Best Auto Insurance

In the vast landscape of auto insurance, finding the best coverage can be a daunting task. With countless options available, from major providers to niche insurers, the quest for the ideal auto insurance policy is a journey that requires careful consideration and a deep understanding of one's specific needs. This comprehensive guide aims to navigate through the intricate world of auto insurance, offering expert insights and practical advice to help you make an informed decision.

Understanding Auto Insurance: A Comprehensive Overview

Auto insurance is a vital financial safeguard designed to protect you against financial loss in the event of an accident or other vehicle-related incidents. It provides coverage for a range of scenarios, from repairing or replacing your vehicle after an accident to covering medical expenses for injuries sustained during a collision. However, the complexity of auto insurance policies often leaves consumers with more questions than answers. Understanding the intricacies of coverage types, policy limits, and potential exclusions is essential to ensuring you’re adequately protected.

The landscape of auto insurance is diverse, with policies tailored to individual needs and circumstances. From liability-only coverage for budget-conscious drivers to comprehensive policies offering extensive protection, the options are vast. Additionally, the emergence of usage-based insurance (UBI) has introduced a data-driven approach, where premiums are determined by an individual's actual driving behavior, providing an innovative alternative to traditional insurance models.

Key Coverage Types and Their Significance

Auto insurance policies typically offer a range of coverage types, each designed to address specific risks and circumstances. Liability coverage, for instance, is a fundamental component, providing financial protection in the event you’re found at fault for an accident. This coverage is crucial as it safeguards your assets and finances against potential lawsuits resulting from an accident.

Furthermore, comprehensive and collision coverage are essential for protecting your vehicle against non-accident-related damages. Comprehensive coverage typically includes protection against theft, vandalism, natural disasters, and other unforeseen events, while collision coverage covers damages resulting from collisions with other vehicles or objects.

| Coverage Type | Description |

|---|---|

| Liability Coverage | Protects you against financial loss if you're at fault in an accident, covering bodily injury and property damage claims. |

| Comprehensive Coverage | Provides protection for your vehicle against damages caused by theft, vandalism, natural disasters, and other non-collision events. |

| Collision Coverage | Covers damages to your vehicle resulting from collisions with other vehicles or objects. |

Additionally, personal injury protection (PIP) and medical payments coverage are vital for covering medical expenses and lost wages resulting from injuries sustained in an accident, regardless of fault. These coverage types are particularly beneficial in no-fault states, where they provide essential financial support for accident victims.

Factors Influencing Auto Insurance Rates: A Deep Dive

Auto insurance rates are influenced by a myriad of factors, each playing a significant role in determining the cost of your policy. Understanding these factors is crucial for predicting and managing your insurance expenses effectively. From your driving record and credit score to the make and model of your vehicle, these elements collectively shape the cost of your auto insurance.

The Impact of Driving History and Credit Score

Your driving history is a key determinant of your auto insurance rates. Insurers closely examine your driving record, considering factors such as accidents, traffic violations, and claims made against your policy. A clean driving record generally results in lower insurance premiums, while a history of accidents or violations can lead to higher rates or even policy denial.

Similarly, your credit score plays a significant role in determining your insurance rates. Many insurers use credit-based insurance scores to assess the risk associated with insuring a particular individual. A higher credit score often correlates with lower insurance rates, as individuals with strong credit histories are perceived as less risky by insurers.

Vehicle Characteristics and Their Influence

The make and model of your vehicle significantly impact your insurance rates. Insurers consider various factors, including the vehicle’s safety features, repair costs, and theft frequency. Vehicles with advanced safety features and lower repair costs generally result in lower insurance premiums, as they pose a lower risk to insurers.

Additionally, the primary use of your vehicle can influence your insurance rates. Insurers typically offer lower rates for vehicles primarily used for pleasure or commuting, as opposed to those used for business or commercial purposes, which carry a higher risk of accidents and claims.

Shopping for Auto Insurance: A Step-by-Step Guide

Navigating the process of shopping for auto insurance can be complex, but with a systematic approach and a clear understanding of your needs, it becomes a more manageable task. This step-by-step guide will walk you through the essential considerations and actions to take when searching for the best auto insurance policy.

