Allstate Insurance Quote Car

Securing the right car insurance coverage is an essential aspect of responsible vehicle ownership. Allstate, a well-known insurance provider, offers comprehensive policies tailored to meet various needs. In this article, we will delve into the world of Allstate car insurance, exploring the features, benefits, and factors that influence your insurance quote. By understanding these elements, you can make an informed decision and ensure you're getting the best coverage for your vehicle.

Understanding Allstate’s Car Insurance Policies

Allstate Insurance offers a range of car insurance policies designed to protect vehicle owners from a variety of risks and potential liabilities. These policies aim to provide financial security and peace of mind, ensuring that drivers are covered in the event of accidents, theft, or other unforeseen circumstances.

The core coverage options available through Allstate include:

- Liability Coverage: This is the foundation of any car insurance policy and is mandatory in most states. It covers the costs associated with bodily injury or property damage caused to others in an accident for which you are at fault.

- Collision Coverage: This optional coverage pays for repairs or replacements if your vehicle is damaged in a collision, regardless of fault.

- Comprehensive Coverage: Comprehensive insurance provides protection against damages caused by events other than collisions, such as theft, vandalism, natural disasters, or animal strikes.

- Medical Payments Coverage: This coverage pays for the medical expenses of you and your passengers, regardless of who is at fault in an accident.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you're involved in an accident with a driver who doesn't have sufficient insurance to cover the damages.

Allstate also offers a variety of additional coverages and endorsements to customize your policy further, including rental car reimbursement, roadside assistance, and gap insurance.

Factors Influencing Your Allstate Car Insurance Quote

When requesting an Allstate car insurance quote, several factors come into play that can influence the final premium amount. Understanding these factors can help you prepare and potentially lower your insurance costs.

Vehicle Information

The type of vehicle you drive is a significant factor in determining your insurance quote. Allstate considers the make, model, and year of your car, as well as its primary use (e.g., commuting, pleasure driving, or business use). Certain vehicle types may be more expensive to insure due to factors like repair costs, theft rates, or safety features.

Driver Profile

Your personal driving history and demographics play a crucial role in the insurance quote. Allstate takes into account your age, gender, marital status, and driving record. Young drivers, especially those under 25, often face higher premiums due to their lack of driving experience. Additionally, a history of accidents, traffic violations, or claims can lead to increased rates.

Location and Usage

The area where you live and the average distance you drive each year are also considered. Urban areas with higher population densities and more traffic tend to have higher insurance rates due to increased accident risks. Similarly, high-mileage drivers may pay more due to the increased likelihood of being involved in an accident.

Coverage Options and Deductibles

The coverage levels and deductibles you choose directly impact your insurance quote. Opting for higher coverage limits and lower deductibles will generally result in a higher premium. It’s essential to strike a balance between the coverage you need and what you can afford.

| Coverage Type | Coverage Limit | Deductible |

|---|---|---|

| Liability | $100,000 per person, $300,000 per accident | $500 |

| Collision | $1,000 | $1,000 |

| Comprehensive | $1,000 | $1,000 |

Discounts and Special Programs

Allstate offers various discounts and programs that can help reduce your insurance costs. These may include discounts for safe driving, multiple policy bundling, good student status, or even for using specific safety features in your vehicle. It’s worth exploring these options to see if you qualify for any additional savings.

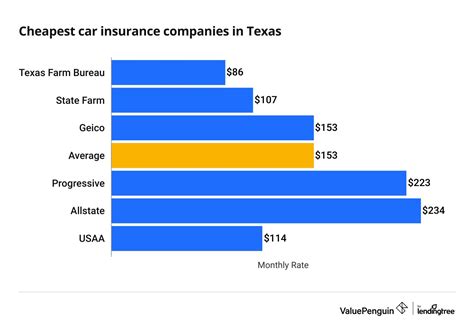

Comparing Allstate Quotes with Other Insurers

When shopping for car insurance, it’s beneficial to compare quotes from multiple providers, including Allstate. While Allstate is known for its comprehensive coverage and excellent customer service, other insurers may offer competitive rates or unique features that align better with your needs.

Consider the following factors when comparing quotes:

- Coverage Options: Ensure that the policies you're comparing offer similar coverage levels. Look at the liability limits, collision and comprehensive deductibles, and any additional coverages you may require.

- Premium Costs: Compare the annual or monthly premiums to see which insurer offers the best value for your money.

- Customer Satisfaction: Research customer reviews and ratings to gauge the insurer's reputation for claim handling and customer service.

- Financial Strength: Check the insurer's financial stability ratings to ensure they can pay out claims if needed.

- Discounts and Rewards: Evaluate the availability and potential savings from various discounts, such as safe driver or multi-policy discounts.

