Health Insurance For Travelers

In today's globalized world, more and more people are venturing beyond their borders, be it for business, leisure, or personal pursuits. However, with the excitement of exploring new places comes the responsibility of ensuring one's health and well-being while abroad. This is where health insurance for travelers plays a crucial role, offering peace of mind and necessary coverage in unexpected situations.

Understanding the Need for Travel Health Insurance

When traveling, especially to foreign countries, unforeseen medical emergencies can occur. These situations can range from minor illnesses to serious accidents, and the cost of medical treatment abroad can be significantly higher than at home. Without adequate insurance, travelers may face financial burdens that could potentially ruin their journey and impact their overall health and safety.

Travel health insurance provides a safety net, ensuring that travelers have access to quality medical care without worrying about the associated costs. It covers a range of medical expenses, from emergency room visits and hospitalization to prescription medications and, in some cases, even evacuation and repatriation.

Key Features and Benefits of Travel Health Insurance

Comprehensive Medical Coverage

The primary benefit of travel health insurance is its comprehensive medical coverage. This includes coverage for illnesses and injuries that may occur during the trip, ensuring that travelers receive the necessary treatment without delay. The coverage typically extends to specialist care, laboratory tests, and even mental health services, depending on the policy.

| Policy Feature | Description |

|---|---|

| Medical Expense Coverage | Reimburses expenses for doctor visits, hospital stays, and prescribed medications. |

| Specialist Care | Covers the cost of consultations with specialists, such as cardiologists or dermatologists. |

| Mental Health Support | Provides access to mental health professionals and covers related expenses. |

Emergency Evacuation and Repatriation

In severe medical situations, emergency evacuation might be necessary to transport the traveler to a more advanced medical facility. Travel health insurance often includes this crucial coverage, ensuring the traveler receives the best possible care. Additionally, some policies cover repatriation, which involves returning the traveler’s remains to their home country in the event of their demise.

24⁄7 Assistance and Support

Many travel health insurance providers offer a 24⁄7 assistance hotline. This means that travelers have access to medical advice, language interpretation services, and help with arranging medical appointments or referrals at any time. This service is invaluable, especially when in a foreign country where language barriers and cultural differences can be challenging.

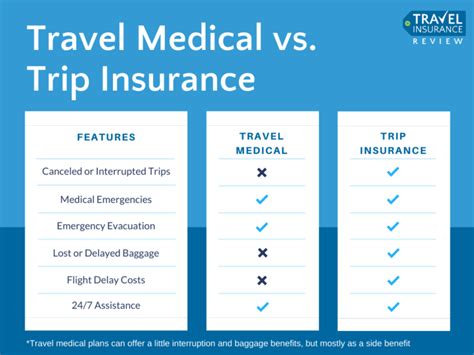

Travel Delay and Cancellation Coverage

Apart from medical emergencies, travel health insurance policies may also cover non-medical travel-related issues. This can include trip delays or cancellations due to severe weather, natural disasters, or other unforeseen circumstances. The coverage may reimburse the traveler for non-refundable expenses, providing financial relief in such situations.

Choosing the Right Travel Health Insurance Policy

Selecting the appropriate travel health insurance policy depends on various factors, including the destination, duration of the trip, and individual health needs. Here are some key considerations when choosing a policy:

- Destination: Different countries have varying healthcare costs and systems. Ensure the policy covers the specific country or countries you plan to visit.

- Trip Duration: Longer trips may require more extensive coverage. Some policies offer annual plans for frequent travelers, which can be more cost-effective.

- Pre-existing Conditions: If you have any pre-existing medical conditions, it's crucial to find a policy that provides coverage for them. Some policies exclude certain conditions, so read the fine print carefully.

- Adventure Activities: If your trip involves adventurous activities like skiing, scuba diving, or trekking, ensure the policy covers these activities. Many standard policies exclude such high-risk activities.

- Deductibles and Co-pays: Understand the deductible (the amount you pay before the insurance kicks in) and co-pay (the portion you pay during a claim) for each policy. Choose a plan that aligns with your budget and risk tolerance.

Real-Life Case Studies: The Impact of Travel Health Insurance

Travel health insurance has proven its worth time and again in real-life situations. Here are a couple of examples showcasing the importance of having comprehensive coverage while abroad:

The Ski Accident

John, an avid skier, planned a winter getaway to the Swiss Alps. Unfortunately, during his first run, he collided with another skier, resulting in a severe leg fracture. Without travel health insurance, John would have faced a daunting medical bill, as emergency treatment and surgery in Switzerland are extremely costly. However, with his comprehensive travel insurance policy, John received immediate medical attention and had his expenses covered, allowing him to focus on his recovery rather than financial worries.

The Food Poisoning Incident

While on a culinary tour of Southeast Asia, Sarah experienced severe food poisoning. She needed immediate medical attention and was hospitalized for several days. Without travel health insurance, Sarah would have had to pay a significant sum out of pocket for her treatment and medication. However, her insurance policy covered all her expenses, and she was able to continue her journey once she recovered, without any financial burden.

The Future of Travel Health Insurance

As the travel industry continues to evolve, so too does the need for innovative travel health insurance solutions. With the rise of remote work and digital nomads, there is a growing demand for long-term travel insurance plans that cater to individuals spending extended periods abroad. Additionally, with the increasing awareness of mental health, travel insurance providers are starting to offer more comprehensive mental health coverage, recognizing the importance of emotional well-being while traveling.

Furthermore, the integration of technology in the insurance industry is set to revolutionize travel health insurance. From digital health records to real-time claim processing and AI-powered assistance, the future promises faster, more efficient, and more personalized insurance experiences. Travelers can expect more accessible and customizable policies that adapt to their unique needs and circumstances.

Conclusion

Travel health insurance is an essential aspect of any international journey. It provides the necessary protection and peace of mind to ensure travelers can fully enjoy their experiences abroad without the worry of unforeseen medical emergencies. By choosing the right policy and understanding its benefits, travelers can make the most of their adventures while staying safe and financially secure.

Can I get travel health insurance if I have a pre-existing medical condition?

+Yes, many travel health insurance policies offer coverage for pre-existing conditions, but it’s essential to declare them during the application process. Some policies may exclude certain conditions, so it’s crucial to read the fine print and choose a policy that suits your needs.

What happens if I need to cancel my trip due to a medical emergency before departure?

+Travel health insurance policies often include trip cancellation coverage, which can reimburse non-refundable expenses if you need to cancel your trip due to a covered medical emergency. Check your policy’s terms and conditions to understand the specific coverage and any potential exclusions.

Is travel health insurance necessary if my destination has a reciprocal healthcare agreement with my home country?

+While reciprocal healthcare agreements can provide some basic coverage, travel health insurance offers more comprehensive protection. These agreements often have limitations, such as specific eligibility criteria or restrictions on the type of treatment covered. Travel health insurance provides peace of mind and ensures you’re covered for a wider range of situations and expenses.