other hand, if you have an older, less valuable vehicle, you might prioritize liability coverage to protect against potential lawsuits.

Explore Discounts and Bundling

Insurance companies often offer discounts to attract and retain customers. These discounts can significantly reduce your insurance premiums. Common discounts include safe driver discounts, multi-policy discounts (bundling your auto insurance with home or renters insurance), and loyalty discounts for long-term customers. Additionally, consider other potential discounts, such as those for low mileage, advanced safety features, or good student records.

Maintain a Clean Driving Record

Your driving history is a critical factor in insurance quotes. Maintaining a clean driving record by avoiding accidents and traffic violations can lead to lower premiums. Insurance companies view drivers with clean records as lower risk, making them more attractive to insure. If you’ve had a history of accidents or violations, consider taking defensive driving courses to improve your record and potentially reduce your insurance costs.

Consider Higher Deductibles

Opting for a higher deductible can lower your insurance premiums. A deductible is the amount you pay out of pocket before your insurance coverage kicks in. By choosing a higher deductible, you’re essentially agreeing to bear more of the financial responsibility in the event of a claim. This shift in risk can lead to lower insurance costs, but it’s important to ensure you have the financial capacity to cover a higher deductible in the event of an accident or incident.

Review and Adjust Coverage Regularly

Your insurance needs may evolve over time. Regularly reviewing and adjusting your coverage to reflect changes in your circumstances is essential. For instance, if you’ve paid off your vehicle or its value has significantly depreciated, you may no longer need comprehensive or collision coverage. On the other hand, if you’ve recently moved to a high-risk area or acquired a more valuable vehicle, you might need to increase your coverage limits.

Utilize Technology and Digital Tools

The insurance industry has embraced digital transformation, offering a range of online tools and apps to streamline the quote process. These tools allow you to compare quotes, manage policies, and even file claims remotely. Additionally, many insurance companies now offer usage-based insurance (UBI) programs, where your driving behavior is tracked and your insurance premiums are adjusted accordingly. These programs can reward safe driving habits with lower premiums.

Case Study: Securing a Competitive Quote

Let’s consider a real-world example to illustrate the process of securing a competitive vehicle insurance quote. Imagine you’re a 35-year-old professional with a clean driving record, driving a 5-year-old sedan valued at $20,000. You’re looking to renew your insurance policy and want to explore your options.

Step 1: Assess Your Coverage Needs

Given your clean driving record and the value of your vehicle, you decide that liability coverage with a 500,000 limit and comprehensive and collision coverage with a 1,000 deductible are sufficient. You also opt for additional coverage for rental car reimbursement and roadside assistance.

Step 2: Compare Quotes

You begin by comparing quotes from three reputable insurance providers: Company A, Company B, and Company C. You provide the same coverage details and vehicle information to each company to ensure an accurate comparison.

| Insurance Company | Annual Premium |

|---|---|

| Company A | $1,200 |

| Company B | $1,150 |

| Company C | $1,050 |

Step 3: Explore Discounts

You discover that Company C offers a 10% discount for safe driving and a 5% discount for bundling your auto insurance with your home insurance policy. By taking advantage of these discounts, you can further reduce your annual premium to $945.

Step 4: Negotiate and Finalize

Satisfied with the quote and coverage offered by Company C, you proceed to negotiate and finalize the policy. You review the policy documents carefully, ensuring all your coverage preferences and discounts are reflected accurately. With the policy in place, you can drive with confidence, knowing you have adequate protection at a competitive rate.

FAQ

How often should I review my vehicle insurance policy?

+It’s recommended to review your insurance policy annually or whenever your circumstances change significantly. This ensures your coverage remains up-to-date and aligned with your needs.

Can I switch insurance providers mid-policy term?

+Yes, you can switch insurance providers at any time. However, be mindful of any cancellation fees or penalties that may apply. Ensure your new policy is in place before canceling your existing one to avoid gaps in coverage.

What factors can lead to an increase in insurance premiums?

+Several factors can lead to higher insurance premiums, including a history of accidents or traffic violations, moving to a higher-risk area, or adding a young or inexperienced driver to your policy.

Are there any alternatives to traditional vehicle insurance?

+Yes, usage-based insurance (UBI) is an alternative where your insurance premiums are based on your actual driving behavior. This can be an attractive option for safe and cautious drivers.