Georgia Health Insurance

Welcome to this comprehensive guide on Georgia Health Insurance, a vital aspect of healthcare coverage in the state of Georgia. Health insurance is an essential financial tool that safeguards individuals and families from the potentially devastating costs of medical care. In this article, we will delve into the intricacies of health insurance options available to Georgians, exploring the unique features, benefits, and considerations that come with this critical financial protection.

Understanding Health Insurance in Georgia

Health insurance in Georgia, as in many other states, is a complex yet crucial system designed to provide residents with access to necessary medical services while managing the associated financial risks. The state’s healthcare landscape offers a range of insurance plans and providers, catering to diverse needs and preferences.

Key Components of Georgia Health Insurance

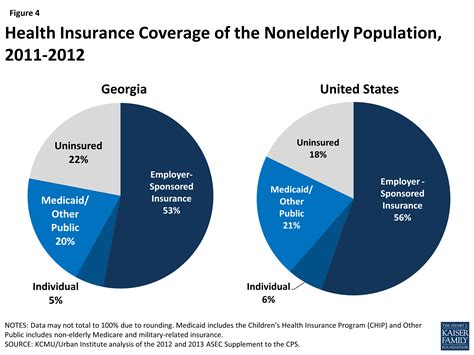

Georgia’s health insurance market primarily operates through a combination of private insurers and government-funded programs. Private health insurance plans are offered by various providers, each with its own network of healthcare providers, coverage options, and pricing structures. These plans often cater to specific demographics or employments, providing tailored benefits and premiums.

On the other hand, government-funded programs like Medicaid and Medicare play a significant role in Georgia's healthcare coverage. Medicaid, a federal and state-funded program, provides health coverage to eligible low-income adults, children, pregnant women, elderly adults, and people with disabilities. Medicare, primarily funded by the federal government, offers health insurance to individuals aged 65 and older, as well as certain younger individuals with disabilities.

| Health Insurance Category | Description |

|---|---|

| Private Insurance | Offered by private companies with varying networks, coverage, and premiums. |

| Medicaid | Federal and state-funded program providing coverage for low-income individuals and families. |

| Medicare | Federal program offering health insurance to seniors and individuals with disabilities. |

Types of Health Insurance in Georgia

Georgia’s health insurance market offers a diverse range of plan types, each with its own advantages and considerations. Understanding these options is crucial for individuals and families to make informed decisions about their healthcare coverage.

Individual and Family Plans

Individual and family health insurance plans in Georgia are tailored to meet the specific needs of single individuals, couples, and families. These plans offer a variety of coverage options, including preferred provider organizations (PPOs), health maintenance organizations (HMOs), and exclusive provider organizations (EPOs). PPOs typically provide more flexibility in choosing healthcare providers, while HMOs often require members to select a primary care physician and coordinate care through that provider.

In Georgia, individual and family plans are available through both private insurers and the state's health insurance marketplace, known as Georgia's Health Insurance Marketplace or Healthcare.gov. This marketplace, established under the Affordable Care Act, allows individuals to compare and purchase qualified health plans, often with the potential for cost assistance.

Employer-Sponsored Plans

Many Georgians receive their health insurance coverage through employer-sponsored plans. These plans are offered as a benefit by employers and are often more cost-effective due to group pricing. Employers may offer a single plan or a choice of plans, typically with a combination of PPOs, HMOs, or EPOs. Some employers may also provide additional coverage options, such as dental, vision, and life insurance.

Employer-sponsored plans often come with a range of benefits, including cost-sharing arrangements like copayments, coinsurance, and deductibles. These plans may also offer additional features like flexible spending accounts (FSAs) or health savings accounts (HSAs), which can provide tax advantages and help cover out-of-pocket healthcare expenses.

Government-Funded Programs

Georgia’s government-funded health insurance programs, including Medicaid and Medicare, provide crucial coverage for specific populations. Medicaid, with its comprehensive benefits package, ensures access to necessary healthcare services for low-income individuals and families. This program covers a wide range of services, including doctor visits, hospital stays, prescription drugs, and preventive care.

