Insurance Quotes Home Insurance

Home insurance is an essential aspect of financial planning for homeowners, providing peace of mind and protection against various risks and unforeseen events. Obtaining insurance quotes is a crucial step in securing adequate coverage for your home and belongings. This article will delve into the world of home insurance, exploring the factors that influence quotes, the process of securing the best coverage, and the key considerations for homeowners. By understanding the intricacies of home insurance, you can make informed decisions to safeguard your valuable assets.

Understanding Home Insurance Quotes

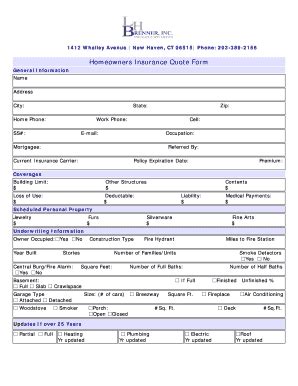

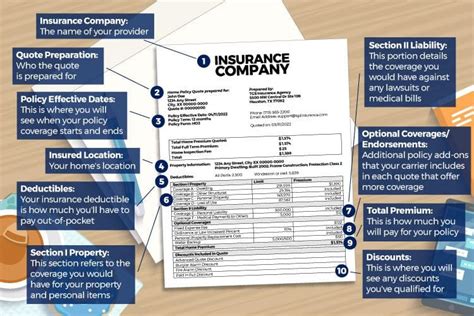

Home insurance quotes are personalized estimates of the cost of insuring your home and its contents. These quotes are tailored to your specific needs and the unique characteristics of your property. Insurance providers consider a range of factors to determine the level of risk associated with your home and subsequently calculate the premium you will pay for coverage.

Factors Influencing Insurance Quotes

- Location: The geographic location of your home plays a significant role in insurance quotes. Areas prone to natural disasters, such as hurricanes, floods, or earthquakes, may carry higher insurance costs due to the increased risk of property damage.

- Property Value: The value of your home and its contents directly impacts the insurance premium. Higher-value homes often require more extensive coverage, leading to higher quotes.

- Age of the Property: Older homes may have unique challenges, such as outdated wiring or plumbing, which can influence insurance rates. Newer homes, on the other hand, may benefit from modern construction techniques and materials that reduce the risk of certain types of damage.

- Construction Materials: The materials used in the construction of your home can affect insurance rates. Homes built with fire-resistant materials or reinforced structures may qualify for lower premiums.

- Security Features: Insurance providers often offer discounts for homes equipped with security systems, such as burglar alarms, surveillance cameras, or reinforced doors and windows. These features reduce the risk of theft and vandalism, leading to potential savings on your insurance quote.

- Previous Claims: Your insurance history is a critical factor. Homes with a history of frequent claims may be considered higher-risk, resulting in higher insurance quotes.

- Deductibles: Deductibles are the amount you agree to pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible can lead to a lower insurance premium, as it reduces the insurer’s financial exposure.

- Coverage Options: The level of coverage you select also impacts your insurance quote. Comprehensive coverage options, such as additional living expenses or personal liability insurance, can increase the overall cost.

| Factor | Description |

|---|---|

| Location | Risk-based pricing based on geographic location and natural disaster potential. |

| Property Value | Premiums are influenced by the replacement cost of the home and its contents. |

| Age of Property | Older homes may have higher risks due to aging infrastructure. |

| Construction Materials | Fire-resistant materials and reinforced structures can lead to lower premiums. |

| Security Features | Discounts are offered for homes with security systems, reducing the risk of theft. |

| Previous Claims | Frequent claims may result in higher insurance quotes. |

| Deductibles | Choosing a higher deductible can lower your insurance premium. |

| Coverage Options | Comprehensive coverage choices can increase the overall cost of insurance. |

Securing the Best Home Insurance Coverage

Obtaining the best home insurance coverage involves a careful balance between cost and adequate protection. Here are some key steps to consider:

Research and Compare

Take the time to research and compare insurance providers and their offerings. Different insurers may have unique policies and coverage options tailored to specific needs. Compare quotes from multiple providers to identify the best combination of coverage and cost.

Understand Your Coverage Needs

Assess your specific needs and the potential risks associated with your home. Consider factors such as natural disasters, theft, liability, and the cost of replacing your belongings. Tailor your coverage to address these risks effectively.

Bundle Policies

Many insurance providers offer discounts when you bundle multiple policies, such as home and auto insurance. Bundling can result in significant savings and simplify the management of your insurance needs.

Explore Discounts

Inquire about potential discounts based on your home’s features. As mentioned earlier, security systems, fire-resistant materials, and other safety measures may qualify you for reduced premiums.

Consider Deductibles

While a higher deductible can lower your insurance premium, it’s essential to choose a deductible amount that you can comfortably afford in the event of a claim. Striking the right balance between cost and coverage is crucial.

Review and Update Regularly

Your home insurance needs may evolve over time. Regularly review your policy to ensure it aligns with your current circumstances. Update your coverage as necessary, especially after significant home improvements or changes in your personal situation.

Key Considerations for Homeowners

As a homeowner, there are several important considerations to keep in mind when navigating the world of home insurance:

Understanding Policy Exclusions

Familiarize yourself with the exclusions in your policy. Certain events, such as floods or earthquakes, may not be covered by standard home insurance policies. You may need to purchase additional coverage or endorsements to protect against these specific risks.

Maintaining Your Home

Regular maintenance of your home can help reduce the risk of claims and lower your insurance costs. Addressing issues promptly, such as roof repairs or plumbing problems, can prevent more significant damage and potential insurance claims.

Insurance Provider Reputation

Choose an insurance provider with a solid reputation for customer service and financial stability. Research reviews and ratings to ensure you select a reliable insurer who will be there to support you in the event of a claim.

Policy Renewal

Don’t overlook the importance of renewing your policy on time. Failure to renew your policy can result in a lapse in coverage, leaving you vulnerable to unforeseen events. Set reminders to ensure your policy is renewed annually.

Filing Claims

In the event of a claim, promptly notify your insurance provider. Document the damage and cooperate fully with the claims process. Keep records of all communications and expenses related to the claim.

What is the average cost of home insurance?

+The average cost of home insurance varies widely depending on factors such as location, property value, and coverage options. According to industry data, the national average for home insurance premiums is approximately 1,300 per year. However, this average can range from as low as 500 to over $3,000 annually, depending on individual circumstances.

How often should I review my home insurance policy?

+It is recommended to review your home insurance policy annually or whenever significant changes occur in your home or personal situation. Regular reviews ensure that your coverage remains adequate and aligned with your needs.

Can I negotiate my insurance quote?

+While insurance quotes are primarily based on risk assessment, there may be room for negotiation, especially if you have a strong relationship with your insurance provider or have been a long-term customer. Discussing your concerns and exploring potential discounts can lead to more favorable rates.