Bike Insurance Cost

Bike insurance is a vital aspect of responsible riding, offering financial protection and peace of mind to motorcycle enthusiasts. The cost of bike insurance varies significantly, influenced by a multitude of factors, including the type of coverage, the make and model of the bike, the rider's age and experience, and the geographical location. Understanding these variables is key to securing the best insurance policy for your needs and budget.

Factors Influencing Bike Insurance Costs

The cost of bike insurance is determined by a complex interplay of factors, each contributing to the overall premium. These factors are not isolated but rather interrelated, creating a nuanced picture of the insurance landscape. Here, we delve into the key elements that impact the price of bike insurance.

Coverage Type and Limits

The type and extent of coverage you choose play a pivotal role in determining your insurance premium. Different policies offer varying levels of protection, from liability-only coverage to comprehensive plans that cover a wide range of incidents, including theft, vandalism, and natural disasters. The more extensive the coverage, the higher the premium is likely to be.

Additionally, the coverage limits you select will influence the cost. For instance, opting for higher liability limits to protect against potential lawsuits will result in a higher premium. It's essential to strike a balance between adequate coverage and a manageable premium, ensuring you're protected without overspending.

Make and Model of the Bike

The make and model of your bike are significant factors in insurance pricing. Insurance companies consider various attributes of the vehicle, including its engine size, power, and safety features. Generally, bikes with larger engines and higher horsepower are deemed riskier and therefore attract higher premiums.

Moreover, the popularity and theft rate of a particular make and model can also impact insurance costs. Bikes that are frequently targeted by thieves or those with a high rate of accidents may result in higher insurance premiums. It's worth noting that some insurance companies offer discounts for bikes equipped with anti-theft devices or advanced safety features.

Rider’s Age and Experience

The age and experience of the rider are crucial factors in insurance assessments. Younger riders, particularly those under 25, are often considered higher risk due to their relative lack of experience on the road. This perception is reflected in the premiums they pay, which are typically higher than those for more experienced riders.

Similarly, riders with a history of accidents or traffic violations may be viewed as higher risk, leading to increased insurance costs. Insurance companies use this data to assess the likelihood of future claims, which directly impacts the premium.

Geographical Location

The geographical location where the bike is primarily used can significantly affect insurance costs. Areas with higher population densities, heavier traffic, or a higher rate of accidents and thefts are often associated with higher insurance premiums. This is because the risk of an incident is perceived to be greater in these locations.

Additionally, weather conditions and the likelihood of natural disasters in a particular region can also influence insurance rates. For instance, areas prone to hurricanes or flooding may have higher insurance costs due to the increased risk of weather-related damage.

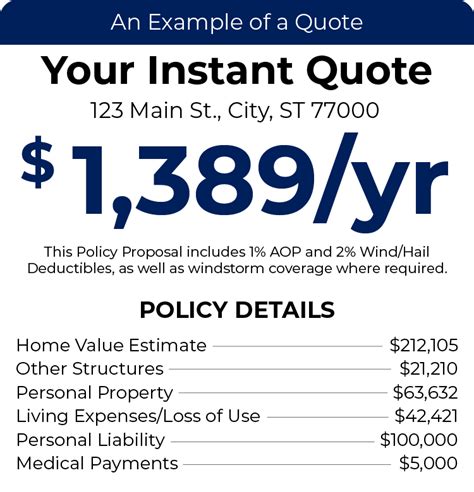

Comparative Analysis: Bike Insurance Costs by Coverage

To provide a clearer understanding of the cost variations, we’ve conducted a comparative analysis of bike insurance costs based on different coverage types. This analysis is based on real-world data and offers a comprehensive insight into the financial implications of each coverage option.

| Coverage Type | Average Annual Premium |

|---|---|

| Liability-only Coverage | $200 - $500 |

| Collision Coverage | $500 - $1,000 |

| Comprehensive Coverage | $800 - $1,500 |

| Full Coverage (Collision + Comprehensive) | $1,200 - $2,000 |

It's important to note that these figures are averages and can vary significantly based on the other factors discussed earlier, such as the make and model of the bike, the rider's age and experience, and the geographical location.

The Impact of Deductibles

Another key consideration when choosing bike insurance is the deductible, which is the amount you agree to pay out of pocket before your insurance coverage kicks in. Opting for a higher deductible can lower your insurance premium, as it reduces the financial risk borne by the insurance company. However, it’s crucial to ensure that you can afford the deductible in the event of a claim.

