Term Life Insurance Prices

Term life insurance is a fundamental pillar of financial planning, offering individuals and families crucial protection during their most vulnerable moments. This form of insurance provides coverage for a specified period, often referred to as the "term," and is designed to safeguard loved ones from potential financial burdens in the event of the policyholder's untimely demise. The cost of term life insurance is a critical consideration for many, as it directly influences the accessibility and viability of this essential financial tool. In this article, we delve into the intricacies of term life insurance prices, exploring the factors that influence them and providing a comprehensive analysis to help you make informed decisions about your financial future.

Understanding the Fundamentals of Term Life Insurance

Term life insurance is a straightforward yet powerful financial instrument. It provides coverage for a predetermined period, typically ranging from 10 to 30 years. During this term, the policyholder pays regular premiums, and in return, the insurance company guarantees a death benefit to the designated beneficiaries should the policyholder pass away during the coverage period. This benefit can be used to cover a wide range of expenses, including funeral costs, outstanding debts, and the ongoing living expenses of the insured’s family.

One of the key advantages of term life insurance is its affordability. Compared to permanent life insurance policies, which offer coverage for the policyholder's entire life, term life insurance is often significantly more cost-effective. This makes it an attractive option for those seeking substantial coverage without a long-term financial commitment. However, it's essential to note that the premiums for term life insurance can increase as the policyholder ages, reflecting the higher likelihood of a claim being made over time.

Factors Influencing Term Life Insurance Prices

The cost of term life insurance is influenced by a multitude of factors, each playing a unique role in determining the final premium. These factors can be broadly categorized into personal, policy-related, and market-driven elements, each of which we’ll explore in detail below.

Personal Factors

Your personal characteristics are a significant determinant of the price you’ll pay for term life insurance. Insurance companies carefully assess your health and lifestyle to gauge the risk they’re taking on by insuring you. Here’s a closer look at some of the personal factors that can impact your premiums:

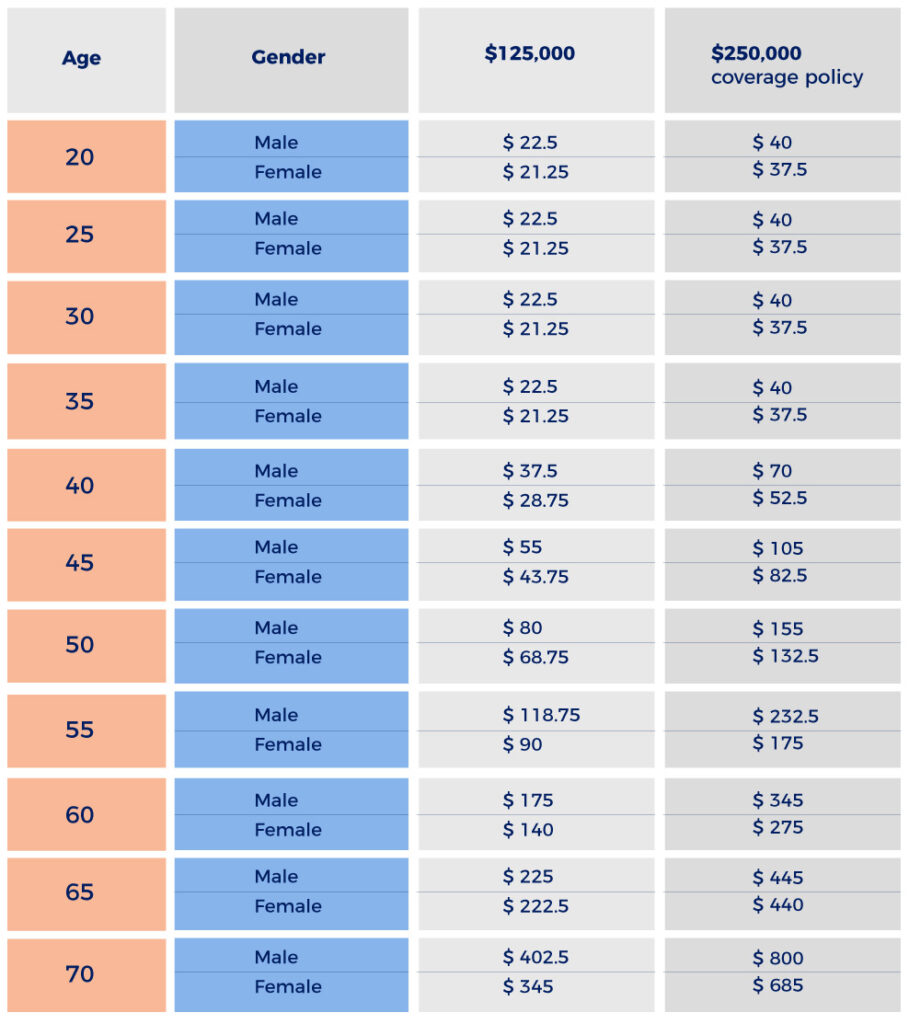

- Age: Younger individuals are typically offered lower premiums due to their lower risk of mortality. As you age, the cost of term life insurance tends to increase, reflecting the higher likelihood of a claim being made.

