Definition Of Insure

In the intricate world of finance and risk management, the concept of insure holds immense significance. It is a fundamental pillar of the financial industry, offering a safety net to individuals, businesses, and various entities against unforeseen circumstances and potential losses. Let's delve into the depths of this vital term and uncover its meaning, purpose, and implications.

Unraveling the Definition of Insure

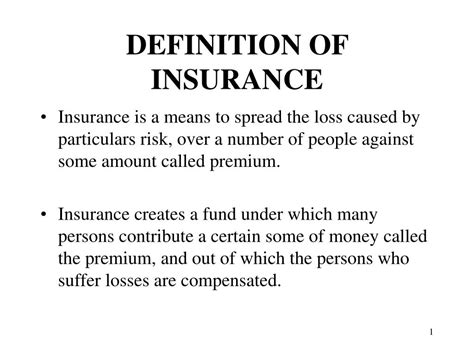

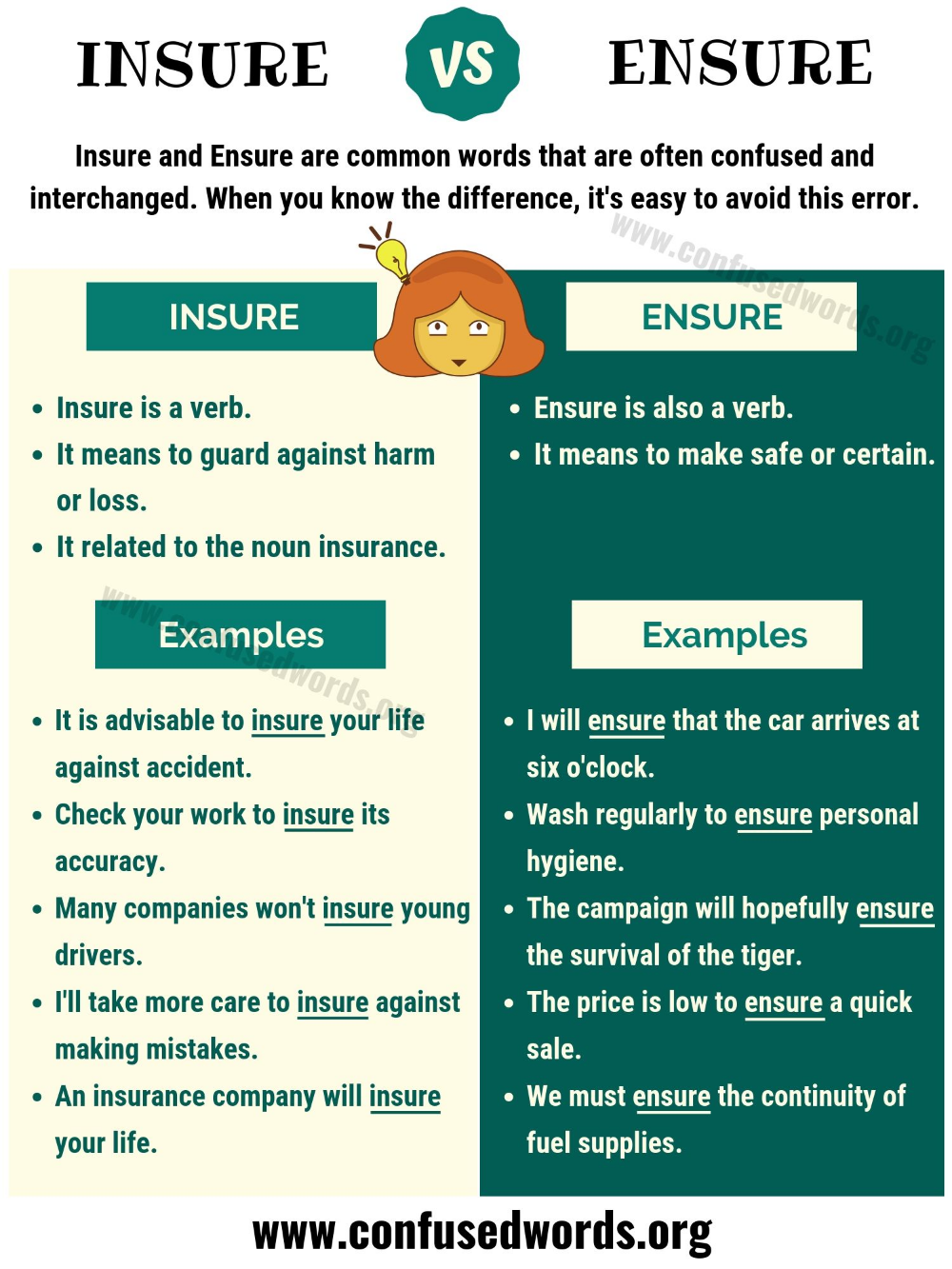

At its core, insure is a verb that signifies the act of providing or obtaining insurance. Insurance, in its essence, is a contractual agreement between an individual or entity (known as the insured) and an insurance company (the insurer). This agreement, often referred to as an insurance policy, serves as a safeguard against financial losses that may arise due to various events or circumstances.

