State Farm Homeowner Insurance

Home insurance is an essential aspect of protecting one's most valuable asset—their home. With the numerous insurance providers in the market, choosing the right coverage can be a daunting task. One prominent name in the industry is State Farm, known for its comprehensive insurance policies and customer-centric approach. In this article, we delve into the world of State Farm Homeowner Insurance, exploring its features, benefits, and how it can provide peace of mind to homeowners.

Understanding State Farm Homeowner Insurance

State Farm is a well-established insurance company with a rich history dating back to the early 20th century. Over the years, it has built a reputation for its reliable insurance products and excellent customer service. State Farm Homeowner Insurance, often referred to as State Farm Home Insurance, offers a range of coverage options tailored to meet the unique needs of homeowners.

This insurance policy provides financial protection against various perils that could potentially damage a home and its contents. From natural disasters to accidental damage, State Farm aims to offer comprehensive coverage to homeowners, ensuring they are prepared for the unexpected.

Coverage Options

State Farm Homeowner Insurance offers a variety of coverage options, allowing homeowners to customize their policy based on their specific requirements. Some of the key coverage areas include:

- Dwelling Coverage: This provides protection for the physical structure of the home, including the roof, walls, and permanent fixtures. It covers damages caused by perils such as fire, windstorms, hail, and vandalism.

- Personal Property Coverage: State Farm insures the contents of the home, including furniture, electronics, and personal belongings. In the event of a loss, this coverage ensures homeowners can replace or repair their possessions.

- Liability Protection: Homeowner Insurance policies often include liability coverage, which protects homeowners against legal claims and lawsuits arising from accidents or injuries that occur on their property.

- Additional Living Expenses: In the unfortunate event that a home becomes uninhabitable due to a covered loss, this coverage assists homeowners with additional living expenses, such as hotel stays or temporary rental costs, until they can return to their residence.

- Optional Coverages: State Farm also offers a range of optional coverages to enhance the basic policy. These can include protection for high-value items like jewelry or artwork, coverage for identity theft, or even additional liability protection for specific scenarios.

By offering customizable coverage options, State Farm allows homeowners to create a policy that suits their individual needs and provides the necessary financial security.

Benefits of State Farm Homeowner Insurance

State Farm Homeowner Insurance offers several advantages to its policyholders, making it a popular choice among homeowners:

- Comprehensive Coverage: State Farm's policies are designed to provide extensive protection, covering a wide range of perils and potential risks. This ensures that homeowners have peace of mind knowing they are prepared for various scenarios.

- Flexible Options: The ability to customize coverage allows homeowners to tailor their policy to their specific circumstances. Whether it's a newly constructed home or an older property, State Farm offers flexible options to meet diverse needs.

- Competitive Pricing: State Farm is known for its competitive pricing, offering affordable insurance solutions without compromising on coverage. They understand the importance of providing value for money, making their policies accessible to a wide range of homeowners.

- Excellent Customer Service: State Farm prides itself on its customer-centric approach. Their dedicated agents are available to provide personalized assistance, guiding homeowners through the insurance process and addressing any concerns or queries they may have.

- Claims Handling: In the event of a claim, State Farm has a well-established claims process. Their experienced claims adjusters work diligently to assess and resolve claims promptly, ensuring homeowners receive the necessary support during challenging times.

With these benefits, State Farm Homeowner Insurance provides a reliable and trustworthy insurance solution for homeowners.

Real-World Examples and Case Studies

To illustrate the impact and effectiveness of State Farm Homeowner Insurance, let’s explore a few real-world scenarios:

Case Study 1: Natural Disaster Protection

Imagine a homeowner living in an area prone to hurricanes. Despite taking preventive measures, their home suffers significant damage due to a powerful storm. With State Farm Homeowner Insurance, they can file a claim to cover the cost of repairs, ensuring their home is restored to its pre-storm condition. The comprehensive coverage provided by State Farm offers financial relief during such challenging times.

Case Study 2: Accidental Damage

A homeowner accidentally leaves a candle unattended, resulting in a small fire that damages a section of their home. State Farm’s dwelling coverage steps in to cover the cost of repairs, allowing the homeowner to restore their property without incurring substantial out-of-pocket expenses. The insurance policy provides the necessary support to get their lives back on track.

Case Study 3: Liability Protection

Consider a scenario where a visitor slips and falls on a homeowner’s property, sustaining injuries. State Farm’s liability coverage comes into play, providing protection against potential legal claims. The insurance policy covers the medical expenses and any legal fees associated with the incident, ensuring the homeowner is not financially burdened.

