Sr22 Vehicle Insurance

Securing affordable vehicle insurance with an SR-22 can be a challenging endeavor, but it's crucial for those facing this requirement. Understanding the process and knowing your options can make a significant difference in managing this essential aspect of your financial well-being. This comprehensive guide aims to provide an in-depth exploration of SR-22 vehicle insurance, offering practical insights and strategies to navigate this often-complex landscape.

Understanding SR-22 Insurance

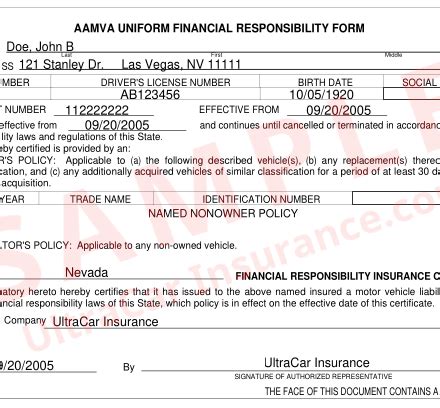

An SR-22, also known as a Certificate of Financial Responsibility, is a legal document required by state authorities in the United States. It serves as proof of financial responsibility for individuals who have committed certain traffic violations or been involved in accidents without adequate insurance coverage. The SR-22 requirement is a serious matter, often resulting from serious infractions like driving under the influence (DUI) or hit-and-run incidents.

The primary purpose of an SR-22 is to ensure that drivers have adequate liability insurance to cover potential damages in the event of an accident. It is typically mandated for a specified period, often ranging from three to five years, depending on the severity of the offense and state regulations.

Who Needs SR-22 Insurance?

SR-22 insurance is not a standard requirement for all drivers. It is typically ordered by a court or the Department of Motor Vehicles (DMV) after a driver has been involved in a serious traffic violation or accident. Common scenarios include:

- Driving Under the Influence (DUI) or Driving While Intoxicated (DWI)

- Hit-and-Run Incidents

- Multiple Serious Traffic Violations

- Uninsured Motorist Involvement in an Accident

Drivers who find themselves in these situations are often mandated to obtain an SR-22 as a condition for reinstating their driver's license or maintaining driving privileges.

The Process of Obtaining an SR-22

The process of obtaining an SR-22 typically involves the following steps:

- Consult with the DMV: Understand the specific requirements and timeframes for your state.

- Choose an Insurance Provider: Not all insurers offer SR-22 policies. Find one that specializes in these types of policies.

- Purchase Insurance: Secure the required level of liability coverage as specified by your state’s regulations.

- File the SR-22: Your insurance provider will file the SR-22 with the DMV on your behalf.

- Maintain Coverage: Ensure continuous coverage throughout the required period to avoid penalties.

It's important to note that SR-22 insurance is often more expensive than standard auto insurance due to the increased risk associated with the driver's history. However, it is a necessary step to regain driving privileges and comply with legal requirements.

Finding Affordable SR-22 Insurance

Given the specialized nature of SR-22 insurance, finding affordable coverage can be a complex task. Here are some strategies to help you secure the best rates:

Shop Around

Not all insurance providers offer SR-22 policies, and those that do may have varying rates and coverage options. Take the time to research and compare quotes from multiple insurers. Online comparison tools can be particularly useful for this purpose.

Understand Your Options

SR-22 insurance is not a one-size-fits-all solution. Different insurers offer varying levels of coverage, from state minimums to more comprehensive plans. Assess your specific needs and choose a policy that provides adequate protection without unnecessary costs.

Improve Your Driving Record

While your past violations cannot be erased, taking steps to improve your driving record can have a positive impact on your insurance rates. Attend traffic school, take defensive driving courses, and maintain a clean driving record during the SR-22 period. This demonstrates responsibility and can lead to more favorable insurance rates in the future.

Consider Bundling Policies

If you have multiple vehicles or own a home, consider bundling your insurance policies. Many insurers offer discounts for customers who combine multiple policies, potentially reducing the overall cost of your SR-22 insurance.

Explore Discounts

Inquire about potential discounts with your insurer. Common discounts include safe driver discounts, good student discounts, and loyalty discounts. Even with an SR-22 requirement, you may still be eligible for certain discounts, helping to offset the increased costs.

| Discount Type | Description |

|---|---|

| Safe Driver Discount | Reward for maintaining a clean driving record during the SR-22 period. |

| Good Student Discount | Offered to students with good academic standing. |

| Loyalty Discount | Given to long-term customers who maintain continuous coverage. |

Managing SR-22 Requirements

Once you’ve obtained SR-22 insurance, it’s crucial to manage your policy effectively to avoid additional penalties and maintain compliance.

Continuous Coverage

Maintaining continuous coverage is essential during the SR-22 period. Any lapse in insurance can result in the cancellation of your SR-22, leading to the suspension of your driver’s license and additional fees to reinstate it.

