Insurance For Small Business Owners

Starting and running a small business is an exciting journey, but it comes with its fair share of challenges and risks. One of the crucial aspects that every small business owner must consider is insurance coverage. Insurance provides a safety net, protecting businesses from various financial pitfalls and ensuring their long-term sustainability. In this comprehensive guide, we will delve into the world of insurance for small businesses, exploring the key types of coverage, the benefits they offer, and the strategies to navigate the complex landscape effectively.

Understanding the Insurance Landscape for Small Businesses

The insurance market offers a vast array of options tailored to the unique needs of small businesses. While the coverage landscape can be overwhelming, understanding the fundamental types of insurance is essential for making informed decisions. Here's a breakdown of the key categories:

1. General Liability Insurance

General liability insurance is often considered the cornerstone of any small business's insurance portfolio. It provides protection against a wide range of common risks, including bodily injury, property damage, and personal and advertising injury claims. For instance, if a customer slips and falls in your store, general liability insurance would cover the resulting medical expenses and potential legal fees.

Real-world Example: Imagine you own a small bakery. A customer trips over a loose rug and injures their ankle. General liability insurance would step in to cover the medical costs and any legal proceedings that may arise, ensuring your business is protected.

2. Professional Liability Insurance (Errors and Omissions)

Professional liability insurance, also known as errors and omissions (E&O) insurance, is crucial for businesses that provide professional services or advice. It protects against claims of negligence, errors, or omissions that result in financial loss for your clients. This coverage is especially vital for industries like consulting, accounting, and legal services.

Consider the Case: A small consulting firm provides marketing advice to a client. If the client's business suffers losses due to the implementation of the firm's strategies, professional liability insurance would cover the potential damages and legal expenses.

3. Product Liability Insurance

If your small business involves the manufacturing, distribution, or sale of products, product liability insurance is a must-have. This coverage safeguards your business against claims arising from defective or harmful products. It's a critical protection for businesses in industries such as manufacturing, retail, and e-commerce.

| Industry | Product Liability Risk |

|---|---|

| Manufacturing (e.g., toys) | Risk of product defects leading to injuries. |

| Retail (e.g., clothing) | Potential for product contamination or allergic reactions. |

| E-commerce (e.g., electronics) | Claims related to faulty products purchased online. |

4. Business Owner's Policy (BOP)

A Business Owner's Policy (BOP) is a comprehensive insurance package designed specifically for small businesses. It typically combines general liability insurance, property insurance, and business interruption insurance into one policy. BOPs offer a cost-effective solution for businesses that require multiple types of coverage.

Key Benefits of a BOP:

- Simplified insurance management with a single policy.

- Cost savings due to bundled coverage.

- Tailored to the unique needs of small businesses.

5. Property Insurance

Property insurance is essential for protecting your business's physical assets, including your office space, equipment, inventory, and furniture. It covers losses due to events like fires, storms, vandalism, and theft. For businesses with significant physical assets, property insurance is a critical component of their risk management strategy.

6. Business Interruption Insurance

Business interruption insurance is a safeguard against the financial losses that can occur when your business operations are disrupted due to covered perils, such as a fire or natural disaster. It provides coverage for lost income and ongoing expenses during the recovery period, ensuring your business can weather the storm.

Real-world Application: Consider a small restaurant that suffers significant damage from a fire. Business interruption insurance would cover the restaurant's lost revenue and expenses while it undergoes repairs, allowing it to stay afloat during this challenging time.

Strategies for Choosing the Right Insurance Coverage

Navigating the insurance landscape as a small business owner can be complex, but adopting a strategic approach can simplify the process and ensure you make informed decisions.

1. Conduct a Risk Assessment

Start by conducting a thorough risk assessment of your business. Identify the unique hazards and potential liabilities associated with your industry, location, and operations. This assessment will help you prioritize the types of insurance coverage you need.

For instance, if your business involves heavy machinery or hazardous materials, you may need to prioritize workers' compensation insurance and environmental liability insurance.

2. Understand Your Industry's Common Risks

Different industries face distinct risks. Understanding the common pitfalls and challenges within your industry is crucial for effective insurance planning. Stay informed about industry-specific regulations and best practices to ensure your coverage aligns with your business's needs.

Example: In the construction industry, common risks include workplace injuries, equipment damage, and liability for structural failures. Understanding these risks is vital for constructing a robust insurance strategy.

3. Tailor Coverage to Your Business's Unique Needs

While certain types of insurance are essential for most small businesses, it's crucial to customize your coverage based on your specific operations. Consider factors like the size of your business, the number of employees, and the nature of your products or services.

