Compare Car Insurance Quotes Online

Unveiling the World of Car Insurance Quotes: A Comprehensive Comparison Guide

Embarking on the journey of securing car insurance is a crucial step for any vehicle owner, and with the myriad of options available, it's essential to navigate the process with expertise and precision. This guide aims to demystify the intricacies of comparing car insurance quotes online, offering a comprehensive roadmap to help you make informed decisions and find the coverage that best suits your needs.

In today's digital age, the landscape of car insurance has evolved, providing an array of online platforms and tools that empower consumers to take control of their insurance journey. However, with the abundance of choices, it's easy to feel overwhelmed. That's why we've crafted this detailed guide, drawing on industry insights and real-world experiences, to ensure you're equipped with the knowledge needed to compare quotes effectively and efficiently.

Understanding the Fundamentals of Car Insurance

Before diving into the comparison process, it's imperative to grasp the foundational aspects of car insurance. Car insurance serves as a protective shield, safeguarding you and your vehicle against a multitude of potential risks and liabilities. These can range from accidents and theft to natural disasters and vandalism. By understanding the core components of car insurance, you'll be better equipped to assess the suitability of different quotes and policies.

At its core, car insurance is a contract between you and the insurance company. This contract outlines the terms and conditions of your coverage, including the types of risks covered, the limits of your policy, and any exclusions or limitations that may apply. It's essential to familiarize yourself with these terms to ensure you're adequately protected.

Key Components of Car Insurance:

- Liability Coverage: This covers the costs associated with damage or injury you cause to others while driving. It includes bodily injury liability and property damage liability.

- Comprehensive Coverage: Comprehensive insurance provides protection against damages not caused by collisions, such as theft, vandalism, or natural disasters.

- Collision Coverage: This type of coverage pays for repairs or replacement of your vehicle if you're involved in an accident, regardless of fault.

- Medical Payments or Personal Injury Protection (PIP): These cover the medical expenses for you and your passengers, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you're involved in an accident with a driver who doesn't have insurance or doesn't have enough insurance to cover the damages.

It's crucial to note that the specific coverage options and their availability may vary depending on your state's regulations and the insurance provider. Understanding these components will enable you to tailor your insurance needs to your specific circumstances.

The Online Quote Comparison Process

Comparing car insurance quotes online has revolutionized the way consumers shop for insurance. It offers convenience, speed, and a wealth of information at your fingertips. Here's a step-by-step guide to help you navigate the process effectively:

Step 1: Gather Essential Information

Before requesting quotes, ensure you have the necessary details readily available. This includes:

- Personal information: Name, date of birth, driver's license number, and social security number.

- Vehicle information: Make, model, year, VIN number, and mileage.

- Driving history: Details of any accidents, tickets, or claims in the past 5 years.

- Current or previous insurance information: Policy number and coverage details.

Having this information organized will streamline the quote comparison process and ensure accuracy.

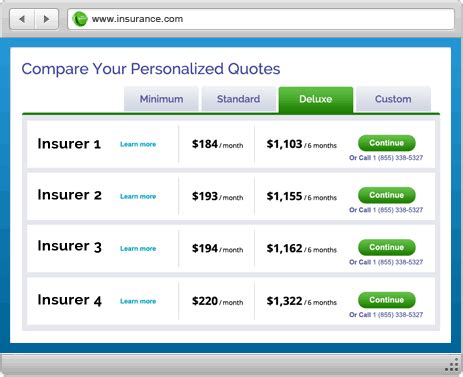

Step 2: Explore Online Comparison Tools

Numerous online platforms and websites offer tools specifically designed to compare car insurance quotes. These tools often provide a comprehensive overview of different insurance providers, their coverage options, and their pricing structures. Some popular comparison sites include:

- InsuranceCompare.com: A user-friendly platform that allows you to compare quotes from multiple insurers in one place.

- InsureMe.org: Offers a quick and efficient way to get quotes tailored to your specific needs.

- CarInsuranceQuotes.net: Provides a comprehensive database of insurance providers and their policies, allowing for detailed comparisons.

When exploring these tools, ensure they are reputable and secure. Look for sites that have privacy policies and secure connections (HTTPS) to protect your personal information.

Step 3: Customize Your Quote Requests

Online comparison tools often allow you to tailor your quote requests to your specific needs. This customization ensures that the quotes you receive are relevant and accurate. Here are some key factors to consider:

- Coverage Levels: Determine the level of coverage you require. Do you need basic liability coverage, or do you prefer comprehensive and collision coverage? Consider your financial situation and the value of your vehicle when making this decision.

- Deductibles: Deductibles are the amount you pay out of pocket before your insurance kicks in. Choosing a higher deductible can lower your premium, but ensure it's an amount you're comfortable paying if needed.

- Additional Coverages: Depending on your circumstances, you may want to explore additional coverages like rental car reimbursement, roadside assistance, or gap insurance.

Step 4: Compare Quotes and Providers

Once you've received a few quotes, it's time to analyze and compare them. Look beyond the premium amounts and consider the following factors:

- Coverage Limits: Ensure the policies you're comparing offer adequate coverage limits for your needs. Higher limits may provide better protection but can also result in higher premiums.

- Policy Exclusions: Carefully review the exclusions listed in each policy. These are situations or events that are not covered by the insurance provider. Understanding these exclusions can help you avoid surprises later on.

- Reputation and Financial Stability: Research the insurance providers' reputations and financial stability. Look for reviews and ratings from reputable sources to ensure the company is reliable and financially sound.

- Customer Service and Claims Process: Consider the ease of interacting with the insurance provider. Do they offer 24/7 customer support? How efficient is their claims process? These factors can significantly impact your experience as a policyholder.

