Newyork Life Insurance

New York Life Insurance, one of the oldest and largest insurance companies in the United States, has a rich history spanning over 175 years. With a strong focus on financial security and a commitment to its policyholders, New York Life has become a trusted name in the insurance industry. In this comprehensive article, we will delve into the world of New York Life Insurance, exploring its history, products, customer experience, and its impact on the financial well-being of individuals and families.

A Legacy of Financial Protection: New York Life’s Journey

Founded in 1845, New York Life Insurance Company has weathered numerous economic storms and has played a pivotal role in shaping the American insurance landscape. Its story began in a small office in Manhattan, where a group of visionary entrepreneurs recognized the importance of providing financial security to families and businesses. Over the decades, the company expanded its reach, offering a wide range of insurance and investment products to meet the evolving needs of its customers.

One of the key milestones in New York Life's history was its resilience during the Great Depression. While many financial institutions struggled, New York Life stood strong, honoring its commitments and providing stability to its policyholders. This reputation for reliability and trust has been a cornerstone of the company's success.

A Glimpse into New York Life’s Impact

New York Life’s impact extends far beyond its financial offerings. The company has been actively involved in various community initiatives and philanthropic endeavors. Through its charitable programs, New York Life has supported education, healthcare, and disaster relief efforts, making a positive difference in the lives of countless individuals.

| Community Initiative | Impact |

|---|---|

| Education Grants | Provided scholarships and funded educational programs, empowering students to pursue their dreams. |

| Healthcare Partnerships | Collaborated with medical institutions to improve access to healthcare services, especially in underserved communities. |

| Disaster Relief | Rapidly responded to natural disasters, offering financial aid and resources to affected policyholders and communities. |

Comprehensive Insurance Solutions

New York Life offers a diverse range of insurance products designed to cater to the unique needs of its customers. Let’s explore some of the key offerings:

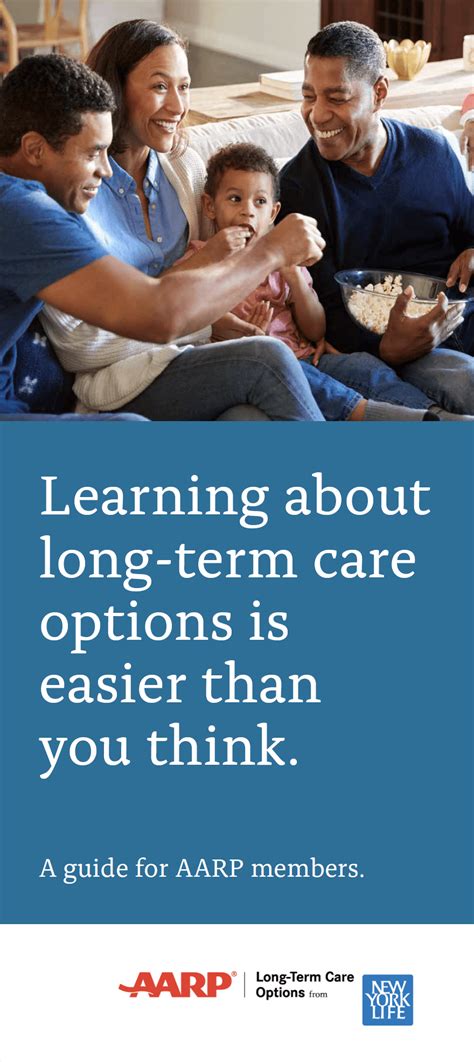

Life Insurance

The cornerstone of New York Life’s business, life insurance policies provide financial protection to families in the event of a loved one’s passing. With various term lengths and coverage options, policyholders can choose a plan that aligns with their goals and budget.

Annuities

Annuities are a popular choice for individuals seeking a stable income stream during retirement. New York Life’s annuity products offer flexible payment options and potential tax benefits, ensuring a secure financial future.

Disability Insurance

Disability insurance protects policyholders’ income in the event of an accident or illness that prevents them from working. New York Life’s disability insurance plans provide peace of mind, ensuring financial stability during challenging times.

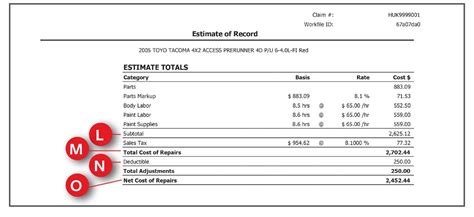

Long-Term Care Insurance

As individuals age, the need for long-term care becomes a critical consideration. New York Life’s long-term care insurance plans cover the costs of assisted living, nursing home care, and other essential services, providing individuals and their families with much-needed support.

