Women's Health Insurance

Women's health insurance is a vital aspect of healthcare coverage, ensuring that women have access to the necessary medical services and treatments to maintain their overall well-being. In today's world, where healthcare costs can be a significant financial burden, having comprehensive insurance becomes crucial. This article aims to delve into the specifics of women's health insurance, exploring its coverage, benefits, and the unique considerations it offers. By understanding the intricacies of this insurance, women can make informed decisions to protect their health and financial stability.

Understanding Women’s Health Insurance: An Overview

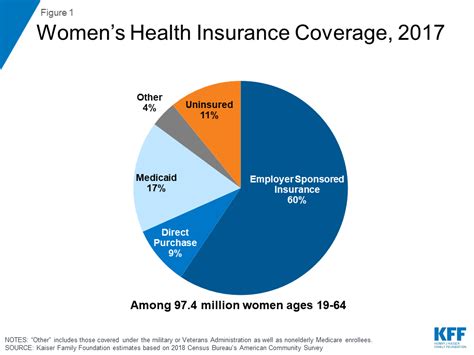

Women’s health insurance is tailored to meet the specific healthcare needs of women, offering a range of benefits and services that cater to their unique physiological and reproductive health requirements. It provides coverage for a broad spectrum of medical services, from routine check-ups and screenings to specialized treatments and procedures.

One of the key advantages of women's health insurance is its focus on preventive care. Insurance plans often cover essential health screenings, such as mammograms, Pap smears, and bone density tests, which are crucial for early detection and management of potential health issues. Additionally, many plans include wellness programs and educational resources to promote a healthier lifestyle and informed decision-making.

Furthermore, women's health insurance recognizes the diverse stages of a woman's life, offering specialized coverage for various phases, including pregnancy, childbirth, and menopause. This comprehensive approach ensures that women receive the necessary support and medical attention throughout their lives.

The Importance of Comprehensive Coverage

Comprehensive women’s health insurance goes beyond basic medical coverage, offering a range of benefits that address the holistic health needs of women. Here’s a closer look at some of the critical aspects covered by these insurance plans:

Maternity and Prenatal Care

Pregnancy and childbirth are significant milestones in a woman’s life, and women’s health insurance plays a vital role in ensuring these experiences are as safe and healthy as possible. Comprehensive plans typically include coverage for prenatal care, including regular check-ups, ultrasounds, and other diagnostic tests. Additionally, they often cover the cost of delivery, whether it’s a vaginal birth or a C-section, as well as postnatal care to support the mother’s recovery.

For expecting mothers, having this level of coverage provides peace of mind, knowing that they can access the necessary medical services without financial strain. It also encourages women to seek regular prenatal care, which is essential for the health of both the mother and the baby.

Preventive Services

Preventive care is a cornerstone of women’s health insurance. These plans often cover a wide range of preventive services, such as annual wellness visits, immunizations, and screenings for various health conditions. For instance, many plans cover mammograms for breast cancer detection, Pap smears for cervical cancer screening, and bone density scans to assess osteoporosis risk.

By emphasizing preventive care, women's health insurance aims to catch potential health issues early on, when they are often more treatable and less costly to manage. This proactive approach to healthcare can significantly impact a woman's long-term health and well-being.

