Insurance Car And Home

In today's world, insurance is an indispensable aspect of financial planning and risk management. While the concept of insurance has been around for centuries, its evolution and diversification have become increasingly evident, especially in the realm of car and home insurance. This article delves into the intricacies of insurance for cars and homes, exploring the types, benefits, and considerations involved in securing adequate coverage.

Understanding Car Insurance

Car insurance is a contract between an individual and an insurance provider, designed to offer financial protection against potential losses or damages arising from road incidents. This coverage is essential, considering the myriad risks associated with operating a motor vehicle. From collisions and accidents to theft and natural disasters, car insurance provides a safety net for policyholders.

Types of Car Insurance

The landscape of car insurance is diverse, offering various types of coverage to cater to different needs and risks. Here’s an overview of the primary types:

- Liability Coverage: This is the most basic form of car insurance, covering damages or injuries caused to others as a result of a policyholder's negligence. It is a legal requirement in most states and typically includes bodily injury liability and property damage liability coverage.

- Collision Coverage: This optional coverage pays for the repair or replacement of a vehicle involved in an accident, regardless of fault. It protects policyholders from the financial burden of repairing or replacing their car after a collision.

- Comprehensive Coverage: This coverage extends beyond collisions, offering protection against theft, vandalism, natural disasters, and other non-collision-related incidents. It provides a broader safety net, ensuring that policyholders are not left bearing the full cost of unexpected damages.

- Uninsured/Underinsured Motorist Coverage: This coverage protects policyholders when involved in an accident with a driver who has little or no insurance. It ensures that the policyholder is not left without compensation in such situations.

- Personal Injury Protection (PIP): PIP coverage provides medical benefits to the policyholder and their passengers, regardless of fault. It covers medical expenses, lost wages, and other related costs, ensuring that individuals can access necessary healthcare without financial strain.

Each type of coverage serves a unique purpose, and policyholders can customize their car insurance plans by selecting the right combination of these options. It is crucial to understand the specific needs and risks associated with one's driving habits and location to make informed decisions about coverage.

Factors Influencing Car Insurance Rates

The cost of car insurance varies significantly based on several factors. These include:

- Vehicle Type: The make, model, and year of a vehicle can impact insurance rates. Sports cars and luxury vehicles, for instance, often have higher premiums due to their increased repair costs and higher likelihood of theft.

- Driver's Profile: Age, gender, driving record, and credit score are significant factors. Young drivers and those with a history of accidents or traffic violations typically pay higher premiums. Conversely, experienced drivers with clean records often enjoy more affordable rates.

- Location: The area where a vehicle is garaged and primarily driven can influence rates. Urban areas with higher population densities and theft rates often result in higher premiums. Similarly, regions prone to natural disasters may also see increased insurance costs.

- Coverage and Deductibles: The level of coverage chosen and the corresponding deductibles can significantly impact insurance costs. Higher coverage limits and lower deductibles generally result in higher premiums.

- Discounts and Bundles: Many insurance providers offer discounts for various reasons, such as safe driving records, vehicle safety features, or bundling car insurance with other policies like home insurance.

By understanding these factors, individuals can make strategic decisions to potentially lower their car insurance costs while ensuring adequate coverage.

Home Insurance: Protecting Your Sanctuary

Home insurance, much like car insurance, is a contract that offers financial protection against losses or damages to one’s home and its contents. It provides a vital safety net for homeowners, safeguarding them from the potentially devastating financial impacts of unforeseen events.

Understanding the Basics of Home Insurance

Home insurance policies typically cover a range of perils, including fire, lightning, windstorms, hail, explosions, and more. Additionally, they often provide coverage for personal liability, protecting homeowners against lawsuits arising from injuries or damages caused to others on their property.

However, it's important to note that standard home insurance policies typically exclude certain perils, such as floods and earthquakes. These require separate coverage, often in the form of flood insurance or earthquake insurance, which are crucial considerations for homeowners in high-risk areas.

Types of Home Insurance Coverage

Home insurance policies are generally categorized into two primary types:

- HO-3 (Special Form) Policy: This is the most common type of home insurance, covering a wide range of perils except those specifically excluded. It provides protection for the structure of the home, as well as personal belongings, and offers liability coverage.

- HO-5 (Open Perils) Policy: This type of policy provides broader coverage, covering all perils except those specifically named in the policy. It offers more comprehensive protection, making it a popular choice for high-value homes or those with valuable belongings.

Additionally, there are other types of home insurance policies, such as the HO-2 (Broad Form) policy, which covers a narrower range of perils, and the HO-8 policy, which is tailored for older homes.

Factors Influencing Home Insurance Rates

Similar to car insurance, home insurance rates are influenced by various factors, including:

- Home Value and Location: The value of the home and its location play a significant role in determining insurance rates. High-value homes or those in areas prone to natural disasters or criminal activity often result in higher premiums.

- Coverage and Deductibles: The level of coverage chosen, including the dwelling coverage limit and personal property coverage, can impact rates. Additionally, the choice of deductibles, with higher deductibles often leading to lower premiums, is a crucial consideration.

- Age and Condition of the Home: Older homes may require more extensive coverage, especially if they have outdated electrical or plumbing systems. The condition of the home, including any recent renovations or upgrades, can also influence insurance rates.

