What Is E And O Insurance

E&O insurance, or Errors and Omissions insurance, is a vital protection for businesses and professionals across various industries. In an increasingly litigious world, this specialized form of liability insurance provides a crucial safety net, safeguarding against the financial risks and legal consequences that can arise from alleged errors, oversights, or omissions in professional services. This article will delve into the intricacies of E&O insurance, exploring its coverage, importance, and implications for a range of industries, with a focus on real-world examples and expert insights.

Understanding E&O Insurance

E&O insurance is a tailored form of liability coverage designed to protect professionals and businesses from the potential financial fallout of client lawsuits. These lawsuits typically arise from claims of negligence, errors, or failures to deliver promised services. The insurance policy kicks in to cover the costs associated with such claims, including legal fees, settlements, and damages.

Key Coverage Areas

The coverage provided by E&O insurance is extensive and tailored to the specific needs of the professional or business. Here are some of the key areas typically covered:

- Professional Negligence: Covers claims arising from alleged errors or negligence in providing professional services.

- Misrepresentation: Protects against claims of incorrect or incomplete information provided to clients.

- Breach of Contract: Offers coverage for instances where a client sues for breach of a service agreement.

- Infringement of Intellectual Property: Provides protection if a client claims that the professional’s work infringed on their intellectual property rights.

- Loss of Client Data: Covers claims resulting from the loss or misuse of client data.

Real-World Example

Consider a software development firm that creates custom applications for businesses. If a client sues the firm, alleging that the developed software caused significant financial losses due to a critical error, the E&O insurance policy would step in. The policy would cover the legal costs and any potential damages awarded to the client, helping the firm navigate the lawsuit and protect its financial stability.

The Importance of E&O Insurance

E&O insurance plays a pivotal role in modern business operations, offering a range of critical benefits that can significantly impact the long-term success and viability of a company.

Financial Protection

The primary function of E&O insurance is to provide a financial safety net. Lawsuits, particularly those related to professional services, can be incredibly costly. Legal fees, settlements, and potential damages can quickly accumulate, often surpassing a company’s annual revenue. E&O insurance steps in to cover these expenses, ensuring that businesses can continue operating without being burdened by catastrophic financial losses.

Peace of Mind

For professionals and business owners, the threat of lawsuits can be a constant source of stress and anxiety. E&O insurance provides a sense of security, knowing that they are protected against the financial consequences of potential errors or omissions. This peace of mind allows professionals to focus on delivering their services with confidence and without the distraction of worrying about future legal battles.

Credibility and Trust

In many industries, E&O insurance is viewed as a sign of professionalism and credibility. Clients often feel more confident engaging with businesses that carry such insurance, knowing that their interests are protected. This can enhance a company’s reputation and attract more business, as potential clients perceive the company as more reliable and trustworthy.

Risk Mitigation

E&O insurance policies often come with additional risk management services. These services can include resources for improving internal processes, training staff on best practices, and implementing measures to reduce the likelihood of errors. By actively working to mitigate risks, businesses can further reduce the chances of claims and improve their overall operational efficiency.

Industries Relying on E&O Insurance

E&O insurance is an essential component of risk management across a wide spectrum of industries. Here’s a look at some sectors where E&O insurance is particularly crucial:

Financial Services

In the financial services industry, professionals like financial advisors, investment managers, and bankers face unique risks. They provide advice and services that can significantly impact their clients’ financial well-being. A simple mistake or oversight could lead to substantial financial losses for clients, resulting in costly lawsuits. E&O insurance helps protect these professionals from the financial fallout of such claims.

Healthcare

Healthcare providers, including doctors, nurses, and medical facilities, rely on E&O insurance to protect against malpractice claims. Medical errors or omissions can have severe consequences, both for patients and healthcare professionals. E&O insurance provides a critical safety net, covering the costs associated with potential malpractice suits.

Technology and IT

The technology sector is rife with potential risks. From software development firms to IT consulting businesses, professionals in this industry face a myriad of potential liabilities. E&O insurance helps protect against claims arising from software glitches, data breaches, or failures to deliver promised services.

Legal

Lawyers and legal firms are not immune to the risk of errors and omissions. A mistake in legal advice or a missed deadline can have significant repercussions for clients. E&O insurance provides a vital layer of protection, covering the costs associated with potential legal malpractice claims.

Real Estate

Real estate professionals, including agents, brokers, and property managers, also benefit from E&O insurance. The real estate industry is rife with potential risks, from misrepresenting properties to errors in contract preparation. E&O insurance helps mitigate these risks, providing coverage for potential claims arising from professional services.