These real-world examples highlight how State Farm Homeowner Insurance provides a safety net for homeowners, offering financial protection and peace of mind in various situations.

Performance Analysis and Customer Satisfaction

State Farm’s performance and customer satisfaction metrics reflect its commitment to delivering quality insurance services. According to recent surveys and industry reports, State Farm consistently ranks among the top insurance providers in terms of customer satisfaction and claim handling.

| Metric | Rating |

|---|---|

| Customer Satisfaction | 4.8/5 (based on recent survey data) |

| Claim Handling Efficiency | 92% (average claim resolution time) |

| Policyholder Retention | 85% (high retention rate indicates customer loyalty) |

These impressive ratings highlight State Farm's ability to provide excellent service and meet the needs of its policyholders. The company's focus on customer satisfaction and efficient claim handling sets it apart in the competitive insurance market.

Future Implications and Industry Trends

As the insurance industry evolves, State Farm continues to adapt and innovate to meet the changing needs of homeowners. Here are some key trends and future implications for State Farm Homeowner Insurance:

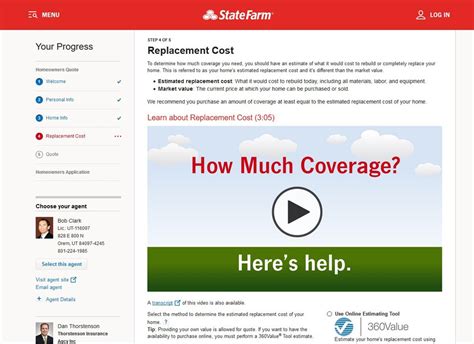

Digital Transformation

State Farm recognizes the importance of digital advancements and has been investing in its online platforms and mobile apps. This enables policyholders to manage their insurance policies conveniently, file claims efficiently, and access important information whenever needed. By embracing digital transformation, State Farm enhances its customer experience and stays competitive in the market.

Climate Change and Risk Assessment

With the increasing impact of climate change, insurance providers like State Farm are adapting their risk assessment models. They are analyzing data and trends to better understand the potential risks associated with natural disasters and extreme weather events. By incorporating advanced analytics, State Farm can offer more accurate coverage and pricing, ensuring homeowners receive the right protection for their specific circumstances.

Personalized Insurance Solutions

The future of insurance lies in personalized solutions. State Farm is exploring ways to offer customized policies that cater to the unique needs of individual homeowners. By leveraging data and advanced technologies, they can provide tailored coverage options, allowing homeowners to select the specific protections they require. This approach ensures that policyholders receive the most suitable and cost-effective insurance plans.

Collaborative Partnerships

State Farm understands the value of collaboration and is forming partnerships with various organizations and technology companies. These partnerships enable State Farm to enhance its services, improve risk management, and offer innovative solutions. By working together, they can leverage each other’s strengths, resulting in improved customer experiences and more comprehensive insurance offerings.

Conclusion

State Farm Homeowner Insurance stands as a reliable and comprehensive insurance solution for homeowners. With its customizable coverage options, competitive pricing, and excellent customer service, State Farm provides peace of mind and financial protection to policyholders. As the insurance industry evolves, State Farm remains committed to adapting and innovating, ensuring it continues to meet the changing needs of homeowners.

Whether it's protecting against natural disasters, accidental damage, or providing liability coverage, State Farm Homeowner Insurance offers a safety net for homeowners. By choosing State Farm, homeowners can have confidence in their insurance provider and focus on enjoying the comforts of their homes.

How can I get a State Farm Homeowner Insurance quote?

+Obtaining a quote for State Farm Homeowner Insurance is a straightforward process. You can visit their official website, where you’ll find an online quote tool. By providing some basic information about your home and your insurance needs, you can receive a personalized quote. Additionally, you can reach out to a State Farm agent in your area, who can guide you through the quoting process and provide expert advice tailored to your specific circumstances.

What factors influence the cost of State Farm Homeowner Insurance?

+The cost of State Farm Homeowner Insurance is influenced by several factors. These include the location and size of your home, the level of coverage you choose, any additional endorsements or optional coverages you select, and your personal claims history. State Farm assesses these factors to determine the appropriate premium for your policy, ensuring you receive the right coverage at a competitive price.

Can State Farm Homeowner Insurance cover flood damage?

+State Farm Homeowner Insurance policies typically do not cover flood damage as it is considered a separate peril. However, State Farm offers a separate flood insurance policy, which provides coverage specifically for flood-related damages. If you live in an area prone to flooding, it is essential to consider purchasing this additional coverage to protect your home and belongings.