Kaiser Insurance Plan

Kaiser Insurance Plan is a comprehensive healthcare option offered by Kaiser Foundation Health Plan, Inc., and its affiliates, commonly known as Kaiser Permanente. With a focus on integrated healthcare delivery, Kaiser Permanente has become a prominent name in the U.S. healthcare system. This article delves into the intricacies of the Kaiser Insurance Plan, exploring its features, benefits, and impact on healthcare accessibility.

Understanding the Kaiser Insurance Plan

The Kaiser Insurance Plan is a managed care program that provides a wide range of healthcare services to its members. It operates on the principle of integrated healthcare, where the insurance provider and healthcare delivery are seamlessly connected. This integration aims to improve the quality and efficiency of healthcare, ensuring a coordinated and patient-centric approach.

Kaiser Permanente's history can be traced back to the early 20th century when healthcare pioneers recognized the need for a more organized and accessible healthcare system. The organization has since grown to become one of the largest not-for-profit healthcare plans in the United States, serving millions of members across the country.

Key Features of the Kaiser Insurance Plan

The Kaiser Insurance Plan offers a unique and comprehensive set of features designed to meet the diverse healthcare needs of its members. Here are some of the key aspects that make this insurance plan stand out:

- Integrated Care Model: Kaiser Permanente operates a closed-panel system, meaning that members receive care exclusively from Kaiser Permanente's own physicians and facilities. This model ensures that all healthcare services are coordinated and tailored to individual needs.