Coverage Considerations and Limitations

While E&O insurance is a powerful tool for risk management, it’s important to understand its limitations and potential exclusions. Here are some key considerations:

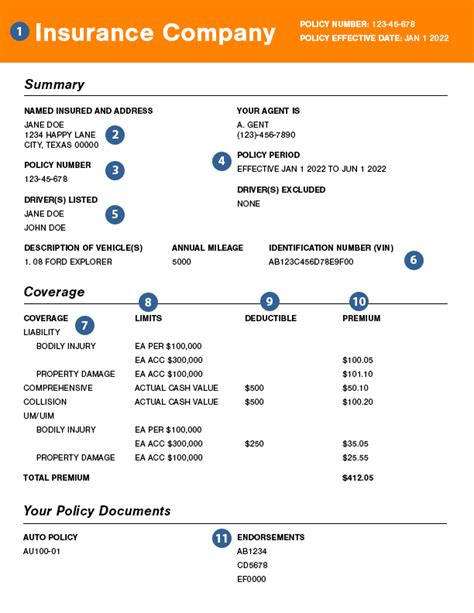

Policy Limits

E&O insurance policies typically have set limits on the amount of coverage provided. It’s crucial to carefully review these limits to ensure they align with the potential risks and exposures faced by the business. In some cases, businesses may opt for higher limits or additional coverage to provide greater financial protection.

Exclusions

Like any insurance policy, E&O insurance comes with a list of exclusions. These are specific situations or types of claims that the policy does not cover. It’s essential to thoroughly review the exclusions to understand the scope of coverage and ensure that the policy meets the business’s needs.

Deductibles

E&O insurance policies often have deductibles, which are the amounts that the insured party must pay out of pocket before the insurance coverage kicks in. Deductibles can vary based on the policy and the industry, and it’s important to consider these when evaluating the financial implications of a claim.

Claims-Made vs. Occurrence Policies

There are two primary types of E&O insurance policies: claims-made and occurrence-based. Claims-made policies cover claims made during the policy period, regardless of when the alleged error occurred. Occurrence-based policies, on the other hand, cover claims arising from incidents that occurred during the policy period, regardless of when the claim is made. Understanding the differences between these policy types is crucial for effective risk management.

The Future of E&O Insurance

As industries evolve and new risks emerge, the landscape of E&O insurance is also evolving. Here are some key trends and considerations for the future:

Emerging Risks

With the rapid advancement of technology and the increasing reliance on digital systems, new risks are emerging. From cyber attacks to data breaches, professionals and businesses face unique challenges that traditional E&O policies may not adequately address. As a result, there is a growing demand for insurance products that specifically address these emerging risks.

Customization and Flexibility

The future of E&O insurance lies in customization and flexibility. As industries become more specialized and unique, insurance providers are adapting to offer tailored coverage options. This allows businesses to select coverage that specifically addresses their unique risks and exposures.

Risk Management Services

In addition to providing financial protection, insurance providers are increasingly focusing on risk management services. These services aim to help businesses proactively mitigate risks, reduce the likelihood of claims, and improve overall operational efficiency. By offering comprehensive risk management solutions, insurance providers can better serve their clients and reduce the frequency and severity of claims.

Data-Driven Insights

The use of data analytics is becoming increasingly prevalent in the insurance industry. By leveraging data, insurance providers can gain deeper insights into the risks faced by businesses and professionals. This allows for more accurate risk assessment, better-tailored coverage options, and improved claims management. Data-driven insights can also help identify emerging risks and trends, enabling insurance providers to stay ahead of the curve.

Conclusion

E&O insurance is a critical component of risk management for businesses and professionals across a wide range of industries. It provides a vital safety net, protecting against the financial and legal consequences of alleged errors, omissions, and oversights. As industries evolve and new risks emerge, the importance of E&O insurance is only set to grow. By staying informed about the latest trends and considerations, businesses can ensure they have the right coverage in place to navigate an increasingly complex and litigious business landscape.

How does E&O insurance differ from general liability insurance?

+While both E&O insurance and general liability insurance provide protection against lawsuits, they cover different types of risks. General liability insurance typically covers bodily injury, property damage, and personal injury claims. E&O insurance, on the other hand, is designed to protect against financial loss resulting from errors, omissions, or failures in professional services.

Can E&O insurance be customized for specific industries or professions?

+Absolutely! E&O insurance policies can be tailored to meet the unique needs of specific industries and professions. Insurance providers work with businesses to understand their risks and exposures, allowing for customized coverage options that provide the most relevant and comprehensive protection.

What are some common exclusions in E&O insurance policies?

+Common exclusions in E&O insurance policies may include intentional acts, criminal acts, intellectual property infringement, pollution, and contractual liability. It’s important to carefully review the policy’s exclusions to ensure that the coverage meets the business’s specific needs.