The definition of insure encapsulates the process of transferring the risk of potential financial losses from the insured to the insurer. In exchange for a premium, which is a periodic payment, the insurer promises to compensate the insured for specific losses or damages outlined in the policy. This transfer of risk provides peace of mind and financial security to the insured, knowing that they are protected against unforeseen events that could otherwise cause significant financial strain.

Types of Insurance and Their Significance

The world of insurance is vast and diverse, catering to a wide array of needs and risks. Here’s a glimpse into some of the key types of insurance and their roles:

Life Insurance

Life insurance is designed to provide financial protection to the policyholder’s beneficiaries upon their death. It ensures that loved ones are taken care of financially, covering expenses such as funeral costs, outstanding debts, and providing a source of income for the family.

Health Insurance

Health insurance is crucial in covering medical expenses, whether it’s for routine check-ups, prescription medications, or unexpected illnesses and injuries. It ensures access to quality healthcare without the burden of exorbitant medical bills.

Property Insurance

Property insurance, including home, auto, and business insurance, protects against losses or damages to physical assets. It provides coverage for events like fire, theft, natural disasters, and accidents, helping individuals and businesses rebuild and recover.

Liability Insurance

Liability insurance safeguards individuals and businesses against legal claims and lawsuits arising from accidents or negligence. It covers the costs of legal defense and any compensation awarded to the claimant, protecting the insured’s financial well-being.

Specialty Insurance

The insurance industry also offers a range of specialty policies tailored to unique needs. This includes pet insurance, travel insurance, cyber insurance, and many more, each designed to address specific risks and provide tailored protection.

| Type of Insurance | Coverage Highlights |

|---|---|

| Life Insurance | Financial protection for beneficiaries upon the policyholder's death. |

| Health Insurance | Coverage for medical expenses, including routine care and emergencies. |

| Property Insurance | Protection against losses or damages to assets like homes and vehicles. |

| Liability Insurance | Defense against legal claims and compensation for damages. |

| Specialty Insurance | Tailored policies for specific risks, such as pet or travel insurance. |

The Benefits of Insuring

The act of insure extends far beyond the mere purchase of an insurance policy. It offers a multitude of benefits that contribute to financial stability and peace of mind. Let’s explore some of these advantages:

Financial Security

Insurance provides a safety net that protects against financial ruin. In the event of a covered loss, such as a house fire or a serious illness, insurance ensures that the insured has the financial means to rebuild, recover, and maintain their standard of living.

Risk Mitigation

By transferring risk to an insurer, individuals and businesses can focus on their core activities without being burdened by the worry of potential losses. Insurance allows for better risk management, enabling entities to operate with confidence and make informed decisions.

Peace of Mind

Knowing that one is protected against unforeseen circumstances brings immense peace of mind. Whether it’s protecting a family’s future with life insurance or ensuring business continuity with property insurance, the assurance of coverage provides mental tranquility and a sense of security.

Access to Expertise

Insurance companies bring a wealth of expertise and resources to the table. They have the knowledge and experience to assess risks, develop comprehensive policies, and provide guidance on risk mitigation strategies. This expertise is invaluable in navigating the complex world of insurance.

Community Impact

Insurance plays a vital role in supporting communities and economies. It ensures that individuals and businesses can recover from losses, stimulating economic growth and stability. Insurance also fosters a sense of community by sharing risks and providing support during challenging times.

The Process of Insuring

The journey of insure involves several key steps that ensure a fair and beneficial agreement for both the insured and the insurer. Here’s an overview of the process:

Assessing Needs

The first step is to identify the specific risks and needs that require insurance coverage. This involves evaluating personal or business circumstances, potential hazards, and the desired level of protection.

Researching Options

With a clear understanding of needs, the next step is to research and compare insurance options. This includes exploring different policies, insurers, and the coverage they offer. It’s essential to find a policy that aligns with one’s unique requirements.

Obtaining Quotes

Once suitable policies are identified, it’s time to obtain quotes. Insurance companies provide quotes based on the information provided, offering a clear understanding of the cost and coverage associated with the policy.

