Auto Insurance Estimates

Understanding auto insurance estimates is crucial for any vehicle owner. This article delves into the intricacies of the auto insurance estimation process, exploring the factors that influence premium costs and how these estimates are calculated. With the right knowledge, you can make informed decisions about your insurance coverage and potentially save on your premiums.

The Science Behind Auto Insurance Estimates

Auto insurance estimates are a vital part of the insurance industry, allowing providers to assess the risk associated with insuring a particular vehicle and driver. These estimates are complex calculations that consider a myriad of factors to determine an appropriate premium. Let's break down the science behind these estimates and uncover the key components that insurance companies take into account.

Driver-Related Factors

Insurance estimates heavily rely on the driver's history and personal information. Age is a significant factor, with younger drivers often facing higher premiums due to their relative inexperience on the road. Gender also plays a role, with statistics showing that young males tend to be involved in more accidents, leading to potentially higher premiums. Driving history is another crucial aspect; a clean record with no accidents or traffic violations can result in lower insurance costs, while a history of accidents or speeding tickets may lead to increased premiums.

Furthermore, location and occupation can impact insurance estimates. Drivers residing in urban areas with higher traffic congestion and theft rates may face elevated premiums. Similarly, certain occupations, like those involving frequent travel or hazardous work environments, can also result in higher insurance costs.

Vehicle-Specific Considerations

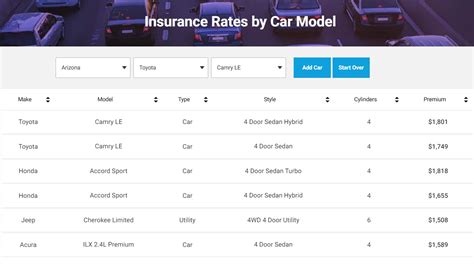

The vehicle being insured is another critical factor in insurance estimates. Vehicle make and model are key considerations, as some vehicles are statistically more prone to accidents or theft, which can increase insurance costs. The vehicle's age and value also come into play; older vehicles may have lower premiums due to their depreciated value, while newer, more expensive models might carry higher insurance costs.

Additionally, the vehicle's safety features can impact insurance estimates. Vehicles equipped with advanced safety technologies, such as lane departure warning systems or automatic emergency braking, may qualify for lower premiums due to their reduced risk of accidents.

Coverage and Deductible Choices

The level of coverage selected by the policyholder significantly influences insurance estimates. Comprehensive coverage, which includes protection against theft, fire, and natural disasters, typically comes with higher premiums. On the other hand, liability-only coverage, which provides protection for accidents caused by the policyholder, may result in lower premiums.

The deductible, or the amount the policyholder pays out of pocket before the insurance coverage kicks in, is another critical factor. Choosing a higher deductible can lead to lower insurance premiums, as it reduces the insurer's potential payout in the event of a claim.

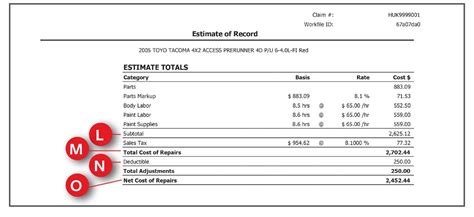

Calculating Insurance Estimates: A Step-by-Step Process

The calculation of insurance estimates is a meticulous process that involves several steps. Here's a simplified breakdown of how insurance providers determine your auto insurance premium:

- Risk Assessment: Insurance companies start by evaluating the risk associated with insuring you and your vehicle. This involves analyzing your personal information, driving history, and vehicle details to determine the likelihood of an accident or claim.

- Data Collection: Insurers gather extensive data from various sources, including government agencies, industry reports, and their own historical records. This data provides insights into factors like accident rates, claim frequencies, and average repair costs for different vehicle models and locations.

- Actuarial Analysis: Actuaries, who are experts in risk assessment and insurance mathematics, use this data to create statistical models. These models help insurers predict the likelihood and cost of potential claims for different policyholders.

- Rate Classification: Based on the risk assessment and actuarial analysis, insurers classify policyholders into different rate classes or rating tiers. These classes consider factors like age, gender, driving record, and location, among others.

- Base Rate Determination: Each rate class is assigned a base rate, which represents the average cost of claims for that particular class. This base rate serves as the starting point for calculating individual insurance estimates.

- Individualized Adjustments: The base rate is then adjusted based on the specific details of your policy. Factors like the level of coverage, deductible amount, and any additional discounts or surcharges are applied to arrive at your personalized insurance estimate.

- Final Estimate: After considering all relevant factors and making the necessary adjustments, the insurance company provides you with a final estimate for your auto insurance premium. This estimate represents the cost of insuring your vehicle and yourself for a specific period, typically one year.

