Liability Auto Insurance

In the intricate landscape of financial security, liability auto insurance stands as a cornerstone, offering vital protection for individuals and businesses alike. This essential coverage safeguards policyholders against financial risks arising from vehicular accidents, providing a critical safety net in the event of property damage or personal injury claims. As we delve into the intricacies of liability auto insurance, we'll uncover the key components, benefits, and implications that make this coverage an indispensable element of modern life.

Understanding Liability Auto Insurance: A Comprehensive Overview

Liability auto insurance is a specialized form of automobile insurance designed to protect individuals and businesses from financial liabilities arising from vehicle-related incidents. This coverage is particularly crucial as it provides a safety net against potentially catastrophic financial losses that could result from accidents involving property damage, bodily injury, or even legal defense costs. Understanding the scope and benefits of liability auto insurance is essential for anyone seeking to safeguard their financial well-being and ensure peace of mind on the road.

Key Components of Liability Auto Insurance

Liability auto insurance is a multifaceted coverage option, comprising several critical components that work in tandem to provide comprehensive protection. These components include:

- Bodily Injury Liability: This coverage protects policyholders from financial liabilities arising from bodily injuries sustained by others in an accident for which the insured is deemed responsible. It covers medical expenses, rehabilitation costs, and even lost wages for the injured parties.

- Property Damage Liability: As the name suggests, this coverage safeguards policyholders against financial liabilities stemming from property damage caused by their vehicle. This could include damage to other vehicles, public or private property, or even personal belongings.

- Legal Defense Coverage: In the event of a lawsuit arising from an accident, liability auto insurance often includes coverage for legal defense costs. This provision ensures that policyholders have the necessary financial support to navigate the legal process and protect their interests.

- Uninsured/Underinsured Motorist Coverage: This optional component of liability auto insurance provides coverage for policyholders who are involved in an accident with a driver who either lacks insurance or has inadequate coverage to compensate for the damages incurred.

Each of these components plays a vital role in ensuring that policyholders are adequately protected against a range of potential financial liabilities, making liability auto insurance an indispensable component of a comprehensive insurance portfolio.

Benefits and Implications of Liability Auto Insurance

The benefits of liability auto insurance are far-reaching and have significant implications for both individuals and businesses. Some of the key advantages and considerations include:

- Financial Protection: Perhaps the most critical benefit of liability auto insurance is the financial protection it offers. By providing coverage for a wide range of potential liabilities, this insurance ensures that policyholders are shielded from catastrophic financial losses that could arise from vehicular accidents.

- Peace of Mind: Knowing that one is adequately insured against potential liabilities provides a sense of security and peace of mind. This assurance allows individuals and businesses to focus on their daily lives and operations without the constant worry of unforeseen financial burdens.

- Legal Compliance: In many jurisdictions, liability auto insurance is a legal requirement for vehicle owners and operators. By ensuring compliance with these regulations, policyholders avoid potential legal penalties and maintain their good standing with regulatory authorities.

- Risk Mitigation: Liability auto insurance plays a pivotal role in mitigating risks associated with vehicle ownership and operation. By transferring the financial burden of potential liabilities to the insurance provider, policyholders can effectively manage and reduce their exposure to risk.

The implications of liability auto insurance extend beyond the immediate financial protection it provides. This coverage fosters a culture of responsibility and accountability among vehicle owners and operators, contributing to safer road conditions and a more secure society as a whole.

Navigating the Landscape of Liability Auto Insurance: Expert Insights

As we delve deeper into the world of liability auto insurance, it’s essential to seek expert guidance to ensure that one’s coverage is tailored to their specific needs and circumstances. Here are some valuable insights and considerations to keep in mind:

Customizing Your Coverage

Every individual and business has unique needs and circumstances when it comes to liability auto insurance. Factors such as the type of vehicle, the nature of its use, and the specific risks associated with one’s driving habits or business operations can all influence the ideal coverage options. Working with a knowledgeable insurance broker or agent can help you customize your policy to ensure that you have the right level of protection without incurring unnecessary costs.

