Cost Of Insurance For A Small Business

Starting and running a small business is an exciting journey filled with challenges and opportunities. One critical aspect that often flies under the radar for aspiring entrepreneurs is the cost of insurance. While insurance might not be the most glamorous topic, it is a vital component of any successful business strategy. This comprehensive guide aims to shed light on the various aspects of insurance costs for small businesses, providing you with the knowledge to make informed decisions and navigate the insurance landscape confidently.

Understanding the Fundamentals: Insurance Costs for Small Businesses

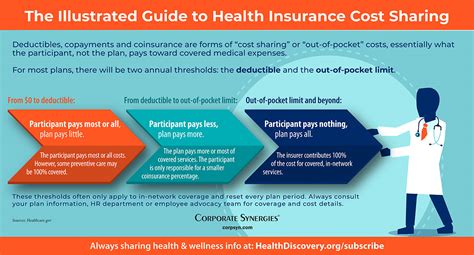

Insurance is a protective measure that safeguards businesses against financial losses resulting from unexpected events. For small businesses, insurance serves as a critical safety net, providing peace of mind and financial stability in the face of potential risks. The cost of insurance is influenced by a myriad of factors, and understanding these variables is key to managing your business’s financial health effectively.

Key Factors Influencing Insurance Costs

The insurance landscape for small businesses is diverse and complex. The cost of insurance can vary significantly based on several key factors, including:

- Industry and Business Type: Different industries carry unique risks. For instance, a construction business faces distinct hazards compared to a retail store. Insurance providers assess these risks and tailor their premiums accordingly.

- Location: The geographical location of your business plays a crucial role. Regions with higher crime rates or natural disaster risks may command higher insurance premiums.

- Size and Revenue: The size and revenue of your business are key considerations. Larger businesses with higher revenue potential often attract more substantial insurance premiums.

- Claim History: A business’s claim history is a significant factor. Businesses with a history of frequent claims may face higher insurance costs.

- Risk Management Strategies: Implementing robust risk management practices can positively impact insurance costs. Demonstrating a commitment to safety and risk mitigation can lead to lower premiums.

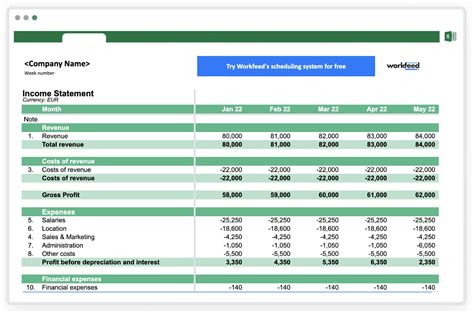

Types of Insurance and Their Costs

Small businesses require a range of insurance policies to protect their operations effectively. Here’s a breakdown of some common insurance types and their associated costs:

| Insurance Type | Average Cost | Description |

|---|---|---|

| General Liability Insurance | 500–1,500 annually | Covers bodily injury, property damage, and advertising injuries. |

| Professional Liability Insurance (E&O) | 500–2,000 annually | Protects against claims of negligence or errors in professional services. |

| Workers’ Compensation Insurance | Varies based on payroll and state regulations | Covers medical costs and lost wages for injured employees. |

| Commercial Property Insurance | 1,000–2,500 annually | Protects physical assets like buildings, equipment, and inventory. |

| Business Interruption Insurance | Varies based on revenue and business type | Covers lost income and expenses if your business is forced to close temporarily. |

| Cyber Liability Insurance | 500–2,000 annually | Protects against data breaches, cyber attacks, and privacy violations. |

Navigating the Insurance Landscape: Strategies for Cost-Effective Coverage

Understanding the fundamentals of insurance costs is a great starting point, but it’s equally important to know how to navigate the insurance landscape strategically. Here are some expert tips to help you secure cost-effective insurance coverage for your small business:

Compare Quotes from Multiple Providers

Don’t settle for the first insurance quote you receive. Take the time to shop around and compare quotes from different providers. Each insurer has its own unique underwriting process, and quotes can vary significantly. By comparing multiple options, you can identify the best coverage at the most competitive price.

Bundle Your Policies

Many insurance providers offer discounts when you bundle multiple policies together. For instance, you might be able to save by purchasing both general liability and professional liability insurance from the same provider. Bundling can provide cost savings and streamline your insurance management process.

Implement Risk Mitigation Measures

Insurance providers reward businesses that demonstrate a commitment to risk mitigation. By implementing robust safety protocols, employee training programs, and security measures, you can lower your insurance costs. These measures not only reduce the likelihood of claims but also showcase your proactive approach to risk management.

Choose the Right Coverage Limits

It’s crucial to strike a balance when selecting coverage limits. While higher limits provide more protection, they also result in higher premiums. Assess your business’s unique risks and financial capacity to determine the appropriate coverage limits. Consult with an insurance professional to ensure you’re neither underinsured nor overinsured.

Explore Alternative Insurance Options

Traditional insurance providers aren’t the only option. Consider exploring alternative insurance solutions, such as peer-to-peer insurance platforms or captive insurance companies. These options can offer customized coverage and potentially lower costs, especially for small businesses with unique risk profiles.

The Future of Insurance for Small Businesses

The insurance landscape is evolving, and small businesses can expect several trends and innovations to shape the industry in the coming years. Here’s a glimpse into the future of insurance for small enterprises:

Digital Transformation

The insurance industry is embracing digital transformation, with online platforms and mobile apps becoming increasingly common. This shift towards digitization offers small businesses greater convenience, allowing them to manage their insurance needs more efficiently and compare quotes with just a few clicks.

Personalized Insurance

Insurance providers are moving away from a one-size-fits-all approach and are instead offering more personalized coverage options. By leveraging data analytics and machine learning, insurers can tailor policies to the unique needs and risk profiles of small businesses, resulting in more accurate pricing and coverage.

Focus on Prevention

The future of insurance is shifting towards a focus on prevention rather than solely on compensation. Insurers are increasingly incentivizing small businesses to adopt risk mitigation measures by offering discounts or premium reductions. This shift encourages businesses to take a proactive approach to risk management, ultimately reducing the likelihood of claims.

Alternative Risk Transfer

Alternative risk transfer mechanisms, such as captive insurance and risk retention groups, are gaining popularity among small businesses. These options provide more control over insurance coverage and costs, allowing businesses to self-insure for certain risks and collaborate with other small businesses to pool their risks collectively.

Conclusion

Insurance is a critical component of any small business’s success, providing the financial stability and peace of mind needed to thrive. By understanding the factors that influence insurance costs and adopting a strategic approach to coverage, small business owners can navigate the insurance landscape effectively. As the industry evolves, small businesses can look forward to more personalized, accessible, and cost-effective insurance options.

What is the average cost of insurance for a small business?

+The average cost of insurance for a small business can vary widely depending on factors such as industry, location, and coverage needs. However, as a rough estimate, small businesses can expect to pay anywhere from 1,000 to 5,000 annually for a comprehensive insurance package, including general liability, professional liability, and workers’ compensation insurance.

How can I reduce the cost of insurance for my small business?

+To reduce insurance costs, consider implementing risk management strategies, such as employee training programs and security measures. Additionally, compare quotes from multiple providers, bundle your policies, and choose coverage limits that align with your business’s unique needs and financial capacity.

What are some common insurance policies small businesses should consider?

+Small businesses should consider a range of insurance policies to protect their operations effectively. Some common policies include general liability insurance, professional liability insurance (E&O), workers’ compensation insurance, commercial property insurance, business interruption insurance, and cyber liability insurance.