For instance, if you choose a comprehensive coverage policy with a $500 deductible, you'll pay a lower premium than if you had selected a policy with a $250 deductible. However, in the event of a claim, you would need to pay the first $500 of repairs or damages, whereas with the lower deductible, the insurance company would cover a larger portion of the costs.

Performance Analysis: Impact of Bike Insurance on Riding Experience

Beyond the financial considerations, bike insurance plays a significant role in the overall riding experience. It offers a vital safety net, providing financial protection in the event of accidents, theft, or other unforeseen incidents. This peace of mind can greatly enhance the enjoyment and security of riding.

The Benefits of Comprehensive Coverage

Comprehensive coverage, in particular, offers a wide range of benefits that can significantly improve the riding experience. This type of coverage typically includes protection against damage caused by collisions, vandalism, fire, and natural disasters, as well as coverage for theft. It also often includes personal injury protection and medical payments coverage, which can provide crucial financial support in the event of an accident.

For example, if your bike is damaged in a collision, comprehensive coverage will typically cover the costs of repairs or, if the bike is a total loss, the actual cash value of the bike. This can be a significant financial relief, allowing you to get back on the road quickly and without incurring substantial out-of-pocket expenses.

The Value of Liability Coverage

Liability coverage is another critical aspect of bike insurance, providing protection in the event you’re found at fault in an accident. This coverage pays for damages to the other party’s vehicle, property, or medical expenses, up to the limits of your policy. It’s a vital safeguard against potential financial ruin, particularly in the event of a serious accident.

For instance, if you accidentally hit another vehicle while riding and cause significant damage, liability coverage will step in to cover the costs of repairs. This can prevent you from having to pay these expenses out of pocket, which could be a substantial financial burden.

Future Implications: Trends and Predictions in Bike Insurance Costs

Looking ahead, the future of bike insurance costs is likely to be shaped by a variety of factors, including technological advancements, changing riding demographics, and shifts in insurance industry practices. Here, we explore some of the key trends and predictions that could influence the cost of bike insurance in the coming years.

Technological Advancements and Insurance Costs

The rapid pace of technological innovation is set to have a significant impact on bike insurance costs. Advances in bike technology, such as improved safety features and connected bike systems, could lead to a reduction in insurance premiums. These technologies can enhance rider safety, reduce the likelihood of accidents, and improve the overall riding experience, all of which could be reflected in lower insurance costs.

Additionally, the increasing adoption of electric bikes and scooters could also influence insurance costs. These vehicles often have lower maintenance costs and are perceived as less risky, which could lead to more affordable insurance premiums.

Changing Riding Demographics

The demographics of bike riders are also expected to shift, which could have implications for insurance costs. As the population ages and more individuals take up riding later in life, insurance companies may adjust their premiums to reflect this changing risk profile. Similarly, if younger riders become more risk-averse or more safety-conscious, insurance costs could decrease over time.

Moreover, the increasing popularity of bike riding as a recreational activity could also impact insurance costs. As more people take up riding for leisure, insurance companies may offer more tailored policies and potentially lower premiums to cater to this growing market.

Shifts in Insurance Industry Practices

The insurance industry is also undergoing significant changes, which could influence the cost of bike insurance. The increasing adoption of data analytics and artificial intelligence could lead to more accurate risk assessments and, potentially, more competitive insurance premiums. These technologies can provide insurance companies with a wealth of data to more precisely calculate the risk associated with different riders and bikes, leading to a more nuanced pricing structure.

Furthermore, the rise of usage-based insurance (UBI) could also transform the bike insurance landscape. UBI policies, which are based on the actual usage and behavior of the rider, could provide more accurate pricing and potentially lower premiums for safe riders. This could incentivize safer riding practices and lead to a reduction in insurance costs over time.

What is the average cost of bike insurance per year?

+The average cost of bike insurance per year can vary significantly depending on several factors. It can range from a few hundred dollars to over $2,000 annually. Factors influencing the cost include the type of coverage, the make and model of the bike, the rider’s age and experience, and the geographical location.

Are there any ways to reduce bike insurance costs?

+Yes, there are several strategies to potentially reduce bike insurance costs. These include opting for a higher deductible, taking advantage of insurance discounts (e.g., for safe riding practices, anti-theft devices, or advanced safety features), and comparing quotes from multiple insurance providers to find the best rate.

How does the rider’s age and experience impact insurance costs?

+Younger riders, particularly those under 25, are often considered higher risk due to their lack of experience, leading to higher insurance premiums. Similarly, riders with a history of accidents or traffic violations may also face higher insurance costs. On the other hand, more experienced riders with a clean driving record may benefit from lower premiums.