Marketplace Health Insurance

Marketplace Health Insurance: Navigating Options and Maximizing Benefits

In the complex landscape of healthcare, understanding the intricacies of marketplace health insurance is crucial for individuals and families seeking affordable and comprehensive coverage. This comprehensive guide aims to shed light on the world of health insurance marketplaces, offering an in-depth analysis of the options, benefits, and strategies to navigate this essential aspect of personal financial planning.

Understanding the Health Insurance Marketplace

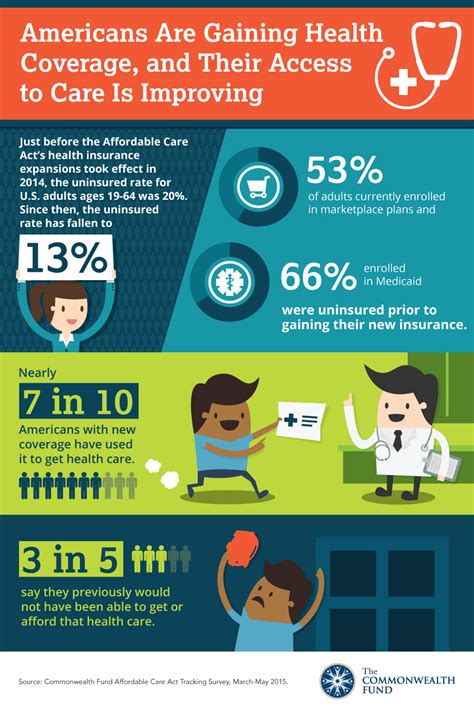

The health insurance marketplace, often referred to as the "healthcare exchange," is a platform that allows individuals and small businesses to compare, choose, and purchase health insurance plans. Established under the Affordable Care Act (ACA), these marketplaces have revolutionized the way Americans access healthcare coverage, making it more accessible and transparent.

Marketplace health insurance plans are typically offered by private insurance companies and are regulated by federal or state governments. They provide a range of benefits, including essential health services such as doctor visits, hospital stays, prescription medications, and preventive care. The specific benefits and costs of these plans can vary based on the insurer, the plan type, and the geographic location.

Key features of marketplace health insurance include:

- Standardized Plan Options: Marketplaces offer four main types of plans: Bronze, Silver, Gold, and Platinum. Each plan category offers a different level of coverage, with Bronze plans typically covering a lower percentage of costs and Platinum plans offering the highest coverage.

- Income-Based Subsidies: One of the key advantages of marketplace plans is the availability of premium tax credits and cost-sharing reductions for eligible individuals and families. These subsidies can significantly reduce the cost of monthly premiums and out-of-pocket expenses.

- Open Enrollment Period: Marketplaces operate on a defined open enrollment period, typically from November to December each year. During this time, individuals can enroll in a new plan or make changes to their existing coverage. Outside of this period, special enrollment periods may be available for qualifying life events.

Analyzing Marketplace Health Insurance Plans

When exploring marketplace health insurance plans, it's essential to consider various factors to find the best fit for your needs and budget. Here's a detailed breakdown of what to look for:

Coverage and Benefits

Each marketplace plan offers a specific set of covered services and benefits. These may include:

- Doctor Visits: Coverage for primary care physician visits and specialist consultations.

- Hospitalization: Benefits for hospital stays, including emergency room visits.

- Prescription Drugs: Coverage for essential and preferred prescription medications.

- Preventive Care: Services like annual check-ups, immunizations, and screenings are often covered without any cost-sharing.

- Mental Health and Substance Abuse Treatment: Plans typically include coverage for mental health services and substance abuse treatment.

- Maternity and Newborn Care: Benefits for prenatal care, childbirth, and postpartum care for the mother and baby.

Cost and Premiums

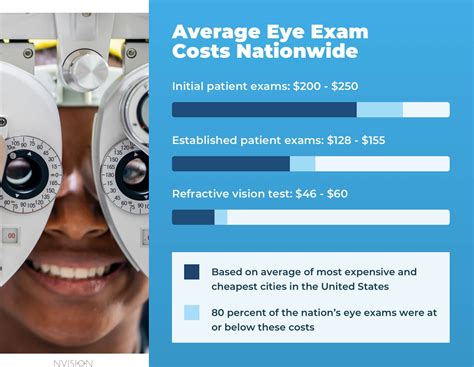

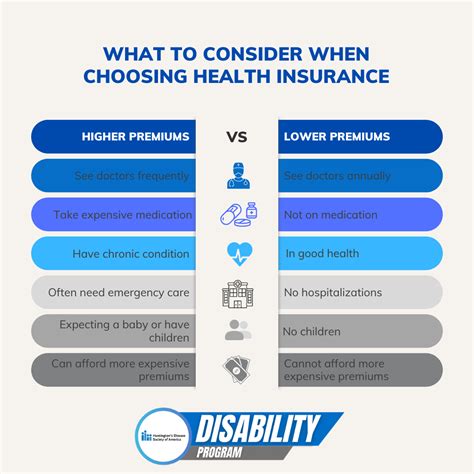

The cost of marketplace health insurance plans can vary based on several factors, including the plan type, your age, and your geographic location. Here's a closer look at the key cost components:

