Health Insurance Open Enrollment

The Health Insurance Open Enrollment period is a critical time for individuals and families to review and select healthcare coverage options for the upcoming year. This period offers a unique opportunity to assess your current plan, compare alternatives, and make informed decisions to ensure you have the right coverage for your needs. As we navigate the complexities of the healthcare system, understanding the ins and outs of open enrollment is essential to make the most of this annual opportunity.

Understanding the Basics of Open Enrollment

Health Insurance Open Enrollment is a designated period when individuals can enroll in a health insurance plan, change their existing plan, or opt for a new one. This annual event is regulated by the Affordable Care Act (ACA) and is designed to provide a standardized process for selecting and purchasing health coverage.

The specific dates for open enrollment vary depending on the plan and location. For example, the federal open enrollment period for individual health insurance plans typically runs from November 1st to December 15th. However, some states may have different timelines, and it's crucial to check the specific dates for your state or plan provider.

Who is Eligible for Open Enrollment?

Open enrollment is available to anyone who is not currently enrolled in a health insurance plan or who is eligible for a Special Enrollment Period (SEP). This includes individuals, families, and small business owners seeking coverage for their employees.

During this period, insurance companies cannot discriminate against applicants based on pre-existing conditions or health status. This means that everyone has an equal opportunity to obtain comprehensive healthcare coverage, regardless of their medical history.

Key Considerations During Open Enrollment

When navigating the open enrollment process, there are several key factors to keep in mind:

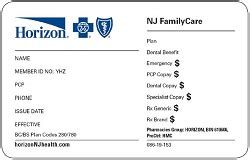

- Premiums: The cost of your health insurance plan, typically paid monthly. Premiums can vary significantly based on the plan's coverage and benefits.

- Deductibles: The amount you must pay out-of-pocket before your insurance coverage begins. Higher deductibles can result in lower premiums, so it's essential to find the right balance for your budget and healthcare needs.

- Copayments: A fixed amount you pay for a covered healthcare service, usually at the time of service. Copayments can vary depending on the type of service and your insurance plan.

- Coinsurance: The percentage of costs you share with your insurance company for covered services. For example, you might pay 20% of the cost, while your insurance covers the remaining 80%.

- Out-of-Pocket Maximum: The most you'll pay for covered services in a year. After you reach this limit, your insurance plan typically covers 100% of the costs.

- Network Providers: Doctors, hospitals, and other healthcare providers that are in-network for your insurance plan. Using in-network providers can result in lower out-of-pocket costs.

- Coverage Limits: The specific services and treatments covered by your insurance plan, as well as any exclusions or limitations.

Navigating the Open Enrollment Process

To make the most of open enrollment, it’s beneficial to start preparing well in advance. Here are some steps to guide you through the process:

Assess Your Current Coverage

Begin by evaluating your current health insurance plan. Consider the following aspects:

- Did your healthcare needs change over the past year? For instance, did you or a family member require extensive medical care, or do you anticipate any significant health changes in the coming year?

- Are you satisfied with your current provider network? Ensure that your preferred doctors and specialists are still in-network for the upcoming year.

- Review your out-of-pocket expenses from the previous year. Did you reach your deductible or out-of-pocket maximum? If so, you might want to consider a plan with a higher premium and lower out-of-pocket costs for the upcoming year.

Compare Alternative Plans

Once you’ve assessed your current coverage, it’s time to explore other options. Compare plans based on the following criteria:

- Premiums: Consider plans with different premium structures to find the best fit for your budget.

- Deductibles and Out-of-Pocket Costs: Weigh the balance between lower premiums and higher out-of-pocket costs, or vice versa.

- Coverage Benefits: Ensure that the plans you're considering cover the services and treatments you anticipate needing.

- Provider Networks: Confirm that your preferred healthcare providers are in-network for the new plan.

Evaluate Cost-Sharing Options

Health insurance plans often offer various cost-sharing options, such as Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs). These accounts allow you to set aside pre-tax dollars to pay for qualified medical expenses. Evaluate these options to determine if they can help reduce your overall healthcare costs.

Enroll or Make Changes

Once you’ve decided on the best plan for your needs, it’s time to enroll or make the necessary changes. This process can typically be done online through the insurance provider’s website or a government-run health insurance marketplace.

If you're changing plans, ensure that you understand the effective date of your new coverage. You may have a grace period to make changes without incurring additional costs, but it's essential to review the specific rules and timelines for your plan.

Making Informed Decisions for Your Healthcare

The Health Insurance Open Enrollment period is a crucial opportunity to ensure you have the right coverage for your healthcare needs. By understanding the basics of open enrollment, assessing your current coverage, and comparing alternative plans, you can make informed decisions that align with your health and financial goals.

Remember, healthcare is a personal journey, and your insurance plan should reflect your unique needs. Take the time to research, compare, and select the plan that offers the best balance of coverage, cost, and provider network for you and your family.

FAQs

Can I enroll in a health insurance plan outside of the open enrollment period?

+In general, you can only enroll in a health insurance plan during the designated open enrollment period. However, there are exceptions. If you experience certain life events, such as getting married, having a baby, or losing your current health coverage, you may qualify for a Special Enrollment Period (SEP), which allows you to enroll outside of the open enrollment window.

What happens if I miss the open enrollment deadline?

+If you miss the open enrollment deadline, you generally cannot enroll in a new health insurance plan until the next open enrollment period. However, if you qualify for a Special Enrollment Period due to a life event, you may still have the opportunity to enroll outside of the regular deadline.

Can I change my health insurance plan during open enrollment?

+Yes, open enrollment is the designated time to make changes to your health insurance plan. You can switch to a different plan offered by your current insurer or explore options with a new provider. This is a great opportunity to assess your needs and find a plan that better aligns with your healthcare requirements.

Are there any penalties for not having health insurance?

+As of 2019, there is no longer a federal tax penalty for not having health insurance. However, some states have their own individual mandate penalties. It’s important to check your state’s regulations to understand any potential consequences of not having health coverage.

How can I get help understanding my health insurance options during open enrollment?

+If you need assistance understanding your health insurance options during open enrollment, you can seek help from various resources. Many insurance providers offer customer support and educational materials to guide you through the process. Additionally, you can consult with an insurance broker or agent who can provide personalized advice based on your specific needs.