Homeowner Insurance Rates

Homeowner insurance rates are a vital aspect of homeownership, providing financial protection against a range of potential risks and liabilities. The cost of these policies can vary significantly depending on various factors, and understanding these variables is crucial for homeowners to make informed decisions about their coverage. This comprehensive guide aims to delve into the intricate world of homeowner insurance rates, offering an in-depth analysis of the factors that influence them, strategies for securing the best rates, and a comparative study of different insurance providers.

Understanding the Factors that Influence Homeowner Insurance Rates

The price of homeowner insurance is influenced by a multitude of factors, each contributing uniquely to the overall cost. These factors can be broadly categorized into three main groups: personal factors, home-related factors, and regional factors.

Personal Factors

Your personal circumstances play a significant role in determining your homeowner insurance rates. Insurance companies consider factors such as your age, marital status, and credit score when calculating your premium. For instance, younger homeowners might pay higher rates due to their perceived higher risk profile, while homeowners with excellent credit scores often enjoy lower premiums as they are seen as more financially responsible.

| Personal Factor | Influence on Rates |

|---|---|

| Age | Younger homeowners often pay higher rates |

| Credit Score | Excellent credit leads to lower premiums |

| Marital Status | Married homeowners may benefit from reduced rates |

Home-Related Factors

The characteristics of your home itself are another key determinant of insurance rates. Insurance providers assess factors such as the age of your home, its construction materials, and its replacement value. Homes built with fire-resistant materials, for example, often qualify for lower rates, as do newer homes that may have more advanced safety features.

| Home-Related Factor | Influence on Rates |

|---|---|

| Age of Home | Older homes may require higher premiums |

| Construction Materials | Fire-resistant materials can lead to lower rates |

| Replacement Value | Higher replacement value often means higher premiums |

Regional Factors

The region where your home is located can significantly impact your insurance rates. This is due to variations in local weather conditions, crime rates, and the prevalence of natural disasters. Areas prone to hurricanes or earthquakes, for instance, often have higher insurance rates to account for the increased risk of damage.

| Regional Factor | Influence on Rates |

|---|---|

| Weather Conditions | Areas with extreme weather may have higher rates |

| Crime Rates | Higher crime areas might lead to increased premiums |

| Natural Disaster Risk | Regions prone to disasters often have higher insurance costs |

Strategies for Securing the Best Homeowner Insurance Rates

Given the multitude of factors that influence homeowner insurance rates, it's understandable that homeowners may feel overwhelmed when trying to secure the best rates. However, by implementing a few strategic approaches, it's possible to navigate these complexities and find the most cost-effective coverage.

Shop Around and Compare Quotes

One of the most effective ways to secure the best homeowner insurance rates is to shop around and compare quotes from multiple providers. Insurance rates can vary significantly between companies, and by soliciting quotes from a variety of insurers, you can ensure you're getting the most competitive price. Consider using online comparison tools, which can provide a quick and efficient way to gather multiple quotes in one place.

Increase Your Deductible

Another strategy to consider is increasing your deductible. A deductible is the amount you agree to pay out-of-pocket before your insurance coverage kicks in. By choosing a higher deductible, you can often lower your premium. This strategy works best for homeowners who have the financial means to cover a higher deductible in the event of a claim.

Bundle Your Insurance Policies

Many insurance companies offer discounts to customers who bundle multiple insurance policies together. For example, if you have both homeowner's insurance and auto insurance with the same provider, you may be eligible for a discount on your homeowner's insurance premium. Bundling your policies can result in significant savings, so it's worth considering if you're in the market for multiple types of insurance.

Improve Your Home's Safety Features

Insurance companies often offer discounts to homeowners who have taken steps to improve the safety and security of their homes. This can include installing fire alarms, sprinkler systems, burglar alarms, or even storm shutters. By investing in these safety features, you not only enhance the protection of your home but also potentially reduce your insurance premiums.

Maintain a Good Credit Score

Your credit score is a significant factor in determining your homeowner insurance rates. Insurance companies often use credit-based insurance scores to assess the risk of insuring a particular individual. By maintaining a good credit score, you can improve your chances of securing lower insurance rates. This is because homeowners with good credit are often seen as more financially responsible and less likely to file claims.