Reviewing and Selecting a Policy

With quotes in hand, the insured can thoroughly review the terms, conditions, and coverage of each policy. It’s crucial to understand the fine print and ensure that the policy meets all the necessary requirements. Selecting the right policy is a critical decision that should be made with careful consideration.

Applying and Binding Coverage

After choosing a policy, the insured completes an application, providing the necessary information and agreeing to the terms. Once the application is approved, the policy is bound, and coverage officially begins.

Premium Payments

To maintain coverage, the insured pays the agreed-upon premium at regular intervals. Premium payments are a crucial part of the insurance agreement, ensuring ongoing protection.

Filing Claims

In the event of a covered loss, the insured files a claim with the insurance company. This involves providing details of the loss, any necessary documentation, and working with the insurer to receive the compensation outlined in the policy.

Renewal and Adjustments

Insurance policies typically have a renewal period, often annually. During this time, the insured can review and adjust their coverage to reflect any changes in their circumstances or needs. This ensures that the policy remains relevant and provides adequate protection.

The Future of Insure: Trends and Innovations

The insurance industry is continually evolving, adapting to new technologies, changing consumer needs, and emerging risks. Here are some key trends and innovations shaping the future of insure:

Digital Transformation

The rise of digital technologies has revolutionized the insurance industry. Online platforms and mobile apps now enable consumers to compare policies, obtain quotes, and manage their insurance needs with ease. Digital transformation also enhances efficiency and reduces administrative burdens for insurers.

Data Analytics and AI

Advanced data analytics and artificial intelligence are transforming risk assessment and underwriting processes. By analyzing vast amounts of data, insurers can make more accurate predictions, develop innovative products, and provide personalized coverage tailored to individual needs.

Parametric Insurance

Parametric insurance is a novel approach that provides coverage based on predefined parameters rather than actual losses. This type of insurance is particularly useful for covering catastrophic events like earthquakes or hurricanes, where traditional insurance claims can be challenging to assess.

Insurtech Innovations

Insurtech, a blend of insurance and technology, is driving significant innovations. Startups and established insurers are leveraging technologies like blockchain, IoT (Internet of Things), and wearables to enhance risk assessment, streamline claims processes, and offer new insurance products.

Focus on Customer Experience

The insurance industry is placing increasing emphasis on delivering a seamless and personalized customer experience. This includes providing user-friendly digital interfaces, offering tailored coverage options, and ensuring efficient claims processes to meet customer expectations.

Sustainable and Social Impact Insurance

Insurance companies are exploring ways to contribute to sustainability and social impact. This includes developing insurance products that support environmental initiatives, provide coverage for social enterprises, and promote responsible business practices.

Conclusion: The Power of Insuring

The definition of insure encapsulates a powerful concept that underpins financial stability and peace of mind. From life insurance to specialty policies, the insurance industry offers a safety net that empowers individuals and businesses to navigate life’s uncertainties with confidence. As the industry continues to evolve, it adapts to new challenges and opportunities, ensuring that insurance remains a vital tool for risk management and financial security.

In a world filled with risks and uncertainties, the act of insure stands as a testament to humanity's resilience and ingenuity. It is a journey that begins with a simple definition but leads to a world of protection, peace, and prosperity.

What is the primary purpose of insurance?

+

The primary purpose of insurance is to provide financial protection and peace of mind to individuals, businesses, and other entities against unforeseen circumstances and potential losses. It transfers the risk of financial hardship from the insured to the insurer, ensuring stability and security.

How does insurance work?

+

Insurance works through a contractual agreement called an insurance policy. The insured pays a premium to the insurer, who in turn promises to compensate the insured for specific losses or damages outlined in the policy. This transfer of risk provides financial protection and allows the insured to focus on their core activities without worrying about potential losses.

What are the key benefits of insuring?

+

The key benefits of insuring include financial security, risk mitigation, peace of mind, access to expertise, and community impact. Insurance provides a safety net that protects against financial ruin, allows for better risk management, and fosters a sense of security and stability.

How has the insurance industry evolved over time?

+

The insurance industry has evolved significantly, adapting to new technologies, consumer needs, and emerging risks. Digital transformation, data analytics, parametric insurance, and insurtechnology are shaping the future of insurance, enhancing efficiency, personalization, and sustainability.

What is the role of insurance in society?

+

Insurance plays a vital role in society by providing a safety net that supports individuals, businesses, and communities. It ensures financial stability, promotes economic growth, and enables entities to recover from losses. Insurance fosters a sense of community and shared responsibility, contributing to overall societal well-being.