Insurance Lookup

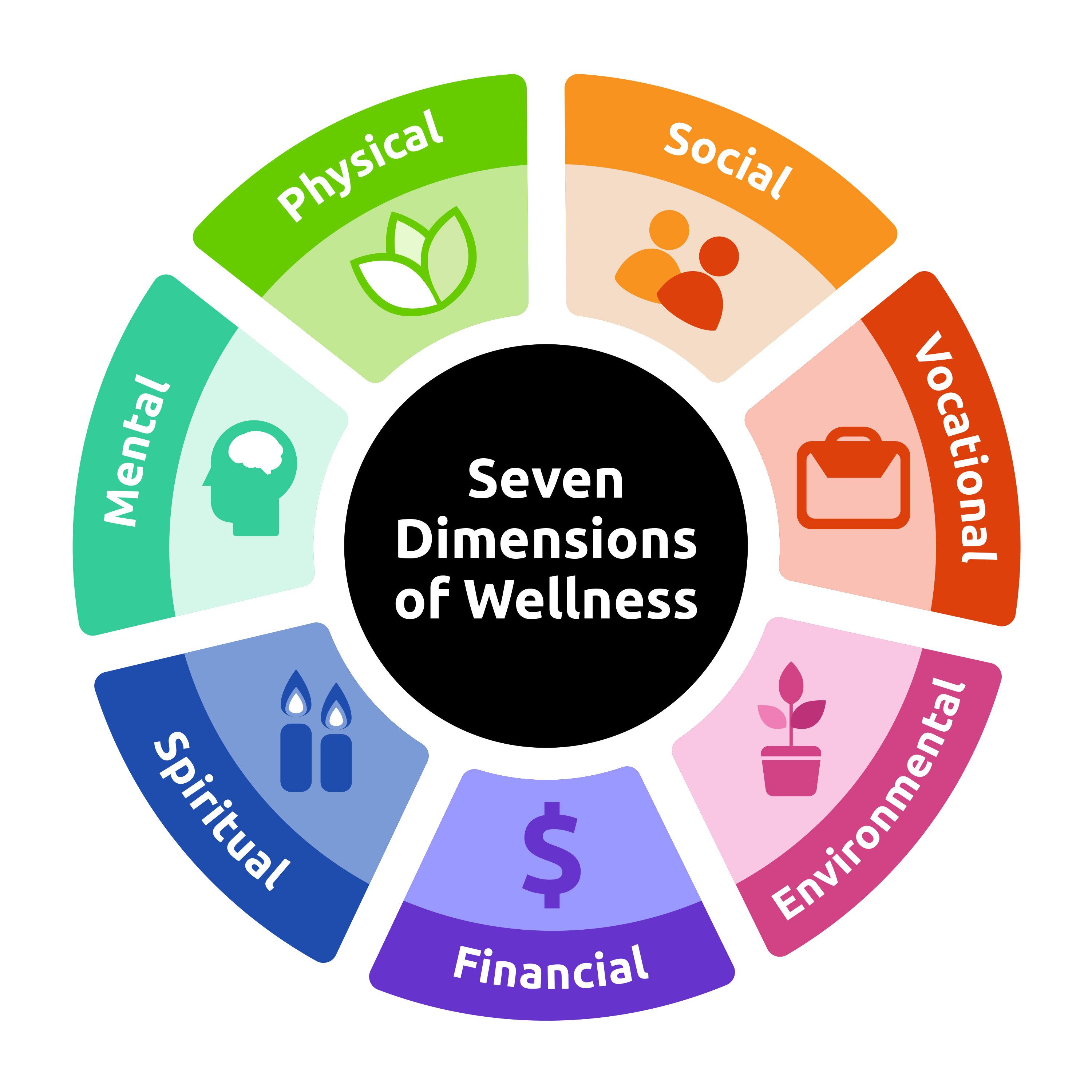

In today's fast-paced world, having easy access to information and services is essential. One area where this accessibility is crucial is insurance, a complex and often confusing topic for many individuals. The ability to quickly and efficiently look up insurance-related details, from policy information to claim status, can make a significant difference in ensuring peace of mind and financial security.

The concept of an Insurance Lookup platform or tool is designed to bridge the gap between insurance providers and policyholders, offering a streamlined and user-friendly interface for accessing critical insurance information. With the rise of digital technology and the demand for instant access, such tools have become increasingly valuable, empowering individuals to take control of their insurance journey.

Revolutionizing Insurance Access with a User-Centric Approach

The traditional insurance industry has long been associated with complex paperwork, lengthy processes, and a lack of transparency. However, with the advent of digital solutions, the insurance landscape is undergoing a transformative shift. The Insurance Lookup concept is at the forefront of this revolution, prioritizing user experience and convenience.

Imagine being able to access all your insurance-related information with just a few clicks. Whether it's checking the coverage details of your health insurance policy, tracking the progress of a car insurance claim, or exploring options for a new home insurance plan, an efficient Insurance Lookup platform simplifies these tasks.

