Purchasing Auto Insurance

Welcome to this comprehensive guide on purchasing auto insurance, a topic that can be complex and often overwhelming for many drivers. Navigating the world of auto insurance policies, coverage options, and legal requirements is crucial to ensure you are adequately protected on the road. This article aims to provide an in-depth analysis of the key considerations when buying auto insurance, offering practical insights and expert advice to help you make informed decisions.

Understanding Auto Insurance Basics

Auto insurance is a contract between you, the policyholder, and the insurance company. It provides financial protection against potential losses or damages that may occur while operating a motor vehicle. These losses can range from vehicle repairs after an accident to medical expenses for injuries sustained by you or others involved.

The coverage provided by auto insurance policies varies widely and is tailored to the needs and budget of the policyholder. It is essential to understand the different types of coverage available and the specific requirements in your state or country to ensure you obtain the right level of protection.

Key Components of Auto Insurance Policies

An auto insurance policy typically includes the following components, each offering distinct coverage:

- Liability Coverage: This is the most basic form of auto insurance and is often mandatory. It covers the cost of damages and injuries you cause to others in an accident.

- Collision Coverage: This coverage pays for the repair or replacement of your vehicle if it's damaged in an accident, regardless of fault.

- Comprehensive Coverage: Comprehensive coverage provides protection for damages caused by events other than collisions, such as theft, vandalism, weather damage, or hitting an animal.

- Medical Payments Coverage: Also known as Personal Injury Protection (PIP), this coverage pays for medical expenses for you and your passengers, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you're involved in an accident with a driver who has no insurance or insufficient coverage.

| Coverage Type | Description |

|---|---|

| Liability | Covers damages and injuries caused to others. |

| Collision | Repairs or replaces your vehicle after an accident. |

| Comprehensive | Protects against non-collision damages. |

| Medical Payments | Pays for medical expenses for you and your passengers. |

| Uninsured/Underinsured Motorist | Protects you if the other driver has no or insufficient coverage. |

Assessing Your Auto Insurance Needs

When purchasing auto insurance, it's crucial to assess your specific needs and circumstances. This ensures you get the right coverage without overspending on unnecessary features.

Considerations for Tailoring Your Policy

Here are some factors to keep in mind when evaluating your auto insurance requirements:

- Vehicle Type and Usage: The type of vehicle you drive and how you use it can impact your insurance needs. For instance, a luxury car or a vehicle used for business purposes may require different coverage than a standard personal vehicle.

- Driving Record: Your driving history, including any accidents or violations, can influence the cost and availability of insurance. Drivers with a clean record often benefit from lower premiums.

- Financial Responsibility: Assess your financial situation and determine how much risk you can comfortably bear. This will help you decide on the appropriate level of coverage and deductibles.

- State Laws and Regulations: Each state or country has its own set of auto insurance laws. Understanding the minimum coverage requirements in your area is essential to ensure you meet legal obligations.

- Personal Preferences: Consider your personal preferences and priorities. For example, you may want to prioritize comprehensive coverage if you live in an area prone to natural disasters or theft.