The Impact of Data-Driven Insights

In recent years, the insurance industry has embraced data-driven insights to enhance the accuracy of insurance estimates. Advanced analytics and machine learning algorithms allow insurers to analyze vast amounts of data, leading to more precise risk assessments. This data-driven approach enables insurance companies to offer tailored coverage options and competitive premiums, benefiting both the insurer and the policyholder.

Tips for Lowering Your Auto Insurance Estimates

While auto insurance estimates are primarily based on risk assessment and statistical models, there are steps you can take to potentially reduce your insurance costs. Here are some practical tips to consider:

- Improve Your Driving Record: A clean driving record is crucial for lowering insurance premiums. Avoid traffic violations and accidents, as these can significantly impact your insurance estimates. Consider taking a defensive driving course to enhance your driving skills and potentially qualify for discounts.

- Shop Around for Quotes: Insurance rates can vary significantly between providers. Take the time to compare quotes from different insurers to find the most competitive rates for your specific situation. Online comparison tools can make this process more efficient and convenient.

- Bundle Your Policies: If you have multiple insurance needs, such as auto, home, or renters insurance, consider bundling your policies with the same provider. Many insurers offer discounts for policyholders who consolidate their insurance needs, potentially saving you money on your auto insurance estimate.

- Consider Higher Deductibles: Opting for a higher deductible can lead to lower insurance premiums. While this means you'll pay more out of pocket in the event of a claim, it can be a cost-effective strategy if you're confident in your ability to manage smaller financial losses.

- Explore Discounts: Insurance companies often offer a range of discounts to policyholders. Common discounts include safe driver discounts, good student discounts, loyalty discounts, and discounts for completing driver training programs. Ask your insurer about the discounts they offer and see if you qualify for any of them.

- Maintain a Good Credit Score: Believe it or not, your credit score can impact your auto insurance estimate. Many insurers use credit-based insurance scores to assess the risk of insuring a policyholder. Maintaining a good credit score can potentially lead to lower insurance premiums, as it indicates financial responsibility and stability.

The Future of Auto Insurance Estimates: Embracing Technology

The auto insurance industry is evolving rapidly, with technology playing an increasingly pivotal role in shaping the future of insurance estimates. Here's a glimpse into how technology is transforming the way insurance estimates are calculated and delivered:

Telematics and Usage-Based Insurance (UBI)

Telematics refers to the technology that enables the collection and transmission of vehicle data, such as driving behavior and mileage. Usage-based insurance (UBI) takes this data and uses it to tailor insurance premiums to an individual's driving habits. With UBI, drivers can potentially lower their insurance estimates by demonstrating safe and responsible driving behavior. This technology not only encourages safer driving but also provides a more accurate assessment of risk, benefiting both insurers and policyholders.

Artificial Intelligence (AI) and Machine Learning

Artificial intelligence and machine learning algorithms are revolutionizing the insurance industry by enhancing the accuracy and efficiency of risk assessment. These technologies enable insurers to analyze vast amounts of data, identify patterns, and make more informed decisions. By leveraging AI and machine learning, insurers can develop more precise actuarial models, leading to fairer and more tailored insurance estimates for policyholders.

Digital Transformation and Online Platforms

The rise of digital transformation in the insurance industry has led to the development of user-friendly online platforms. These platforms streamline the insurance estimation process, allowing policyholders to obtain quotes and purchase coverage with just a few clicks. Additionally, online platforms often offer a more transparent and personalized experience, providing policyholders with real-time updates and a better understanding of their insurance coverage.

The Role of Connected Vehicles

The advent of connected vehicles, equipped with advanced telematics and data transmission capabilities, is set to transform the auto insurance landscape. These vehicles can provide real-time data on driving behavior, vehicle health, and location, offering insurers an unprecedented level of insight into risk assessment. As connected vehicles become more prevalent, insurers can leverage this data to develop more accurate and dynamic insurance estimates, further enhancing the efficiency and fairness of the insurance industry.

FAQ

How often should I review my auto insurance estimates?

+

It’s recommended to review your auto insurance estimates annually or whenever your circumstances change significantly. This ensures you’re always getting the best value for your insurance coverage.

Can I negotiate my auto insurance estimate with the insurer?

+

While negotiating directly with insurers may not always be possible, you can certainly shop around for quotes from different providers. Competition in the insurance market often drives down premiums, so comparing quotes is a great way to potentially find a better deal.

What factors can I control to lower my auto insurance estimates?

+

You have control over certain factors that can impact your insurance estimates. Maintaining a clean driving record, shopping around for quotes, and exploring discounts are all within your reach. Additionally, considering higher deductibles and opting for comprehensive coverage can also lead to lower premiums.

How does my credit score influence my auto insurance estimates?

+

Insurance companies often use credit-based insurance scores to assess the risk of insuring a policyholder. A good credit score can indicate financial responsibility and stability, which may lead to lower insurance estimates. On the other hand, a poor credit score could result in higher premiums.