How Much For Insurance On A Car

Car insurance is a vital aspect of vehicle ownership, offering financial protection and peace of mind to drivers. The cost of insurance can vary significantly depending on numerous factors, making it a complex and personalized matter. Understanding the variables that influence insurance rates is crucial for both consumers and insurance providers.

In this in-depth analysis, we will explore the factors that affect car insurance rates, provide real-world examples, and offer insights into how insurance companies determine these costs. By delving into the world of automotive insurance, we aim to empower individuals with the knowledge to make informed decisions about their coverage and potentially save money on their policies.

Factors Influencing Car Insurance Rates

The cost of car insurance is determined by a multitude of factors, each contributing to the overall risk assessment made by insurance providers. These factors can be broadly categorized into personal, vehicle-related, and environmental aspects.

Personal Factors

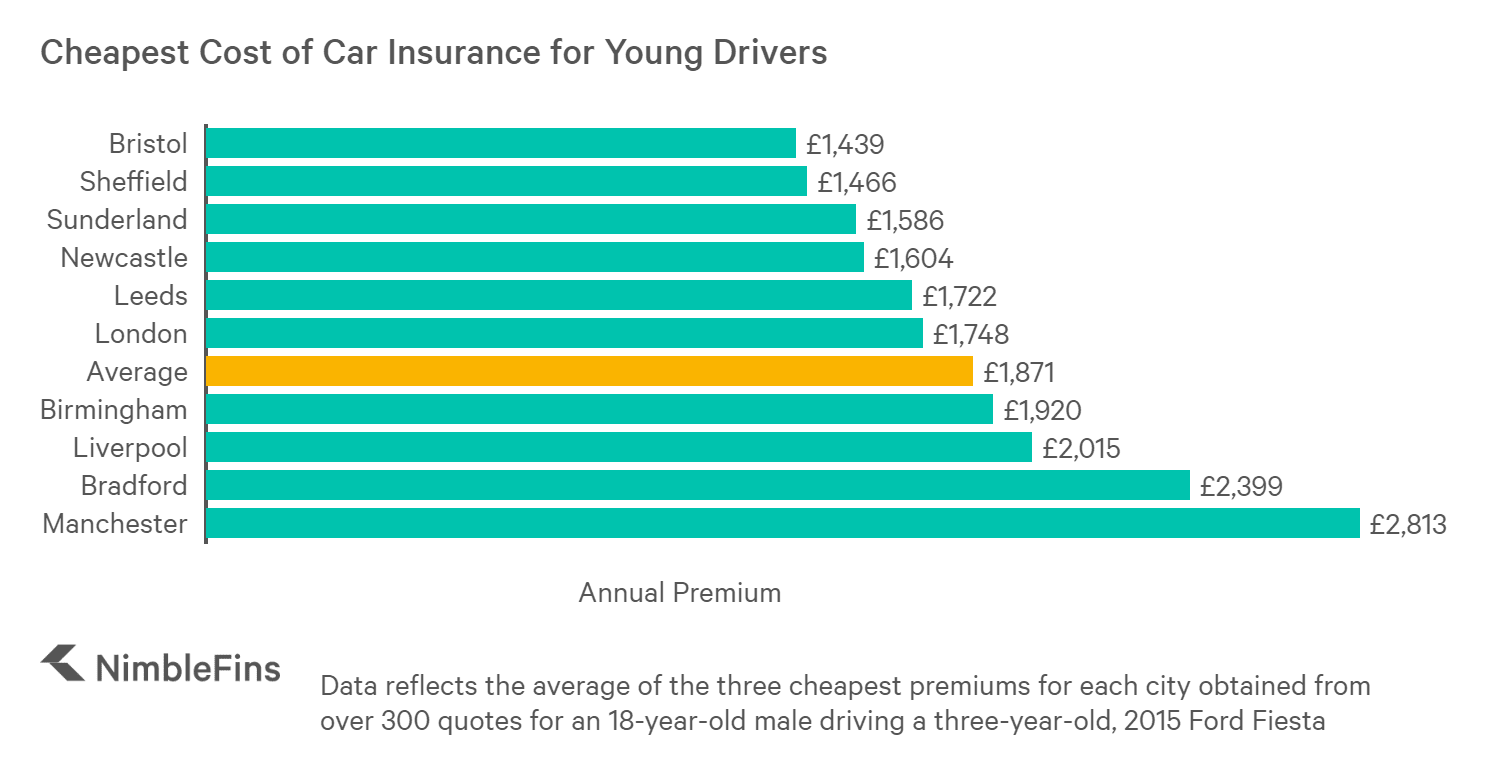

Your personal details play a significant role in determining your insurance rates. Age is a key factor, with younger drivers often facing higher premiums due to their lack of experience on the road. Gender can also impact rates, with statistical differences in driving behaviors and accident rates between males and females influencing insurance costs.

