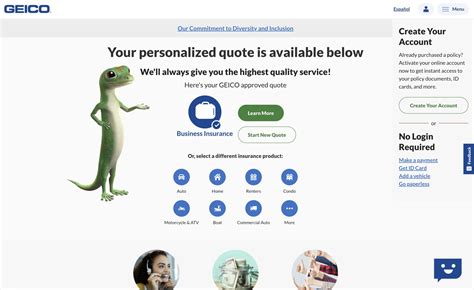

Business Insurance Geico

Business Insurance: A Comprehensive Guide with Geico

As a business owner, understanding and securing the right insurance coverage is paramount to protecting your venture. With a myriad of options available, it's crucial to choose a provider that offers tailored solutions and expert guidance. In this comprehensive guide, we delve into the world of business insurance, exploring the offerings of a well-known industry player, Geico, and how it can safeguard your business against various risks.

Understanding Business Insurance

Business insurance, often referred to as commercial insurance, is a collection of insurance policies designed to protect businesses from potential financial losses. These policies cover a wide range of risks, from property damage and liability claims to business interruption and employee-related issues. The specific needs of a business determine the types of insurance it requires, making a customized approach essential.

The significance of business insurance lies in its ability to provide a safety net, allowing businesses to recover from unforeseen events without incurring catastrophic financial burdens. It's an investment in the long-term health and stability of your venture, ensuring you can continue operations even in the face of adversity.

Geico: A Trusted Provider

Geico, known for its comprehensive personal insurance offerings, has expanded its expertise into the realm of business insurance. With a focus on small and medium-sized enterprises, Geico offers a tailored approach, providing coverage that aligns with the unique needs of each business.

One of the standout features of Geico's business insurance is its flexibility. Whether you're a sole proprietor, a partnership, or a corporation, Geico tailors its policies to fit your specific business structure. This level of customization ensures that you're not paying for coverage you don't need, making it an efficient and cost-effective choice.

Key Coverage Options with Geico

Geico offers a comprehensive suite of business insurance products, including:

- Commercial Property Insurance: Protects your business property, including buildings, equipment, and inventory, against damage or loss due to fire, theft, or natural disasters.

- General Liability Insurance: Covers a wide range of liability risks, including bodily injury, property damage, and personal and advertising injury claims. It's essential for protecting your business against lawsuits.

- Business Owners Policy (BOP): A package policy that combines property, liability, and business interruption insurance, providing comprehensive coverage at a competitive price.

- Professional Liability Insurance: Also known as Errors and Omissions (E&O) insurance, it protects professionals against claims of negligence or inadequate work. It's particularly important for businesses offering professional services.

- Workers' Compensation Insurance: A legally required coverage in most states, it provides benefits to employees who are injured or become ill due to their work. It covers medical expenses and a portion of lost wages.

- Commercial Auto Insurance: Insures vehicles used for business purposes, including trucks, vans, and cars. It covers physical damage to the vehicles, as well as liability for bodily injury and property damage.

Why Choose Geico for Business Insurance?

There are several compelling reasons why Geico stands out as a preferred choice for business insurance:

Customized Coverage

Geico understands that every business is unique. Their approach to business insurance is highly personalized, ensuring that you receive coverage tailored to your specific industry, operations, and risks. This level of customization ensures you’re adequately protected without paying for unnecessary add-ons.

Competitive Pricing

Geico is renowned for its competitive pricing, offering cost-effective solutions without compromising on quality. By analyzing your business needs and providing tailored coverage, they ensure you receive the best value for your insurance dollar.

Expert Guidance

With a team of experienced professionals, Geico provides expert guidance throughout the insurance process. From assessing your business risks to recommending the right coverage, their advisors ensure you make informed decisions. They’re dedicated to helping you understand your insurance options, providing clarity and peace of mind.

Easy Claims Process

In the event of a claim, Geico simplifies the process, offering a quick and efficient system. Their dedicated claims team is available 24⁄7, ensuring you receive prompt assistance when you need it most. With a focus on customer satisfaction, they work diligently to resolve claims fairly and efficiently.

Real-World Examples

Let’s look at a few scenarios where Geico’s business insurance has made a significant impact:

Scenario 1: Property Damage

A small bakery, insured with Geico, suffered significant water damage due to a burst pipe. Geico’s commercial property insurance coverage helped cover the cost of repairs and replacement of damaged equipment, allowing the bakery to resume operations within a week.

Scenario 2: Liability Claim

A local gym, insured with Geico, faced a liability claim after a member slipped and fell, resulting in a serious injury. Geico’s general liability insurance stepped in, covering the legal costs and settlement, protecting the gym’s financial stability.

Scenario 3: Business Interruption

A popular restaurant, insured with Geico, had to temporarily shut down due to a fire. Geico’s business interruption insurance provided coverage for lost income during the closure, ensuring the restaurant could pay its employees and bills while it underwent repairs.

| Business Type | Coverage Needed |

|---|---|

| Retail Store | Property, General Liability, Workers' Comp |

| Professional Services Firm | Professional Liability, General Liability |

| Construction Company | Commercial Auto, General Liability, Workers' Comp |

| Online Business | Cyber Liability, General Liability |

Future Implications and Growth

As the business landscape evolves, so do the risks. Geico recognizes the dynamic nature of the business world and is committed to adapting its insurance offerings to meet these changing needs. With a focus on innovation and customer satisfaction, they’re continually enhancing their products and services to provide the best protection for businesses of all sizes.

As businesses grow and expand, their insurance needs also evolve. Geico understands this and provides scalable solutions, ensuring that as your business flourishes, your insurance coverage can keep pace. Whether you're expanding your operations, introducing new products or services, or entering new markets, Geico is equipped to provide the necessary coverage adjustments to maintain your protection.

Conclusion: Empowering Your Business with Geico

In a world filled with uncertainties, business insurance is a critical component of any successful enterprise. Geico’s commitment to providing comprehensive, customized coverage, coupled with its competitive pricing and expert guidance, makes it an excellent choice for safeguarding your business. By partnering with Geico, you can rest assured that your business is protected, allowing you to focus on what you do best – growing and thriving.

Frequently Asked Questions

What is the cost of business insurance with Geico?

+The cost of business insurance with Geico varies depending on several factors, including the type of business, its size, location, and the specific coverage needs. Geico offers competitive pricing and provides tailored quotes based on your unique business requirements. Contact a Geico advisor to receive a personalized quote.

How do I choose the right coverage for my business?

+Choosing the right coverage involves assessing your business’s unique risks and needs. Consider factors like the nature of your business operations, potential liabilities, and any specific industry regulations. Geico’s advisors can guide you through this process, helping you understand the different coverage options and recommending the best fit for your business.

Does Geico offer coverage for home-based businesses?

+Yes, Geico provides insurance solutions tailored for home-based businesses. They understand the unique challenges and risks associated with operating a business from home and can offer coverage to protect your business assets, as well as your personal property and liability.

What happens if I need to make a claim with Geico business insurance?

+In the event of a claim, Geico has a dedicated claims team available 24⁄7 to assist you. You can report a claim online, over the phone, or through their mobile app. Geico aims to provide a quick and efficient claims process, ensuring you receive the support you need during challenging times.