- Health Status: Your overall health is a critical factor. Those with pre-existing medical conditions or a history of serious illnesses may face higher premiums or even be declined coverage. Regular check-ups and maintaining a healthy lifestyle can significantly impact the cost of your term life insurance.

- Lifestyle Choices: Insurance companies also consider your lifestyle habits. Smoking, excessive alcohol consumption, and participation in high-risk activities can lead to higher premiums or policy exclusions. Leading a healthy and safe lifestyle can result in more affordable term life insurance options.

Policy-Related Factors

The features and specifics of your chosen term life insurance policy also play a crucial role in determining its cost. Here are some key policy-related factors to consider:

- Coverage Amount: The higher the death benefit you require, the higher your premiums are likely to be. It's essential to strike a balance between your financial needs and your budget when choosing a coverage amount.

- Policy Term: The length of your policy term is another significant factor. Longer terms generally result in higher overall premiums, as the insurance company is taking on the risk of covering you for an extended period. Shorter terms may be more affordable but might not provide the coverage you need over the long haul.

- Riders and Add-Ons: Optional riders or add-ons to your policy can enhance its benefits but often come at an additional cost. Examples include accelerated death benefits, waiver of premium riders, or spousal coverage. Carefully consider which riders are necessary and which might add unnecessary expense.

Market-Driven Factors

The broader insurance market also influences the cost of term life insurance. These market-driven factors are often beyond the control of individual policyholders but can significantly impact the premiums offered by insurance companies. Here are some key market-driven factors to be aware of:

- Economic Conditions: The state of the economy can affect insurance rates. During economic downturns, insurance companies may raise premiums to offset potential losses. Conversely, a strong economy might lead to more competitive pricing.

- Competitive Landscape: The level of competition among insurance providers can drive prices down. When there are numerous insurers offering similar products, policyholders often benefit from more affordable rates and enhanced benefits.

- Regulatory Changes: Government regulations and industry standards can impact the cost of insurance. Changes in laws or guidelines may lead to adjustments in how insurance companies operate and, consequently, the premiums they charge.

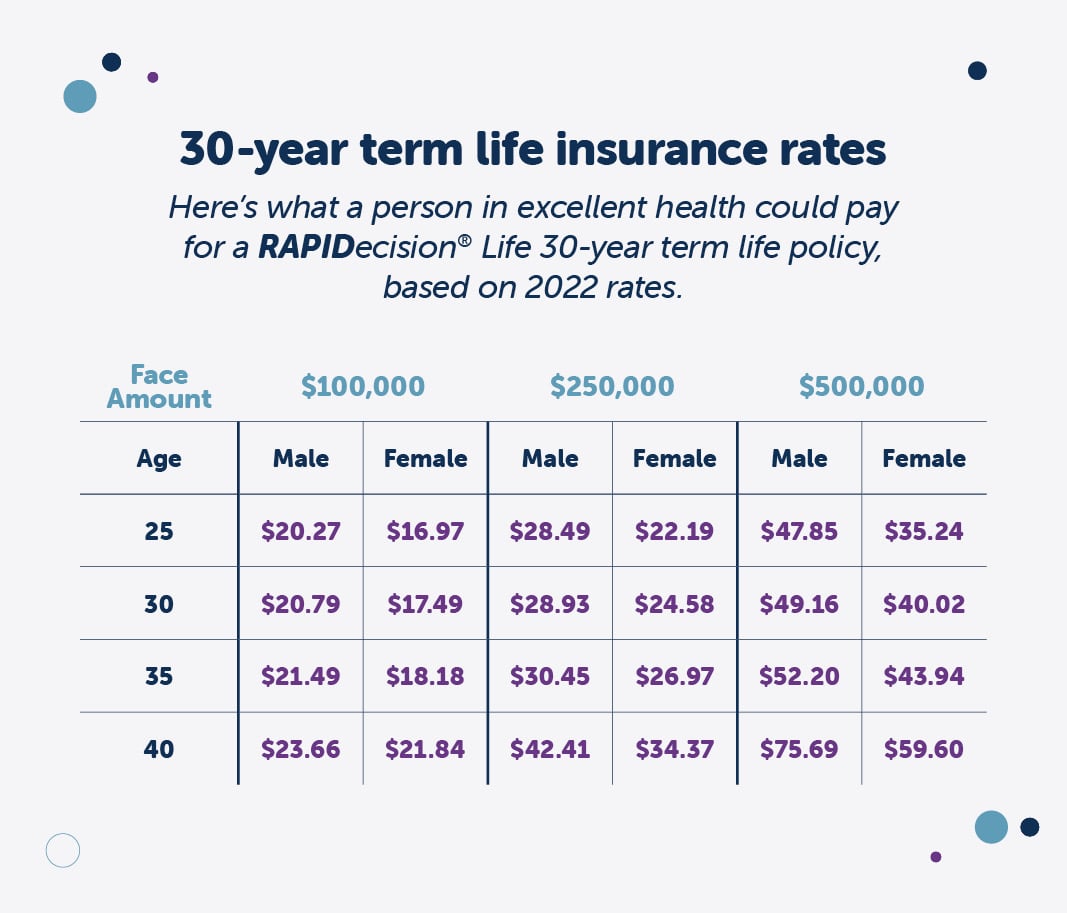

Analyzing Real-World Term Life Insurance Prices

To provide a tangible understanding of term life insurance prices, let’s examine some real-world examples. These examples are based on average rates for individuals with good health and no pre-existing conditions. Please note that individual rates may vary based on the factors discussed earlier.