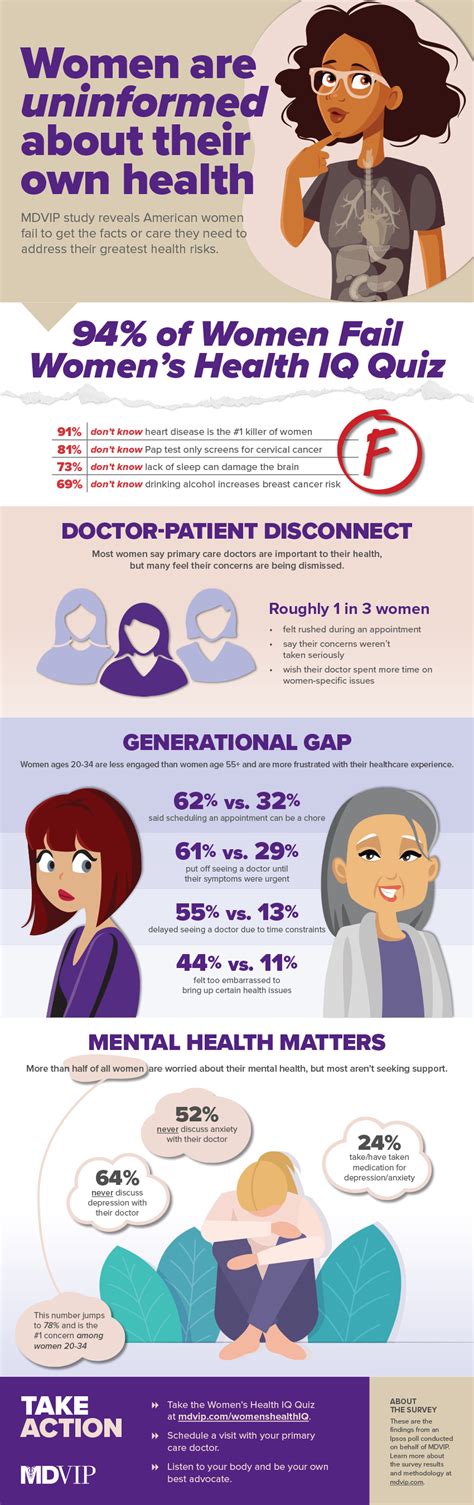

Mental Health and Well-being

Women’s health insurance recognizes the importance of mental health and its impact on overall well-being. Many plans include coverage for mental health services, such as therapy, counseling, and psychiatric care. This coverage can be particularly beneficial for women dealing with issues like depression, anxiety, or stress-related disorders.

In addition to traditional mental health services, some insurance plans also offer alternative wellness programs, such as yoga, meditation, or stress management workshops. These holistic approaches can complement conventional treatments and promote a more balanced and healthy lifestyle.

Specialized Treatments and Procedures

Women’s health insurance often extends coverage to specialized treatments and procedures that are unique to women’s health. This can include gynecological surgeries, hormonal therapies, and treatments for conditions like endometriosis, polycystic ovary syndrome (PCOS), or urinary incontinence.

By providing coverage for these specialized treatments, women's health insurance ensures that women have access to the care they need, without facing significant financial barriers. This is especially important for conditions that may require ongoing management and specialized care.

Real-World Benefits and Success Stories

To truly understand the impact of women’s health insurance, it’s essential to look at real-world examples and success stories. Here are a few instances where comprehensive women’s health insurance made a significant difference:

Story 1: Early Detection and Peace of Mind

Sarah, a 40-year-old woman with a family history of breast cancer, had always been diligent about her annual mammograms. Thanks to her comprehensive women’s health insurance, she was able to detect a small lump during her regular screening. The early detection led to a successful treatment plan, and Sarah is now cancer-free. Her insurance coverage not only saved her life but also provided the financial support needed during her treatment journey.

Story 2: Supporting Maternal Health

Emily, a first-time mother, faced complications during her pregnancy. Her women’s health insurance plan covered the necessary specialized care, including regular monitoring and additional ultrasounds. With the support of her insurance, Emily was able to navigate these challenges and deliver a healthy baby. The insurance not only ensured her access to the best medical care but also relieved the financial burden associated with unexpected pregnancy complications.

Story 3: Mental Health Recovery

After experiencing a traumatic event, Maria struggled with severe anxiety and depression. Her women’s health insurance plan included coverage for mental health services, which allowed her to access therapy and medication management. With the support of her insurance, Maria was able to make significant progress in her recovery journey, finding the tools she needed to manage her mental health effectively.

Comparative Analysis: Traditional vs. Women’s Health Insurance

When comparing traditional health insurance plans with those specifically designed for women, several key differences emerge. Here’s a closer look at how women’s health insurance stands out:

Coverage for Unique Needs

Women’s health insurance is tailored to meet the specific needs of women, offering coverage for services and treatments that are often overlooked or under-covered by traditional plans. This includes specialized care for reproductive health, menopause, and conditions unique to women’s physiology.

Emphasis on Preventive Care

Traditional health insurance plans may provide some preventive care coverage, but women’s health insurance takes this a step further. These plans often have a stronger focus on preventive services, ensuring that women have access to the screenings and wellness programs necessary for early detection and management of potential health issues.

Financial Protection

Women’s health insurance can provide significant financial protection, especially during critical stages of a woman’s life, such as pregnancy and childbirth. By covering the costs of prenatal care, delivery, and postnatal care, these plans alleviate the financial burden associated with these significant life events.

Holistic Approach to Wellness

Women’s health insurance recognizes the importance of a holistic approach to wellness. In addition to traditional medical services, these plans often include coverage for alternative therapies, wellness programs, and mental health services, promoting a more comprehensive view of women’s health and well-being.

Choosing the Right Women’s Health Insurance Plan

Selecting the right women’s health insurance plan can be a complex decision, as it involves understanding your specific health needs and preferences. Here are some key factors to consider when choosing a plan:

Coverage Options

Review the coverage options offered by different insurance providers. Look for plans that align with your health needs, whether you require specialized care for a specific condition or simply want comprehensive coverage for routine check-ups and screenings.

Network of Providers

Check the network of healthcare providers associated with each insurance plan. Ensure that your preferred doctors, specialists, and hospitals are included in the network to avoid unexpected out-of-network charges.

