Homeowners Insurance Coverage

Homeowners insurance is an essential financial safeguard for property owners, providing protection against a range of unforeseen events and perils. This comprehensive policy offers peace of mind and financial security, covering both the structure of your home and its contents. However, understanding the intricacies of homeowners insurance coverage is crucial to ensure you have the right protection for your specific needs.

Comprehensive Coverage for Peace of Mind

Homeowners insurance policies are designed to offer a comprehensive range of coverage options, tailored to the unique needs of each homeowner. These policies typically cover damage or loss caused by various perils, including:

- Fire: Fire damage is one of the most common perils covered by homeowners insurance. Whether caused by a kitchen mishap or a natural disaster, fire damage can be devastating. Homeowners insurance provides financial protection to rebuild and repair your home and replace your belongings.

- Wind and Hail: In regions prone to storms, wind and hail damage can be a significant concern. From roof damage to broken windows, homeowners insurance helps cover the costs of repairs and replacements.

- Theft and Vandalism: Unfortunately, theft and vandalism are realities that many homeowners face. Insurance coverage can help replace stolen items and repair any damage caused by vandals.

- Water Damage: Water damage can result from various sources, such as burst pipes, heavy rainfall, or overflowing appliances. Homeowners insurance typically covers these incidents, providing funds for repairs and replacements.

- Liability: In the event of an accident on your property, liability coverage protects you from potential lawsuits and medical expenses incurred by visitors.

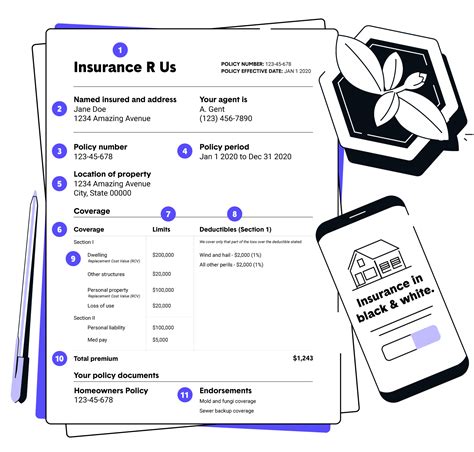

Understanding Policy Limits and Deductibles

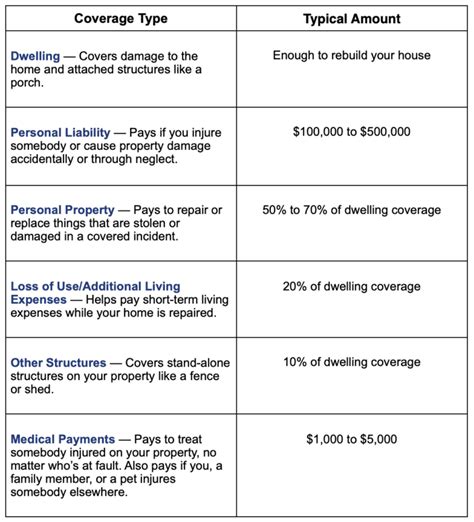

While homeowners insurance offers extensive coverage, it’s important to understand the policy limits and deductibles. Policy limits refer to the maximum amount an insurance company will pay for a covered loss. These limits vary depending on the type of coverage and the specific policy.

Deductibles, on the other hand, are the amount you must pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible can lower your insurance premiums, but it’s essential to select a deductible that you can afford in the event of a claim.

| Coverage Type | Policy Limit |

|---|---|

| Dwelling Coverage | 500,000</td> </tr> <tr> <td>Personal Property</td> <td>200,000 |

| Liability | $300,000 |

Additional Coverage Options

Beyond the standard coverage options, homeowners insurance policies often offer additional endorsements or riders to cater to specific needs. These add-ons can provide enhanced protection for valuable possessions or unique circumstances.