Example 1: 30-Year-Old Male, 20-Year Term

John, a healthy 30-year-old male, is looking for term life insurance to cover his family’s financial needs in the event of his untimely demise. He opts for a 20-year term policy with a 500,000 death benefit. Based on his age and health status, he can expect to pay an annual premium of approximately 250. This premium is relatively affordable and provides John’s family with substantial financial protection for the next two decades.

| Coverage Amount | Annual Premium |

|---|---|

| $500,000 | $250 |

Example 2: 40-Year-Old Female, 10-Year Term

Sarah, a healthy 40-year-old female, is considering term life insurance to ensure her children’s financial security. She chooses a 10-year term policy with a 250,000 death benefit. Given her age, Sarah can expect to pay an annual premium of around 350. While this premium is higher than John’s due to her being older, it still represents a cost-effective way to secure her family’s future.

| Coverage Amount | Annual Premium |

|---|---|

| $250,000 | $350 |

Example 3: 55-Year-Old Couple, 15-Year Term

Mike and Jane, a healthy couple in their mid-50s, are seeking term life insurance to protect their estate and provide for their retirement. They opt for a joint 15-year term policy with a 1,000,000 death benefit. Given their age, the annual premium for this policy could be upwards of 1,500. While this is a significant expense, it ensures their financial goals and legacy are protected.

| Coverage Amount | Annual Premium |

|---|---|

| $1,000,000 | $1,500 |

Maximizing Your Term Life Insurance Coverage

To ensure you’re getting the most out of your term life insurance policy, consider the following strategies:

- Shop Around: Compare quotes from multiple insurance companies. This can help you identify the most competitive rates and find the policy that best aligns with your needs.

- Consider Your Coverage Needs: Assess your financial obligations and the amount of coverage required to meet those needs. Avoid over-insuring yourself, as this can lead to unnecessary expense, but also ensure you have sufficient coverage to protect your loved ones.

- Opt for a Longer Term: While longer terms typically come with higher premiums, they can provide peace of mind and stability. A longer term can also be more cost-effective over time, as you lock in a lower rate for a more extended period.

- Focus on Health and Lifestyle: Maintaining a healthy lifestyle can significantly impact your term life insurance premiums. Regular exercise, a balanced diet, and avoiding risky behaviors can lead to more affordable coverage.

Future Implications and Considerations

As you navigate the world of term life insurance, it’s essential to consider the potential changes and implications that may arise over time. Here are some key points to keep in mind as you plan for the future:

- Renewal Options: Many term life insurance policies offer the option to renew at the end of the term. However, it's crucial to understand that renewal often comes with higher premiums due to the increased age of the policyholder. Carefully consider whether a renewable policy is the right choice for your long-term needs.

- Changing Circumstances: Life is full of surprises, and your financial needs and obligations may evolve over time. Regularly review your term life insurance policy to ensure it still aligns with your current circumstances. Consider increasing your coverage amount or adjusting your policy term as your needs change.

- Market Fluctuations: The insurance market is subject to fluctuations, and rates can change over time. Stay informed about market trends and be prepared to adapt your coverage as necessary. Regularly comparing quotes can help you identify more affordable options or take advantage of market changes.

Conclusion

Term life insurance is a critical financial tool, offering peace of mind and financial security to individuals and families. While the cost of term life insurance can vary significantly based on a multitude of factors, understanding these influences can help you make informed decisions about your coverage. By considering your personal characteristics, policy details, and market dynamics, you can find a term life insurance policy that provides the protection you need at a price that fits your budget. Remember, your financial well-being and the security of your loved ones are worth the investment, and term life insurance is a powerful tool to ensure that security.

How do I choose the right term length for my life insurance policy?

+

The term length of your life insurance policy depends on your specific needs and goals. Consider the age at which you expect to no longer need life insurance coverage, such as when your children become financially independent or when you pay off your mortgage. Choose a term that aligns with this timeline to ensure you have adequate coverage for the duration you need it.

What happens if I outlive my term life insurance policy?

+

If you outlive your term life insurance policy, your coverage will expire, and you will no longer be protected. However, many insurance companies offer conversion options, allowing you to convert your term policy into a permanent life insurance policy without a medical exam. This can provide ongoing coverage, albeit at a higher cost.

Can I change my life insurance policy if my circumstances change?

+

Yes, you can typically make changes to your life insurance policy if your circumstances change. This might include increasing or decreasing your coverage amount, changing beneficiaries, or adjusting your payment schedule. It’s important to review your policy regularly and make updates as needed to ensure it aligns with your current needs.