Insurence Auto

Welcome to an in-depth exploration of the world of insurance, with a specific focus on the automotive sector. This article aims to provide a comprehensive guide to understanding the nuances of insurance auto, an essential aspect of modern life for many individuals and businesses. From the basics of auto insurance coverage to the latest trends and innovations, we'll cover it all, ensuring you leave with a deeper understanding of this vital industry.

The Fundamentals of Auto Insurance

Auto insurance, a vital component of the insurance industry, serves as a financial safeguard for individuals and businesses operating vehicles on roads. This coverage mitigates the financial risks associated with vehicle ownership, providing protection against various scenarios, from accidents to theft. The foundation of auto insurance lies in its ability to offer peace of mind, ensuring that policyholders can navigate the complexities of vehicle ownership with a sense of security.

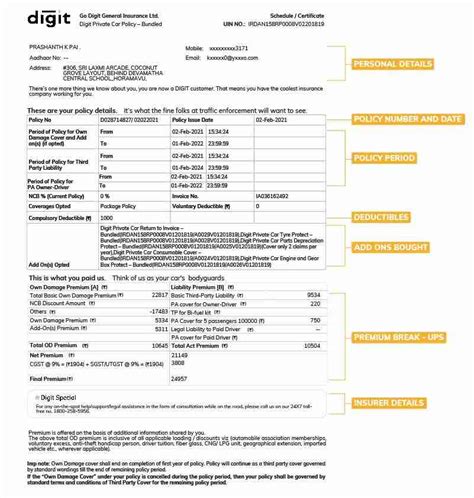

At its core, auto insurance operates through a contract between the policyholder and the insurance company. This contract, known as a policy, outlines the specific coverage, terms, and conditions agreed upon by both parties. It delineates the responsibilities and expectations of each, providing a clear framework for handling various situations that may arise during the policy period.

Key Components of Auto Insurance Policies

Auto insurance policies encompass a range of coverage types, each designed to address specific risks and scenarios. These include:

- Liability Coverage: This is a fundamental component, safeguarding policyholders against claims arising from accidents they cause. It covers both bodily injury and property damage claims, ensuring financial protection for the policyholder.

- Comprehensive Coverage: This optional coverage protects against damages caused by events other than collisions, such as theft, vandalism, natural disasters, or hitting an animal. It provides a broader level of protection, ensuring peace of mind for policyholders.

- Collision Coverage: As the name suggests, this coverage kicks in when the policyholder’s vehicle is involved in a collision, regardless of fault. It covers repairs or replacements, providing financial assistance in situations where the vehicle sustains damage.

- Medical Payments Coverage: Also known as Personal Injury Protection (PIP), this coverage assists with the medical expenses of the policyholder and their passengers, regardless of fault. It ensures prompt medical attention and financial support in the aftermath of an accident.

- Uninsured/Underinsured Motorist Coverage: This coverage steps in when the at-fault driver lacks sufficient insurance coverage. It provides protection for the policyholder, ensuring they are not left financially burdened in such scenarios.

| Coverage Type | Description |

|---|---|

| Liability | Protects against claims arising from accidents caused by the policyholder. |

| Comprehensive | Covers damages from non-collision events like theft or natural disasters. |

| Collision | Provides coverage for vehicle repairs or replacements after a collision. |

| Medical Payments | Assists with medical expenses for the policyholder and passengers after an accident. |

| Uninsured/Underinsured Motorist | Protects policyholders when the at-fault driver lacks sufficient insurance. |

The Auto Insurance Claims Process

When an incident occurs, the auto insurance claims process comes into play. This process involves several steps, each designed to ensure a fair and efficient resolution. The policyholder’s role is pivotal, as they must initiate the process by reporting the incident to their insurance provider.

Steps in the Claims Process

- Reporting the Incident: Policyholders should promptly notify their insurance company, providing details of the accident or incident. This step is crucial as it initiates the claims process and ensures timely assistance.

- Assessment and Investigation: The insurance company assigns a claims adjuster to evaluate the situation. This involves a thorough investigation, including assessing the extent of damages, gathering evidence, and determining liability.

