Eye Exam Insurance

Eye exams are an essential aspect of maintaining good vision and overall eye health. Regular comprehensive eye examinations can detect not only refractive errors but also various eye conditions and even systemic health issues. In today's world, where vision problems are becoming increasingly common, understanding the importance of eye exams and their coverage by insurance is crucial. This article aims to provide a comprehensive guide to eye exam insurance, covering everything from the necessity of eye exams to the intricacies of insurance coverage and its benefits.

Understanding the Importance of Regular Eye Exams

The human eye is a complex organ, and its health is often taken for granted until problems arise. Regular eye exams play a pivotal role in ensuring optimal visual acuity and identifying potential eye diseases early on, when they are more treatable. Moreover, eye exams can reveal underlying health conditions that may not exhibit obvious symptoms, making them a vital component of overall health maintenance.

A comprehensive eye exam typically involves a series of tests to assess visual acuity, color vision, eye muscle movements, and the overall health of the eye. These tests can detect a wide range of issues, including refractive errors like nearsightedness, farsightedness, and astigmatism, as well as more serious conditions such as glaucoma, cataracts, and macular degeneration. Early detection of these conditions is key to successful management and treatment.

Additionally, eye exams can uncover signs of systemic health issues, such as diabetes, high blood pressure, and even certain types of cancer. For instance, diabetes can cause damage to the retina, known as diabetic retinopathy, which can lead to vision loss if left untreated. High blood pressure can also affect the blood vessels in the eye, a condition called hypertensive retinopathy. Regular eye exams provide an opportunity to identify these issues early, allowing for prompt medical intervention.

Benefits of Early Detection and Treatment

The significance of early detection cannot be overstated. Many eye conditions, if caught early, can be managed or even reversed with appropriate treatment. For example, glaucoma, a leading cause of blindness worldwide, can be controlled with medication or surgery if detected in its early stages. Similarly, macular degeneration, which affects the central vision, can be managed with various treatments, including vitamin supplements and anti-VEGF injections, if identified early.

Early detection also allows for better management of refractive errors. While these errors are not considered diseases, they can significantly impact daily life and overall quality of life. Corrective measures, such as prescription eyeglasses or contact lenses, can greatly improve vision and prevent further complications. In some cases, refractive surgery, such as LASIK or PRK, may be an option to correct these errors and provide long-term vision improvement.

Furthermore, regular eye exams are especially crucial for children and young adults. Vision plays a critical role in learning and development, and undiagnosed vision problems can lead to learning difficulties and even behavioral issues. Early intervention can help correct these problems, ensuring that children have the best chance at academic and social success.

Insurance Coverage for Eye Exams: A Detailed Overview

Understanding the coverage provided by insurance plans for eye exams is essential for both individuals and families. While the specifics can vary greatly depending on the insurance provider and the plan selected, there are some general guidelines and commonalities to be aware of.

Types of Insurance Plans and Their Coverage

When it comes to eye exam insurance, there are several types of plans to consider. These include private health insurance, Medicare, and Medicaid, each with its own set of benefits and limitations.

- Private Health Insurance: Private health insurance plans typically offer coverage for eye exams, though the extent of coverage can vary. Some plans may cover annual comprehensive eye exams, while others may have limitations or require additional premiums for vision coverage. It is essential to review the specific details of your plan to understand what is covered and any associated costs.

- Medicare: Medicare, the federal health insurance program for individuals aged 65 and older, also provides coverage for eye exams. However, the coverage is limited to specific conditions and situations. For instance, Medicare Part B covers medically necessary eye exams for conditions such as glaucoma, macular degeneration, and diabetic retinopathy. It does not, however, cover routine eye exams for prescription eyeglasses or contact lenses.

- Medicaid: Medicaid, a joint federal and state program that provides health coverage to eligible low-income adults, children, pregnant women, elderly adults, and people with disabilities, also offers coverage for eye exams. The specific coverage can vary by state, but in general, Medicaid covers eye exams for individuals with specific medical conditions or those who are at high risk for certain eye diseases. It is important to check with your state's Medicaid program to understand the exact coverage provided.

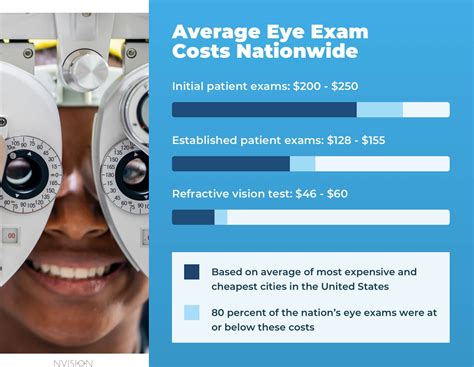

Understanding the Cost of Eye Exams

The cost of an eye exam can vary depending on several factors, including the location of the exam, the eye doctor’s fees, and the specific tests required. On average, a comprehensive eye exam can range from 50 to 300 or more. However, with insurance coverage, the out-of-pocket expenses can be significantly reduced.