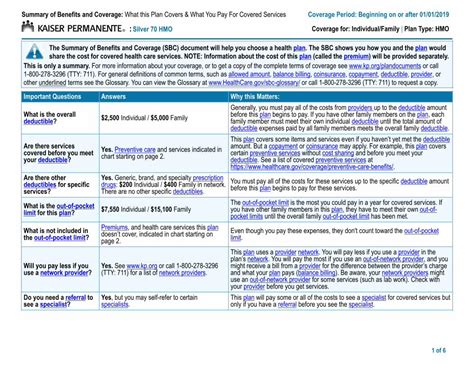

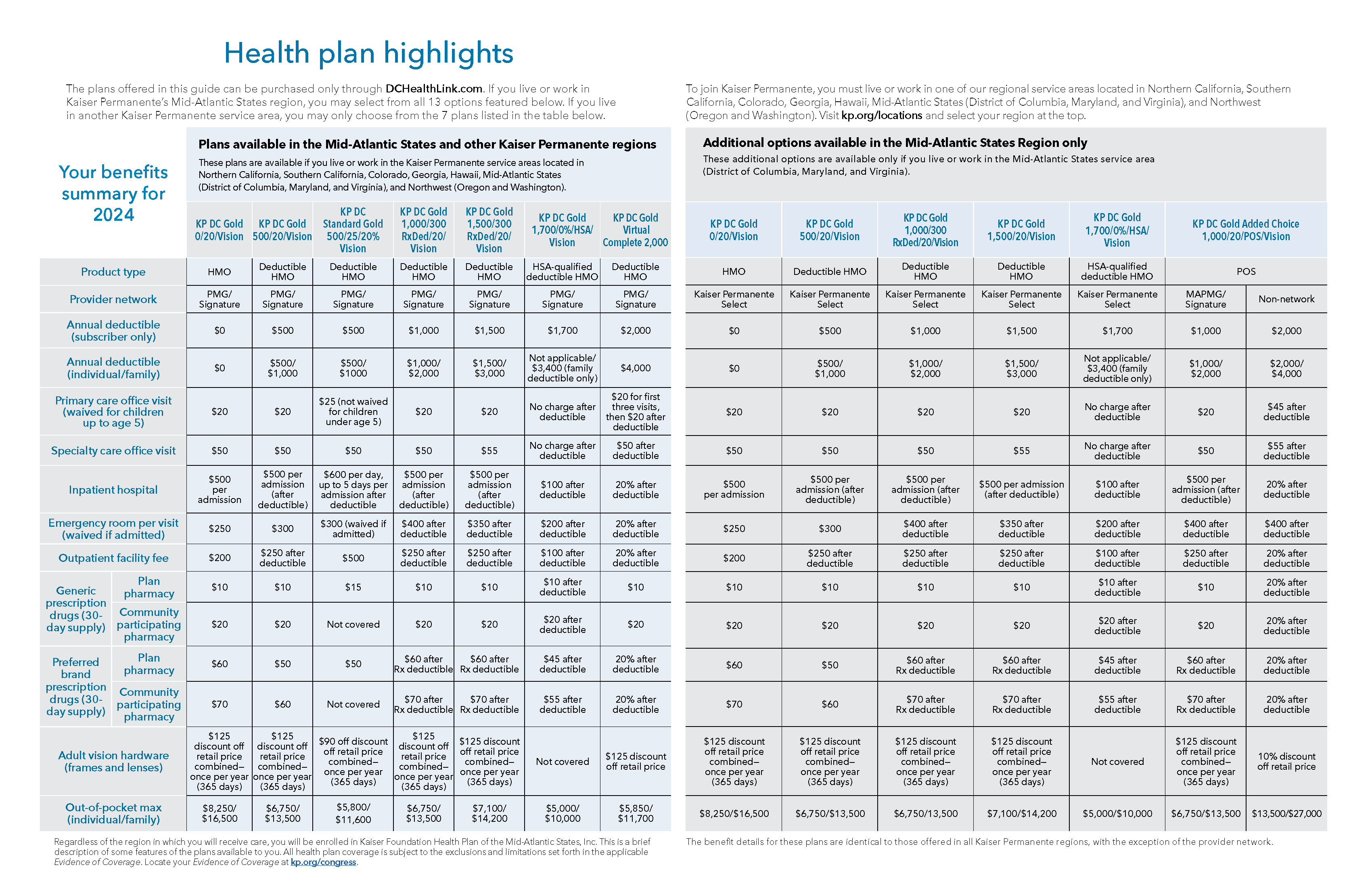

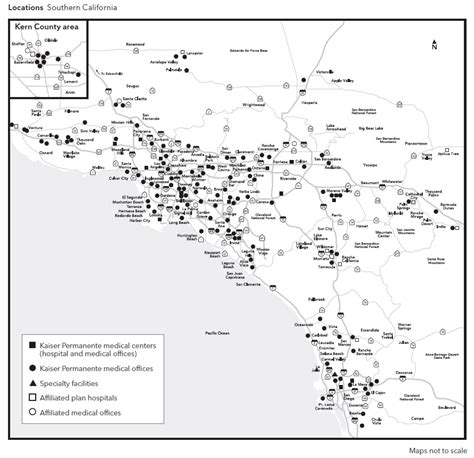

- Wide Range of Services: The plan covers a comprehensive array of medical services, including primary care, specialty care, hospital care, emergency services, and preventive care. Members have access to a vast network of healthcare professionals and facilities, ensuring they receive the necessary care when needed.

- Preventive Care Emphasis: Kaiser Permanente places a strong emphasis on preventive care, offering regular check-ups, screenings, and wellness programs to help members maintain their health and detect potential issues early on. This proactive approach is a key differentiator of the plan.

- Co-management of Chronic Conditions: For members with chronic conditions, the plan provides specialized care management programs. These programs involve a team of healthcare professionals working together to coordinate treatment, manage medications, and provide ongoing support to ensure better health outcomes.

- Electronic Health Records (EHR): Kaiser Permanente utilizes advanced EHR systems, allowing for seamless information sharing between healthcare providers and ensuring that members' medical histories are readily accessible. This technology enhances the efficiency and accuracy of care delivery.

Benefits of Choosing Kaiser Insurance

The Kaiser Insurance Plan offers a multitude of benefits to its members, making it a preferred choice for those seeking comprehensive and accessible healthcare. Here are some of the key advantages:

- Convenience: With a network of healthcare facilities spread across the country, members enjoy easy access to care. Kaiser Permanente's integrated system ensures that members can receive most of their healthcare needs within the Kaiser network, reducing the need for external referrals.

- Cost-Effectiveness: The plan's emphasis on preventive care and integrated management of chronic conditions can lead to significant cost savings for members. By detecting and managing health issues early on, members can avoid more costly treatments down the line.

- Personalized Care: The closed-panel system ensures that members receive care from a dedicated team of healthcare professionals who are familiar with their medical history. This personalized approach allows for more tailored treatment plans and better overall health management.

