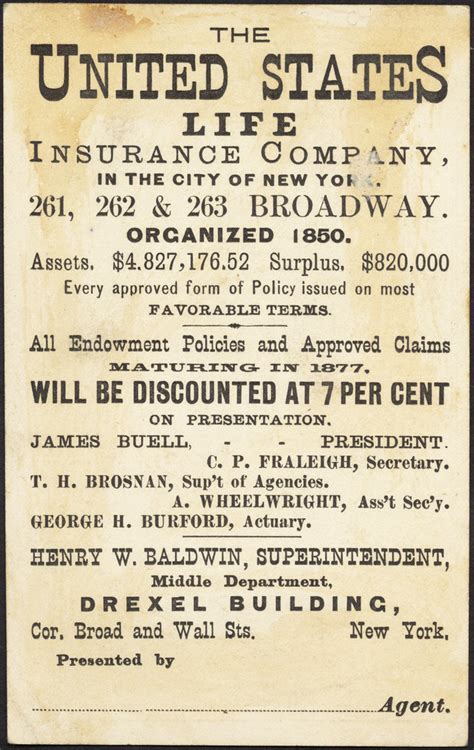

United States Life Insurance Company

The United States Life Insurance Company, often recognized as US Life, is a notable player in the American insurance landscape, offering a range of comprehensive life insurance policies tailored to meet the diverse needs of individuals and families. With a rich history spanning over a century, US Life has solidified its position as a trusted provider, catering to a broad spectrum of clients, from young adults embarking on their career journeys to seasoned professionals seeking financial protection for their loved ones. This comprehensive guide delves into the core aspects of US Life Insurance Company, exploring its history, product offerings, industry standing, and the value it brings to its policyholders.

A Historical Perspective: US Life’s Journey

The origins of the United States Life Insurance Company can be traced back to the late 19th century, a time when the American insurance industry was still in its formative years. Founded in 1890 by a group of visionary entrepreneurs, US Life emerged as a pioneer in the life insurance sector, introducing innovative concepts and policies that set new standards for the industry. Over the decades, the company has weathered various economic cycles and market fluctuations, consistently adapting its strategies to meet the evolving needs of its customers.

A significant milestone in US Life's history was its acquisition by a leading financial services conglomerate in the 1970s. This strategic move not only provided the company with a broader platform for growth but also allowed it to expand its product offerings, leveraging the conglomerate's diverse financial expertise. Since then, US Life has continued to grow, solidifying its position as a major player in the American insurance market.

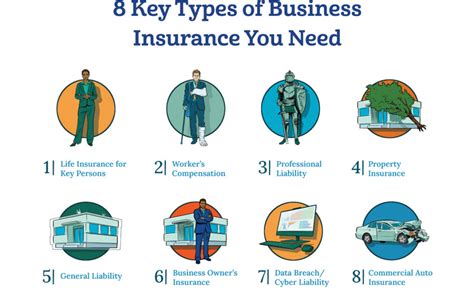

Comprehensive Product Suite: Meeting Diverse Needs

One of the standout features of the United States Life Insurance Company is its extensive product portfolio, designed to cater to a wide range of customer needs and preferences. Here’s an in-depth look at some of their key offerings:

Term Life Insurance

US Life’s term life insurance policies provide policyholders with coverage for a specified period, typically ranging from 10 to 30 years. These policies are ideal for individuals seeking affordable protection for a defined term, such as during their working years when their income is vital to their family’s financial well-being.

Key features of US Life's term life insurance include:

- Flexibility: Policyholders can choose from various term lengths, ensuring they get coverage that aligns with their specific needs.

- Competitive Pricing: US Life offers some of the most competitive rates in the market, making its term life insurance an attractive option for budget-conscious individuals.

- Renewal Options: Many of their term policies can be renewed, providing the flexibility to extend coverage as needed.

Whole Life Insurance

In contrast to term life insurance, whole life policies offer lifetime coverage, providing policyholders with peace of mind that their loved ones will be financially protected, regardless of life's uncertainties. US Life's whole life insurance policies are designed to cater to those seeking long-term financial security.

Key aspects of their whole life insurance include:

- Guaranteed Coverage: Once a policy is issued, coverage is guaranteed for the insured's lifetime, ensuring long-term financial protection.

- Cash Value Accumulation: These policies come with a cash value component that grows over time, offering policyholders the potential for financial growth and flexibility.