- Determining Coverage and Liability: Based on the investigation, the claims adjuster decides on the coverage applicable to the incident. This step is critical, as it defines the scope of the insurance company’s responsibility and the policyholder’s rights.

- Repairs and Settlements: Once coverage and liability are established, the insurance company facilitates the necessary repairs or settlements. This may involve arranging for vehicle repairs, negotiating settlements with other parties, or providing financial compensation to the policyholder.

- Final Resolution: The claims process concludes with a final resolution, which may include a settlement agreement, repair completion, or other forms of compensation. This step ensures that the policyholder’s needs are met and that the incident is resolved satisfactorily.

Throughout the claims process, communication between the policyholder and the insurance company is essential. Policyholders should provide accurate and timely information, while insurance providers must ensure a fair and transparent process, adhering to industry standards and regulations.

Trends and Innovations in Auto Insurance

The auto insurance industry is evolving, driven by technological advancements and changing consumer needs. Several trends and innovations are shaping the landscape, offering new opportunities and challenges.

Telematics and Usage-Based Insurance

Telematics technology, which involves the use of sensors and data transmission, is transforming auto insurance. This technology allows insurance companies to track driving behavior, such as speed, acceleration, and braking patterns. Based on this data, insurers can offer usage-based insurance, also known as pay-as-you-drive or pay-how-you-drive policies.

Usage-based insurance provides a more personalized and flexible approach to auto insurance. Policyholders can benefit from lower premiums if they exhibit safe driving behavior, as evidenced by the telematics data. This incentivizes safer driving practices and rewards responsible drivers.

Connected Car Technologies

The rise of connected car technologies is another significant trend in auto insurance. Connected cars, equipped with advanced sensors and communication capabilities, can provide real-time data on vehicle performance, maintenance needs, and even driving behavior. This data can be leveraged by insurance companies to offer more accurate and tailored insurance products.

For instance, connected car data can be used to detect sudden acceleration or harsh braking, providing insights into the driver's behavior. This information can then be used to adjust insurance premiums, offering discounts to drivers who exhibit safe driving habits. Additionally, connected car technologies can facilitate quicker and more efficient claims processes, as insurers can remotely access vehicle data to assess damages and determine liability.

Artificial Intelligence and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) are revolutionizing various industries, including auto insurance. These technologies enable insurers to analyze vast amounts of data, identify patterns, and make more accurate predictions. This enhances risk assessment, fraud detection, and overall operational efficiency.

AI-powered systems can analyze historical claim data, driving behavior patterns, and other relevant factors to predict the likelihood of future claims. This enables insurers to price policies more accurately and offer personalized coverage options. Additionally, AI can assist in streamlining the claims process, automating routine tasks, and providing faster and more efficient customer service.

Digital Transformation and Customer Experience

The digital transformation of the auto insurance industry is focused on enhancing the customer experience. Insurers are investing in digital platforms and mobile apps to provide policyholders with convenient and accessible services. This includes online policy management, digital claim reporting, and real-time updates on claim progress.

Digital transformation also enables insurers to offer more personalized experiences. By leveraging customer data and preferences, insurers can tailor insurance products and services to individual needs. This can include offering customized coverage options, providing educational resources, and offering discounts for policyholders who engage in safe driving practices or take preventive measures.

The Future of Auto Insurance

As we look ahead, the future of auto insurance is poised for significant changes. The ongoing development and adoption of autonomous vehicles, electric cars, and shared mobility services are expected to have a profound impact on the industry.

Autonomous Vehicles and Insurance

The rise of autonomous vehicles presents both challenges and opportunities for the auto insurance industry. As self-driving cars become more prevalent, the nature of accidents and liability will shift. Insurance companies will need to adapt their policies and coverage to account for the unique risks and responsibilities associated with autonomous driving.

For instance, with autonomous vehicles, the traditional concept of driver negligence may become less relevant. Instead, insurance coverage may need to focus on the vehicle's performance, software, and hardware, as well as the responsibilities of the vehicle owner or operator. This shift in focus will require insurance companies to develop new risk assessment models and coverage options to address the evolving landscape.