For instance, under private health insurance plans, the cost of an eye exam is often covered as a preventive service, meaning there may be no additional cost to the patient beyond the usual copayment or deductible. Medicare also covers a significant portion of the cost for medically necessary eye exams, with patients typically responsible for a 20% coinsurance of the Medicare-approved amount.

It is worth noting that some insurance plans may have limitations on the frequency of covered eye exams. For example, a plan might cover a comprehensive eye exam once every two years for individuals without specific medical conditions. However, for those with certain eye diseases or systemic health conditions that affect the eyes, more frequent exams may be covered.

| Insurance Type | Coverage Details |

|---|---|

| Private Health Insurance | Varies by plan; may cover annual comprehensive eye exams with potential copayments or deductibles. |

| Medicare | Covers medically necessary eye exams for specific conditions; 20% coinsurance is typically required. |

| Medicaid | Coverage varies by state; covers eye exams for individuals with specific medical conditions or high-risk factors. |

Maximizing Your Eye Exam Insurance Benefits

Understanding your insurance coverage is the first step towards maximizing your benefits. Here are some strategies to ensure you’re making the most of your eye exam insurance:

Choosing the Right Eye Care Professional

When selecting an eye care professional, it’s essential to choose someone who accepts your insurance. This ensures that you can utilize your coverage benefits fully. Most insurance providers maintain a directory of in-network eye care professionals, which can be a helpful resource when making your choice.

Understanding Your Plan’s Limitations and Exclusions

While insurance coverage for eye exams is beneficial, it’s important to be aware of any limitations or exclusions. For instance, some plans may only cover a certain number of eye exams per year, or they may have specific requirements for the types of tests that are covered. Understanding these limitations can help you plan your eye care accordingly and avoid unexpected out-of-pocket expenses.

Utilizing Preventive Care Benefits

Many insurance plans, particularly private health insurance plans, offer preventive care benefits. These benefits often include coverage for annual comprehensive eye exams, which can help detect potential issues before they become serious problems. Taking advantage of these preventive care benefits can not only save you money but also improve your overall eye health and well-being.

The Future of Eye Exam Insurance: Trends and Innovations

The field of eye care and insurance coverage is continually evolving. As technology advances and our understanding of eye health deepens, we can expect to see several trends and innovations that will shape the future of eye exam insurance.

Telehealth and Remote Eye Exams

The rise of telehealth services has opened up new possibilities for eye exams. Remote eye exams, conducted via video conferencing, allow patients to receive eye care from the comfort of their own homes. While these exams may not replace the need for in-person comprehensive eye exams, they can provide a convenient option for certain types of eye care, such as prescription updates or monitoring of existing conditions.

AI-Assisted Eye Care

Artificial intelligence (AI) is increasingly being used in eye care to enhance diagnostic accuracy and efficiency. AI-assisted eye exams can help identify a wide range of eye conditions, from refractive errors to more complex diseases. This technology has the potential to improve access to eye care, especially in rural or underserved areas, and can also reduce the workload on eye care professionals, allowing them to focus on more complex cases.

Integrating Eye Care with Overall Health Management

As the link between eye health and overall systemic health becomes more apparent, we can expect to see a greater integration of eye care into overall health management. This may involve more comprehensive insurance coverage for eye exams, particularly for individuals with certain health conditions. Additionally, eye care professionals may play a more active role in the early detection and management of systemic health issues, working closely with primary care physicians and other healthcare providers.

Conclusion

Eye exams are a vital component of maintaining good vision and overall health. Understanding the importance of these exams and the coverage provided by insurance plans is essential for making informed decisions about your eye care. By staying informed about your insurance coverage, choosing the right eye care professional, and keeping up with the latest trends and innovations, you can ensure that you’re taking the best possible care of your eyes and maximizing the benefits of your eye exam insurance.

How often should I have an eye exam, and does insurance cover it every time?

+The frequency of eye exams can vary based on age, individual health, and specific eye conditions. For individuals without any known eye problems, a comprehensive eye exam is typically recommended every one to two years. However, for those with certain eye diseases or systemic health conditions that affect the eyes, more frequent exams may be necessary. Insurance coverage for eye exams can vary as well. Some plans cover annual comprehensive eye exams, while others may have limitations on the frequency of covered exams. It’s important to review your specific insurance plan to understand the coverage details.

Can I choose any eye doctor, or do I need to stay within my insurance network?

+The ability to choose your eye doctor depends on your insurance plan. Some plans require you to stay within their network of providers, while others may offer out-of-network benefits with potentially higher out-of-pocket costs. It’s essential to review your insurance plan’s provider network and understand the benefits and limitations associated with in-network and out-of-network care.

What if I need specialized eye care or surgery? Is that covered by my insurance plan?

+The coverage for specialized eye care and surgery can vary greatly depending on your insurance plan and the specific procedure. Some plans may cover a wide range of specialized eye care services, while others may have limitations or require pre-authorization. It’s crucial to review your insurance plan’s benefits and coverage details, and if you’re considering specialized eye care or surgery, consult with your eye doctor and insurance provider to understand the costs and coverage involved.