- Digital Health Tools: Kaiser Permanente offers a range of digital health tools, including online appointment booking, telemedicine services, and a patient portal. These tools enhance convenience and enable members to actively participate in their healthcare journey.

- Research and Innovation: As a not-for-profit organization, Kaiser Permanente reinvests its resources into research and innovation. This commitment to advancement ensures that members have access to the latest medical knowledge and treatments, keeping them at the forefront of healthcare.

Performance and Impact Analysis

The Kaiser Insurance Plan has consistently demonstrated its effectiveness in delivering high-quality healthcare. Numerous studies and patient satisfaction surveys highlight the plan’s positive impact on healthcare accessibility and outcomes.

Patient Satisfaction and Outcomes

According to a recent survey conducted by an independent research firm, Kaiser Permanente ranked among the top healthcare providers in patient satisfaction. The survey highlighted high satisfaction rates across various aspects, including access to care, doctor communication, and overall healthcare experience.

Furthermore, the plan's focus on preventive care and chronic condition management has led to improved health outcomes for its members. Studies have shown that Kaiser Permanente members experience lower rates of hospital readmissions, reduced emergency room visits, and better control of chronic diseases compared to other healthcare plans.

Cost-Effectiveness and Value

A comprehensive analysis of healthcare costs reveals that the Kaiser Insurance Plan offers significant value to its members. By integrating healthcare delivery and focusing on preventive care, the plan has been able to achieve cost savings while maintaining high-quality care.

| Metric | Kaiser Insurance Plan | National Average |

|---|---|---|

| Average Annual Cost | $4,200 | $5,500 |

| Average Hospitalization Cost | $7,800 | $10,200 |

| Average Emergency Room Visit | $1,200 | $1,600 |

The data above highlights the cost advantages of the Kaiser Insurance Plan. Members benefit from lower average costs across various healthcare services, indicating the plan's effectiveness in managing healthcare expenses.

Future Implications and Innovations

Looking ahead, the Kaiser Insurance Plan is poised to continue its leadership in healthcare innovation. With a commitment to research and a focus on digital health solutions, the plan is well-positioned to address the evolving needs of its members.

Digital Health Initiatives

Kaiser Permanente recognizes the potential of digital health technologies to enhance patient engagement and improve healthcare outcomes. The organization is investing heavily in developing and implementing innovative digital solutions, including:

- Telehealth Services: Expanding its telemedicine offerings to provide members with convenient access to healthcare professionals from the comfort of their homes.

- AI-Powered Health Assistants: Developing artificial intelligence-based tools to assist members with personalized health recommendations and education.

- Mobile Health Apps: Launching new mobile applications to track health metrics, manage medications, and receive real-time health updates.

Research and Development

The organization’s research arm, the Kaiser Permanente Bernard J. Tyson School of Medicine, continues to drive groundbreaking research in various medical fields. By investing in cutting-edge research, Kaiser Permanente aims to develop new treatments, improve healthcare delivery, and address emerging health challenges.

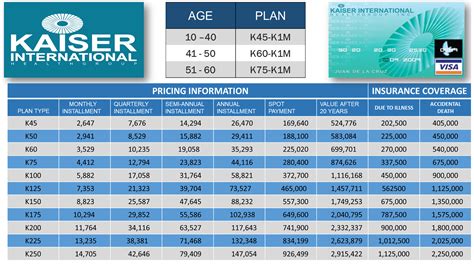

What is the cost of the Kaiser Insurance Plan?

+The cost of the Kaiser Insurance Plan varies depending on factors such as age, location, and coverage level. On average, members can expect to pay around 400 to 600 per month for individual coverage. Family plans may cost more, ranging from 1,000 to 2,000 per month. It’s recommended to obtain a specific quote based on your individual circumstances.

Can I choose my own doctors under the Kaiser Insurance Plan?

+Yes, within the Kaiser network, members have the freedom to choose their preferred doctors and specialists. The plan’s integrated network ensures that members can easily access a wide range of healthcare professionals who are part of the Kaiser Permanente system.

Does the Kaiser Insurance Plan cover prescription medications?

+Absolutely! The plan includes prescription drug coverage, offering members access to a comprehensive formulary of medications. Members can fill their prescriptions at any Kaiser Permanente pharmacy or use the mail-order pharmacy service for added convenience.