Electric Vehicles and Insurance

The growing popularity of electric vehicles (EVs) is also shaping the auto insurance industry. EVs have unique characteristics and maintenance needs compared to traditional internal combustion engine vehicles. This includes different repair and replacement costs, as well as specific charging and battery-related considerations.

Insurance companies are adapting their policies to address the specific risks and benefits associated with EVs. This includes offering coverage for battery degradation, charging station damage, and unique repair or replacement needs. Additionally, insurers are exploring incentives and discounts for EV owners, recognizing the environmental benefits and lower maintenance costs associated with these vehicles.

Shared Mobility and Insurance

The rise of shared mobility services, such as ride-sharing and car-sharing platforms, is transforming the way people travel. This shift away from traditional car ownership is impacting the auto insurance industry, as the need for personal auto insurance policies may decrease for those who primarily rely on shared mobility services.

Insurance companies are responding to this trend by developing new coverage options for shared mobility providers and users. This includes offering specialized insurance products for ride-sharing companies, as well as providing temporary coverage for individuals who rent or borrow vehicles through car-sharing platforms. Additionally, insurers are exploring ways to integrate with shared mobility platforms, offering seamless insurance coverage for users on a per-trip or subscription basis.

Conclusion

In conclusion, the world of auto insurance is a complex and dynamic landscape, offering vital protection to individuals and businesses alike. From the fundamentals of coverage to the latest trends and innovations, this article has provided an in-depth exploration of the industry. As we move forward, the auto insurance sector will continue to evolve, driven by technological advancements and changing consumer needs. By staying informed and engaged, policyholders can ensure they have the right coverage to protect their vehicles and themselves on the road.

FAQ

How do I choose the right auto insurance coverage for my needs?

+

When selecting auto insurance coverage, consider your specific needs and risks. Assess your driving habits, the value of your vehicle, and any additional coverage requirements. Compare policies from different insurers to find the best combination of coverage, price, and customer service that aligns with your needs.

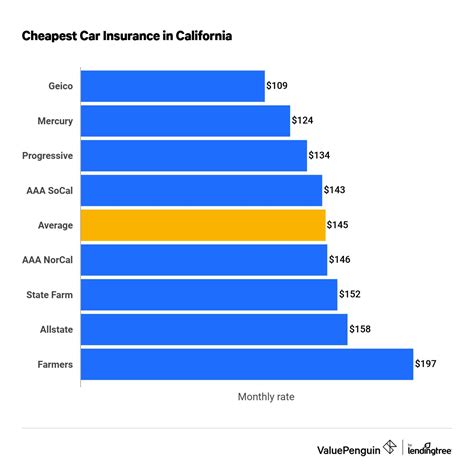

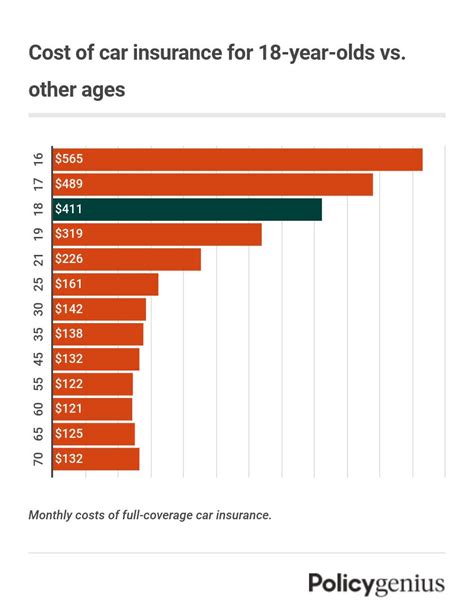

What factors influence auto insurance rates?

+

Auto insurance rates are influenced by various factors, including your driving record, the type and value of your vehicle, your location, and your age and gender. Insurers also consider the statistical risk associated with certain demographics and geographic areas. Additionally, the coverage options you choose and any discounts you qualify for can impact your rates.

How can I save money on my auto insurance policy?

+

To save money on your auto insurance, you can explore various options. This includes shopping around for different insurers, comparing quotes, and negotiating discounts. You can also consider increasing your deductible, which can lower your premium. Additionally, maintaining a good driving record and taking advantage of any available discounts, such as safe driver or multi-policy discounts, can help reduce your insurance costs.