How Much Is Humira With Insurance

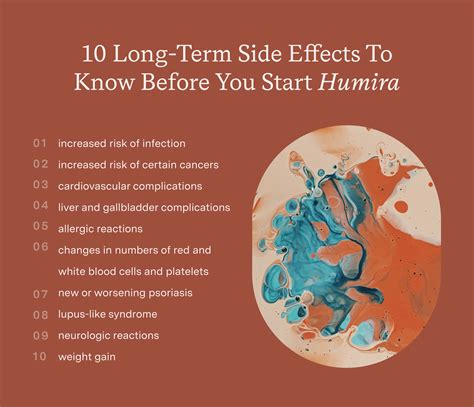

When it comes to managing the costs of prescription medications, understanding the impact of insurance coverage is crucial. Humira, a well-known medication used to treat various inflammatory conditions, can be an expensive treatment option. This article aims to provide an in-depth analysis of the cost of Humira with insurance, exploring the factors that influence the final price and offering valuable insights for patients seeking affordable access to this medication.

The Complexity of Humira Pricing

Determining the exact cost of Humira with insurance is not a straightforward task, as it involves numerous variables. The price of Humira can vary significantly based on factors such as the patient’s insurance plan, the specific pharmacy or provider, and the quantity and dosage of the medication prescribed. Additionally, insurance coverage for Humira may differ between plans, with some offering comprehensive coverage while others may have limitations or require prior authorization.

Insurance Coverage and Out-of-Pocket Costs

To gain a comprehensive understanding of the costs associated with Humira, it’s essential to break down the different components of insurance coverage and out-of-pocket expenses. Typically, insurance plans cover a portion of the medication’s cost, while patients are responsible for paying the remaining amount, known as the out-of-pocket cost.

Understanding Insurance Formularies

Insurance providers maintain formularies, which are lists of medications and their associated costs. These formularies categorize medications into different tiers, each with its own cost-sharing structure. Humira may fall into a specific tier, and the patient’s insurance plan dictates the cost-sharing arrangement for that tier. For instance, some plans may require a higher co-pay or coinsurance rate for specialty medications like Humira.

| Formulary Tier | Cost-Sharing Example |

|---|---|

| Tier 1 (Generic) | 20% coinsurance, up to a $50 maximum |

| Tier 2 (Brand-Name) | 30% co-pay, with no maximum |

| Tier 3 (Specialty) | 50% coinsurance, capped at $200 per prescription |

Calculating Out-of-Pocket Expenses

The out-of-pocket cost for Humira can be calculated based on the insurance plan’s formulary and the patient’s prescription details. For instance, if Humira is categorized as a Tier 3 specialty medication and the patient’s insurance plan has a 50% coinsurance rate with a 200 cap, the out-of-pocket cost for a prescription with a list price of 1,000 would be calculated as follows:

- Coinsurance: 50% of $1,000 = $500

- Cap: $200

- Out-of-Pocket Cost: $200

However, it's important to note that these calculations can become more complex when considering deductibles, maximum out-of-pocket limits, and other insurance plan specifics.

Influencing Factors on Humira Costs

Several factors can impact the final cost of Humira, even when insurance coverage is in place. Understanding these factors can help patients anticipate and manage their expenses effectively.

Prescription Quantity and Dosage

The quantity and dosage of Humira prescribed can significantly affect the overall cost. Higher dosages or larger quantities may result in increased out-of-pocket expenses, especially if the insurance plan has a cap on the allowed amount per prescription.

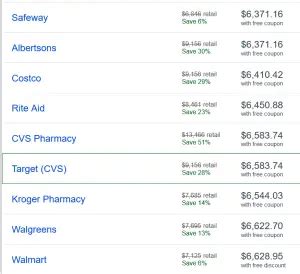

Pharmacy Choice

Patients have the option to fill their Humira prescription at various pharmacies, including retail pharmacies, mail-order pharmacies, or specialty pharmacies. The choice of pharmacy can impact the final cost, as some pharmacies may offer discounts, price matching, or loyalty programs that reduce the out-of-pocket expense.

Insurance Provider and Plan

Different insurance providers and plans have varying coverage for Humira. Some plans may offer better coverage or have more favorable cost-sharing arrangements, while others may require prior authorization or have more stringent criteria for approval. Patients should carefully review their insurance plan details to understand the specific coverage and potential out-of-pocket costs.

Cost-Saving Strategies for Humira

Navigating the costs of Humira can be challenging, but there are strategies patients can employ to potentially reduce their out-of-pocket expenses.

Exploring Prescription Assistance Programs

Pharmaceutical companies often offer prescription assistance programs that provide financial support to eligible patients. These programs may cover a portion of the medication cost or offer free medication to those who meet specific income or insurance criteria. Patients should inquire about these programs with their healthcare provider or the manufacturer of Humira.

Utilizing Manufacturer Coupons and Rebates

The manufacturer of Humira may provide coupons or rebates that can be applied to reduce the out-of-pocket cost. These offers are typically available through the manufacturer’s website or by contacting their patient assistance program. Patients should regularly check for such offers and discuss them with their healthcare provider or pharmacist.

Negotiating with Insurance Providers

In some cases, patients may be able to negotiate with their insurance provider to obtain better coverage for Humira. This could involve appealing a denied claim, requesting a prior authorization, or exploring alternative coverage options within the same insurance plan. Patients should consult with their healthcare provider or a knowledgeable insurance advocate for guidance on negotiating with insurance providers.

The Impact of Prior Authorization

Prior authorization is a common requirement for medications like Humira, particularly for those with complex insurance plans or those that fall into specialty medication tiers. This process involves the insurance provider reviewing and approving the prescription before coverage is granted. While prior authorization can be time-consuming, it is a necessary step to ensure coverage and manage costs.