| Cost Component | Description |

|---|---|

| Premium | The monthly cost of the insurance plan. You pay this amount regardless of whether you use healthcare services. |

| Deductible | The amount you must pay out-of-pocket before your insurance plan starts covering expenses. Plans with lower premiums often have higher deductibles. |

| Copayment (Copay) | A fixed amount you pay for a covered healthcare service, such as a doctor visit or prescription medication. |

| Coinsurance | Your share of the costs of a covered healthcare service, calculated as a percentage of the total cost. For instance, if your plan has a 20% coinsurance for a specific service, you pay 20% of the cost, and your insurance covers the remaining 80%. |

| Out-of-Pocket Maximum | The most you will pay out-of-pocket for covered services in a year. This includes your deductible, copays, and coinsurance. |

Network and Provider Choices

Marketplace health insurance plans often operate within a specific network of healthcare providers. This means that using in-network providers is generally more cost-effective than using out-of-network providers. Consider the following when evaluating network options:

- In-Network Providers: Check if your current healthcare providers are in the plan's network. If not, you may need to switch providers or be prepared to pay more for out-of-network care.

- Specialist Access: Ensure that the plan's network includes specialists for any specific healthcare needs you or your family may have.

- Pharmacy Network: Review the plan's pharmacy network to ensure your preferred pharmacies and the medications you need are covered.

Maximizing Benefits and Saving Money

Navigating the marketplace and selecting the right health insurance plan is just the first step. To truly maximize the benefits and value of your insurance, consider these strategies:

Take Advantage of Preventive Care

Marketplace health insurance plans are required to cover certain preventive services at no cost to you. These include annual check-ups, immunizations, cancer screenings, and more. By taking advantage of these services, you can catch potential health issues early and potentially avoid more costly treatments down the line.

Use In-Network Providers

As mentioned earlier, using in-network providers can significantly reduce your out-of-pocket expenses. Before scheduling an appointment or seeking treatment, verify that the provider is in your plan's network. This simple step can save you from unexpected bills.

Understand Your Plan's Coverage Limits

While marketplace plans offer comprehensive coverage, there may be certain services or treatments that are not covered or have limited coverage. Familiarize yourself with your plan's benefits and exclusions to avoid unexpected surprises.

Consider Health Savings Accounts (HSAs)

If you have a high-deductible health plan (HDHP), you may be eligible to open a Health Savings Account. HSAs allow you to save pre-tax dollars for qualified medical expenses. The funds in your HSA roll over year to year and can be invested, providing a potential long-term savings strategy.

Review Your Plan Annually

During the open enrollment period, review your current plan and explore other options. Your needs may change from year to year, and a different plan may offer better coverage or savings. Additionally, keep an eye out for special enrollment periods that may allow you to make changes outside of the open enrollment window.

The Future of Marketplace Health Insurance

The landscape of marketplace health insurance is continually evolving. Recent policy changes and advancements in healthcare technology are shaping the future of this industry. Here are some key trends and developments to watch:

Expanding Access and Affordability

Efforts are underway to expand access to healthcare for underserved populations and to make insurance more affordable. This includes proposals to enhance subsidies and extend coverage options, particularly for low-income individuals and families.

Telehealth and Digital Innovations

The COVID-19 pandemic accelerated the adoption of telehealth services, and this trend is expected to continue. Marketplace plans are increasingly incorporating telehealth benefits, offering convenient and cost-effective virtual healthcare options.

Value-Based Care Models

Value-based care models focus on delivering high-quality healthcare while controlling costs. These models incentivize healthcare providers to coordinate care and improve patient outcomes. As these models gain traction, marketplace plans may offer more incentives for enrollees to seek value-based care.

Consumer Education and Transparency

Marketplaces are investing in initiatives to improve consumer education and transparency. This includes providing clearer explanations of plan benefits and costs, as well as tools to help consumers compare plans and make informed choices.

FAQ

What is the difference between a marketplace plan and a traditional insurance plan?

+Marketplace plans are standardized and regulated, offering a set of essential health benefits and income-based subsidies. Traditional plans, on the other hand, may have more flexibility in terms of benefits and costs but are not subject to the same regulations.

How do I know if I qualify for premium tax credits?

+Eligibility for premium tax credits depends on your income level. Generally, individuals and families with incomes between 100% and 400% of the federal poverty level may qualify. You can use the healthcare marketplace's income calculator to determine your eligibility.

Can I switch marketplace plans during the year?

+Switching plans outside of the open enrollment period is typically not allowed unless you qualify for a special enrollment period due to a qualifying life event, such as marriage, divorce, or the birth of a child.

Understanding the intricacies of marketplace health insurance is a crucial step toward ensuring you and your family have the coverage you need. By staying informed and actively managing your health insurance, you can navigate the healthcare system with confidence and make the most of your benefits.