Avg Monthly Car Insurance

Welcome to this comprehensive guide on understanding and optimizing your average monthly car insurance costs. In today's world, where vehicles are an integral part of our daily lives, it's essential to have a clear grasp of the financial responsibilities associated with car ownership, especially when it comes to insurance. This article will delve into the various factors that influence your monthly premiums, offering insights and strategies to help you navigate the complex world of car insurance with confidence.

Demystifying Car Insurance Premiums

Car insurance is a crucial aspect of vehicle ownership, providing financial protection in the event of accidents, theft, or other unforeseen circumstances. The average monthly car insurance cost can vary significantly depending on numerous factors, and understanding these variables is key to making informed decisions and potentially reducing your insurance expenses.

Factors Influencing Average Monthly Premiums

The cost of car insurance is influenced by a multitude of factors, each playing a unique role in determining your monthly premium. These factors can be broadly categorized into three main groups: personal characteristics, vehicle-related factors, and geographical and demographic considerations.

Personal Characteristics

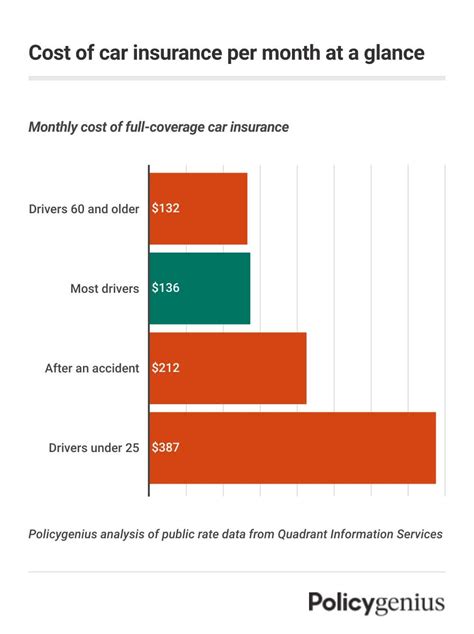

- Age and Gender: Insurance premiums often vary based on age and gender. Young drivers, especially males under 25, tend to pay higher premiums due to their relative inexperience and higher risk profile. As drivers age, their premiums may decrease, with mature drivers often enjoying lower rates.

- Driving History: Your driving record is a critical factor. A clean driving history with no accidents or traffic violations can lead to lower premiums. On the other hand, a history of accidents or moving violations may result in higher insurance costs.

- Credit Score: Believe it or not, your credit score can impact your insurance rates. Insurers often use credit-based insurance scores to assess risk, and a higher credit score may result in more favorable insurance rates.

Vehicle-Related Factors

- Vehicle Type and Value: The make, model, and age of your vehicle play a significant role. High-performance cars, luxury vehicles, and newer models generally attract higher insurance premiums due to their higher replacement and repair costs.

- Safety Features: Vehicles equipped with advanced safety features like anti-lock brakes, air bags, and collision avoidance systems may qualify for insurance discounts. These features reduce the risk of accidents and subsequent insurance claims.

- Usage: The purpose for which you use your vehicle can impact your insurance rates. Personal use typically attracts lower premiums compared to commercial or business use, which may require additional coverage.

Geographical and Demographic Factors

- Location: Where you live and drive your vehicle can significantly affect your insurance rates. Urban areas often have higher premiums due to increased traffic density and the higher likelihood of accidents and theft.

- Traffic and Crime Rates: Insurance rates are influenced by the traffic and crime statistics of your area. High-traffic areas or neighborhoods with high crime rates may result in higher premiums.

- Population Density: The population density of your area can impact insurance rates. More densely populated areas often have higher insurance costs due to increased risk of accidents and claims.

Understanding Average Monthly Premiums by State

Car insurance rates can vary significantly from one state to another due to differences in regulations, demographics, and driving conditions. Let's take a closer look at the average monthly car insurance costs in various states across the US.

| State | Average Monthly Premium |

|---|---|

| California | $140 |

| Texas | $115 |

| New York | $200 |

| Florida | $155 |

| Illinois | $125 |

| Ohio | $100 |

| Pennsylvania | $130 |

| Michigan | $220 |

| New Jersey | $180 |

| Massachusetts | $160 |

These figures provide a general overview, but it's important to note that individual rates can vary widely based on personal circumstances and the specific coverage chosen.