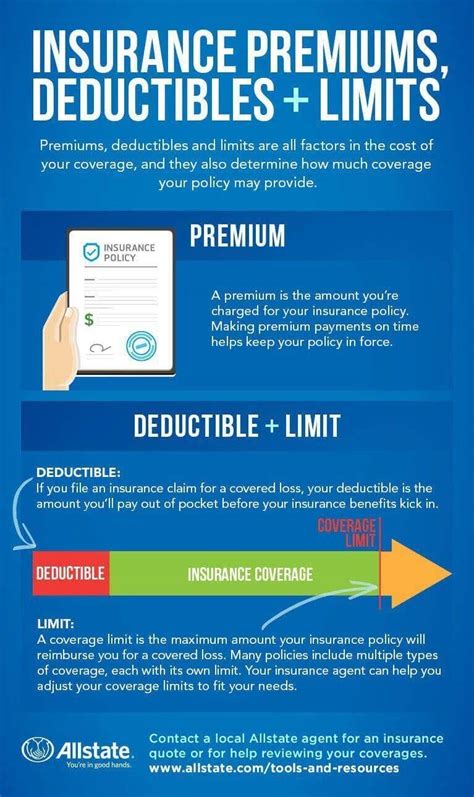

Cost and Deductibles

Evaluate the cost of the insurance plan, including premiums, deductibles, and co-pays. Consider your budget and financial stability when making this decision. Remember that a lower premium may come with higher out-of-pocket costs, so balance these factors accordingly.

Additional Benefits

Explore the additional benefits offered by different insurance plans. Some plans may include wellness programs, alternative therapy coverage, or discounted fitness memberships, which can enhance your overall well-being.

Customer Reviews and Reputation

Research the reputation and customer satisfaction of the insurance provider. Look for reviews and feedback from current or former policyholders to get a sense of the company’s reliability and customer service.

Future Trends and Innovations in Women’s Health Insurance

The field of women’s health insurance is continually evolving, driven by advancements in medical science and a growing understanding of women’s unique health needs. Here are some emerging trends and innovations that are shaping the future of women’s health insurance:

Personalized Medicine and Precision Health

The concept of personalized medicine is gaining traction, allowing for tailored treatment plans based on an individual’s genetic makeup and unique health needs. Women’s health insurance is expected to adapt to this trend, offering coverage for genetic testing and precision therapies that target specific health conditions.

Telehealth and Virtual Care

The COVID-19 pandemic has accelerated the adoption of telehealth services, and this trend is likely to continue. Women’s health insurance plans are increasingly incorporating telehealth options, allowing women to access medical advice and consultations remotely, especially for non-emergency issues.

Digital Health Tools and Apps

Digital health tools and apps are becoming integral to managing personal health. Insurance providers are exploring partnerships with digital health platforms to offer discounts or incentives for using these tools, which can range from tracking menstrual cycles to monitoring chronic conditions.

Focus on Mental Health

Recognizing the growing importance of mental health, women’s health insurance plans are expected to further enhance their coverage for mental health services. This may include increased access to therapy, improved medication management, and specialized programs for stress and anxiety management.

Preventive Care Innovations

The focus on preventive care is likely to continue, with insurance providers investing in innovative approaches to early detection and disease prevention. This could include expanded coverage for wellness programs, lifestyle coaching, and access to cutting-edge screening technologies.

Conclusion: Empowering Women Through Health Insurance

Women’s health insurance is more than just a financial safety net; it’s a powerful tool for empowering women to take control of their health and well-being. By providing comprehensive coverage, emphasizing preventive care, and recognizing the unique needs of women, these insurance plans play a vital role in ensuring that women can access the medical services they need without financial barriers.

As the field of women's health insurance continues to evolve, it's essential for women to stay informed about their options and the benefits available to them. By choosing the right insurance plan, women can not only protect their health but also invest in their future, knowing that they have the support and resources to navigate life's health challenges.

What is the average cost of women’s health insurance plans?

+The cost of women’s health insurance plans can vary significantly based on factors such as location, age, and the level of coverage desired. On average, premiums for individual plans can range from 200 to 600 per month, while family plans can be higher. However, it’s important to note that cost-sharing measures like deductibles and co-pays can impact the overall out-of-pocket expenses.

Are there any government programs that offer women’s health insurance?

+Yes, several government programs provide health insurance coverage specifically for women. For example, Medicaid is a state-run program that offers coverage to low-income individuals, including women who may not have access to private insurance. Additionally, the Children’s Health Insurance Program (CHIP) provides coverage for pregnant women and their children.

How does women’s health insurance address the cost of fertility treatments?

+The coverage for fertility treatments varies widely among women’s health insurance plans. Some plans may offer comprehensive coverage for a range of fertility services, including in vitro fertilization (IVF) and other assisted reproductive technologies. However, many plans have limitations or exclusions for fertility treatments, so it’s crucial to carefully review the policy details before enrolling.

Can I switch to a women’s health insurance plan if I already have traditional insurance?

+Switching to a women’s health insurance plan from a traditional plan is possible, but it often depends on your specific situation and the insurance provider. It’s advisable to consult with an insurance agent or financial advisor to understand the potential benefits and drawbacks of such a switch. Additionally, be mindful of any open enrollment periods or special enrollment events that may allow for a change in coverage.