Insurance Board

Understanding the Insurance Board: An In-Depth Exploration

The Insurance Board, a critical component of the insurance industry, plays a pivotal role in regulating and overseeing insurance practices. This board, composed of industry experts and government representatives, ensures fair and ethical standards within the insurance sector. In this comprehensive guide, we will delve into the intricacies of the Insurance Board, exploring its functions, structure, and impact on the insurance landscape.

The Role and Responsibilities of the Insurance Board

The Insurance Board serves as a regulatory authority, tasked with multiple essential functions. Its primary role is to establish and enforce guidelines that govern insurance companies' operations. This includes setting standards for underwriting, claims handling, and investment practices to protect policyholders' interests and ensure a stable insurance market.

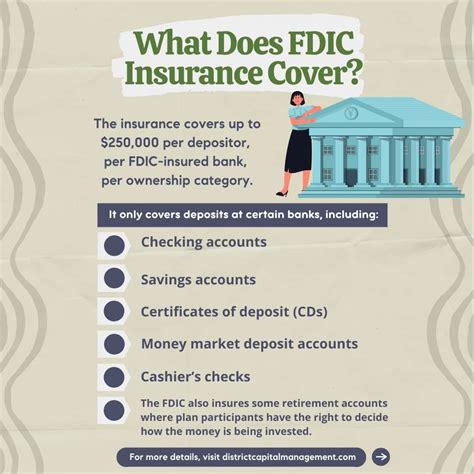

One of the board's key responsibilities is to oversee the solvency and financial stability of insurance companies. By evaluating companies' financial health and risk management practices, the board aims to prevent instances of insolvency and protect policyholders from potential losses. This involves regular audits, financial stress testing, and the implementation of robust capital requirements.

Furthermore, the Insurance Board plays a crucial role in consumer protection. It educates the public about insurance products, ensuring transparency and clarity in policy terms and conditions. The board also investigates and addresses consumer complaints, mediating disputes between policyholders and insurance companies to ensure fair resolution.

Structure and Governance of the Insurance Board

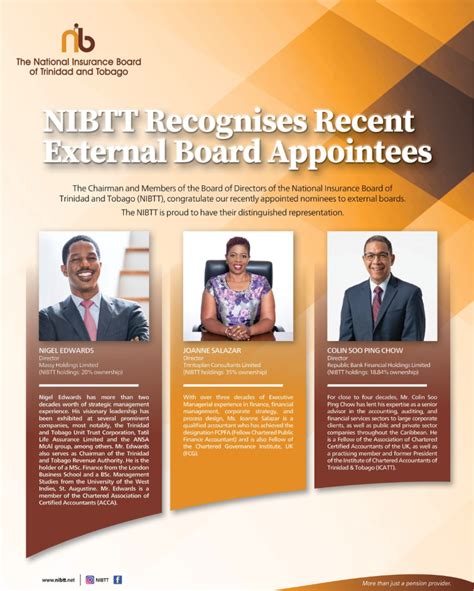

The Insurance Board operates as an independent body, free from external influence. Its governance structure is designed to balance industry expertise with public interest representation.

The board typically consists of a chairperson, who provides overall leadership and strategic direction, and several members appointed by the government. These members bring diverse expertise, including insurance industry knowledge, legal and regulatory experience, and consumer advocacy. The board's independence is further reinforced by its ability to hire staff, set budgets, and make decisions without government interference.

To ensure effective governance, the Insurance Board operates through various committees, each focused on specific aspects of insurance regulation. These committees include the Solvency and Financial Stability Committee, the Consumer Protection Committee, and the Market Conduct Committee. Each committee is chaired by a board member and comprises industry experts and representatives from relevant government agencies.

Insurance Board's Impact on the Industry

The Insurance Board's influence extends across the entire insurance ecosystem, shaping the industry's practices and outcomes.

For insurance companies, the board's regulations and guidelines provide a framework for ethical and sustainable business practices. By adhering to these standards, companies can build trust with policyholders, attract investors, and maintain a competitive edge. The board's oversight also fosters a culture of innovation, encouraging companies to develop new products and services that meet evolving consumer needs.

