Underwriters Insurance

In the world of insurance, the role of an underwriter is crucial yet often misunderstood. Underwriters are the gatekeepers of the insurance industry, playing a vital role in assessing risk, determining premiums, and ensuring the financial stability of insurance companies. This article aims to delve into the intricate world of underwriters, exploring their responsibilities, the skills required for the job, and the impact they have on the insurance landscape.

The Role of Underwriters: Unveiling the Process

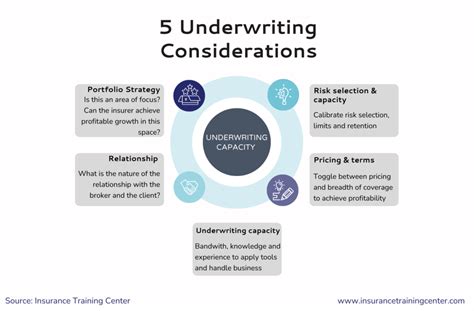

Underwriters are the experts who evaluate and classify risk for insurance purposes. Their primary responsibility is to analyze potential risks associated with insurance policies, such as health, life, property, or liability insurance. By assessing these risks, underwriters determine whether to accept or decline an insurance application and set the appropriate premium rates.

The underwriter's role involves a meticulous examination of various factors. They review an applicant's medical history, financial records, property assessments, and other relevant information to make informed decisions. For instance, in health insurance, underwriters consider factors like pre-existing conditions, age, and lifestyle habits to assess the risk level and set the premium accordingly.

Additionally, underwriters play a crucial role in managing the financial health of insurance companies. They ensure that the risks taken on by the company are within acceptable limits, thus protecting the company's assets and maintaining its solvency. By carefully selecting and pricing policies, underwriters contribute to the overall stability and profitability of the insurance industry.

The Skillset of an Underwriter: A Blend of Art and Science

The role of an underwriter demands a unique combination of analytical skills, industry knowledge, and judgment. Here are some key skills that define a successful underwriter:

- Analytical Acumen: Underwriters must possess exceptional analytical abilities to assess complex data and identify patterns. They use statistical models, actuarial calculations, and risk management techniques to evaluate risks accurately.

- Industry Expertise: A deep understanding of the insurance industry is essential. Underwriters stay updated with market trends, regulatory changes, and emerging risks to make informed decisions.

- Risk Assessment: The ability to assess and quantify risk is fundamental. Underwriters must identify potential hazards, evaluate their likelihood and impact, and make judgments about acceptability.

- Decision-Making Skills: Underwriters often face complex situations where they must make quick and accurate decisions. They must balance risk assessment with business goals and regulatory requirements.

- Communication and Interpersonal Skills: Effective communication is vital for underwriters, as they interact with various stakeholders, including brokers, agents, and clients. They must convey complex risk assessments in a clear and concise manner.

The Impact of Underwriters on the Insurance Industry

The work of underwriters has a profound impact on the insurance industry and its stakeholders. Here are some key ways in which underwriters shape the insurance landscape:

- Financial Stability: By carefully assessing risks and setting appropriate premiums, underwriters contribute to the financial stability of insurance companies. This ensures that companies can honor their commitments to policyholders and maintain solvency.

- Risk Mitigation: Underwriters play a critical role in identifying and mitigating risks. They collaborate with risk managers and actuaries to develop strategies that minimize potential losses, benefiting both the insurance company and its clients.

- Consumer Protection: Underwriters help protect consumers by ensuring that insurance policies are fairly priced and cover appropriate risks. Their expertise ensures that policyholders receive adequate coverage without overpaying.

- Innovation and Adaptation: Underwriters are at the forefront of industry innovation. They adapt to changing market conditions, emerging risks, and technological advancements to provide relevant and timely insurance solutions.

- Regulatory Compliance: With their understanding of insurance regulations, underwriters ensure that insurance companies adhere to legal and ethical standards. This protects policyholders and maintains the integrity of the insurance industry.

The Future of Underwriting: Embracing Technology and Data

The insurance industry is undergoing significant transformations, and underwriters are at the center of this evolution. With advancements in technology and data analytics, underwriters now have access to vast amounts of information, enabling them to make more accurate risk assessments.

Artificial intelligence (AI) and machine learning algorithms are revolutionizing the underwriting process. These technologies can analyze large datasets, identify patterns, and make predictions, enhancing the accuracy and efficiency of risk assessment. Underwriters can leverage these tools to streamline their workflow and make more informed decisions.

Additionally, the rise of telemedicine and digital health technologies is transforming the health insurance landscape. Underwriters now have access to real-time health data, allowing them to assess risks more accurately and offer personalized insurance solutions. This shift towards data-driven underwriting is expected to continue, shaping the future of the insurance industry.

| Industry Sector | Key Underwriting Challenges |

|---|---|

| Health Insurance | Managing rising healthcare costs, assessing pre-existing conditions, and adapting to changing regulations. |

| Property & Casualty | Evaluating natural disaster risks, assessing property values, and addressing climate change impacts. |

| Life Insurance | Determining mortality rates, assessing lifestyle factors, and offering tailored policies. |

How do underwriters assess risk for insurance purposes?

+Underwriters employ a comprehensive approach to risk assessment. They analyze various factors, including medical history, financial records, property assessments, and industry-specific risks. By evaluating these factors, they determine the likelihood and potential impact of a risk event and set appropriate premiums.

What skills are essential for a successful underwriter?

+Successful underwriters possess a blend of analytical skills, industry knowledge, and judgment. They need strong analytical abilities to assess complex data, expertise in insurance regulations and market trends, and the ability to make quick and accurate decisions. Effective communication skills are also crucial for interacting with various stakeholders.

How do underwriters contribute to the financial stability of insurance companies?

+Underwriters play a crucial role in managing the financial health of insurance companies. By carefully assessing risks and setting appropriate premiums, they ensure that the company’s portfolio is balanced and profitable. This helps maintain the company’s solvency and ability to honor policyholder commitments.