The Benefits of Allstate Car Insurance

Allstate Insurance stands out in the market for several reasons, offering a range of benefits to its customers.

Comprehensive Coverage Options

Allstate provides an extensive array of coverage options, ensuring that you can tailor your policy to your specific needs. Whether you require basic liability coverage or extensive protection against a range of risks, Allstate has a plan to suit your requirements.

Flexible Payment Options

Understanding that insurance payments can be a significant expense, Allstate offers flexible payment plans to make coverage more accessible. Policyholders can choose from various payment methods, including monthly installments, automatic payments, or even pay-as-you-drive options.

Excellent Customer Service

Allstate is renowned for its exceptional customer service. The company provides 24⁄7 support, ensuring that policyholders can access assistance whenever they need it. Allstate’s claims process is efficient and straightforward, with a dedicated team to guide you through the entire process.

Innovative Tools and Resources

Allstate leverages technology to enhance the customer experience. Their online platform offers a range of tools, including a digital garage to manage your policy, a mobile app for on-the-go access, and resources like the Allstate Driving Safety Quiz to help improve your driving skills.

Real-Life Examples: Allstate Car Insurance Claims

Understanding how Allstate’s car insurance policies perform in real-life scenarios can provide valuable insights. Let’s explore a couple of case studies to see how Allstate handles claims.

Case Study 1: Collision Repair

John, a 35-year-old professional, was involved in a collision while commuting to work. His Allstate policy included collision coverage with a 500 deductible. Allstate promptly dispatched a claims adjuster to assess the damage. The adjuster determined that the repairs would cost 3,500, and John’s policy covered the remaining $3,000 after the deductible. The repair shop, a preferred Allstate vendor, completed the work within a week, and John was back on the road with minimal inconvenience.

Case Study 2: Medical Payments Coverage

Sarah, a 22-year-old student, was a passenger in a friend’s car when they were involved in an accident. Fortunately, both Sarah and her friend had Allstate car insurance policies that included medical payments coverage. Sarah sustained minor injuries and was taken to the hospital. Her medical bills totaled 2,500. Thanks to her Allstate policy, she received a prompt payment of 2,000 (the policy limit) to cover her medical expenses without any out-of-pocket costs.

Future of Allstate Car Insurance

Allstate is committed to staying ahead of the curve in the insurance industry. With a focus on innovation and technology, the company continues to enhance its offerings to meet the evolving needs of its customers.

Telematics and Usage-Based Insurance

Allstate is exploring the use of telematics devices and usage-based insurance programs. These initiatives aim to provide personalized insurance rates based on an individual’s actual driving behavior. By incentivizing safe driving habits, Allstate can offer more competitive rates to responsible drivers.

Digital Transformation

Allstate is investing heavily in digital transformation to improve the customer experience. This includes enhancing their online and mobile platforms for easier policy management and claims submission. Additionally, they are exploring AI-powered chatbots and virtual assistants to provide instant support and information to policyholders.

Sustainable Initiatives

Allstate is committed to environmental sustainability and has implemented various initiatives to reduce its carbon footprint. The company encourages electric vehicle adoption and offers incentives for policyholders who choose eco-friendly vehicles. Additionally, Allstate is exploring ways to incorporate green practices into its operations, from paperless policies to energy-efficient offices.

Conclusion

Obtaining an Allstate car insurance quote is a crucial step toward securing comprehensive and reliable coverage for your vehicle. By understanding the factors that influence your quote and exploring Allstate’s benefits and unique offerings, you can make an informed decision about your insurance needs. Remember to compare quotes and explore Allstate’s resources to ensure you’re getting the best value for your insurance dollar.

Can I get a quote for Allstate car insurance online?

+Yes, you can easily obtain an Allstate car insurance quote online by visiting their official website. The process is straightforward and allows you to compare different coverage options and premiums.

What discounts does Allstate offer for car insurance?

+Allstate provides a range of discounts, including safe driver, good student, multiple policy, and loyalty discounts. They also offer discounts for vehicles equipped with certain safety features and for bundling your car insurance with other Allstate policies.

How does Allstate’s claims process work?

+Allstate has a dedicated claims team available 24⁄7 to assist policyholders. The process typically involves reporting the claim, having it assessed by an adjuster, and then receiving a settlement based on your policy coverage and the nature of the claim.

Can I customize my Allstate car insurance policy?

+Absolutely! Allstate allows you to tailor your car insurance policy to your specific needs. You can choose from a range of coverage options, adjust deductibles, and add optional coverages to create a policy that fits your budget and requirements.

Does Allstate offer any digital tools for policy management?

+Yes, Allstate provides an online platform and mobile app for policyholders. These tools allow you to manage your policy, view coverage details, make payments, and even file claims from the convenience of your device.