Your driving history is a critical consideration. A clean driving record with no accidents or traffic violations can lead to lower premiums, while a history of accidents or citations may result in higher rates. Insurance companies also consider credit scores, as statistical correlations between creditworthiness and driving behavior can impact insurance risk assessments.

Vehicle-Related Factors

The type of vehicle you drive can significantly influence your insurance costs. Car make and model are important considerations, as certain vehicles may have higher repair costs or be more prone to theft, affecting insurance rates. Vehicle age and mileage also play a role, with older or high-mileage vehicles often carrying lower insurance premiums.

The vehicle's safety features can impact insurance rates. Cars equipped with advanced safety technologies, such as lane departure warning systems or automatic emergency braking, may be eligible for insurance discounts. Additionally, the primary usage of the vehicle, whether for commuting, pleasure, or business, can affect insurance costs.

Environmental Factors

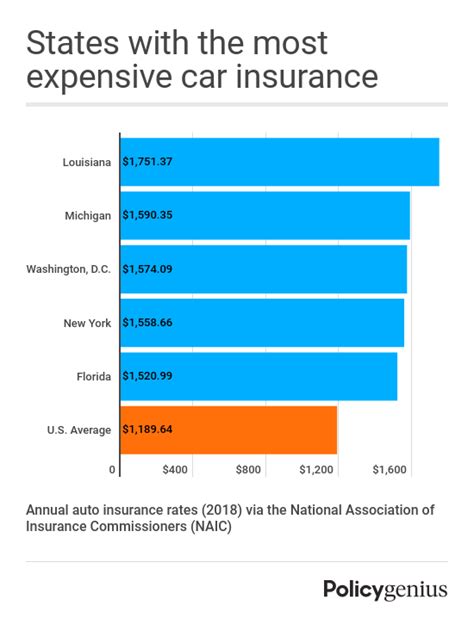

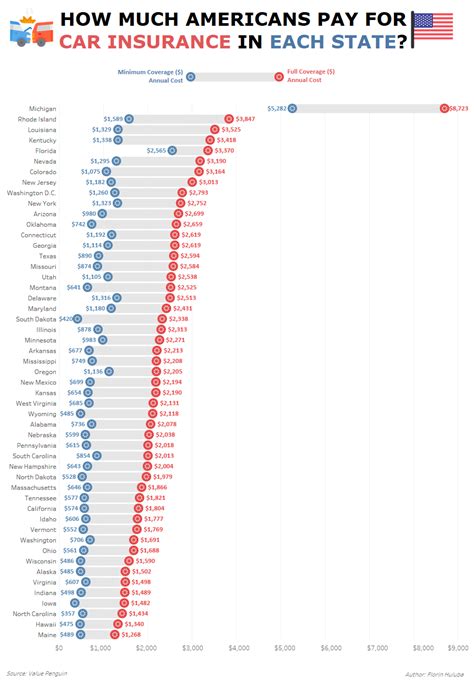

The location where you reside and drive your vehicle is a significant factor in insurance rates. Urban areas with higher population densities and increased traffic often have higher insurance costs due to the higher likelihood of accidents and theft. Conversely, rural areas may offer lower insurance rates due to reduced traffic and crime rates.

The weather conditions in your area can also impact insurance rates. Regions prone to severe weather events, such as hurricanes or blizzards, may have higher insurance costs due to the increased risk of weather-related accidents or damage. Additionally, the type of coverage you choose, such as liability-only or comprehensive coverage, will influence your insurance premiums.

Real-World Examples of Insurance Rates

To illustrate the variability of insurance rates, let’s consider some real-world examples. In the United States, the average annual car insurance premium in 2022 was approximately $1,674, according to the Insurance Information Institute. However, this average hides significant variations based on the factors mentioned above.