Jewelry and Fine Art Coverage

Standard homeowners insurance policies often have limitations on coverage for high-value items like jewelry, collectibles, or fine art. To protect these valuable possessions adequately, consider adding a rider or endorsement to your policy. These additions typically provide broader coverage limits and specialized appraisals to ensure accurate valuations.

Flood Insurance

Flood damage is often not covered by standard homeowners insurance policies. If your home is located in a high-risk flood zone, it’s essential to consider purchasing a separate flood insurance policy. The National Flood Insurance Program (NFIP) offers coverage for homeowners, renters, and businesses in participating communities.

While flood insurance may be an additional expense, it provides crucial protection against one of the most common and costly natural disasters. Consider the potential risks and benefits to determine if flood insurance is a necessary addition to your coverage.

The Claims Process

In the event of a covered loss, understanding the claims process is vital. Here’s a step-by-step guide to help you navigate this process efficiently:

- Contact Your Insurance Company: As soon as possible after the incident, contact your insurance provider to report the claim. Provide all relevant details about the loss, including any photos or videos you have taken.

- Document the Damage: Take comprehensive photos and videos of the damage to your home and belongings. These visual records will help your insurance adjuster assess the extent of the loss.

- Cooperate with the Adjuster: Your insurance company will assign an adjuster to evaluate your claim. Cooperate fully with the adjuster, providing any requested documentation and answering their questions truthfully.

- Receive the Settlement: Once the adjuster has assessed the claim, you will receive a settlement offer. Review the offer carefully to ensure it covers the full extent of your losses. If you disagree with the settlement, you can negotiate or appeal the decision.

- Repair and Replace: Use the settlement funds to repair or replace your damaged property. Keep all receipts and documentation for your records, as your insurance company may require proof of expenses.

Tips for a Smooth Claims Process

To ensure a smooth and efficient claims process, consider the following tips:

- Keep a Home Inventory: Maintain a detailed record of your belongings, including photos, receipts, and appraisals. This inventory will help expedite the claims process and ensure accurate compensation.

- Understand Your Policy: Familiarize yourself with your homeowners insurance policy, including coverage limits, deductibles, and any exclusions. This knowledge will help you navigate the claims process with confidence.

- Communicate Regularly: Stay in touch with your insurance company throughout the claims process. Regular communication can help address any concerns or questions promptly.

The Future of Homeowners Insurance

The insurance industry is constantly evolving, and homeowners insurance is no exception. As technology advances and data becomes more accessible, insurance providers are leveraging these tools to enhance their services.

Data-Driven Risk Assessment

Insurance companies are increasingly using data analytics to assess risk and determine insurance premiums. By analyzing historical data, weather patterns, and even social media posts, insurers can identify potential risks and offer more accurate coverage.

Smart Home Technology

The integration of smart home technology is transforming the way homeowners interact with their insurance providers. Smart sensors and devices can detect and prevent potential hazards, such as water leaks or smoke, providing early warnings and reducing the likelihood of costly claims.

Additionally, smart home technology can offer real-time monitoring and remote access, allowing homeowners to take immediate action to mitigate potential losses. This proactive approach to risk management is a win-win for both homeowners and insurance companies.

FAQ

What is the average cost of homeowners insurance?

+The average cost of homeowners insurance varies depending on factors such as location, the value of your home, and the level of coverage you choose. On average, homeowners can expect to pay between 1,000 and 2,000 annually for basic coverage. However, premiums can range from as low as 500 to over 3,000, so it’s essential to shop around and compare quotes.

How often should I review my homeowners insurance policy?

+It’s a good practice to review your homeowners insurance policy annually, especially if you’ve made significant changes to your home or your financial situation. Regular reviews ensure that your coverage remains adequate and up-to-date.

Can I bundle my homeowners insurance with other policies to save money?

+Yes, bundling your homeowners insurance with other policies, such as auto insurance, can often lead to significant savings. Many insurance providers offer multi-policy discounts, so it’s worth exploring these options to maximize your savings.