Comparing Insurance Quotes

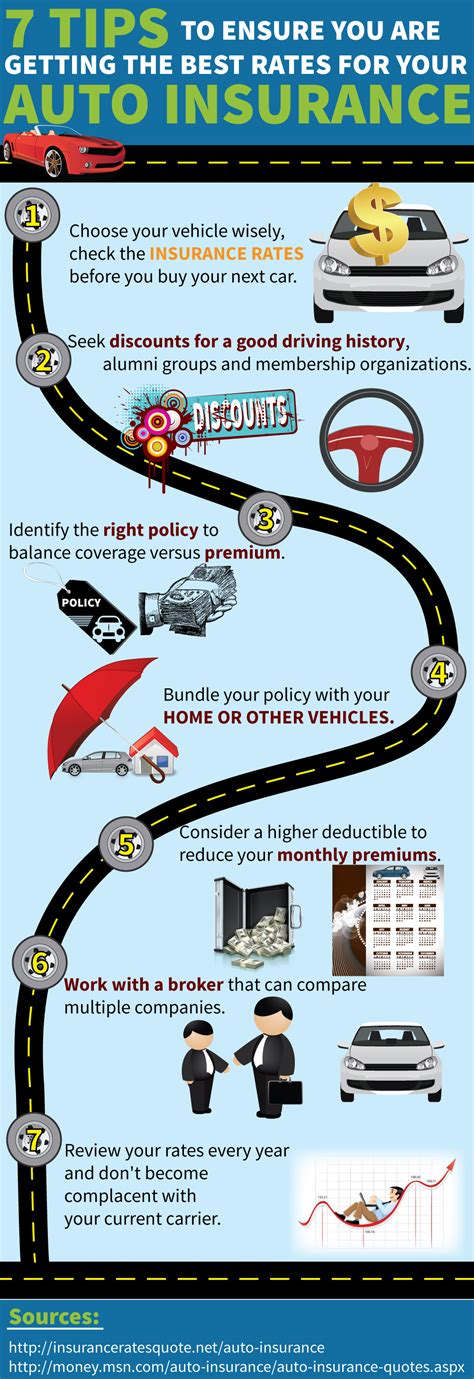

To make an informed decision, it's beneficial to compare quotes from multiple insurance providers. This process allows you to assess the coverage offered, understand any exclusions or limitations, and compare prices.

When comparing quotes, pay attention to the following:

- Coverage Limits: Ensure the policy provides adequate coverage for your needs. Higher limits often result in higher premiums, but they can provide greater financial protection.

- Deductibles: Deductibles are the amount you pay out of pocket before your insurance kicks in. Higher deductibles can lower your premium, but consider whether you can afford the deductible in the event of a claim.

- Additional Coverages

- Discounts: Many insurance providers offer discounts for various reasons, such as safe driving, multiple policies, or membership in certain organizations. Be sure to inquire about potential discounts.

- Customer Service and Claims Handling: Research the reputation of the insurance company for customer service and claims handling. Efficient and responsive service can make a significant difference in the event of an accident or claim.

The Impact of Deductibles and Premiums

Deductibles and premiums are two critical aspects of auto insurance that directly influence the cost and level of coverage you receive.

Understanding Deductibles

A deductible is the amount you must pay out of pocket when filing a claim. For instance, if you have a $500 deductible and make a claim for repairs costing $2,000, you will pay the first $500, and the insurance company will cover the remaining $1,500.

Higher deductibles typically result in lower premiums, as you are taking on more financial responsibility in the event of a claim. On the other hand, lower deductibles mean you pay less out of pocket when filing a claim, but your premiums will be higher.

Managing Premiums

Premiums are the amount you pay for your auto insurance policy, usually on a monthly or annual basis. The cost of premiums can vary significantly based on factors such as your driving record, the type of vehicle you drive, your age, and the coverage limits you choose.

To manage your premiums effectively, consider the following strategies:

- Shop Around: Compare quotes from multiple insurance providers to find the best rate for your needs.

- Bundle Policies: Many insurance companies offer discounts when you bundle multiple policies, such as auto and home insurance.

- Maintain a Clean Driving Record: A clean driving record can lead to significant savings on your premiums. Avoid accidents and violations to keep your record clear.

- Consider Payment Options: Some insurance companies offer discounts for paying your premium in full rather than monthly installments.

The Role of Technology in Auto Insurance

Advancements in technology have significantly impacted the auto insurance industry, offering new opportunities for drivers to save money and access personalized coverage.

Telematics and Usage-Based Insurance

Telematics is a technology that allows insurance companies to track driving behavior in real-time. Usage-Based Insurance (UBI) is an insurance model that utilizes telematics to offer rates based on how, when, and where a person drives.

With UBI, drivers can potentially save money by demonstrating safe driving habits. The insurance company may offer discounts or rewards for driving during low-risk hours, avoiding aggressive driving behaviors, and maintaining a consistent driving pattern.