For instance, a 30-year-old male driver with a clean driving record residing in a suburban area might pay around $1,200 annually for comprehensive insurance on a 5-year-old Toyota Camry. In contrast, a 20-year-old female driver with a history of accidents living in an urban center might pay $2,500 or more for the same coverage and vehicle type.

| Driver Profile | Insurance Cost (Annual) |

|---|---|

| Young, Urban Driver with Accidents | $2,500+ |

| Middle-Aged Suburban Driver with Clean Record | $1,200 |

| Elderly Rural Driver with Comprehensive Coverage | $800 |

These examples demonstrate how personal, vehicle, and environmental factors can lead to significant differences in insurance costs. It's important to note that insurance rates are unique to each individual and situation, and the examples provided are for illustrative purposes only.

How Insurance Companies Determine Rates

Insurance companies utilize complex algorithms and risk assessment models to determine insurance rates. These models consider the factors discussed earlier and analyze vast amounts of historical data to predict the likelihood of accidents and claims. By understanding these risk factors, insurance companies can set premiums accordingly.

Additionally, insurance companies may employ usage-based insurance (UBI) programs, where drivers' real-time driving behaviors are monitored to assess their risk profile. UBI programs use telematics devices or smartphone apps to collect data on driving habits, such as acceleration, braking, and mileage. Drivers with safer driving behaviors may be eligible for insurance discounts through these programs.

Tips for Reducing Insurance Costs

While insurance rates are largely influenced by factors beyond your control, there are several strategies you can employ to potentially reduce your insurance costs:

- Shop around: Compare insurance quotes from multiple providers to find the best rates for your specific situation. Insurance rates can vary significantly between companies, so obtaining multiple quotes is essential.

- Bundle policies: Many insurance companies offer discounts when you bundle multiple policies, such as car insurance with home or renters insurance. Bundling can lead to substantial savings.

- Increase deductibles: Opting for a higher deductible (the amount you pay out-of-pocket before insurance coverage kicks in) can reduce your insurance premiums. However, it's important to ensure you can afford the higher deductible in the event of a claim.

- Maintain a clean driving record: A clean driving record with no accidents or violations is a significant factor in reducing insurance costs. Safe driving practices not only keep you and others safe on the road but also lead to lower insurance premiums.

- Consider usage-based insurance: If you have a good driving record and are confident in your driving abilities, you may benefit from usage-based insurance programs. These programs can offer substantial discounts for safe driving behaviors.

Future Implications and Industry Trends

The car insurance industry is constantly evolving, and several trends and developments are shaping its future. The increasing adoption of autonomous vehicles and advanced driver-assistance systems (ADAS) is expected to significantly impact insurance rates in the coming years. As these technologies become more prevalent, insurance companies will need to adjust their risk assessment models to account for the reduced accident risk associated with autonomous driving.

Additionally, the sharing economy and the rise of ride-sharing services are influencing insurance needs. Insurance providers are developing new products and coverage options to cater to the unique risks and requirements of ride-sharing drivers and passengers. This includes specialized insurance policies that cover personal vehicles used for commercial purposes.

The insurance industry is also embracing technology and data analytics to enhance risk assessment and improve customer experiences. Advanced data analytics and machine learning algorithms are being utilized to more accurately predict insurance risks and tailor insurance offerings to individual needs. This trend is expected to continue, leading to more personalized insurance options and potentially lower costs for certain drivers.

Conclusion

Car insurance rates are influenced by a multitude of factors, including personal details, vehicle characteristics, and environmental conditions. By understanding these factors and the methods insurance companies use to determine rates, individuals can make informed decisions about their insurance coverage and potentially save money. The car insurance landscape is dynamic, and staying informed about industry trends and developments is crucial for both consumers and insurance providers.

How often should I review my car insurance policy and rates?

+

It’s a good practice to review your car insurance policy and rates annually, or whenever your circumstances change significantly. This ensures you have the appropriate coverage and are not overpaying for your insurance.

Can I get car insurance if I have a poor credit score?

+

Yes, you can still obtain car insurance with a poor credit score. However, insurance companies often use credit scores as a factor in determining insurance rates, so you may face higher premiums. It’s advisable to shop around and compare quotes from multiple providers to find the best rates.

What is the difference between liability-only and comprehensive car insurance?

+

Liability-only insurance covers the costs of damages or injuries you cause to others in an accident, but it does not provide coverage for your own vehicle. Comprehensive insurance, on the other hand, provides coverage for a wider range of incidents, including accidents, theft, vandalism, and natural disasters. It offers more comprehensive protection for your vehicle.