Assessing Your Coverage Needs and Budget

The first step in your auto insurance journey is to assess your specific coverage needs and budget. Consider the level of protection you require and the financial implications of different coverage options. For instance, while comprehensive coverage offers extensive protection, it may not be necessary if you drive an older vehicle with a lower market value. Assessing your budget and coverage preferences will help you narrow down your options and make more informed decisions.

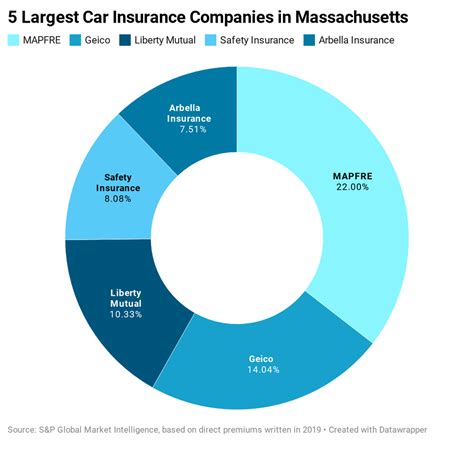

Researching Insurance Providers and Their Offerings

Once you have a clear understanding of your coverage needs, it’s time to research insurance providers and their offerings. Explore the market, comparing different insurers based on their reputation, financial stability, and the range of coverage options they provide. Consider seeking recommendations from friends, family, or online communities to gain insights into the experiences of others with various insurance providers.

Additionally, leverage online resources and comparison tools to evaluate insurance quotes from multiple providers. These tools allow you to input your specific details and preferences, generating personalized quotes that help you compare rates and coverage across different insurers.

Understanding Policy Terms and Conditions

When reviewing insurance quotes and policies, it’s crucial to thoroughly understand the terms and conditions. Pay close attention to the coverage limits, deductibles, and potential exclusions. Ensure that the policy aligns with your specific needs and provides adequate protection for your circumstances. Don’t hesitate to reach out to the insurer with any questions or concerns, as clarity on these details is essential to making an informed decision.

Maximizing Your Auto Insurance Experience: Expert Tips

Beyond selecting the right auto insurance policy, there are numerous strategies you can employ to maximize your insurance experience and potentially reduce your premiums. From adopting safe driving habits to leveraging discounts and bundle offers, these expert tips can help you optimize your insurance coverage and save money in the process.

The Benefits of Safe Driving and Discounts

Maintaining a clean driving record is not only essential for keeping your insurance premiums low but also a crucial aspect of road safety. Insurers reward safe driving with various discounts, including safe driver discounts, accident-free discounts, and even discounts for completing defensive driving courses. By adopting safe driving habits and avoiding accidents and violations, you can not only protect yourself and others on the road but also enjoy significant savings on your insurance premiums.

Additionally, many insurers offer discounts for specific vehicle features, such as anti-theft devices, advanced safety features, and hybrid or electric vehicles. By investing in these features, you not only enhance the safety and efficiency of your vehicle but also potentially qualify for insurance discounts, making your driving experience more cost-effective.

The Power of Bundling and Other Strategies

Bundling your auto insurance with other insurance policies, such as homeowners or renters insurance, can lead to substantial savings. Many insurers offer multi-policy discounts, providing a cost-effective way to protect your assets and reduce your insurance expenses. By consolidating your insurance needs with a single provider, you can streamline your coverage and potentially enjoy significant discounts.

Furthermore, exploring other strategies, such as increasing your deductibles or adjusting your coverage limits, can also impact your insurance premiums. While increasing deductibles can lead to lower premiums, it's essential to ensure that the deductible amount remains manageable in the event of a claim. Similarly, adjusting your coverage limits, particularly for comprehensive and collision coverage, can impact your premiums, allowing you to find the right balance between protection and cost.

Future Trends and Innovations in Auto Insurance

The world of auto insurance is evolving rapidly, with technological advancements and changing consumer needs driving significant innovations. From the rise of telematics and usage-based insurance to the integration of artificial intelligence and machine learning, the future of auto insurance is poised to bring about transformative changes. Understanding these emerging trends is crucial for staying ahead of the curve and ensuring you’re well-prepared for the future of auto insurance.