Understanding Policy Limits

Policy limits refer to the maximum amount of coverage provided by your liability auto insurance policy. These limits are typically defined in terms of bodily injury liability and property damage liability, with separate limits for each type of coverage. It’s crucial to understand these limits and ensure that they are sufficient to cover potential liabilities. In cases where the policy limits may be insufficient, additional coverage options such as umbrella policies can be considered to provide an extra layer of protection.

The Impact of Deductibles

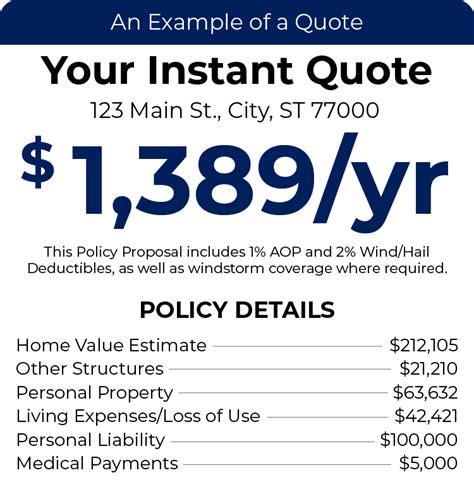

Deductibles are the amount that policyholders must pay out of pocket before their insurance coverage kicks in. While higher deductibles can result in lower premiums, it’s essential to strike a balance that ensures you can comfortably afford the deductible in the event of a claim. Consulting with an insurance professional can help you determine the appropriate deductible amount based on your financial situation and risk tolerance.

The Role of Claims History

Your claims history can have a significant impact on your liability auto insurance coverage and premiums. A clean claims history can often lead to more favorable terms and lower premiums, while multiple claims or a history of high-value claims may result in increased premiums or even difficulty in securing coverage. Maintaining a safe driving record and taking steps to reduce the risk of accidents can help keep your claims history in good standing and ensure continued access to affordable insurance coverage.

Comparative Analysis: Liability Auto Insurance Providers

The market for liability auto insurance is highly competitive, with numerous providers offering a range of coverage options and pricing structures. Conducting a comparative analysis of different providers can help you identify the best fit for your needs. Factors to consider in this analysis include coverage options, policy limits, deductibles, customer service reputation, and, of course, premium costs. Online resources and consumer reviews can provide valuable insights to guide your decision-making process.

Future Trends and Innovations

The landscape of liability auto insurance is evolving, driven by technological advancements and changing consumer expectations. As autonomous vehicles and other innovative technologies continue to shape the future of transportation, the role and scope of liability auto insurance are likely to evolve as well. Staying abreast of these developments and understanding their potential implications can help you make informed decisions about your insurance coverage and ensure that you remain adequately protected in an ever-changing world.

| Coverage Component | Description |

|---|---|

| Bodily Injury Liability | Protects policyholders from financial liabilities arising from bodily injuries sustained by others in an accident. |

| Property Damage Liability | Covers financial liabilities stemming from property damage caused by the insured vehicle. |

| Legal Defense Coverage | Provides coverage for legal defense costs in the event of a lawsuit arising from an accident. |

| Uninsured/Underinsured Motorist Coverage | Optional coverage for accidents involving uninsured or underinsured drivers. |

What is the difference between liability auto insurance and other types of auto insurance?

+Liability auto insurance is a specialized form of auto insurance that focuses on protecting policyholders from financial liabilities arising from accidents. In contrast, other types of auto insurance, such as collision coverage and comprehensive coverage, provide protection for the insured vehicle itself, covering repairs or replacement costs in the event of an accident, theft, or other incidents.

Is liability auto insurance a legal requirement?

+In many jurisdictions, liability auto insurance is a legal requirement for vehicle owners and operators. Failure to maintain adequate liability coverage can result in legal penalties, including fines, license suspension, or even vehicle impoundment. It’s essential to check the specific regulations in your area to ensure compliance.

How do I choose the right policy limits for my liability auto insurance coverage?

+Choosing the right policy limits involves a careful assessment of your financial situation and the potential risks you face. It’s recommended to consult with an insurance professional who can guide you in selecting appropriate limits based on factors such as your net worth, the type of vehicle you drive, and the nature of your driving habits or business operations. Aim for limits that provide adequate protection without incurring unnecessary costs.