Understanding the Prior Authorization Process

The prior authorization process typically involves the submission of medical records, prescription details, and sometimes additional documentation to demonstrate the medical necessity of Humira. This process can take several days or even weeks, and patients should anticipate potential delays in receiving their medication. Healthcare providers and pharmacies play a crucial role in guiding patients through this process and ensuring timely approval.

Tips for a Successful Prior Authorization

To increase the chances of a successful prior authorization, patients should:

- Ensure all required documentation is complete and accurate.

- Provide detailed medical records that demonstrate the need for Humira.

- Work closely with their healthcare provider and pharmacist to gather the necessary information.

- Stay informed about the status of their prior authorization request and follow up with the insurance provider if needed.

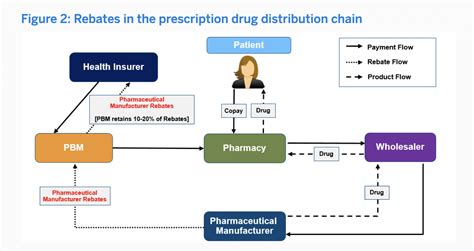

The Role of Pharmacy Benefits Managers

Pharmacy Benefits Managers (PBMs) are organizations that work with insurance providers to manage prescription drug benefits. They play a significant role in determining the coverage and costs of medications like Humira. PBMs negotiate drug prices, establish formularies, and influence the overall pricing structure for medications.

Understanding PBMs and Their Impact

PBMs aim to control drug costs and ensure the efficient management of prescription drug benefits. They negotiate discounts and rebates with pharmaceutical manufacturers, which can impact the final price patients pay for their medications. However, the influence of PBMs on drug pricing is complex, and their negotiations may not always result in lower out-of-pocket costs for patients.

Navigating PBMs for Better Costs

Patients can take certain steps to potentially navigate PBMs for better costs. This includes:

- Researching and comparing different insurance plans to understand their PBM partnerships and potential impact on medication costs.

- Engaging with their healthcare provider and pharmacist to discuss the role of PBMs and how they may affect their Humira prescription.

- Considering alternative medication options if the PBM's influence on Humira pricing is unfavorable.

The Future of Humira Costs and Access

The cost of Humira and other specialty medications is a topic of ongoing debate and discussion within the healthcare industry. Efforts are being made to improve access and affordability for patients, but the path forward is complex and multifaceted.

Policy and Regulatory Changes

Policy changes at the federal and state levels can influence the pricing and coverage of medications like Humira. For instance, proposals to allow the importation of medications from other countries or to implement price caps on certain drugs could potentially reduce costs. Additionally, regulatory changes aimed at increasing transparency in drug pricing and improving insurance coverage could also impact the affordability of Humira.

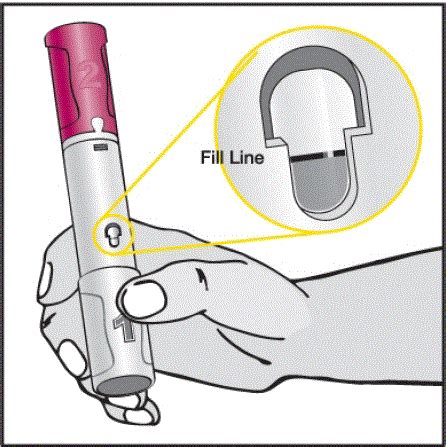

Innovations in Drug Delivery and Administration

Advancements in drug delivery technologies and administration methods can potentially reduce the cost of medications like Humira. For instance, the development of biosimilars, which are biologically similar but less expensive versions of biologic medications, could provide more affordable alternatives. Additionally, improvements in self-administration methods, such as pre-filled syringes or auto-injectors, may simplify the process and reduce the need for frequent clinic visits.

Expanding Patient Assistance Programs

Expanding and improving patient assistance programs can provide greater financial support to patients who require medications like Humira. These programs, offered by pharmaceutical companies or independent organizations, can help bridge the gap between insurance coverage and out-of-pocket expenses. Efforts to increase awareness and accessibility of these programs could benefit a larger patient population.

Conclusion

Understanding the costs of Humira with insurance is a complex but crucial aspect of managing this medication. By breaking down the various components of insurance coverage, exploring cost-saving strategies, and staying informed about the factors that influence pricing, patients can navigate the financial challenges associated with Humira. As the healthcare industry continues to evolve, ongoing efforts to improve access and affordability will play a vital role in ensuring that patients can obtain the medications they need.

How often do I need to take Humira, and does it impact the cost?

+The frequency of Humira injections can vary based on the condition being treated and the patient’s specific needs. For instance, patients with rheumatoid arthritis may receive injections every other week, while those with Crohn’s disease may require more frequent injections. The cost of Humira can be influenced by the dosage and frequency of administration, as higher dosages or more frequent injections may result in increased out-of-pocket expenses.

Are there any generic versions of Humira available, and do they cost less?

+Currently, there are no generic versions of Humira available in the United States. However, biosimilars, which are biologically similar to the original biologic medication, are emerging as potential cost-saving alternatives. Biosimilars for Humira are under development, and their approval and availability may offer more affordable options for patients in the future.

What if my insurance denies coverage for Humira? Are there any alternatives?

+If your insurance denies coverage for Humira, it’s important to explore alternative treatment options with your healthcare provider. There may be other medications or treatment approaches that can effectively manage your condition. Additionally, appealing the denial or discussing coverage options with your insurance provider may be worth considering. Patients should not hesitate to seek guidance from their healthcare team to find the best treatment plan within their insurance coverage.