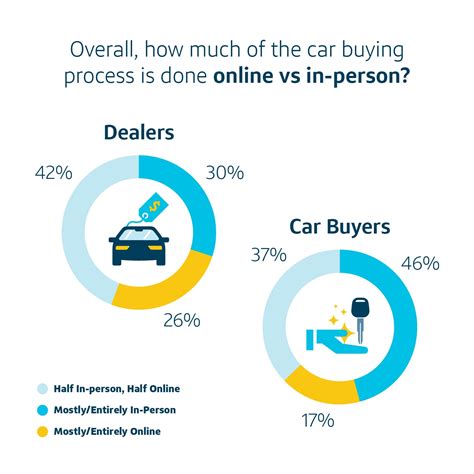

Online Quotes and Comparison Tools

The internet has revolutionized the way drivers shop for auto insurance. Online comparison tools and quote engines allow you to quickly and easily compare policies, coverage options, and premiums from multiple providers.

These tools often provide detailed information about the coverage and exclusions, allowing you to make an informed decision without the pressure of speaking to a sales representative. You can also save and compare quotes over time, helping you identify trends and potential savings.

Future Trends and Innovations in Auto Insurance

The auto insurance industry is constantly evolving, and several trends and innovations are shaping the future of this sector.

Automated Vehicles and Insurance

As autonomous vehicles become more prevalent, the insurance landscape is expected to shift significantly. While it's unclear how exactly insurance will adapt to this new technology, some experts predict a move towards liability-based coverage, where the manufacturer of the vehicle or the technology provider would bear the brunt of liability in the event of an accident.

Blockchain and Smart Contracts

Blockchain technology has the potential to revolutionize the insurance industry by offering secure, transparent, and efficient transactions. Smart contracts, which are self-executing contracts with the terms of the agreement directly written into code, could automate many insurance processes, including claims handling and policy administration.

Data Analytics and Personalized Coverage

Advanced data analytics and machine learning are already being used to personalize insurance coverage. By analyzing vast amounts of data, insurance companies can offer more tailored policies that take into account individual driving behaviors, preferences, and risk profiles. This level of personalization can lead to more accurate pricing and better coverage options for consumers.

FAQ: Auto Insurance Questions Answered

What happens if I can't afford the deductible when filing a claim?

+If you're unable to afford the deductible when filing a claim, it's important to communicate this to your insurance provider. They may offer payment plans or other solutions to help you manage the cost. However, keep in mind that failing to pay the deductible could result in your claim being denied or delayed.

How often should I review my auto insurance policy?

+It's recommended to review your auto insurance policy annually or whenever your circumstances change significantly. This includes changes in your driving habits, vehicle usage, or personal financial situation. Regular reviews ensure your coverage remains adequate and cost-effective.

Can I switch auto insurance providers mid-policy term?

+Yes, you can typically switch auto insurance providers at any time, even mid-policy term. However, be aware that some providers may charge a fee for canceling your policy early. It's a good idea to carefully review the terms of your current policy before switching to understand any potential penalties.

How does my credit score impact my auto insurance rates?

+Your credit score can significantly influence your auto insurance rates. Many insurance companies use credit-based insurance scores to assess risk and determine premiums. A higher credit score often results in lower insurance rates, as it's seen as an indicator of financial responsibility and stability.

What should I do if I'm involved in an accident?

+If you're involved in an accident, the first priority is to ensure the safety of yourself and others involved. Call emergency services if needed. Then, collect as much information as possible, including the other driver's contact and insurance details, witness statements, and photos of the scene and any damages. Contact your insurance provider promptly to report the accident and begin the claims process.

Purchasing auto insurance is a critical step in ensuring your safety and financial protection on the road. By understanding the basics, assessing your needs, and staying informed about the latest trends and innovations, you can make confident decisions when choosing an auto insurance policy. Remember, auto insurance is not a one-size-fits-all product, so take the time to find the coverage that best suits your individual circumstances.