How Much Should Homeowners Insurance Increase Each Year

Homeowners insurance is a vital financial safeguard for property owners, offering protection against a range of potential risks. Understanding how this coverage evolves over time is essential for making informed decisions and ensuring adequate protection. In this article, we delve into the factors influencing the annual increase in homeowners insurance premiums, providing an in-depth analysis backed by industry insights and real-world examples.

The Dynamics of Homeowners Insurance Premiums

Homeowners insurance premiums are not static; they are subject to annual adjustments based on a multitude of factors. These adjustments aim to reflect the evolving risks associated with homeownership and the costs of providing coverage. While the exact increase can vary significantly, understanding the key drivers can help homeowners anticipate and plan for these changes.

Inflation and Rising Costs

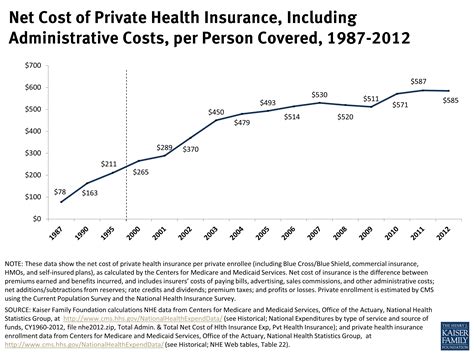

One of the primary factors influencing the annual increase in homeowners insurance premiums is inflation. As the cost of living rises, so do the expenses associated with repairing or rebuilding homes, which directly impacts insurance costs. For instance, a report by the National Association of Insurance Commissioners (NAIC) revealed that the average cost of a homeowners insurance claim has increased by 20% over the past decade, primarily due to rising material and labor costs.

| Year | Average Cost of Homeowners Insurance Claim |

|---|---|

| 2013 | $8,500 |

| 2023 | $10,200 |

Additionally, inflation affects the administrative and operational costs of insurance companies, which are often passed on to policyholders in the form of higher premiums.

Catastrophic Events and Risk Exposure

The frequency and severity of natural disasters, such as hurricanes, wildfires, and floods, have a significant impact on homeowners insurance premiums. When these events occur, they can lead to a surge in claims, straining insurance companies’ resources. As a result, insurers may adjust their premiums to account for the increased risk and potential for future losses.

For example, the devastating 2020 wildfire season in California prompted many insurance carriers to reassess their policies and premiums. Some carriers even withdrew from high-risk areas, leaving homeowners with fewer options and potentially higher costs.

Changes in Coverage and Policy Terms

Insurance companies regularly review and update their policies to ensure they remain compliant with regulations and reflect the evolving needs of homeowners. This can include adding new coverage options, adjusting deductibles, or modifying policy terms and conditions. Such changes often result in premium adjustments, either upward or downward, depending on the nature of the revisions.

A notable example is the introduction of water backup coverage, which provides protection against damage caused by water intrusion from plumbing or sewer systems. Many insurers now offer this coverage as an optional add-on, which can increase the overall premium.

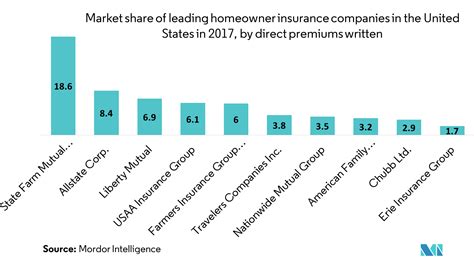

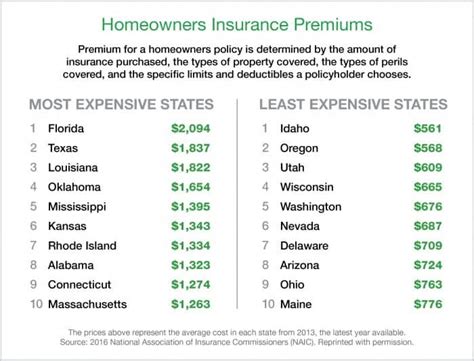

Regional and Local Factors

Homeowners insurance premiums can vary significantly depending on the location of the property. Regional factors such as crime rates, local building codes, and the proximity to natural disaster-prone areas can all influence insurance costs. For instance, a home located in a high-crime neighborhood may face higher premiums due to the increased risk of theft or vandalism.

| Region | Average Annual Premium Increase |

|---|---|

| Southeast (Hurricane-prone areas) | 6% |

| West Coast (Wildfire and Earthquake zones) | 5% |

| Midwest (Tornado Alley) | 4% |

Market Competition and Regulatory Changes

The insurance market is dynamic, with competition among carriers playing a crucial role in premium adjustments. Insurers may lower premiums to attract new customers or retain existing ones, especially in competitive markets. Conversely, regulatory changes, such as modifications to state insurance laws, can also impact premiums. For example, changes in resurrection laws, which govern the re-evaluation of old policies, can lead to higher premiums for older homes.