Step 5: Consider Additional Factors

While the premium and coverage are crucial, there are other factors to consider when choosing an insurance provider:

- Discounts: Many insurance companies offer discounts for various reasons, such as safe driving records, multiple policies, or loyalty. Explore the available discounts and calculate their impact on your overall premium.

- Bundling Options: If you have multiple insurance needs, such as home and auto insurance, consider bundling your policies with one provider. This can often result in significant savings.

- Digital Services and Convenience: In today's digital age, many insurance providers offer convenient online and mobile services. Consider whether the provider offers digital tools for policy management, claims submission, and other interactions.

Analyzing the Quote: A Deeper Dive

Now that you've gathered and compared quotes, it's time to delve deeper into the specifics. Here's a closer look at some key aspects to consider when analyzing your car insurance quotes:

Understanding the Premium

The premium is the amount you pay for your insurance coverage. It's essential to understand how the premium is calculated and what factors influence it. Here are some key considerations:

- Risk Assessment: Insurance companies assess your risk level based on various factors, including your age, gender, driving history, and the type of vehicle you drive. Higher-risk drivers may pay higher premiums.

- Coverage and Deductibles: As mentioned earlier, the level of coverage and your chosen deductibles significantly impact your premium. Higher coverage limits and lower deductibles generally result in higher premiums.

- Location and Usage: Your premium may vary based on your location and how you use your vehicle. Urban areas or high-crime neighborhoods may result in higher premiums. Additionally, factors like commute distance and the purpose of your vehicle (e.g., personal use vs. business use) can influence your premium.

Examining Coverage Limits

Coverage limits refer to the maximum amount your insurance provider will pay out for a covered claim. It's crucial to ensure that your coverage limits are adequate to protect your financial interests. Here's what to consider:

- Liability Coverage Limits: These limits dictate how much your insurance will pay if you're found at fault in an accident. Higher limits provide more protection but can result in higher premiums. Ensure your liability limits align with your financial situation and potential risks.

- Comprehensive and Collision Coverage Limits: These limits apply to damages caused by incidents other than collisions (e.g., theft, vandalism) and collisions, respectively. Assess the value of your vehicle and your financial comfort level to determine the appropriate coverage limits.

Reviewing Policy Exclusions

Policy exclusions are specific situations or events that are not covered by your insurance policy. It's crucial to carefully review these exclusions to ensure you're not caught off guard in the event of a claim. Here are some common exclusions to watch out for:

- Normal wear and tear: Most policies exclude damages caused by normal wear and tear, such as aging parts or regular maintenance issues.

- Mechanical or electrical failures: Unless specifically covered, damages resulting from mechanical or electrical failures are often excluded.

- Flood or water damage: Flood-related damages are typically excluded from standard policies, and separate flood insurance may be required in high-risk areas.

- Intentional acts: Damages resulting from intentional acts, such as racing or reckless driving, are often excluded.

The Future of Car Insurance: Trends and Innovations

The car insurance industry is continuously evolving, driven by technological advancements and changing consumer needs. Here's a glimpse into the future of car insurance and some trends to watch out for:

Telematics and Usage-Based Insurance

Telematics refers to the use of technology to track and analyze driving behavior. Usage-Based Insurance (UBI) takes this a step further by offering insurance rates based on actual driving behavior rather than traditional risk factors. With UBI, drivers can potentially lower their premiums by demonstrating safe driving habits.

Artificial Intelligence and Data Analytics

AI and data analytics are transforming the insurance industry. These technologies enable insurers to process vast amounts of data quickly and accurately, leading to more precise risk assessments and personalized insurance offerings. AI-powered chatbots and virtual assistants are also enhancing customer service and claim processing.

Connected Car Technology

The rise of connected car technology is expected to have a significant impact on car insurance. With vehicles becoming increasingly connected and capable of sharing data, insurers can gain insights into driving behavior, vehicle health, and even road conditions. This data can be used to offer more accurate and tailored insurance products.

Automated Claims Processing

Automated claims processing is gaining traction, leveraging AI and machine learning to streamline the claims process. This technology can quickly assess damage, validate claims, and speed up the payment process, providing a more efficient and customer-centric experience.

Conclusion: Empowering Your Insurance Journey

Comparing car insurance quotes online is a powerful tool that empowers you to take control of your insurance journey. By understanding the fundamentals of car insurance, utilizing online comparison tools, and analyzing quotes thoroughly, you can make informed decisions and find the coverage that best suits your needs and budget. Remember, car insurance is more than just a financial product; it's a safeguard for your peace of mind and financial well-being.

As the car insurance landscape continues to evolve, staying informed about the latest trends and innovations will ensure you remain ahead of the curve. Embrace the opportunities presented by technology, and don't hesitate to reach out to insurance experts or comparison platforms for guidance and support. Your journey towards finding the perfect car insurance policy begins with knowledge and a strategic approach.

How often should I compare car insurance quotes?

+

It’s recommended to review and compare your car insurance quotes annually or whenever your circumstances change significantly. This ensures you’re always getting the best value and coverage for your needs.

Can I negotiate car insurance rates with providers?

+

While insurance rates are primarily determined by risk assessments and industry regulations, some providers may offer discounts or bundle options that can lower your overall premium. It’s worth discussing these options with your insurance agent or provider.

What factors can cause my car insurance rates to increase?

+

Car insurance rates can be influenced by various factors, including your age, driving record, location, and the type of vehicle you drive. Additionally, making claims can sometimes lead to higher rates, as insurers consider it a risk factor. However, shopping around and comparing quotes can help you find more competitive rates.

Are there any alternative insurance options for high-risk drivers?

+

Yes, for high-risk drivers with multiple violations or accidents, there are often specialized insurance programs or providers that cater to their needs. These programs may have higher premiums but can still provide the necessary coverage. It’s worth exploring these options if you fall into this category.