- Discounts and Bundles: Much like car insurance, home insurance providers often offer discounts for various reasons. These can include multi-policy discounts for bundling home and car insurance, as well as discounts for safety features like burglar alarms or sprinkler systems.

The Benefits of Bundling Car and Home Insurance

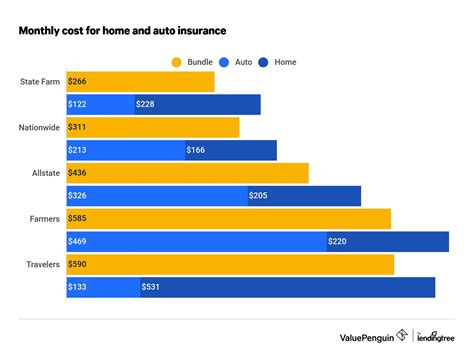

Bundling car and home insurance offers several advantages. Not only does it simplify the insurance process, but it can also result in significant cost savings. Many insurance providers offer multi-policy discounts when customers bundle their car and home insurance policies, making it a financially savvy choice.

Furthermore, bundling allows for better coordination of coverage. For instance, if an individual has both their car and home insured with the same provider, it becomes easier to manage and understand their coverage, especially in the event of a claim. The process becomes more streamlined, and policyholders can ensure they have the right level of protection across all their assets.

Choosing the Right Insurance Provider

When it comes to selecting an insurance provider, there are several key considerations:

- Financial Stability: It is crucial to choose an insurance provider with a strong financial background. This ensures that the provider will be able to honor their commitments and pay out claims in the event of a loss.

- Coverage Options: Different providers offer varying levels of coverage. It is essential to compare policies to ensure one is getting the right level of protection for their specific needs.

- Customer Service and Claims Handling: The quality of customer service and claims handling can significantly impact the overall experience with an insurance provider. Positive reviews and a track record of prompt and fair claims handling are indicators of a reliable provider.

- Discounts and Bundling Options: As mentioned earlier, discounts and bundling options can result in significant cost savings. Comparing providers to find the best deals is a wise strategy.

The Future of Insurance: Technological Advancements

The insurance industry is evolving rapidly, with technological advancements playing a pivotal role. From digital applications for easier policy management to the use of data analytics for more accurate risk assessment, technology is transforming the insurance landscape.

One of the most significant advancements is the integration of telematics in car insurance. Telematics devices, which monitor driving behavior and provide real-time data, are revolutionizing the way insurance premiums are calculated. By incentivizing safe driving habits, these devices offer policyholders the opportunity to lower their premiums.

Similarly, in the realm of home insurance, smart home technology is making a significant impact. With the increasing popularity of smart home devices, insurance providers are offering discounts for homes equipped with these technologies. Smart home devices, such as smoke detectors, water leak detectors, and security systems, not only enhance home safety but also reduce the risk of losses, leading to lower insurance premiums.

The Role of Data Analytics

Data analytics is another critical aspect of the evolving insurance landscape. Insurance providers are leveraging advanced analytics to gain deeper insights into risk factors and potential losses. By analyzing vast amounts of data, insurers can make more accurate predictions and offer more tailored coverage options.

For instance, in car insurance, data analytics can help identify high-risk driving behaviors, such as aggressive acceleration or late-night driving, which can then be used to provide personalized advice and incentives for safer driving. In home insurance, analytics can help identify potential risks associated with specific locations, such as the likelihood of natural disasters or crime rates, allowing for more precise pricing and coverage options.

Conclusion: Navigating the World of Insurance

Insurance, whether for cars or homes, is a critical component of financial planning and risk management. By understanding the different types of coverage, the factors influencing rates, and the benefits of bundling, individuals can make informed decisions to protect their assets and financial well-being.

As the insurance industry continues to evolve with technological advancements and data analytics, policyholders can expect more personalized and efficient coverage options. By staying informed and engaging with their insurance providers, individuals can navigate the world of insurance with confidence and ensure they have the right protection in place.

How do I choose the right car insurance coverage for my needs?

+Choosing the right car insurance coverage involves assessing your specific needs and risks. Consider factors such as your vehicle type, driving habits, and location. If you frequently drive in urban areas or have a high-performance vehicle, you may want to prioritize collision and comprehensive coverage. Conversely, if you have an older car with low repair costs, liability coverage may suffice. Additionally, consider adding coverage for specific risks like uninsured/underinsured motorists or personal injury protection.

What should I look for in a home insurance policy?

+When selecting a home insurance policy, consider the value of your home and its contents, as well as any specific risks associated with your location. Look for a policy that provides adequate coverage for your home’s structure, personal belongings, and personal liability. Ensure the policy covers perils relevant to your area, such as floods or earthquakes if necessary. Also, consider additional coverage options like personal property endorsements or increased liability limits.

Can I negotiate my insurance rates with my provider?

+While insurance rates are primarily determined by various factors, you can negotiate with your provider to potentially lower your premiums. Discuss your specific needs and risks, and inquire about discounts or coverage adjustments that may reduce your costs. Some providers offer loyalty discounts for long-term customers or discounts for maintaining a clean driving or claims history. Additionally, consider shopping around for quotes from multiple providers to find the best rates.