Nj Insurance

Understanding the intricacies of insurance, especially in a state as diverse as New Jersey, is crucial for individuals and businesses alike. This comprehensive guide aims to demystify the world of NJ Insurance, offering an in-depth analysis of the state's unique insurance landscape.

Unraveling the Complexity of NJ Insurance

New Jersey, with its vibrant economy and diverse population, presents a complex insurance environment. From mandatory auto insurance to specialized health plans, the state’s insurance requirements and offerings are tailored to meet the needs of its residents.

The Mandatory Auto Insurance Landscape

In New Jersey, auto insurance is not just a legal requirement but a necessity. The state’s no-fault insurance system, also known as the Personal Injury Protection (PIP) system, ensures that every driver is covered for medical expenses and lost wages in the event of an accident, regardless of who is at fault.

The minimum coverage requirements in New Jersey are as follows:

| Coverage Type | Minimum Requirement |

|---|---|

| Bodily Injury Liability (per person) | $15,000 |

| Bodily Injury Liability (per accident) | $30,000 |

| Property Damage Liability | $5,000 |

| Uninsured Motorist Coverage | $15,000/$30,000 |

| Personal Injury Protection (PIP) | $250,000 |

However, many experts recommend opting for higher coverage limits to ensure adequate protection. The cost of auto insurance in New Jersey can vary significantly based on factors like the driver's age, driving record, and the type of vehicle.

Navigating Health Insurance Options

When it comes to health insurance, New Jersey residents have a variety of options. The state’s health insurance marketplace, NJHealthPlans.com, offers plans from multiple insurers, providing residents with a range of choices for their healthcare needs.

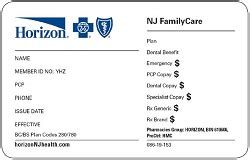

New Jersey has also implemented several initiatives to expand healthcare coverage. The state's Medicaid program, NJ FamilyCare, provides low-cost or free health coverage for eligible residents, including children, parents, relatives, caregivers, and individuals with disabilities.

Additionally, New Jersey has expanded Medicaid coverage under the Affordable Care Act, making more residents eligible for this program.

Property and Casualty Insurance

New Jersey’s property and casualty insurance market is diverse, offering coverage for homes, businesses, and various liabilities. The state’s Department of Banking and Insurance provides resources and guidelines to help residents and businesses navigate this complex sector.

For businesses, New Jersey requires various insurance coverages, including workers' compensation and commercial auto insurance. The specific requirements depend on the nature and size of the business.

Life Insurance and Annuities

New Jersey residents also have access to a wide range of life insurance and annuity products. These products can provide financial protection for families and individuals, ensuring a stable future and offering tax-advantaged retirement savings.

The state's insurance regulations ensure that these products are offered fairly and transparently, with clear guidelines for insurers and consumers alike.

The Future of Insurance in New Jersey

As the insurance industry evolves, New Jersey is expected to continue adapting its regulations and offerings. The state’s insurance department regularly reviews and updates its guidelines to keep pace with changing market conditions and consumer needs.

With advancements in technology, the insurance landscape in New Jersey is likely to see further innovation, from digital insurance platforms to the use of big data analytics for more precise risk assessment and pricing.

Furthermore, New Jersey's role as a leader in environmental and social initiatives may influence the development of new insurance products and services, particularly in the areas of sustainability and social impact.

What are the key factors influencing auto insurance rates in New Jersey?

+Auto insurance rates in New Jersey are influenced by a variety of factors, including the driver’s age, driving record, and the type of vehicle. The state’s high population density and traffic congestion can also impact rates. Additionally, the history of fraudulent insurance claims in New Jersey contributes to higher overall insurance costs.

How can I find affordable health insurance in New Jersey?

+New Jersey residents can explore affordable health insurance options through the state’s health insurance marketplace, NJHealthPlans.com. Additionally, the state’s Medicaid program, NJ FamilyCare, provides low-cost or free health coverage for eligible residents. Expanding Medicaid coverage under the Affordable Care Act has further increased access to affordable healthcare in the state.

What are the specific insurance requirements for businesses in New Jersey?

+New Jersey businesses are required to have various insurance coverages, including workers’ compensation and commercial auto insurance. The specific requirements depend on the nature and size of the business. The state’s Department of Banking and Insurance provides detailed guidelines to help businesses navigate their insurance obligations.