Optimizing Your Car Insurance Costs

Now that we’ve explored the factors influencing car insurance premiums, let’s discuss some strategies to help you optimize your monthly costs and find the best insurance deal for your needs.

Shop Around and Compare Quotes

Car insurance is a competitive market, and insurers offer a wide range of rates and coverage options. Shopping around and comparing quotes from multiple insurers is essential to finding the best deal. Online comparison tools can provide a quick and convenient way to compare rates from different providers.

Understand Your Coverage Needs

Different drivers have varying insurance needs. Consider your specific requirements and tailor your coverage accordingly. If you own an older vehicle, you may not need comprehensive coverage, which can save you money. On the other hand, if you have a luxury or high-performance car, comprehensive coverage is essential.

Explore Discounts and Bundles

Insurers often offer a variety of discounts to attract and retain customers. Common discounts include safe driver discounts, good student discounts, multi-policy discounts (bundling car insurance with other policies like home or renters insurance), and loyalty discounts for long-term customers. Ask your insurer about the discounts they offer and ensure you're taking advantage of all applicable savings.

Maintain a Good Driving Record

A clean driving record is crucial to keeping your insurance premiums low. Avoid accidents and traffic violations, as these can significantly increase your insurance costs. If you have a clean record, consider asking your insurer about safe driver discounts or other incentives.

Consider Higher Deductibles

Opting for a higher deductible can reduce your monthly premiums. A deductible is the amount you pay out of pocket before your insurance coverage kicks in. While it may mean a higher upfront cost in the event of a claim, it can result in substantial savings on your monthly insurance payments.

Review Your Policy Regularly

Your insurance needs may change over time. Regularly review your policy to ensure it still meets your requirements. Life events like getting married, buying a new car, or moving to a new location may impact your insurance needs and premiums. Stay informed and adjust your coverage as necessary.

Future Implications and Trends in Car Insurance

The car insurance industry is evolving, and several trends are shaping the future of insurance coverage and costs. Understanding these trends can help you make more informed decisions and stay ahead of the curve.

Telematics and Usage-Based Insurance

Telematics technology, which uses sensors and GPS to track driving behavior, is gaining popularity. Usage-based insurance policies, also known as pay-as-you-drive or pay-how-you-drive, offer insurance rates based on an individual's actual driving behavior. These policies can reward safe drivers with lower premiums.

Connected Car Technology

The rise of connected car technology, where vehicles are equipped with advanced sensors and communication systems, is expected to impact insurance rates. This technology can provide real-time data on driving behavior, vehicle performance, and potential risks, allowing insurers to offer more accurate and personalized insurance rates.

Autonomous Vehicles and Insurance

The advent of autonomous vehicles is expected to revolutionize the insurance industry. As self-driving cars become more prevalent, the nature of accidents and liability may shift, potentially leading to significant changes in insurance coverage and costs. Insurers are already exploring new models to address the unique risks and benefits associated with autonomous vehicles.

Conclusion

Understanding the factors that influence your average monthly car insurance cost is the first step toward making informed decisions and potentially reducing your insurance expenses. By shopping around, comparing quotes, and optimizing your coverage, you can find the best insurance deal that suits your needs and budget. Stay informed about the evolving trends in the insurance industry to ensure you’re always ahead of the curve when it comes to protecting your vehicle and your finances.

What is the average monthly car insurance cost in the US?

+The average monthly car insurance cost in the US varies depending on several factors, including location, driving record, and vehicle type. As of 2023, the national average for monthly car insurance premiums is approximately $130.

How can I lower my car insurance costs?

+To lower your car insurance costs, consider shopping around for quotes from multiple insurers, maintaining a clean driving record, opting for higher deductibles, and exploring discounts like safe driver or multi-policy discounts. Regularly reviewing your coverage and making adjustments based on your needs can also help reduce costs.

Are there any trends in car insurance that may impact future costs?

+Yes, several trends are shaping the future of car insurance. Telematics and usage-based insurance, connected car technology, and the advent of autonomous vehicles are expected to influence insurance rates and coverage. Staying informed about these trends can help you anticipate and prepare for potential changes in insurance costs.