Medicare, on the other hand, is primarily designed for individuals aged 65 and older, as well as certain younger individuals with disabilities. Medicare offers four main parts: Part A (Hospital Insurance), Part B (Medical Insurance), Part C (Medicare Advantage Plans), and Part D (Prescription Drug Coverage). Each part covers a specific set of services, allowing individuals to customize their coverage based on their needs.

Selecting the Right Health Insurance Plan

Choosing the right health insurance plan in Georgia involves careful consideration of various factors, including individual needs, financial circumstances, and the desired level of coverage. Here are some key aspects to keep in mind when selecting a health insurance plan:

Coverage and Benefits

Health insurance plans vary significantly in the types and levels of coverage they offer. Some plans may focus more on preventive care and routine check-ups, while others may provide more extensive coverage for specialized treatments or chronic conditions. It’s essential to review the specific benefits and exclusions of each plan to ensure they align with your healthcare needs.

Network of Providers

Health insurance plans typically have a network of preferred healthcare providers, including doctors, hospitals, and specialists. It’s crucial to verify that your preferred healthcare providers are included in the plan’s network to avoid potential out-of-network costs. Additionally, consider the convenience of accessing healthcare services within the plan’s network, including the availability of nearby providers and facilities.

Cost and Affordability

The cost of health insurance is a critical consideration, as premiums, deductibles, copayments, and other out-of-pocket expenses can vary significantly between plans. Assess your ability to afford the monthly premiums and consider the potential financial impact of reaching your deductible or incurring other out-of-pocket costs. Keep in mind that lower premiums may be accompanied by higher deductibles or limited coverage, so strike a balance that suits your budget and healthcare needs.

Customer Service and Reputation

Researching the reputation and customer service of the insurance provider is essential. Look for reviews and ratings from current and past customers to gauge the quality of service and responsiveness. Consider factors such as claim processing times, ease of communication, and the availability of support resources. A reputable insurer with a strong track record of customer satisfaction can provide added peace of mind.

Navigating Health Insurance in Georgia

Understanding the intricacies of health insurance in Georgia can be complex, but several resources are available to guide individuals and families through the process. The state’s Department of Insurance provides valuable information on health insurance regulations, consumer protection, and complaint resolution. Additionally, the Georgia Health Insurance Marketplace offers a user-friendly platform for comparing and selecting qualified health plans.

For those seeking more personalized assistance, licensed insurance agents and brokers can provide expert guidance on plan options, coverage, and pricing. These professionals can help navigate the complexities of the healthcare insurance landscape, ensuring individuals and families make informed decisions about their coverage.

Key Takeaways and Future Considerations

Health insurance in Georgia plays a vital role in ensuring access to quality healthcare services while managing the financial risks associated with medical care. With a diverse range of plan types, coverage options, and providers, Georgians have the opportunity to select insurance plans that best meet their unique needs and preferences.

As the healthcare landscape continues to evolve, it's essential to stay informed about changes in coverage options, benefits, and costs. Regularly reviewing and reassessing your health insurance plan can help ensure it remains aligned with your evolving healthcare needs and financial circumstances. By staying proactive and informed, individuals and families in Georgia can effectively navigate the complex world of health insurance and make the most of their coverage.

How can I determine if I’m eligible for Medicaid in Georgia?

+

Eligibility for Medicaid in Georgia is based on a combination of income, family size, and other factors. You can visit the Georgia Department of Community Health’s website or use the online eligibility tool to determine if you qualify. It’s important to review the specific guidelines and requirements to ensure an accurate assessment of your eligibility.

What is the Affordable Care Act (ACA) and how does it impact health insurance in Georgia?

+

The Affordable Care Act (ACA), also known as Obamacare, is a federal law that has significantly impacted health insurance in Georgia and across the United States. The ACA expanded coverage options, mandated essential health benefits, and introduced cost assistance for eligible individuals. It has played a crucial role in increasing access to healthcare and ensuring more Georgians have affordable insurance options.

Are there any special enrollment periods for health insurance in Georgia?

+

Yes, Georgia’s Health Insurance Marketplace offers special enrollment periods for individuals who experience certain life events, such as losing job-based coverage, getting married, or having a baby. These special enrollment periods allow individuals to enroll outside of the annual open enrollment period, ensuring access to health insurance during significant life changes.