- Fixed Premiums: Whole life insurance policies typically have fixed premiums, providing policyholders with predictable and stable costs.

Universal Life Insurance

Universal life insurance is a flexible alternative that combines the features of both term and whole life insurance. It offers policyholders the flexibility to adjust their coverage and premiums over time, making it an ideal choice for those whose financial needs may evolve.

Key characteristics of US Life's universal life insurance include:

- Flexibility: Policyholders can adjust their coverage and premiums as their financial circumstances change, ensuring their insurance remains aligned with their needs.

- Cash Value Accumulation: Similar to whole life insurance, universal life policies also accumulate cash value, providing policyholders with potential financial growth.

- Death Benefit Protection: The policy's death benefit is guaranteed, offering policyholders and their beneficiaries the assurance of financial security.

Additional Benefits and Riders

US Life understands that life insurance needs can be unique and complex. To address these specific needs, they offer a range of additional benefits and riders that can be added to their core policies. These include:

- Waiver of Premium: This rider waives premium payments if the insured becomes disabled, ensuring coverage continues even during challenging times.

- Accelerated Death Benefit: This option allows policyholders to access a portion of their death benefit while they are still alive, providing financial support for critical illnesses or long-term care needs.

- Spousal and Child Riders: These riders extend coverage to the insured's spouse and children, offering additional financial protection for the entire family.

Industry Standing and Customer Satisfaction

The United States Life Insurance Company has consistently maintained a strong position within the American insurance market, earning a reputation for reliability and customer satisfaction. Independent rating agencies, such as A.M. Best and Standard & Poor's, have consistently awarded US Life high ratings for financial strength and stability, indicating its ability to meet its ongoing obligations to policyholders.

In addition to its financial standing, US Life has also been recognized for its commitment to customer service. The company's focus on personalized attention and tailored solutions has resulted in high customer satisfaction rates, with many policyholders highlighting the ease of doing business and the responsiveness of the company's customer service team.

The Future of US Life Insurance Company

As the insurance landscape continues to evolve, driven by technological advancements and changing consumer expectations, US Life is poised to remain at the forefront. The company has embraced digital innovations, leveraging technology to enhance its product offerings and improve the overall customer experience. From streamlined online applications to efficient claim processes, US Life is committed to staying ahead of the curve, ensuring its policies remain accessible and relevant to modern consumers.

Furthermore, US Life's focus on innovation extends beyond digital advancements. The company actively invests in research and development, constantly refining its underwriting processes and product offerings to meet the evolving needs of its diverse customer base. This commitment to innovation and adaptability positions US Life to thrive in the dynamic insurance market, ensuring it remains a trusted provider for generations to come.

How does US Life ensure the financial protection of its policyholders?

+

US Life prioritizes the financial security of its policyholders through a combination of strategies. Firstly, they maintain a strong financial position, as evidenced by their high ratings from independent agencies like A.M. Best and Standard & Poor’s. This financial strength ensures they can meet their obligations to policyholders. Secondly, US Life offers a diverse range of life insurance policies, including term, whole, and universal life insurance, each designed to cater to different needs and provide comprehensive coverage. Additionally, they provide various riders and additional benefits that can be added to core policies, offering enhanced protection for specific circumstances.

What sets US Life’s term life insurance apart from other providers?

+

US Life’s term life insurance stands out for its flexibility and competitive pricing. Policyholders can choose from various term lengths, ensuring they get coverage that aligns with their specific needs. Additionally, US Life offers some of the most competitive rates in the market, making its term life insurance an attractive option for budget-conscious individuals. Many of their term policies can also be renewed, providing the flexibility to extend coverage as needed.

How does US Life’s whole life insurance policy differ from other whole life policies in the market?

+

US Life’s whole life insurance policy is designed to offer guaranteed coverage for the insured’s lifetime, ensuring long-term financial protection. The policy also includes a cash value component that grows over time, providing policyholders with potential financial growth and flexibility. Furthermore, US Life’s whole life insurance policies typically have fixed premiums, ensuring predictable and stable costs for policyholders.

What are the key advantages of US Life’s universal life insurance policy?

+

US Life’s universal life insurance policy is a flexible alternative that combines the features of term and whole life insurance. It offers policyholders the flexibility to adjust their coverage and premiums over time, making it ideal for those whose financial needs may evolve. Like whole life insurance, universal life policies also accumulate cash value, providing potential financial growth. Additionally, the policy’s death benefit is guaranteed, offering policyholders and their beneficiaries assurance of financial security.