Regular Filing

Your insurance provider will file an SR-22 form with the DMV when you first obtain the policy. However, it’s your responsibility to ensure that the SR-22 is renewed annually or as required by your state. Failure to do so can result in serious consequences.

Understanding Cancellation Policies

Insurance policies can be canceled for various reasons, including non-payment or significant changes in your driving record. If your policy is canceled, you must inform your insurer immediately to avoid any gaps in coverage. They will then file a notice of cancellation with the DMV, which can impact your driving privileges.

Renewal and Reinstatement

As your SR-22 period nears its end, ensure that you understand the process for renewing your policy and reinstating your driver’s license. This may involve providing proof of continuous coverage and paying any outstanding fees or fines.

Performance Analysis: SR-22 Insurance Providers

When shopping for SR-22 insurance, it’s important to consider the reputation and financial stability of the insurance provider. Here’s a performance analysis of some well-known providers in the industry:

GEICO

GEICO, known for its competitive rates and digital-first approach, offers SR-22 insurance in all 50 states. They provide a straightforward online process for obtaining an SR-22 and are known for their excellent customer service. GEICO’s financial strength and extensive coverage options make them a reliable choice for SR-22 insurance.

Progressive

Progressive is another major insurer that specializes in SR-22 policies. They offer a wide range of coverage options and provide a user-friendly online platform for managing your policy. Progressive’s competitive rates and focus on customer satisfaction make them a popular choice for drivers with SR-22 requirements.

Esurance

Esurance, a subsidiary of Allstate, is known for its digital-first approach and innovative insurance solutions. They offer SR-22 insurance with a simple online application process and provide 24⁄7 customer support. Esurance’s strong financial backing and commitment to customer convenience make them a reliable option for SR-22 insurance.

State Farm

State Farm is one of the largest insurance providers in the United States and offers SR-22 insurance in all states. They provide personalized service through a network of local agents and offer a wide range of coverage options. State Farm’s financial stability and extensive agent network make them a trusted choice for SR-22 insurance.

The General

The General, a subsidiary of Direct General, specializes in non-standard auto insurance, including SR-22 policies. They offer affordable rates and a simple online application process. The General’s focus on high-risk drivers and commitment to providing coverage for those with SR-22 requirements make them a valuable option for this niche market.

Future Implications: Navigating Post-SR-22 Insurance

Successfully completing your SR-22 period is a significant achievement, but it’s important to understand the long-term implications on your insurance rates. Here’s what you can expect:

Improved Insurance Rates

Completing your SR-22 period without any incidents or lapses in coverage can lead to more favorable insurance rates. Insurance providers may view you as a lower risk, resulting in reduced premiums. However, the impact of your past violations may still affect your rates for several years.

Maintaining a Clean Record

To continue enjoying lower insurance rates, it’s crucial to maintain a clean driving record. Even a single traffic violation can increase your insurance rates significantly. Focus on safe driving practices and consider defensive driving courses to enhance your skills and reduce the likelihood of future incidents.

Exploring New Insurance Options

Once your SR-22 period is over, you may have more flexibility in choosing an insurance provider. Consider shopping around again to find the best rates and coverage options. You may be eligible for standard auto insurance policies, which often offer more competitive rates and a wider range of coverage choices.

Understanding Long-Term Impact

While your SR-22 requirement may eventually expire, the impact of your past violations can remain on your driving record for a significant period. Some states have “look-back” periods, during which insurance providers can consider your past violations when setting rates. Understanding these look-back periods can help you anticipate potential rate increases and plan accordingly.

Conclusion

Navigating SR-22 vehicle insurance requires a combination of understanding, strategy, and persistence. By educating yourself on the process, comparing insurance options, and taking steps to improve your driving record, you can effectively manage this challenging requirement. Remember, while SR-22 insurance may be more expensive, it is a necessary step towards regaining your driving privileges and maintaining financial responsibility on the road.

How long does an SR-22 requirement typically last?

+The duration of an SR-22 requirement can vary depending on state regulations and the severity of the offense. It is typically mandated for a period ranging from three to five years.

Can I get SR-22 insurance if I have a poor credit score?

+Yes, SR-22 insurance is available regardless of credit score. However, a poor credit score may impact your insurance rates, so it’s important to shop around for the best rates.

What happens if my SR-22 policy is canceled?

+If your SR-22 policy is canceled, your insurer will file a notice of cancellation with the DMV. This can result in the suspension of your driver’s license and additional fees to reinstate it. It’s crucial to maintain continuous coverage during the SR-22 period.

Can I switch insurance providers during my SR-22 period?

+Yes, you can switch insurance providers during your SR-22 period. However, it’s important to ensure that your new provider files an updated SR-22 form with the DMV to avoid any lapses in coverage.

How can I improve my insurance rates after completing my SR-22 period?

+To improve your insurance rates post-SR-22, maintain a clean driving record, consider defensive driving courses, and shop around for the best rates. Building a positive driving history can lead to more favorable insurance rates over time.