The Rise of Telematics and Usage-Based Insurance

Telematics and usage-based insurance (UBI) are revolutionizing the auto insurance industry by introducing a data-driven approach to risk assessment and pricing. Telematics devices, installed in vehicles, collect real-time driving data, including speed, acceleration, braking, and mileage. This data is then used to calculate insurance premiums, offering a more accurate and personalized pricing model. UBI provides an innovative alternative to traditional insurance models, rewarding safe drivers with lower premiums and encouraging safer driving habits.

Additionally, telematics data can be leveraged to enhance claims handling and fraud detection. By analyzing driving behavior and vehicle performance data, insurers can more accurately assess the circumstances of an accident, leading to faster and more efficient claims processing. Furthermore, telematics can identify suspicious patterns or anomalies, aiding in the detection and prevention of insurance fraud, which ultimately benefits honest policyholders.

Artificial Intelligence and Machine Learning: Transforming Insurance

Artificial intelligence (AI) and machine learning (ML) are poised to revolutionize the auto insurance industry, enhancing efficiency, accuracy, and personalization. AI and ML algorithms can analyze vast amounts of data, including driving behavior, vehicle performance, and historical claims data, to predict risks and optimize insurance pricing. This technology can identify patterns and trends, enabling insurers to offer more precise and tailored coverage options, ultimately benefiting consumers with more accurate and affordable insurance.

Furthermore, AI and ML can automate various aspects of the insurance process, from policy issuance and renewal to claims handling and fraud detection. By streamlining these processes, insurers can reduce administrative costs and provide faster, more efficient service to policyholders. Additionally, AI-powered chatbots and virtual assistants can offer 24/7 customer support, enhancing the overall insurance experience and providing instant assistance for policyholders.

Conclusion: Navigating the Future of Auto Insurance

As the auto insurance landscape continues to evolve, staying informed and adaptable is key to making the most of your insurance coverage. By understanding the intricacies of auto insurance, from coverage types and policy limits to the factors influencing rates and the emerging trends shaping the industry, you can navigate the complex world of auto insurance with confidence. Remember, auto insurance is not a one-size-fits-all solution, and by tailoring your coverage to your specific needs and circumstances, you can ensure you’re adequately protected while maximizing your insurance experience.

Whether you're a seasoned driver or a new car owner, the journey of finding the best auto insurance policy is an ongoing process. By staying informed, adopting safe driving habits, and leveraging the latest innovations and strategies, you can navigate the complex world of auto insurance with ease and make informed decisions that benefit your wallet and your peace of mind.

What are the most important factors to consider when choosing auto insurance?

+When selecting auto insurance, it’s crucial to consider factors such as coverage types (liability, comprehensive, collision), policy limits, deductibles, and potential exclusions. Additionally, assess your driving history, credit score, and the make and model of your vehicle, as these factors influence insurance rates. Research insurance providers’ reputation, financial stability, and the range of coverage options they offer.

How can I reduce my auto insurance premiums?

+To reduce your auto insurance premiums, maintain a clean driving record, as insurers reward safe driving with discounts. Consider investing in vehicle features that qualify for insurance discounts, such as anti-theft devices and advanced safety features. Bundle your auto insurance with other policies, like homeowners or renters insurance, to potentially save money. Explore increasing your deductibles or adjusting coverage limits to find the right balance between protection and cost.

What is usage-based insurance (UBI) and how does it work?

+Usage-based insurance (UBI) is an innovative approach to auto insurance that uses telematics devices to collect real-time driving data, including speed, acceleration, braking, and mileage. This data is then used to calculate insurance premiums, offering a more accurate and personalized pricing model. UBI rewards safe drivers with lower premiums and encourages safer driving habits.

How does artificial intelligence (AI) impact the auto insurance industry?

+Artificial intelligence (AI) and machine learning (ML) are transforming the auto insurance industry by enhancing efficiency, accuracy, and personalization. AI and ML algorithms analyze vast amounts of data to predict risks and optimize insurance pricing, offering more precise and tailored coverage options. Additionally, AI automates various insurance processes, reducing costs and providing faster, more efficient service to policyholders.