Policyholders benefit from the Insurance Board's protection and advocacy. The board's focus on consumer education empowers individuals to make informed decisions about their insurance coverage. Moreover, the board's complaint resolution process ensures that policyholders' rights are upheld, providing a vital safeguard against unfair practices.

The Insurance Board's impact also extends to the broader economy. By maintaining a stable and well-regulated insurance market, the board contributes to economic growth and financial stability. Insurance companies' ability to manage risk effectively supports businesses and individuals, enabling them to navigate uncertainties and plan for the future.

Case Study: The Insurance Board's Response to Industry Challenges

In recent years, the insurance industry has faced significant challenges, particularly in the wake of natural disasters and economic downturns. The Insurance Board's response to these crises has been instrumental in stabilizing the market and protecting policyholders.

For instance, following a series of devastating hurricanes, the Insurance Board implemented emergency measures to address the surge in claims. This included expediting the claims process, providing temporary relief for policyholders, and coordinating with industry stakeholders to ensure timely payouts. The board's proactive approach prevented widespread financial distress among policyholders and helped the industry recover swiftly.

Similarly, during the global economic recession, the Insurance Board played a crucial role in mitigating the impact on the insurance sector. By implementing stress tests and strengthening capital requirements, the board ensured that insurance companies remained resilient and able to meet their obligations. This stability protected policyholders' investments and maintained confidence in the insurance market.

The Future of the Insurance Board: Trends and Predictions

As the insurance industry continues to evolve, the Insurance Board is poised to adapt and address emerging challenges. Several key trends are shaping the board's future agenda.

Embracing Technological Innovation

The rapid advancement of technology is transforming the insurance landscape. The Insurance Board is expected to encourage and regulate the adoption of digital innovations, such as blockchain, artificial intelligence, and automated underwriting systems. These technologies can enhance efficiency, reduce costs, and improve the customer experience.

However, the board must also navigate the potential risks associated with technological advancements. This includes addressing cybersecurity concerns, ensuring data privacy, and mitigating the impact of emerging technologies on employment and industry dynamics.

Focus on Climate Change and Environmental Risks

Climate change is a growing concern for the insurance industry, with increasing frequency and severity of natural disasters. The Insurance Board is likely to prioritize the development of resilient insurance products and practices to address these risks. This may involve encouraging the adoption of green technologies, promoting sustainable business practices, and adapting insurance policies to cover emerging climate-related risks.

Enhancing Consumer Protection

With the rise of digital insurance platforms and direct-to-consumer models, the Insurance Board is expected to strengthen consumer protection measures. This includes educating policyholders about the risks and benefits of new insurance products, ensuring fair pricing practices, and addressing concerns related to data privacy and security.

Additionally, the board may explore ways to improve access to insurance for underserved populations, such as low-income individuals and small businesses. This could involve promoting community-based insurance models and partnering with non-profit organizations to expand insurance coverage.

Conclusion

The Insurance Board stands as a critical pillar of the insurance industry, safeguarding the interests of policyholders and promoting a stable and ethical insurance market. Through its regulatory and oversight functions, the board shapes the industry's practices and outcomes, ensuring consumer protection, financial stability, and innovation.

As the insurance landscape continues to evolve, the Insurance Board's adaptability and expertise will be instrumental in addressing emerging challenges and opportunities. By embracing technological advancements, addressing environmental risks, and enhancing consumer protection, the board will continue to play a vital role in shaping the future of the insurance industry.

What are the key responsibilities of the Insurance Board?

+The Insurance Board is responsible for regulating insurance practices, overseeing financial stability, protecting consumer interests, and ensuring fair and ethical standards in the insurance industry.

How does the Insurance Board contribute to financial stability in the insurance industry?

+The board assesses the financial health of insurance companies, conducts stress tests, and enforces robust capital requirements to prevent insolvency and protect policyholders.

What measures does the Insurance Board take to educate and protect policyholders?

+The board provides educational resources, investigates consumer complaints, and mediates disputes to ensure fair resolution and protect policyholders’ rights.

How does the Insurance Board adapt to technological advancements in the insurance industry?

+The board encourages the adoption of digital innovations while addressing associated risks, such as cybersecurity and data privacy concerns.