What Is Sr 22 Insurance Coverage

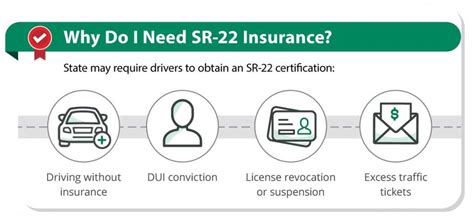

SR-22 insurance coverage, often referred to as a "Certificate of Financial Responsibility," is a specific type of insurance filing required by state authorities in the United States for individuals who have committed certain traffic violations or have had their driver's license suspended or revoked.

This insurance certificate serves as proof that the driver has obtained the minimum level of liability insurance coverage mandated by their state. It ensures that even if a driver has a history of violations or license issues, they are still capable of covering potential damages or injuries they may cause in future accidents.

Understanding SR-22 Insurance

SR-22 insurance is not a traditional insurance policy; rather, it is a form filed by your insurance provider to the relevant state authorities. This form certifies that you, as the policyholder, have the required minimum liability coverage to operate a vehicle. The SR-22 filing is typically necessary for a specified period, often ranging from 3 to 5 years, depending on the state's regulations and the severity of the violation.

The SR-22 form is a critical document for drivers with a troubled history. It allows them to regain their driving privileges by demonstrating financial responsibility. This form is usually required after incidents such as DUI (driving under the influence), multiple traffic violations, accidents without insurance, or any other offense that might lead to a license suspension.

The SR-22 Process

The process of obtaining an SR-22 involves the following steps:

- Assessment of Need: The first step is to determine if you require an SR-22. This is typically mandated by a court or the Department of Motor Vehicles (DMV) in your state after a serious traffic violation.

- Selecting an Insurance Provider: Not all insurance companies offer SR-22 filings. You'll need to find an insurer who provides this service. It's advisable to shop around for the best rates, as SR-22 insurance can be more expensive than standard policies.

- Completing the SR-22 Form: Your insurance provider will complete the SR-22 form on your behalf. This form will include your personal details, the type of violation, and the level of insurance coverage you've purchased.

- Filing with the State: Once completed, the insurance provider will electronically file the SR-22 with your state's DMV. The filing process can vary slightly between states.

- Maintaining Coverage: It's crucial to maintain your SR-22 insurance coverage throughout the specified period. Any lapse in coverage could result in your license being suspended again.

Remember, an SR-22 is a tool to help you regain your driving privileges and demonstrate responsibility. It's a chance to rebuild your driving record and ensure you're covered in the event of an accident.

Coverage and Costs

The cost of SR-22 insurance can vary significantly depending on the state you reside in, your driving history, and the type of coverage you require. Generally, it tends to be more expensive than standard auto insurance due to the increased risk associated with your driving record.

The specific coverage limits for SR-22 insurance can also vary by state and the nature of the violation. However, most states require at least the following minimum liability limits:

| Coverage Type | Minimum Limit |

|---|---|

| Bodily Injury Liability (per person) | $25,000 |

| Bodily Injury Liability (per accident) | $50,000 |

| Property Damage Liability | $20,000 |

In addition to these minimums, your insurance provider may recommend additional coverage to protect your assets and provide more comprehensive protection. This could include collision and comprehensive coverage, personal injury protection (PIP), and uninsured/underinsured motorist coverage.

Frequently Asked Questions (FAQ)

What happens if I let my SR-22 insurance lapse?

+If your SR-22 insurance lapses, your insurance provider is required to notify the state DMV. This could result in the immediate suspension of your driving privileges. To reinstate your license, you'll need to pay any associated fees and provide proof of new insurance coverage.

Can I get an SR-22 if I don't own a car?

+Yes, it's possible to obtain an SR-22 even if you don't own a vehicle. Some insurance providers offer non-owner SR-22 policies, which cover you in the event you rent or borrow a car. This type of policy is essential if you want to drive but don't own a car.

How long do I need to maintain SR-22 insurance?

+The duration of SR-22 insurance varies by state and the nature of your violation. It can range from 1 to 5 years. However, it's crucial to maintain the coverage for the entire period to avoid license suspension.

Will SR-22 insurance cover me in all states?

+SR-22 insurance is a state-specific filing, so it only applies to the state where it was issued. If you travel or move to another state, you may need to obtain an SR-22 in that state to comply with local laws.

Can I switch insurance providers while on SR-22 insurance?

+Yes, you can switch insurance providers while on SR-22 insurance. However, it's essential to ensure that your new provider can and will file the SR-22 form on your behalf. Make sure to maintain continuous coverage to avoid any lapses.

SR-22 insurance is a vital tool for drivers looking to get back on the road after a violation or license suspension. While it may be more expensive and come with specific requirements, it offers a pathway to regain driving privileges and demonstrate financial responsibility. Understanding the process, coverage, and costs associated with SR-22 insurance is key to making informed decisions about your driving future.