Strategy: If you operate a home-based business, you may need additional coverage to protect your personal assets from business-related liabilities. Home-based businesses often require endorsements to their homeowners' insurance policies to ensure adequate protection.

4. Review and Update Your Coverage Regularly

Insurance needs can evolve as your business grows and changes. Regularly review your policies to ensure they align with your current operations and risks. This proactive approach ensures that your coverage remains relevant and comprehensive.

Scenario: As your small business expands, you may hire additional employees or open new locations. Updating your insurance coverage to reflect these changes is essential to maintain adequate protection.

Maximizing the Benefits of Insurance for Small Businesses

Insurance isn't just about risk mitigation; it's a strategic tool that can contribute to your small business's success. Here's how to make the most of your insurance coverage:

1. Leverage Insurance as a Competitive Advantage

Insurance can set your small business apart from competitors, especially when it comes to client confidence and trust. By demonstrating a commitment to risk management through comprehensive insurance coverage, you can build a strong reputation and attract clients.

Strategy: Highlight your insurance credentials in your marketing materials and client communications. This can be a powerful differentiator, especially in industries where clients value reliability and stability.

2. Access to Resources and Support

Many insurance providers offer resources and support beyond the basic coverage. These resources can include risk management tools, safety training materials, and even access to legal or financial advice. Leverage these resources to enhance your business operations and mitigate risks.

Example: Some insurance providers offer online portals with risk assessment tools and educational resources. These tools can help you identify and address potential hazards in your workplace, contributing to a safer and more efficient operation.

3. Negotiate for Better Rates and Coverage

Insurance rates can vary significantly between providers and policies. Take the time to shop around and compare options. Negotiate with insurance brokers and carriers to secure the best rates and coverage for your small business. Remember, it's a competitive market, and you have the power to choose the option that best suits your needs.

4. Build a Strong Relationship with Your Insurance Broker

Your insurance broker can be a valuable partner in navigating the complex world of insurance. Build a strong relationship based on trust and open communication. Your broker can provide expert guidance, offer tailored solutions, and advocate for your business's best interests when negotiating with insurance carriers.

Benefits of a Strong Broker Relationship:

- Personalized advice and recommendations.

- Assistance in filing claims and navigating the claims process.

- Access to exclusive insurance programs and discounts.

FAQs: Insurance for Small Businesses

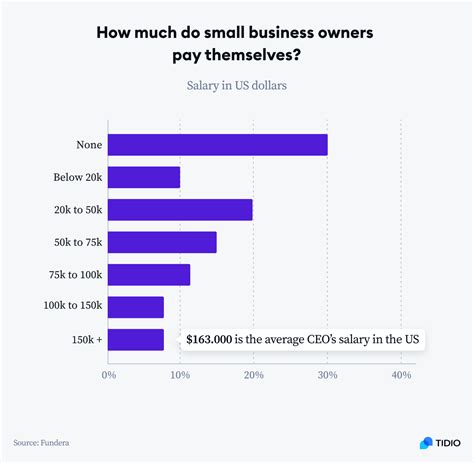

How much does small business insurance typically cost?

+The cost of small business insurance can vary widely based on factors such as the type of business, location, and level of coverage needed. On average, small businesses can expect to pay between $500 and $1,000 per year for general liability insurance, with other policies like professional liability or product liability insurance adding to the overall cost. It's essential to obtain multiple quotes and tailor your coverage to your specific needs to find the most cost-effective solution.

Are there any government programs or incentives for small businesses to obtain insurance?

+Yes, several government programs and initiatives exist to support small businesses in obtaining insurance. For example, the Small Business Administration (SBA) offers resources and guidance on insurance options. Additionally, some states provide insurance funds or programs specifically tailored to small businesses, offering more affordable coverage. It's worth exploring these options to potentially reduce insurance costs.

How often should I review and update my small business insurance coverage?

+It's recommended to review your insurance coverage annually or whenever significant changes occur in your business. This includes expansions, new products or services, hiring additional employees, or relocating. Regular reviews ensure that your coverage remains adequate and aligns with your evolving business needs.

What are some common mistakes small business owners make when it comes to insurance?

+Small business owners often make mistakes like underestimating their insurance needs, assuming they are adequately covered by personal insurance policies, or failing to review and update their coverage regularly. Additionally, not seeking expert advice from insurance brokers or agents can lead to costly gaps in coverage. It's crucial to approach insurance with a strategic mindset and seek professional guidance.

Insurance is a critical aspect of running a successful small business. By understanding the various types of coverage, adopting a strategic approach, and maximizing the benefits of insurance, small business owners can protect their ventures, build client trust, and ensure long-term sustainability. Remember, insurance is an investment in your business’s future, providing the peace of mind to focus on growth and success.