Comparative Analysis of Top Homeowner Insurance Providers

When it comes to choosing a homeowner insurance provider, there are numerous options available. To help navigate this landscape, we've conducted a comparative analysis of some of the top homeowner insurance providers in the market. This analysis takes into account factors such as coverage options, customer service, claim handling, and of course, insurance rates.

| Provider | Coverage Options | Customer Service | Claim Handling | Insurance Rates |

|---|---|---|---|---|

| State Farm | Comprehensive coverage options, including optional add-ons | Excellent customer service, with a strong focus on personal relationships | Efficient claim handling, with a reputation for fair and prompt settlements | Competitive rates, especially for policyholders with a long tenure |

| Allstate | Wide range of coverage options, including unique endorsements | Good customer service, with a focus on digital convenience | Efficient claim process, with a strong online presence for tracking claims | Rates can vary, but often competitive for bundled policies |

| Liberty Mutual | Comprehensive coverage, with a focus on home protection | Excellent customer service, with a commitment to personalized attention | Efficient and fair claim handling, with a strong focus on customer satisfaction | Rates can be competitive, especially for loyal customers |

| USAA | Comprehensive coverage options, tailored for military families | Exceptional customer service, with a strong focus on military community | Efficient and supportive claim handling, with a reputation for fairness | Rates are often very competitive for military personnel and their families |

| GEICO | Wide range of coverage options, including unique discounts | Good customer service, with a strong online presence | Efficient claim process, with a focus on digital convenience | Rates are often very competitive, especially for policyholders with good driving records |

Frequently Asked Questions (FAQ)

What factors can I control to lower my homeowner insurance rates?

+

You can take several steps to potentially lower your homeowner insurance rates. These include maintaining a good credit score, increasing your deductible, investing in home safety features, and bundling your insurance policies. Additionally, regularly reviewing and updating your coverage to ensure it aligns with your current needs can help keep costs down.

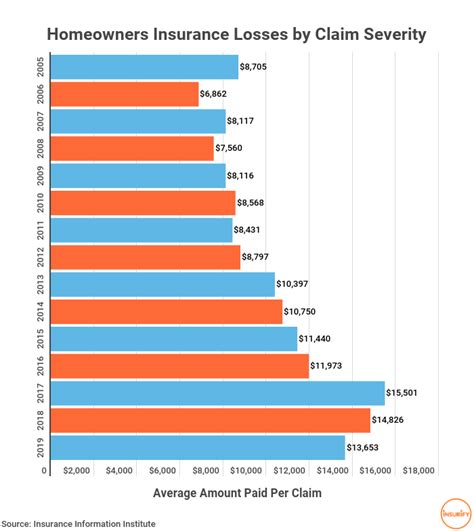

How do natural disasters impact homeowner insurance rates?

+

Natural disasters such as hurricanes, earthquakes, and floods can significantly impact homeowner insurance rates. Areas prone to these disasters often have higher insurance rates to account for the increased risk of damage. Insurance companies may also limit or exclude coverage for certain natural disasters in high-risk areas.

What are some common discounts offered by homeowner insurance providers?

+

Common discounts offered by homeowner insurance providers include multi-policy discounts (for bundling insurance policies), loyalty discounts (for long-term policyholders), safety feature discounts (for homes with fire alarms, burglar alarms, etc.), and credit-based insurance discounts (for policyholders with good credit scores). Some providers also offer discounts for specific professions or membership in certain organizations.

How often should I review my homeowner insurance policy and rates?

+

It’s a good practice to review your homeowner insurance policy and rates at least once a year. This allows you to ensure your coverage still aligns with your needs and to take advantage of any discounts or special offers your provider may be offering. Additionally, if you’ve made significant improvements to your home or have changed personal circumstances, you should review your policy to ensure it still provides adequate coverage.

Can I switch homeowner insurance providers to save money?

+

Absolutely. Shopping around and comparing quotes from multiple insurance providers is one of the most effective ways to save money on your homeowner insurance. By switching providers, you can potentially find a more competitive rate, especially if your current provider has increased your rates significantly or if your circumstances have changed.