Strategies for Managing Annual Premium Increases

While homeowners may not have control over all the factors influencing insurance premiums, there are strategies they can employ to manage these increases and potentially mitigate their impact.

Regular Policy Review and Comparison

Staying informed about the market and regularly reviewing insurance policies can help homeowners identify opportunities for cost savings. Comparing quotes from multiple insurers and understanding the specific coverage offered can lead to more competitive premiums. Online platforms and insurance brokers can assist in this process, providing a comprehensive overview of available options.

Improving Home Security and Mitigating Risks

Investing in home security measures, such as alarm systems, fire sprinklers, and reinforced doors, can make a home less vulnerable to certain risks. This not only enhances safety but can also lead to premium discounts. Additionally, taking steps to reduce the likelihood of natural disasters impacting the home, such as installing storm shutters or reinforcing roofs, can signal to insurers a reduced risk profile.

Bundling Policies and Loyalty Rewards

Many insurance companies offer discounts for customers who bundle multiple policies, such as homeowners and auto insurance. These multi-policy discounts can lead to significant savings. Furthermore, insurers often reward customer loyalty with long-term policyholder discounts or incentives, which can offset annual premium increases.

Understanding Deductibles and Coverage Limits

Homeowners can influence their premium costs by adjusting deductibles and coverage limits. Opting for a higher deductible can lead to lower premiums, as it reduces the insurer’s potential payout in the event of a claim. Similarly, carefully reviewing coverage limits and ensuring they align with the home’s actual replacement cost can prevent overinsurance, which can drive up premiums unnecessarily.

Maintaining a Good Claims History

Insurance companies consider a homeowner’s claims history when setting premiums. A clean claims record can lead to more favorable rates, as it signals a lower risk profile. However, it’s important to note that making frequent claims, even for small amounts, can have the opposite effect and result in higher premiums or even policy cancellation.

Future Outlook and Industry Trends

Looking ahead, the homeowners insurance landscape is expected to continue evolving in response to changing risk factors and technological advancements. Climate change and its associated increase in natural disasters are likely to remain a significant influence on premiums. Additionally, the growing adoption of smart home technologies and data analytics by insurers may lead to more personalized and accurate risk assessments, potentially impacting premium calculations.

The development of parametric insurance, which provides coverage based on the occurrence of specific events rather than the actual damage incurred, could also disrupt the traditional homeowners insurance model. This type of insurance, while still emerging, has the potential to offer more flexibility and faster claim payouts, albeit with potentially higher premiums.

FAQ

How often should I review my homeowners insurance policy?

+

It’s recommended to review your policy annually, especially after significant life events such as marriage, home renovations, or the purchase of valuable assets. Regular reviews ensure your coverage remains adequate and allow you to take advantage of any new discounts or coverage options.

Can I negotiate my homeowners insurance premium?

+

While homeowners insurance premiums are largely determined by standardized rates, there may be room for negotiation in certain situations. If you have a long-standing relationship with your insurer or have multiple policies with them, you may be able to negotiate a better rate, especially if you can demonstrate a low-risk profile.

What factors can lead to a decrease in homeowners insurance premiums?

+

Several factors can lead to lower premiums, including a decrease in local crime rates, improvements in home security, or changes in personal circumstances (e.g., an adult child moving out, reducing the risk of theft). Additionally, insurers may offer discounts for policyholders who maintain a clean claims history or bundle multiple policies.

How do insurers determine the replacement cost of my home?

+

Insurers typically use a combination of factors to determine the replacement cost of a home, including its size, location, construction materials, and local building codes. They may also consider the cost of labor and materials in your area. It’s important to review this estimate regularly to ensure it aligns with the actual cost of rebuilding your home.