Other Insurance Offerings

In addition to the above, New York Life also provides a range of other insurance products, including:

- Home and Auto Insurance

- Business Insurance Solutions

- Travel Insurance

- Pet Insurance

With such a comprehensive suite of insurance offerings, New York Life ensures that its customers can find tailored solutions for every stage of life.

Exceptional Customer Experience

At the heart of New York Life’s success is its unwavering commitment to delivering an exceptional customer experience. The company understands that financial decisions are personal, and its agents and representatives are dedicated to providing personalized guidance and support.

Agent Network

New York Life boasts an extensive network of knowledgeable and experienced agents. These professionals work closely with clients, offering tailored advice and assisting them in selecting the most suitable insurance products. The agent-client relationship often extends beyond financial matters, fostering trust and long-lasting partnerships.

Digital Innovations

In today’s digital age, New York Life has embraced technology to enhance its customer experience. The company’s online platforms and mobile apps offer convenient access to policy information, allowing policyholders to manage their accounts efficiently. Additionally, the introduction of digital tools for claim submissions and policy updates has streamlined the entire process.

Claims Process

When it matters most, New York Life’s claims process is designed to be efficient and empathetic. The company’s dedicated claims specialists work diligently to process claims promptly, ensuring that policyholders receive the financial support they need during difficult times. The focus on timely claims settlement reflects New York Life’s commitment to its customers’ well-being.

Performance and Financial Strength

New York Life’s longevity and success are a testament to its financial stability and sound management. The company has consistently demonstrated strong financial performance, as evidenced by its high credit ratings and robust financial reserves.

According to industry reports, New York Life has maintained an exceptional level of financial strength, with a A.M. Best rating of A++ (Superior). This rating reflects the company's ability to meet its financial obligations and provides reassurance to policyholders and investors alike.

Investment Strategy

New York Life’s investment strategy is focused on long-term growth and stability. The company’s investment portfolio is diversified, encompassing a range of assets, including stocks, bonds, and real estate. This approach minimizes risk and ensures a steady stream of income, benefiting both policyholders and the company’s overall financial health.

The Future of Financial Security

As the insurance industry continues to evolve, New York Life remains at the forefront of innovation. The company is actively exploring new technologies, such as artificial intelligence and blockchain, to enhance its services and provide even greater value to its customers.

One of the key areas of focus for New York Life is the development of personalized insurance products. By leveraging advanced analytics and customer data, the company aims to offer tailored solutions that meet the unique needs of individuals and businesses. This approach ensures that New York Life remains a trusted partner in an ever-changing financial landscape.

Environmental and Social Responsibility

In addition to its financial prowess, New York Life is committed to environmental and social responsibility. The company has implemented sustainable practices and initiatives to reduce its environmental footprint. From eco-friendly office spaces to energy-efficient investments, New York Life is dedicated to creating a positive impact on the planet.

Conclusion

With a rich history, a comprehensive suite of insurance products, and a commitment to exceptional customer service, New York Life Insurance stands as a beacon of financial security and trust. As the company continues to adapt and innovate, its legacy of protecting families and businesses will endure for generations to come. Whether it’s providing peace of mind through life insurance, offering retirement income solutions, or supporting communities in need, New York Life remains a stalwart partner in the journey towards financial well-being.

How can I find a New York Life agent in my area?

+To locate a New York Life agent near you, you can visit the company’s official website and use their agent locator tool. Simply enter your zip code or city, and you’ll be provided with a list of agents in your area. Alternatively, you can contact New York Life’s customer service, and they can assist you in finding a suitable agent based on your location and insurance needs.

What sets New York Life’s life insurance policies apart from competitors?

+New York Life’s life insurance policies are known for their flexibility and customization options. Policyholders can choose from various term lengths and coverage amounts, allowing them to tailor their policy to their specific needs and budget. Additionally, New York Life’s strong financial standing and reputation for reliability provide added peace of mind.

Does New York Life offer online policy management and digital services?

+Absolutely! New York Life understands the importance of convenience and digital accessibility. Their online platform allows policyholders to manage their policies, view account details, make payments, and even submit claims electronically. Additionally, the company offers mobile apps for on-the-go access to policy information and services.