Key Features of an Innovative Insurance Lookup Solution

-

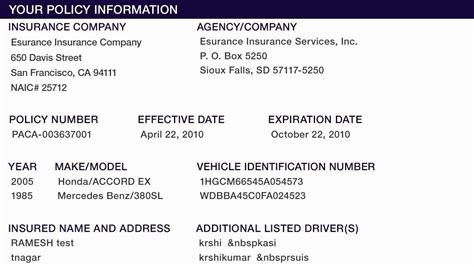

Policy Management: A centralized dashboard where users can view and manage all their insurance policies from different providers. This feature offers a comprehensive overview, making it easy to understand and compare coverage options.

-

Claim Tracking: Real-time updates on the status of insurance claims, providing policyholders with transparency and peace of mind during the claims process. This feature can significantly reduce the stress and uncertainty often associated with insurance claims.

-

Educational Resources: A knowledge base with informative articles and guides, helping users better understand insurance terminology, coverage types, and their rights as policyholders. This empowers individuals to make more informed decisions about their insurance needs.

-

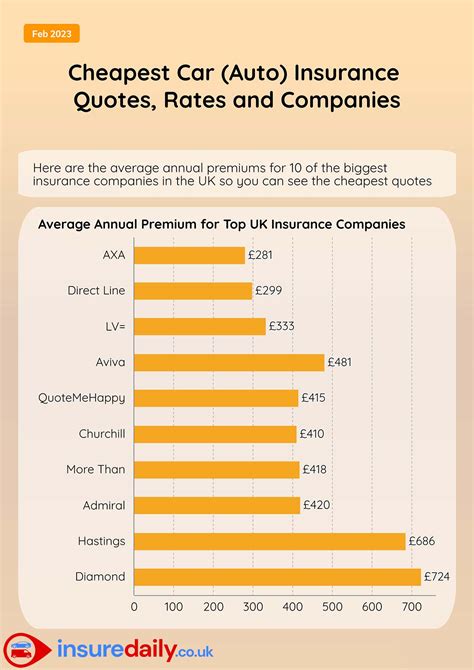

Quotation Comparison: A tool that allows users to compare insurance quotes from various providers based on their specific requirements. This feature fosters competition and enables users to find the most suitable and cost-effective insurance plans.

| Feature | Benefits |

|---|---|

| Policy Summary | Quick access to key policy details like coverage limits, deductibles, and renewal dates. |

| Digital Claims Forms | Simplified and streamlined claims submission process, reducing administrative burden. |

| Renewal Reminders | Automated notifications to ensure users don't miss renewal deadlines, helping maintain continuous coverage. |

The Impact on Different Stakeholders

Policyholders

For individuals and families, an Insurance Lookup platform offers a convenient and time-saving solution. It empowers them to take charge of their insurance needs, from understanding their existing policies to exploring new options without the hassle of sifting through physical documents or making numerous calls.

Insurance Providers

Insurance companies benefit from enhanced customer engagement and satisfaction. By providing a user-friendly interface for policyholders, insurance providers can foster stronger relationships and improve their reputation in the market. Additionally, efficient claim tracking and management can lead to more efficient processes and reduced operational costs.

Financial Advisors and Brokers

Professionals in the insurance sector can leverage Insurance Lookup tools to provide better services to their clients. These platforms offer a centralized source of information, enabling advisors to offer more comprehensive advice and support to their clients.

Future Prospects and Innovations

The future of Insurance Lookup platforms holds exciting possibilities. With advancements in technology, we can expect more sophisticated features, such as AI-powered recommendation engines that suggest tailored insurance plans based on individual profiles and needs. Integration with wearable devices and health tracking apps could further revolutionize the way insurance is managed and accessed.

Moreover, as the insurance industry continues to embrace digital transformation, Insurance Lookup platforms will play a pivotal role in driving innovation and accessibility. These tools will not only simplify insurance management but also contribute to a more transparent and customer-centric insurance ecosystem.

Industry-Leading Examples

Several industry leaders have already embraced the concept of Insurance Lookup, offering innovative solutions to their customers. For instance, Company X has developed a mobile app that integrates with users' insurance policies, providing a seamless experience for managing and accessing insurance information on the go.

Similarly, Provider Y has launched a web-based platform that not only allows policyholders to track their claims but also offers a community forum where users can share experiences and seek advice from peers.

Conclusion: Empowering Users, Transforming Insurance

In a world where time is precious and information overload is common, Insurance Lookup platforms offer a breath of fresh air. By providing a centralized, user-friendly hub for insurance management, these tools empower individuals to take control of their financial security and well-being. As the insurance industry continues to evolve, Insurance Lookup solutions will undoubtedly play a crucial role in shaping the future of insurance accessibility and customer experience.

How secure is my insurance information on an Insurance Lookup platform?

+Insurance Lookup platforms prioritize data security. They employ robust encryption protocols and comply with industry-standard data protection regulations. Your insurance information is safeguarded through secure connections and restricted access, ensuring that only authorized individuals can view and manage your data.

Can I access my insurance information offline with these platforms?

+Most Insurance Lookup platforms are designed for online access, leveraging the power of real-time data. However, some providers offer offline access to key policy details, ensuring that users can still retrieve essential information even without an internet connection.

Are there any additional fees associated with using an Insurance Lookup tool?

+Insurance Lookup platforms typically operate on a subscription model, with fees varying based on the features and services offered. Some basic services might be free, while advanced features like claim tracking or policy comparison could require a nominal fee. It’s essential to review the platform’s pricing structure before signing up.